Addressing High Stock Market Valuations: BofA's View

Table of Contents

BofA's Assessment of Current Stock Market Valuations

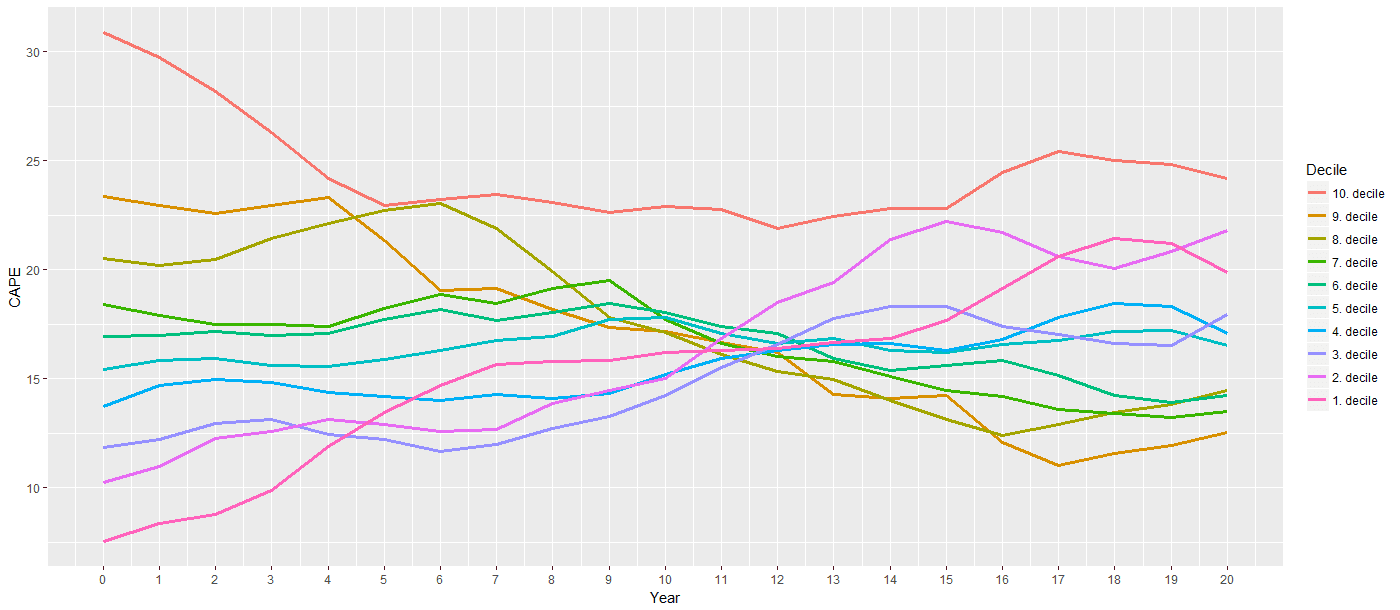

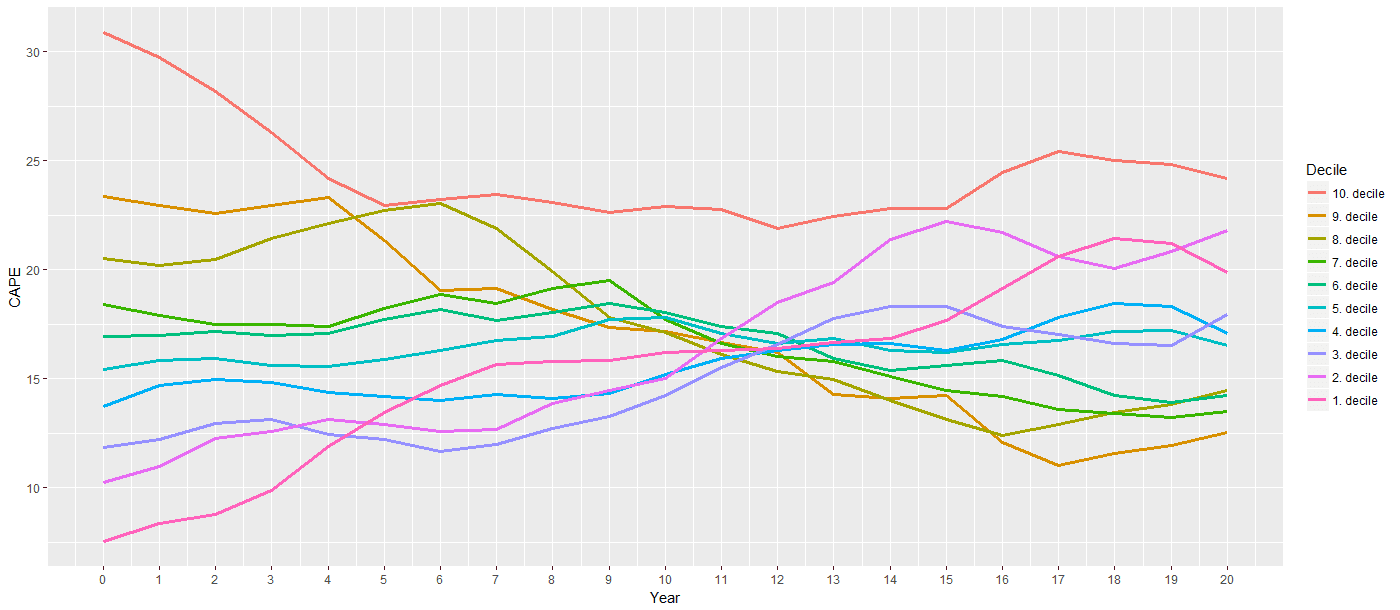

BofA employs a multifaceted approach to evaluating market valuations, utilizing a range of established metrics. Their analysis goes beyond simple price-to-earnings ratios (P/E) to incorporate more nuanced measures like the cyclically adjusted price-to-earnings ratio (CAPE), which smooths out earnings fluctuations over a longer period (typically 10 years). This provides a more robust picture of long-term valuation trends.

-

Specific valuation metrics used by BofA: In addition to P/E and CAPE ratios, BofA likely incorporates other valuation metrics such as price-to-sales ratios (P/S), price-to-book ratios (P/B), and dividend yield. They also consider industry-specific valuation benchmarks.

-

BofA's assessment of current market valuation levels compared to historical averages: While specific data points require access to BofA's proprietary research, their public statements generally indicate that current valuations, particularly in certain sectors, are elevated relative to historical averages. This suggests a higher level of risk.

-

Identification of overvalued sectors or specific stocks according to BofA's analysis: BofA's analysts likely identify specific sectors or companies they deem overvalued based on their valuation models and fundamental analysis. These might include sectors experiencing rapid growth but with unsustainable valuations.

-

