5 Do's And Don'ts For Landing A Private Credit Job

Table of Contents

DO: Network Strategically within the Private Credit Industry

Networking is paramount in the private credit industry. Building relationships with professionals in the field can open doors to unadvertised opportunities and provide invaluable insights.

Attend Industry Events and Conferences

Actively participate in private credit conferences, workshops, and networking events. These events provide unparalleled opportunities to connect with professionals from leading firms.

- Engage meaningfully: Don't just collect business cards; engage in genuine conversations, demonstrating your knowledge and enthusiasm for private credit.

- Follow up promptly: After each event, send personalized emails to individuals you connected with, referencing a specific detail from your conversation.

- Leverage LinkedIn: Use LinkedIn to connect with attendees and continue building your network after the event. Search for relevant hashtags like #privatecredit, #creditfunds, #privateequity to find relevant connections.

Informational Interviews

Reaching out for informational interviews is a powerful networking strategy. This allows you to learn firsthand about career paths and gain valuable insights into the industry.

- Target strategically: Identify individuals working in roles you aspire to and tailor your outreach message to their specific experience.

- Prepare thoughtful questions: Your questions should demonstrate your understanding of the industry and your genuine interest in private credit.

- Express gratitude: Always thank the individual for their time and consider sending a small token of appreciation afterward.

Cultivate Relationships

Networking is an ongoing process. Nurturing your network through consistent engagement is essential for long-term success.

- Stay in touch: Regularly connect with your contacts through LinkedIn, emails, or occasional phone calls.

- Offer value: Share relevant articles, industry insights, or even offer assistance when appropriate.

- Be reciprocal: Networking is a two-way street; be prepared to offer help and support to your contacts.

DON'T: Neglect Your Resume and Cover Letter

Your resume and cover letter are your first impression – make it count! A poorly crafted application can quickly disqualify you from consideration.

Generic Application Materials

Avoid using generic application materials. Each application should be tailored to the specific job description and the company's needs.

- Keyword optimization: Research keywords relevant to the job description and incorporate them naturally into your resume and cover letter.

- Highlight relevant skills: Focus on the skills and experiences that directly align with the requirements outlined in the job posting.

- Quantify your achievements: Use numbers and data to demonstrate your impact in previous roles. For example, instead of saying "Increased sales," say "Increased sales by 15% within six months."

Typos and Grammatical Errors

Typos and grammatical errors are unacceptable. They demonstrate carelessness and can significantly impact your chances of getting an interview.

- Proofread meticulously: Carefully review your resume and cover letter multiple times, looking for any errors in grammar, spelling, or punctuation.

- Seek feedback: Ask a friend, colleague, or career counselor to review your materials for errors and provide constructive feedback.

- Utilize grammar-checking tools: Leverage tools like Grammarly to catch errors you may have missed.

Lack of Specificity

Vague descriptions of your accomplishments are ineffective. Use specific examples to showcase your skills and experience.

- Use the STAR method: The STAR method (Situation, Task, Action, Result) is a helpful framework for structuring your accomplishments.

- Focus on results: Highlight the tangible outcomes of your actions, emphasizing quantifiable achievements whenever possible.

- Show, don't tell: Use action verbs and specific examples to illustrate your skills and experience rather than simply listing them.

DO: Showcase Relevant Financial Modeling Skills

Proficiency in financial modeling is essential for success in private credit. Demonstrate your skills through your resume, portfolio, and interviews.

Master Excel and Financial Modeling Software

Become highly proficient in Excel and other financial modeling software packages used in the industry, such as Bloomberg Terminal and Argus.

- Build a strong foundation: Master essential financial modeling techniques, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and sensitivity analysis.

- Practice regularly: Consistently practice building and refining financial models to hone your skills and improve your speed and accuracy.

- Showcase your projects: Include relevant projects in your resume and portfolio that highlight your financial modeling capabilities.

Demonstrate Understanding of Financial Statements

A deep understanding of financial statements (balance sheets, income statements, cash flow statements) is critical.

- Analyze financial data: Demonstrate your ability to interpret and analyze financial data to identify key trends and insights.

- Communicate clearly: Practice explaining complex financial concepts in a clear and concise manner, tailored to your audience.

- Focus on key ratios: Understand and be able to discuss key financial ratios, such as debt-to-equity, interest coverage, and return on assets.

Highlight Relevant Projects

Showcase your financial modeling skills through specific projects in your resume and portfolio.

- Detail your methodology: Explain your approach to financial modeling, highlighting the techniques and assumptions used.

