Analysis Of Today's Stock Market: Dow Futures Movement Amidst US-China Trade Tensions

Table of Contents

Understanding the Dow Futures Market

Dow Futures contracts represent an agreement to buy or sell the Dow Jones Industrial Average (DJIA) at a predetermined price on a future date. They serve as a crucial barometer of market sentiment and are often used to predict short-term market trends. The movement of Dow Futures is influenced by several factors, including:

- Interest Rates: Changes in interest rates set by central banks significantly impact investor borrowing costs and overall market attractiveness.

- Economic Data: Key economic indicators like GDP growth, inflation, and employment figures strongly influence investor confidence and Dow Futures prices.

- Geopolitical Events: Global events, particularly those with economic implications like the US-China trade war, heavily influence market sentiment and Dow Futures trading.

Key aspects of Dow Futures:

- Definition: A Dow Futures contract is a legally binding agreement to buy or sell the DJIA at a specific price on a specified future date.

- Trading Mechanism: Dow Futures are traded on exchanges like the Chicago Mercantile Exchange (CME), allowing investors to speculate on the future direction of the DJIA.

- Risk Management: Dow Futures provide a valuable tool for hedging against potential losses in the stock market. Investors can use them to offset risks associated with their existing stock portfolios.

The Impact of US-China Trade Tensions on Global Markets

The US-China trade relationship has been marked by escalating tensions in recent years. This trade war, characterized by the imposition of tariffs and other trade restrictions, significantly impacts investor confidence and global market sentiment.

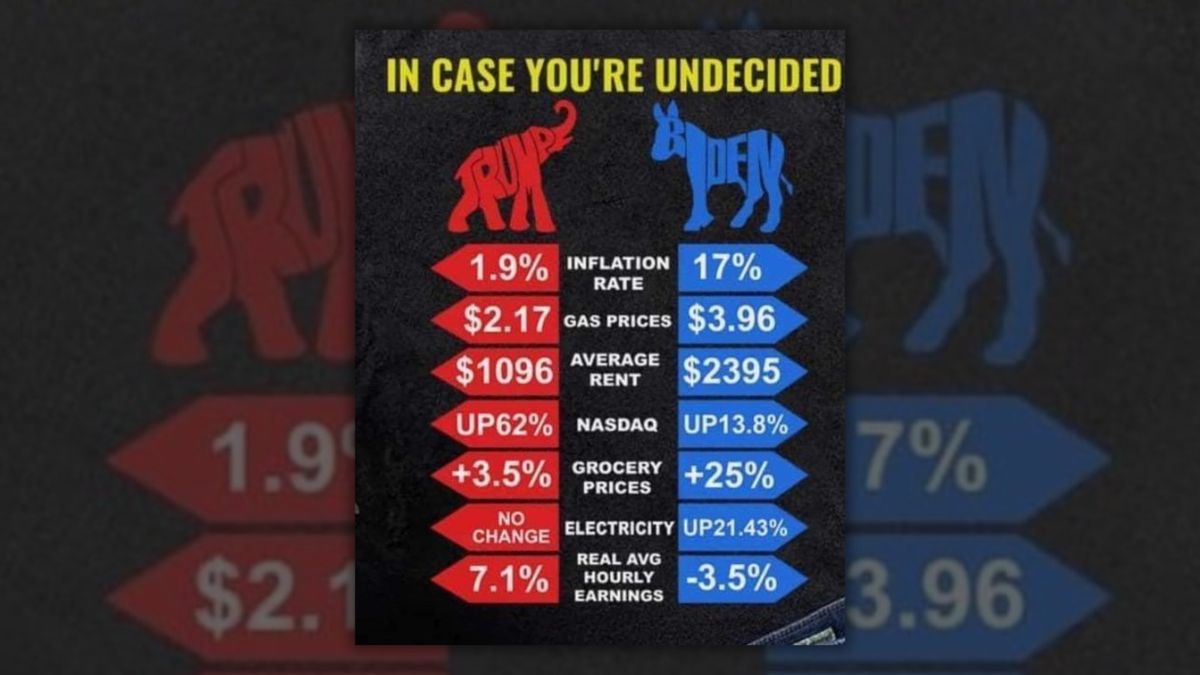

- Historical Context: The trade dispute began with the Trump administration's imposition of tariffs on various Chinese goods, escalating into a tit-for-tat exchange of tariffs between the two economic superpowers.

- Investor Confidence: Uncertainty surrounding trade policies erodes investor confidence, leading to increased market volatility and potential capital flight.