Consideration of macroeconomic factors influencing valuations (interest rates, inflation, economic growth): BofA's assessment integrates macroeconomic factors. High inflation, rising interest rates, and slowing economic growth can all negatively impact stock valuations. These elements are crucial in their overall assessment.

(Note: Illustrative charts and graphs would be inserted here if available from BofA's public research.)

BofA's Strategies for Navigating High Stock Market Valuations

Given the elevated stock market valuations, BofA likely advocates a cautious yet opportunistic approach to investment. Their recommended strategies emphasize risk management and diversification.

-

Emphasis on diversification across asset classes (bonds, real estate, etc.): Diversification reduces portfolio volatility. Holding a mix of stocks, bonds, and alternative assets like real estate helps mitigate the impact of a potential stock market correction.

-

Suggestions for stock selection focusing on undervalued companies or sectors with strong growth potential: Rather than chasing high-flying stocks, BofA may advise investors to focus on fundamentally sound companies trading at reasonable valuations or sectors with long-term growth potential, even if they appear slightly more expensive.

-

Discussion of defensive investment strategies to mitigate potential downside risks: Defensive strategies, such as increasing the allocation to low-volatility stocks or high-quality bonds, aim to protect capital during market downturns.

-

Advice on adjusting portfolio allocation based on risk tolerance and investment goals: BofA likely stresses the importance of tailoring investment strategies to individual risk tolerance and financial goals. Conservative investors might favor a more defensive approach, while those with a higher risk tolerance may maintain a larger allocation to equities.