- Discuss your conclusions: Clearly articulate your findings and insights from your analysis.

- Present your work professionally: Ensure your portfolio is well-organized and easy to navigate.

DON'T: Underestimate the Importance of Interview Preparation

Thorough interview preparation is crucial for success. Failing to prepare adequately can significantly diminish your chances.

Lack of Research

Researching the firm and the role is essential. This demonstrates your genuine interest and initiative.

- Understand the firm's investment strategy: Research the firm's history, investment philosophy, and recent transactions.

- Know the team: Learn about the people you will be interviewing with and their backgrounds.

- Align your skills: Connect your skills and experience to the firm's specific needs and the requirements of the role.

Poor Communication Skills

Clearly articulating your thoughts and ideas is crucial. Practice answering common interview questions beforehand.

- Practice behavioral questions: Prepare examples that showcase your skills and experience using the STAR method.

- Practice technical questions: Be ready to discuss your financial modeling skills and your understanding of private credit concepts.

- Engage actively: Maintain eye contact, listen attentively, and actively participate in the conversation.

Failing to Ask Questions

Asking insightful questions demonstrates your interest and engagement. Prepare questions that show your critical thinking.

- Prepare thoughtful questions: Formulate questions about the firm’s culture, investment strategy, and future plans.

- Ask about the team: Inquire about the team dynamics, mentorship opportunities, and the firm's approach to professional development.

- Avoid generic questions: Avoid asking questions that could easily be answered by reviewing the firm's website.

DO: Follow Up After the Interview

Following up after an interview demonstrates your continued interest and professionalism.

Send a Thank-You Note

Send a personalized thank-you note to each interviewer within 24 hours. This shows your appreciation and reinforces your interest.

- Personalize your message: Reference a specific detail from your conversation to demonstrate your engagement.

- Reiterate your interest: Express your continued interest in the position and the firm.

- Maintain professionalism: Ensure your message is concise, professional, and error-free.

Follow Up on the Timeline

If you haven't heard back within the expected timeframe, a polite follow-up is acceptable.

- Be patient: Allow sufficient time for the firm to complete their hiring process before following up.

- Be polite and professional: Maintain a courteous and professional tone in your communication.

- Express continued interest: Reiterate your strong interest in the position and your enthusiasm for the opportunity.

Conclusion

Landing a private credit job requires a strategic and proactive approach. By following these five do's and don'ts—from networking effectively and crafting compelling application materials to mastering financial modeling and acing the interview—you'll significantly enhance your chances of success. Remember, thorough preparation and a genuine passion for private credit are key differentiators. Don't delay—start implementing these tips today to advance your private credit career! Good luck with your job search – finding the right private credit job is within your reach!

Featured Posts

-

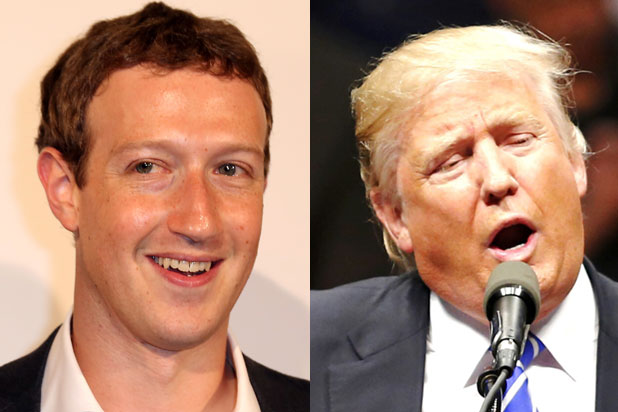

How Trumps Presidency Will Shape Zuckerbergs Next Move

Apr 22, 2025

How Trumps Presidency Will Shape Zuckerbergs Next Move

Apr 22, 2025 -

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 22, 2025

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 22, 2025 -

Razer Blade 16 2025 Ultra Thin Laptop Performance And Price Analysis

Apr 22, 2025

Razer Blade 16 2025 Ultra Thin Laptop Performance And Price Analysis

Apr 22, 2025 -

The Fractured Relationship Understanding The Current State Of U S China Relations And The Cold War Specter

Apr 22, 2025

The Fractured Relationship Understanding The Current State Of U S China Relations And The Cold War Specter

Apr 22, 2025 -

Escalating Tensions A Deep Dive Into The Breakdown Of U S China Relations And The Potential For Conflict

Apr 22, 2025

Escalating Tensions A Deep Dive Into The Breakdown Of U S China Relations And The Potential For Conflict

Apr 22, 2025