Addressing Elevated Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's market analysis points to several key factors contributing to elevated stock market valuations. These include historically low interest rates, sustained quantitative easing programs, and robust corporate earnings, particularly in the technology sector. However, these factors aren't without counterpoints. The current economic climate is marked by several uncertainties.

-

BofA's assessment of the current economic climate: BofA acknowledges the ongoing recovery from the pandemic but also highlights lingering inflationary pressures and supply chain disruptions. These factors contribute to an environment of both opportunity and significant risk.

-

Key economic indicators influencing stock market valuations: Inflation remains a key concern, impacting consumer spending and potentially slowing economic growth. GDP growth, while positive, is slowing in several key markets, impacting corporate earnings expectations.

-

Analysis of interest rate hikes and their impact on market performance: The Federal Reserve's recent interest rate hikes aim to curb inflation but could negatively impact stock valuations by increasing borrowing costs for companies and potentially slowing economic growth. BofA's analysis models various interest rate scenarios and their potential market effects.

-

BofA's prediction for future economic growth: BofA's projections suggest moderate economic growth in the near term, but with significant uncertainty depending on the effectiveness of monetary policy and the evolution of geopolitical risks.

Identifying Potential Risks Associated with High Valuations

Investing in a market with high valuations inherently carries increased risk. While strong corporate earnings support current prices, several factors could trigger a market correction or even a more substantial downturn. BofA employs sophisticated risk assessment methodologies to quantify these potential risks.

-

Risk of a market correction or crash: High valuations leave the market vulnerable to negative news, creating a potential for significant price drops. Even small negative surprises could trigger substantial sell-offs, given the current pricing.

-

Potential impact of rising interest rates on stock prices: Higher interest rates increase borrowing costs and reduce the attractiveness of equities relative to bonds, potentially leading to lower stock prices. BofA’s modeling highlights the sensitivity of stock valuations to interest rate changes.

-

Increased vulnerability to negative economic news: Unexpected negative economic data, such as a sharper-than-expected slowdown in GDP growth or a surge in inflation, could trigger widespread selling pressure in the market.

-

Sector-specific risks and their potential impact: Certain sectors are more susceptible to interest rate hikes or economic downturns. BofA’s analysis highlights sector-specific risks and recommends a diversified approach to portfolio management.

BofA's Recommended Investment Strategies in a High-Valuation Market

Given the elevated valuations, BofA recommends a cautious and diversified investment strategy. This approach emphasizes risk mitigation while still seeking opportunities for growth. The focus is on thoughtful portfolio construction rather than aggressive bets on high-growth, high-valuation stocks.

-

Diversification strategies across asset classes: BofA suggests diversifying across different asset classes, including equities, bonds, and potentially alternative investments, to reduce overall portfolio risk.

-

Focus on value stocks versus growth stocks: In a high-valuation market, BofA suggests a greater focus on value stocks—companies trading at lower price-to-earnings ratios relative to their fundamentals—as they may offer better risk-adjusted returns.

-

Sector-specific investment recommendations: BofA's analysis suggests specific sectors that may be relatively less vulnerable to interest rate hikes or economic slowdowns.

-

Importance of risk management techniques: BofA emphasizes the use of stop-loss orders and other risk management techniques to limit potential losses in case of a market correction.

-

Strategies for navigating market volatility: BofA advises investors to develop a long-term investment horizon and to avoid making impulsive decisions based on short-term market fluctuations.

Long-Term Outlook and Future Market Predictions from BofA

BofA's long-term outlook for the stock market is cautiously optimistic. While acknowledging the risks associated with elevated valuations, they believe that long-term economic growth, driven by technological advancements and evolving consumer preferences, will continue to support market gains.

-

BofA's predictions for long-term economic growth: BofA forecasts sustained, albeit moderate, long-term economic growth, although this projection is dependent on various factors, including global geopolitical stability.

-

Expected impact of technological advancements on the market: BofA anticipates that technological advancements will continue to drive innovation and create new investment opportunities, particularly in sectors such as artificial intelligence, renewable energy, and biotechnology.

-

Potential shifts in market leadership (sectors or companies): BofA's analysis points towards potential shifts in market leadership as certain sectors outperform others in response to changing economic conditions and technological innovations.

-

Considerations for long-term investors: BofA emphasizes the importance of a long-term investment horizon for navigating market volatility and realizing long-term gains.

Conclusion:

BofA's analysis of elevated stock market valuations underscores the need for a cautious yet opportunistic investment strategy. While attractive opportunities remain, the inherent risks associated with high valuations cannot be ignored. Careful risk assessment, diversification across asset classes, and a focus on value stocks are crucial for mitigating potential downside and capitalizing on long-term growth. Consider BofA's insights when formulating your investment strategy to effectively address elevated stock market valuations. Further research into BofA's detailed reports and market analysis is recommended for a comprehensive understanding of the current market landscape.

Featured Posts

-

Preordering My Nintendo Switch 2 The Old Fashioned Way A Game Stop Tale

Apr 26, 2025

Preordering My Nintendo Switch 2 The Old Fashioned Way A Game Stop Tale

Apr 26, 2025 -

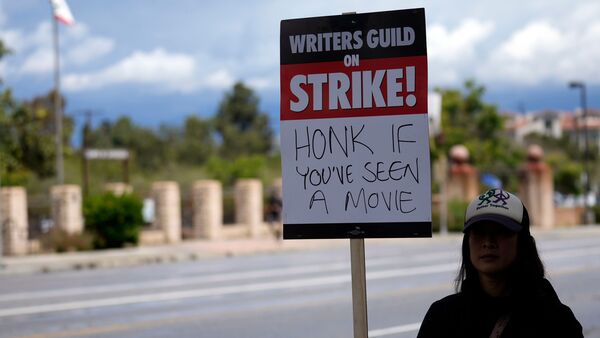

Double Trouble In Hollywood Writers And Actors Strikes Halt Production

Apr 26, 2025

Double Trouble In Hollywood Writers And Actors Strikes Halt Production

Apr 26, 2025 -

Is Ahmed Hassanein On Track To Break Nfl Barriers

Apr 26, 2025

Is Ahmed Hassanein On Track To Break Nfl Barriers

Apr 26, 2025 -

Open Ai Simplifies Voice Assistant Development

Apr 26, 2025

Open Ai Simplifies Voice Assistant Development

Apr 26, 2025 -

Europe Rejects Trump Administrations Ai Regulatory Push

Apr 26, 2025

Europe Rejects Trump Administrations Ai Regulatory Push

Apr 26, 2025