The Role of Interest Rates in BofA's Valuation Analysis

Interest rates play a significant role in BofA's valuation analysis, reflecting the inverse relationship between interest rates and stock valuations.

-

Explain the inverse relationship between interest rates and stock valuations: Higher interest rates increase the attractiveness of fixed-income investments, potentially drawing capital away from the stock market and decreasing stock prices.

-

BofA's predictions regarding future interest rate movements: BofA's economists provide forecasts on future interest rate movements. These predictions influence their valuation models and investment recommendations.

-

How interest rate changes may influence BofA's recommended investment strategies: Anticipating interest rate hikes might lead BofA to suggest a more conservative portfolio allocation, shifting towards fixed-income securities.

Potential Risks and Opportunities in the Current Market

BofA's analysis likely highlights both the risks and opportunities within the current high-valuation environment.

-

Discussion of potential market corrections or downturns: Given the high valuations, BofA likely acknowledges the potential for a market correction or downturn.

-

Highlighting sectors or stocks with higher growth potential despite high valuations: Certain sectors might still offer growth opportunities despite high valuations. BofA's research would identify these sectors.

-

Mentioning geopolitical events or other factors affecting market valuations: Geopolitical instability, unexpected economic shocks, or regulatory changes can significantly impact market valuations. BofA's analysis accounts for such factors.

-

Opportunities for strategic rebalancing of portfolios: Periods of market volatility present opportunities for strategic rebalancing – adjusting the portfolio allocation to capitalize on price fluctuations.

Conclusion

BofA's analysis suggests that current stock market valuations are elevated compared to historical averages. Their assessment incorporates various valuation metrics and considers macroeconomic factors like interest rates and inflation. To navigate this environment, BofA likely recommends a diversified approach, emphasizing defensive strategies and a focus on undervalued companies or sectors with strong growth potential. Understanding the impact of interest rate changes is vital. Addressing high stock market valuations requires a careful and nuanced approach.

Understanding and addressing high stock market valuations is crucial for informed investment decisions. Consult with a financial advisor to create a personalized strategy based on your risk tolerance and financial goals. Stay updated on BofA's research and analysis for ongoing insights into stock market valuations and effective investment strategies.

