5 Critical Do's And Don'ts To Succeed In The Private Credit Job Market

Table of Contents

Do: Network Strategically within the Private Credit Industry

Building a strong network is crucial for securing a private credit job. Don't underestimate the power of connections in this specialized field.

Leverage LinkedIn Effectively:

- Optimize your profile: Use relevant keywords like "private credit," "direct lending," "private debt," "fund manager," "credit analyst," "underwriting," "portfolio management," "structured finance," and "leveraged finance." A compelling headline and summary highlighting your experience and career goals are essential.

- Engage actively: Participate in industry discussions, comment on insightful posts, and share relevant articles. This demonstrates your knowledge and interest in private credit.

- Connect strategically: Connect with recruiters specializing in private credit placements and professionals working at firms you admire. Personalize your connection requests whenever possible.

Attend Industry Events:

- Target relevant events: Attend conferences, seminars, and workshops focused on private credit, alternative investments, and related areas like distressed debt or mezzanine financing.

- Prepare for networking: Develop insightful questions to ask potential employers and peers. Show genuine interest in their work and experiences.

- Follow up diligently: Send personalized emails to contacts you made, referencing specific conversations and reiterating your interest.

Informational Interviews:

- Reach out proactively: Don't be afraid to reach out to professionals in private credit for informational interviews. A well-crafted email explaining your interest and career goals is key.

- Prepare thoughtful questions: Ask about their career path, the challenges and rewards of working in private credit, and their advice for aspiring professionals.

- Express genuine interest: Show genuine enthusiasm for the field and the person's experience. This leaves a positive impression and could lead to future opportunities.

Don't: Neglect Your Financial Modeling Skills

Proficiency in financial modeling is non-negotiable in the private credit industry. Your ability to build accurate and insightful models will be rigorously tested.

Master Financial Modeling Software:

- Excel proficiency: Become highly proficient in Excel, mastering functions crucial for financial modeling, such as discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and sensitivity analysis.

- Specialized software: Familiarize yourself with industry-standard software like Argus or Bloomberg Terminal. These tools are frequently used in private credit analysis and portfolio management.

- Practice consistently: Regularly create financial models for different scenarios and transaction types. This builds your speed, accuracy, and understanding.

Underestimate the Importance of Accuracy:

- Double-check your work: Ensure your models are accurate and free of errors. A single mistake can lead to significant miscalculations.

- Understand assumptions: Be prepared to explain the underlying assumptions and limitations of your models. Understanding these nuances is key to insightful analysis.

- Communicate effectively: Clearly articulate your modeling approach and assumptions during interviews and on the job.

Do: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count by highlighting relevant skills and experience and tailoring them to each specific opportunity.

Highlight Relevant Experience:

- Focus on achievements: Emphasize experience in credit analysis, underwriting, portfolio management, financial modeling, or related areas within private equity or private debt. Quantify your achievements using metrics and data whenever possible (e.g., "increased portfolio yield by 15%").

- Use keywords strategically: Incorporate relevant keywords from private credit job descriptions to improve the chances of your resume being selected by Applicant Tracking Systems (ATS).

- Showcase your skills: Highlight your expertise in areas like financial statement analysis, valuation, due diligence, credit risk assessment, and deal structuring.

Showcase Your Skills:

