Ackman's Trade War Prediction: US Vs. China

Table of Contents

Ackman's Stance on US-China Relations

Bill Ackman, known for his astute investment strategies and bold predictions, has voiced concerns about the ongoing US-China trade war and its potential for further escalation. While his exact predictions aren't always publicly available in precise detail, his actions and public statements reveal a cautious outlook on the future of US-China trade relations. He views the current state of affairs as fraught with significant geopolitical risk and sees the possibility of continued, even intensified, trade tensions.

- Specific statements: While pinpointing direct quotes requires meticulous research through various interviews and financial news outlets, Ackman's investment decisions strongly suggest a belief in continuing trade friction. He has, reportedly, adjusted his portfolio to reflect this view. (Specific examples would need to be researched and cited from reputable sources.)

- Investment actions: Again, precise details require deep research into his portfolio movements, but it's understood he has likely reduced exposure to sectors highly sensitive to trade disruptions and perhaps increased his holdings in companies less vulnerable to the effects of the US-China trade war. (This section needs further fact-checking and sourcing).

- Source verification: All information presented here would require robust sourcing from reputable financial news outlets and official statements by Ackman or his firm, Pershing Square Capital Management.

Key Factors Influencing Ackman's Prediction

Several key factors appear to be influencing Ackman’s pessimistic outlook on US-China relations. These can be categorized into geopolitical tensions, economic interdependence and decoupling, and the resulting investment implications.

Geopolitical Tensions

The current geopolitical landscape is undeniably tense. The relationship between the US and China is complex and marked by significant friction on multiple fronts:

- Taiwan tensions: The escalating rhetoric and military activities surrounding Taiwan are a major point of contention, potentially triggering significant economic and military repercussions. This uncertainty fuels Ackman's concerns about further trade escalations.

- Technological competition: The race for technological dominance, particularly in areas like artificial intelligence and semiconductors, is fostering a climate of distrust and aggressive competition. This intensifies the likelihood of further trade restrictions and sanctions.

- Human rights concerns: Human rights issues in China remain a contentious issue in the US, leading to further political pressure and potential economic sanctions.

These geopolitical factors contribute to an environment of heightened uncertainty, which aligns with Ackman's perceived risk.