- Global Economic Impact: Trade wars disrupt global supply chains, increasing production costs and potentially slowing down global economic growth. Specific sectors, like technology and manufacturing, are particularly vulnerable.

Examples of the impact:

- Tariffs on Chinese technology products have led to increased costs for US businesses and consumers.

- Trade disputes have impacted supply chains for various goods, leading to shortages and price increases.

- Negative news regarding trade negotiations often triggers immediate sell-offs in global stock markets.

Analyzing Today's Dow Futures Movement

Analyzing the current Dow Futures movement requires a multifaceted approach, combining technical and fundamental analysis. Today's movement is largely influenced by the ongoing developments in US-China trade relations. For example, positive news regarding trade negotiations often leads to an increase in Dow Futures prices, while negative news results in a decline.

Current market indicators:

- Dow Futures Price: [Insert current Dow Futures price here - this will need to be updated regularly].

- Trading Volume: [Insert current trading volume here - this will need to be updated regularly].

- Support and Resistance Levels: [Identify key support and resistance levels based on current chart analysis - this will need to be updated regularly].

- Technical Indicators: [Discuss relevant technical indicators like moving averages, RSI, MACD, etc. – this will need to be updated regularly].

Predicting Future Dow Futures Movement Based on US-China Trade Dynamics

Predicting the future movement of Dow Futures is inherently challenging, but considering various scenarios related to US-China trade dynamics is crucial. The outcome of ongoing trade negotiations and future policy decisions will significantly influence market sentiment.

Potential scenarios:

- Resolution of Trade Disputes: A successful resolution of trade disputes could boost investor confidence and lead to a rise in Dow Futures prices.

- Escalation of Trade War: Further escalation of the trade war could significantly depress market sentiment and lead to a decline in Dow Futures prices.

- Uncertain Future: Prolonged uncertainty surrounding trade relations could maintain high levels of market volatility.

Investor strategies:

- Risk Management: Diversifying your investment portfolio is crucial in navigating a volatile market.

- Long-Term vs. Short-Term Strategies: Long-term investors might consider dollar-cost averaging to mitigate risk, while short-term traders may adopt more speculative strategies.

Conclusion: Navigating the Stock Market Amidst US-China Trade Tensions – A Look at Dow Futures

Our analysis highlights the significant correlation between US-China trade tensions and the movement of Dow Futures. Understanding the Dow Futures market and its sensitivity to geopolitical events like trade wars is vital for effective market analysis and investment decision-making. Staying informed about the latest developments in US-China trade relations and their impact on global markets is crucial for investors. Subscribe to our newsletter for regular updates on Dow Futures analysis and US-China trade developments. For more in-depth analysis of Dow futures and the stock market, consult reputable financial news sources and market analysis platforms. Stay tuned for further insights into Dow Futures analysis, US-China trade impact, stock market insights, and market trends.

Featured Posts

-

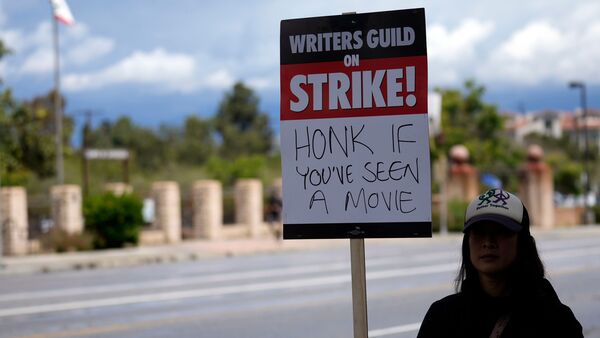

Double Trouble In Hollywood Writers And Actors Strikes Halt Production

Apr 26, 2025

Double Trouble In Hollywood Writers And Actors Strikes Halt Production

Apr 26, 2025 -

Ai Regulation Showdown Trump Administration Vs Europe

Apr 26, 2025

Ai Regulation Showdown Trump Administration Vs Europe

Apr 26, 2025 -

Meta Under Trump Zuckerbergs Challenges And Opportunities

Apr 26, 2025

Meta Under Trump Zuckerbergs Challenges And Opportunities

Apr 26, 2025 -

Actors Join Writers Strike The Full Impact On Hollywood

Apr 26, 2025

Actors Join Writers Strike The Full Impact On Hollywood

Apr 26, 2025 -

Point72 Traders Exit As Emerging Markets Focused Fund Closes

Apr 26, 2025

Point72 Traders Exit As Emerging Markets Focused Fund Closes

Apr 26, 2025