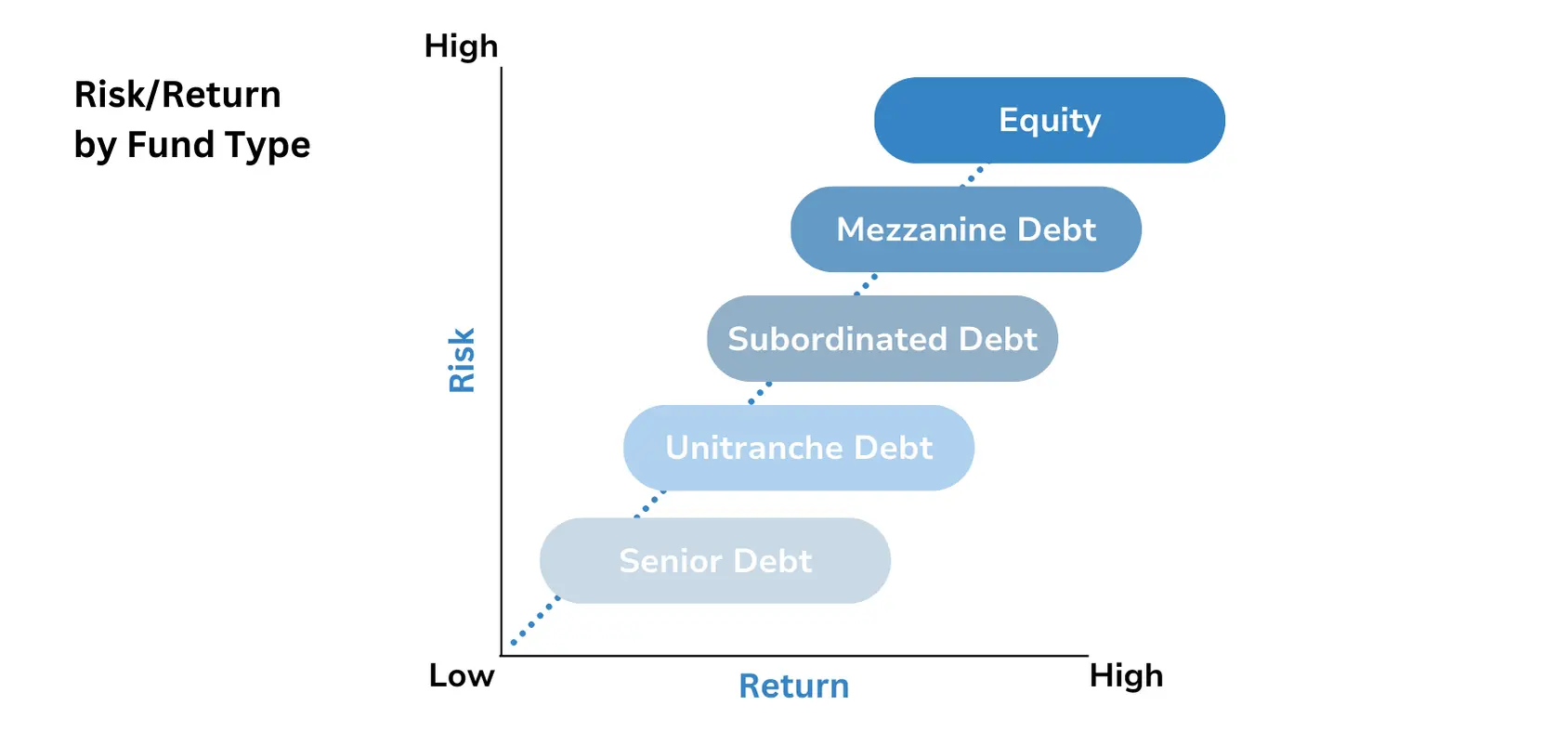

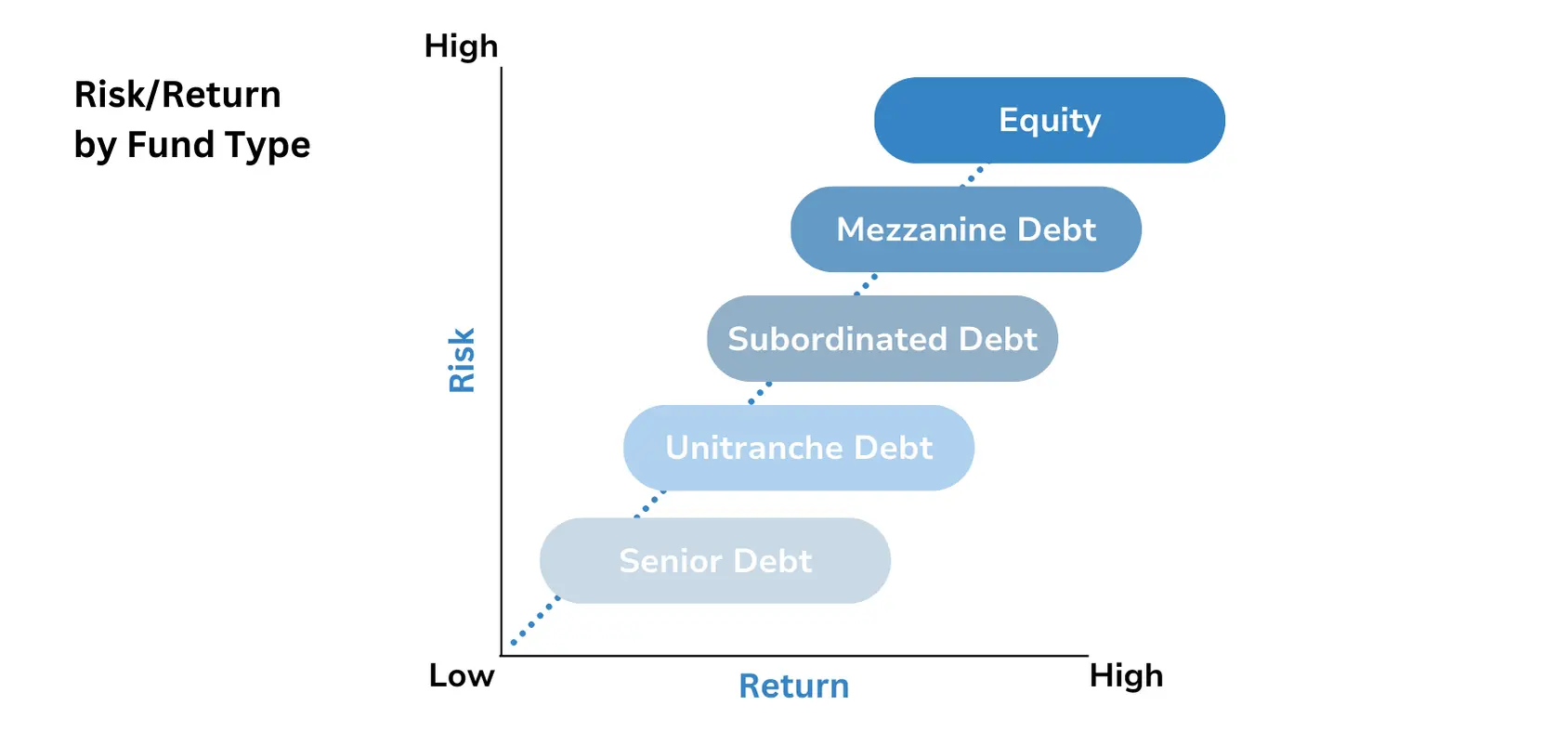

- Demonstrate understanding: Clearly demonstrate your understanding of various private credit investment strategies, such as direct lending, mezzanine financing, and distressed debt investing.

- Tailor to each job: Customize your resume and cover letter to each specific job application, emphasizing the skills and experiences most relevant to that particular role and company.

Don't: Underprepare for Interviews

The interview process is your chance to shine. Thorough preparation is essential for success.

Practice Behavioral Interview Questions:

- STAR method: Utilize the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions about your strengths, weaknesses, and past experiences.

- Prepare examples: Prepare specific examples demonstrating your problem-solving skills, teamwork abilities, and resilience in challenging situations.

- Research the firm: Thoroughly research the firm and the interviewer(s) to demonstrate your genuine interest and preparedness.

Neglect Technical Interview Preparation:

- Review fundamental concepts: Review key concepts in financial modeling, valuation, credit analysis, and private credit principles.

- Practice case studies: Practice solving case studies related to private credit transactions, such as evaluating a potential investment opportunity or analyzing a company's creditworthiness.

- Demonstrate deep understanding: Show a comprehensive understanding of industry trends, market dynamics, and regulatory considerations relevant to private credit.

Do: Follow Up After Interviews

Following up demonstrates your continued interest and professionalism.

Send a Thank-You Note:

- Personalize your message: Send a personalized thank-you note to each interviewer within 24 hours of the interview.