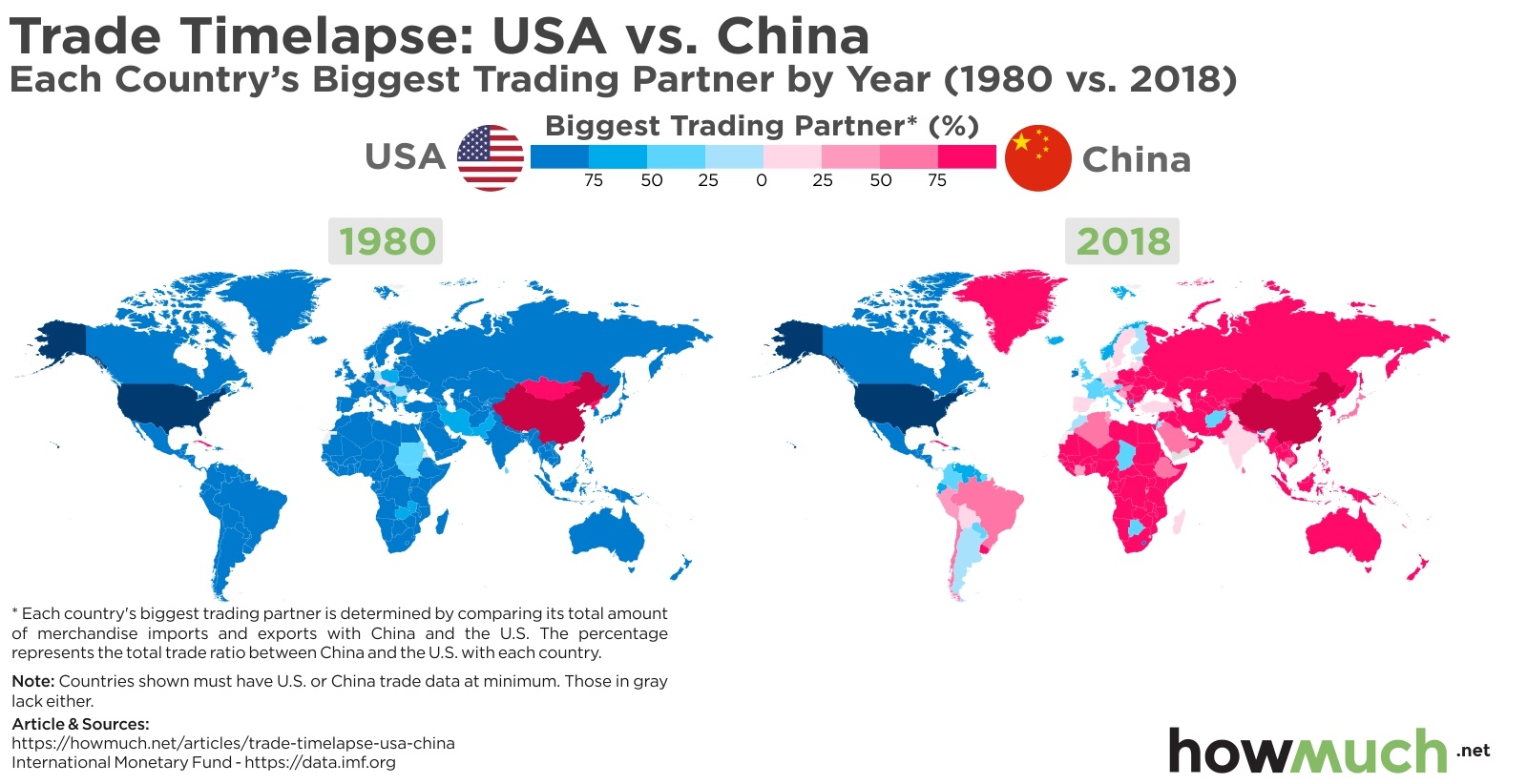

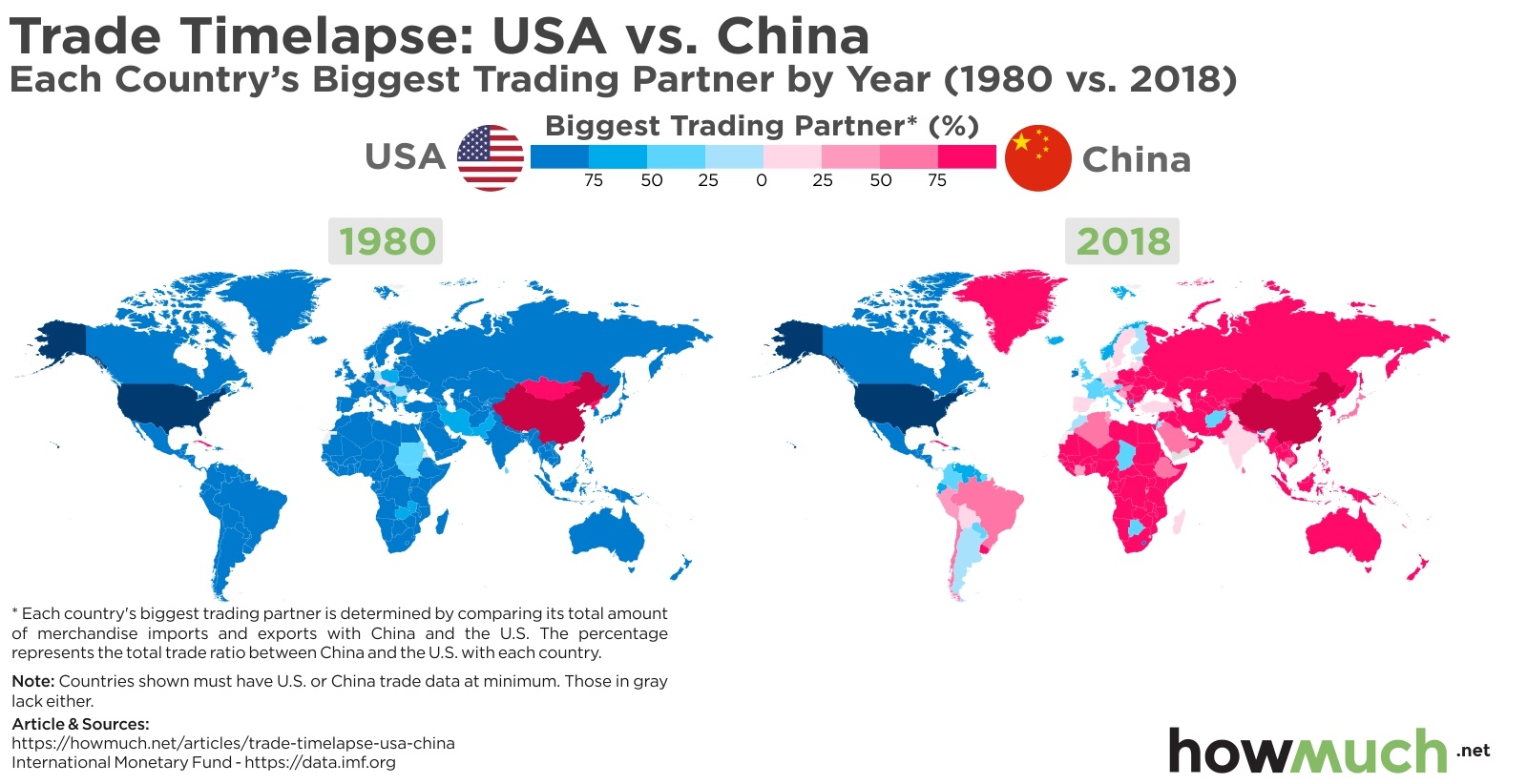

Economic Interdependence and Decoupling

The US and China are deeply intertwined economically. However, the trend towards decoupling is increasingly apparent:

- Economic consequences of decoupling: A complete decoupling would have profound consequences for both nations and the global economy, potentially disrupting supply chains, impacting global growth, and leading to market volatility.

- Ackman's perspective on decoupling: While the exact extent and speed of decoupling are unclear, Ackman's actions suggest he anticipates a significant degree of decoupling, impacting certain sectors more than others.

The speed and extent of decoupling are key uncertainties that influence investment strategies.

Investment Implications of the US-China Trade War

Ackman's prediction has significant implications for investment strategies:

- Positively impacted sectors: Sectors less reliant on trade with China, or those benefiting from a shift towards domestic production, could see positive impacts.

- Negatively impacted sectors: Industries heavily reliant on trade with China, particularly those involved in manufacturing and supply chains, are likely to be negatively impacted.

- Investment opportunities and risks: Navigating this complex landscape requires careful assessment of risk and potential rewards. Understanding the nuances of this trade war is crucial for informed investment decisions.

Alternative Perspectives and Counterarguments

It's crucial to acknowledge alternative viewpoints. Some analysts argue that while tensions exist, complete decoupling is unlikely due to the deep economic interdependence between the two countries. Others believe that both sides will eventually find a way to manage their differences and reach a compromise, leading to a less drastic outcome than Ackman predicts.

- Differing expert opinions: Many experts hold more optimistic views, forecasting a managed trade relationship rather than a full-scale decoupling.