Featured Posts

-

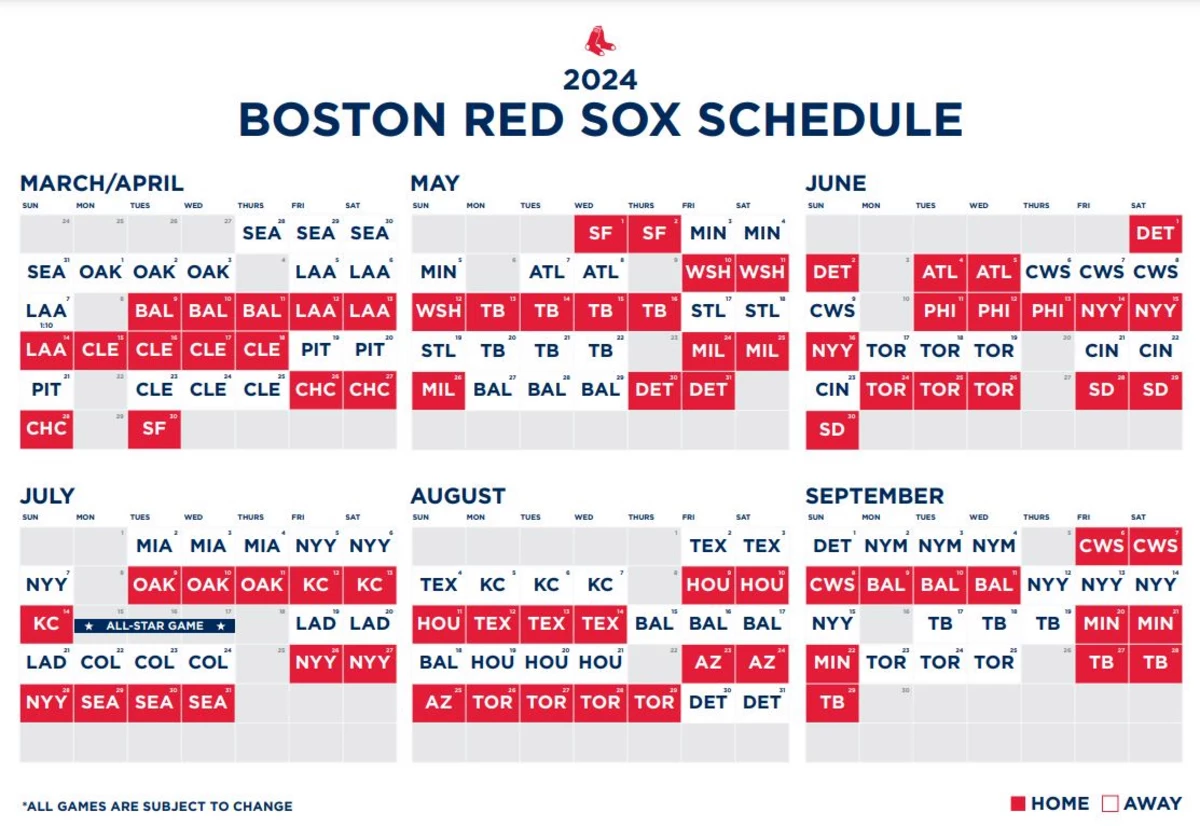

Boston Red Sox Lineup Changes Casas Demotion Outfielder Back In Action

Apr 28, 2025

Boston Red Sox Lineup Changes Casas Demotion Outfielder Back In Action

Apr 28, 2025 -

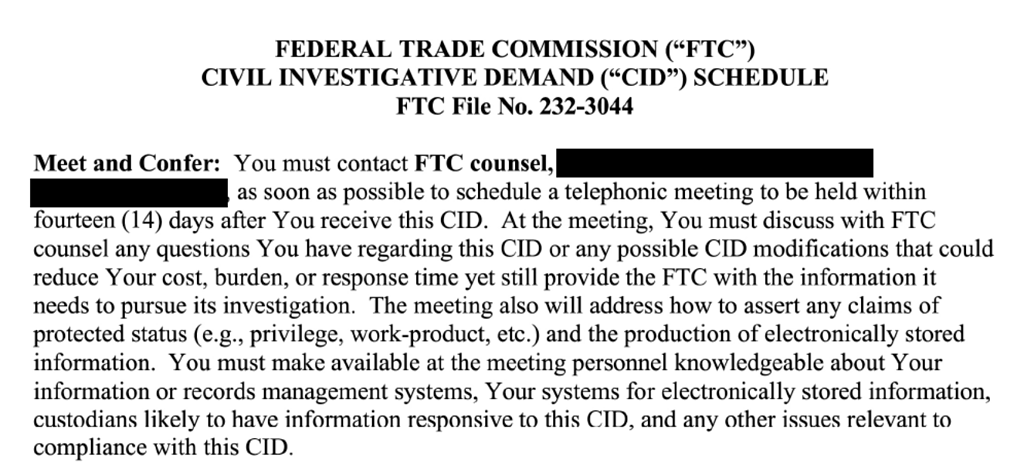

Open Ai Faces Ftc Investigation Analyzing The Potential Impact On The Future Of Ai

Apr 28, 2025

Open Ai Faces Ftc Investigation Analyzing The Potential Impact On The Future Of Ai

Apr 28, 2025 -

Richard Jeffersons Subtle Dig At Shaquille O Neal A Detailed Look

Apr 28, 2025

Richard Jeffersons Subtle Dig At Shaquille O Neal A Detailed Look

Apr 28, 2025 -

Eva Longorias Dinner With The Worlds Most Influential Chef A Fishermans Stew Highlight

Apr 28, 2025

Eva Longorias Dinner With The Worlds Most Influential Chef A Fishermans Stew Highlight

Apr 28, 2025 -

Yankees Star Aaron Judge Matches Babe Ruths Impressive Home Run Record

Apr 28, 2025

Yankees Star Aaron Judge Matches Babe Ruths Impressive Home Run Record

Apr 28, 2025