Activision Blizzard Acquisition: FTC's Appeal Explained

Table of Contents

The FTC's Concerns Regarding the Activision Blizzard Acquisition

The FTC's core argument against the merger hinges on the potential harm to competition within the gaming market. They argue that the acquisition would give Microsoft an unfair advantage, stifling innovation and harming consumers.

Anti-competitive Practices

The FTC's concerns regarding anti-competitive practices are multifaceted:

- Reduced competition in the console gaming market (Xbox vs. PlayStation): The FTC worries that Microsoft, with the added strength of Activision Blizzard's titles, could leverage its market position to disadvantage Sony's PlayStation, potentially reducing consumer choice and innovation.

- Potential for Microsoft to leverage exclusive content (Call of Duty): The immensely popular Call of Duty franchise is a key concern. The FTC fears Microsoft could make it exclusive to Xbox, harming PlayStation players and potentially hindering competition. This exclusivity could significantly impact market share and consumer loyalty.

- Impact on subscription services (Game Pass): The FTC is concerned that Microsoft could use the acquisition to bolster its Game Pass subscription service, making it even more attractive to consumers while potentially damaging rival subscription services. This could lead to a monopolistic situation in the subscription market.

- Harm to game developers and publishers: The FTC also argues that the acquisition could create an uneven playing field for smaller game developers and publishers, potentially limiting their opportunities and stifling competition. This could lead to reduced innovation and fewer diverse gaming experiences.

Market Domination Fears

The FTC's apprehension extends to Microsoft's potential market dominance post-acquisition.

- Microsoft's already substantial market share in gaming: Microsoft already holds a considerable share of the gaming market, particularly with Xbox and its substantial gaming ecosystem.

- The addition of Activision Blizzard's significant franchises: Activision Blizzard's portfolio includes major franchises like Call of Duty, World of Warcraft, Candy Crush, and Overwatch. Adding these to Microsoft's existing lineup significantly expands its market reach and power.

- The potential for anti-competitive pricing practices: With increased market power, the FTC fears Microsoft could engage in anti-competitive pricing practices, potentially raising prices or reducing the quality of services.

- Reduced innovation due to lack of competition: Less competition can lead to reduced innovation, as Microsoft may have less incentive to invest in new technologies or game experiences.

Microsoft's Defense Against the FTC's Claims

Microsoft has actively refuted the FTC's claims, arguing that the acquisition will ultimately benefit consumers and foster competition.

Commitment to Maintaining Competition

Microsoft has outlined several commitments aimed at addressing the FTC's concerns:

- Long-term Call of Duty agreements with PlayStation: Microsoft has pledged to maintain Call of Duty availability on PlayStation for a significant period, mitigating the FTC's concerns about exclusivity.

- Continued availability of Activision Blizzard games on other platforms: Microsoft has promised to keep Activision Blizzard games accessible on other platforms, including PC and Nintendo Switch, to maintain market diversity.

- Investment in game development and cloud gaming infrastructure: Microsoft has committed to invest further in game development and cloud gaming infrastructure, potentially benefiting consumers through better games and more accessible technology.

Benefits of the Acquisition for Consumers

Microsoft highlights the potential benefits for gamers:

- Lower game prices: Through economies of scale, Microsoft suggests the acquisition could lead to lower prices for games.

- More game choices: The merger expands the variety of games available, benefiting consumers with more options and potentially more diverse gaming experiences.

- Improved game quality: Increased investment could lead to improved game quality and more engaging gaming experiences.

- Access to cloud gaming technologies: The combination of Microsoft's cloud technology and Activision Blizzard's games could improve access to cloud gaming services for a wider range of players.

The Legal Battle and Potential Outcomes

The legal battle surrounding the Activision Blizzard Acquisition is complex and ongoing.

The Appeal Process

The FTC's appeal involves multiple legal steps, including evidentiary hearings, briefs, and potential court appearances. The timeline for a final resolution is uncertain, potentially stretching over several months or even years.

Potential Impacts on the Gaming Industry

The outcome of this appeal will have significant consequences for the gaming industry:

- Setting precedents for future acquisitions: The decision will set crucial precedents for future mergers and acquisitions in the gaming industry, potentially shaping future regulatory approaches.

- Impact on industry regulations: The outcome could lead to tighter regulations on mergers and acquisitions within the gaming sector, impacting how companies approach future deals.

- Shaping the competitive landscape: The ruling will have a direct impact on the competitive balance within the gaming industry, affecting the market share of major players and the choices available to consumers.

Conclusion

The FTC's appeal of the Microsoft-Activision Blizzard acquisition is a pivotal moment for the gaming industry. The arguments revolve around competitive concerns, market dominance, and the potential impact on both gamers and developers. Understanding the FTC's reasoning, Microsoft's counterarguments, and the potential outcomes is vital for anyone following the gaming landscape. The future of the Activision Blizzard acquisition, and indeed the future of the gaming industry, hangs in the balance. Stay informed on the latest developments to understand the evolving dynamics of this critical merger.

Featured Posts

-

The Ahmed Hassanein Story A Potential Nfl Milestone

Apr 26, 2025

The Ahmed Hassanein Story A Potential Nfl Milestone

Apr 26, 2025 -

Meta Under Trump Zuckerbergs Challenges And Opportunities

Apr 26, 2025

Meta Under Trump Zuckerbergs Challenges And Opportunities

Apr 26, 2025 -

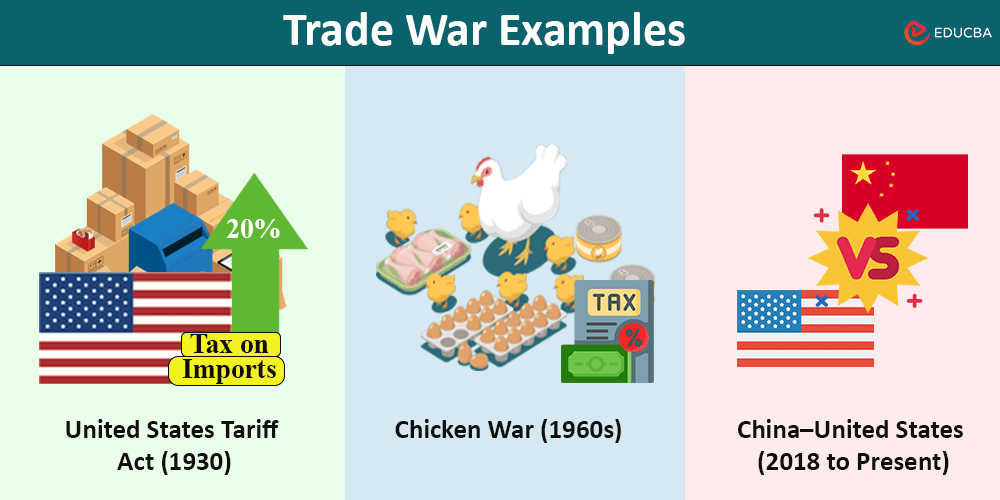

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025 -

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Heart Of The Lawsuit

Apr 26, 2025

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Heart Of The Lawsuit

Apr 26, 2025 -

The Trump Administration And The Fight Over Europes Ai Rulebook

Apr 26, 2025

The Trump Administration And The Fight Over Europes Ai Rulebook

Apr 26, 2025