- Reiterate your interest: Reiterate your enthusiasm for the position and the company, referencing key discussion points from the interview.

- Express gratitude: Express your sincere appreciation for their time and consideration.

Maintain Contact:

- Follow up appropriately: Follow up with the recruiter or hiring manager after a reasonable timeframe (e.g., one week) if you haven't heard back.

- Maintain professionalism: Maintain professional and respectful communication throughout the process.

- Express continued interest: Express your continued interest and enthusiasm for the opportunity.

Conclusion

Successfully navigating the private credit job market requires a strategic and proactive approach. By following these five critical do's and don'ts – from strategic networking and mastering financial modeling to meticulous interview preparation and consistent follow-up – you'll significantly increase your chances of securing your dream private credit role. Remember, preparation and a proactive approach are key to standing out in this competitive field. Start implementing these tips today and accelerate your journey to a successful career in the private credit job market!

Featured Posts

-

Liberal Party Platform A Voters Guide By William Watson

Apr 24, 2025

Liberal Party Platform A Voters Guide By William Watson

Apr 24, 2025 -

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025 -

Elite Universities Facing Trump Administration Funding Cuts A Financial Response

Apr 24, 2025

Elite Universities Facing Trump Administration Funding Cuts A Financial Response

Apr 24, 2025 -

Microsoft Activision Deal Ftcs Appeal Challenges Regulatory Approval

Apr 24, 2025

Microsoft Activision Deal Ftcs Appeal Challenges Regulatory Approval

Apr 24, 2025 -

The Paradox Of Pope Francis Global Reach Internal Divisions

Apr 24, 2025

The Paradox Of Pope Francis Global Reach Internal Divisions

Apr 24, 2025