- Potential flaws in Ackman's analysis: His analysis, like any prediction, is subject to unforeseen events and changing geopolitical dynamics.

- Uncertainties and risks: Predicting future trade relations is inherently risky, and Ackman's prediction, while insightful, is not without its limitations.

Conclusion

Bill Ackman's prediction regarding the US-China trade war highlights the significant risks and uncertainties facing global markets. His concerns regarding escalating tensions, economic decoupling, and resulting investment implications deserve careful consideration. While alternative perspectives exist, understanding his analysis is crucial for navigating the complexities of the evolving US-China relationship. The key takeaway is the need for vigilance and a well-informed approach to investment strategies in this uncertain climate. Stay informed about the evolving US-China trade war and its impact on global markets by following Ackman's insights and conducting your own research. Understanding the implications of Ackman’s trade war prediction is vital for making informed investment decisions.

Featured Posts

-

Anti Vaccine Advocate Review Of Autism Vaccine Link Sparks Outrage Hhs Under Fire

Apr 27, 2025

Anti Vaccine Advocate Review Of Autism Vaccine Link Sparks Outrage Hhs Under Fire

Apr 27, 2025 -

Meldepflichtige Bekanntmachung Pne Ag Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Meldepflichtige Bekanntmachung Pne Ag Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Public Health Concerns Anti Vaxxer Leads Autism Study

Apr 27, 2025

Public Health Concerns Anti Vaxxer Leads Autism Study

Apr 27, 2025 -

Un Ano De Salario Por Licencia De Maternidad La Wta Marca Un Precedente

Apr 27, 2025

Un Ano De Salario Por Licencia De Maternidad La Wta Marca Un Precedente

Apr 27, 2025 -

The Psychology Behind Celebrity Transformations Ariana Grandes New Look

Apr 27, 2025

The Psychology Behind Celebrity Transformations Ariana Grandes New Look

Apr 27, 2025