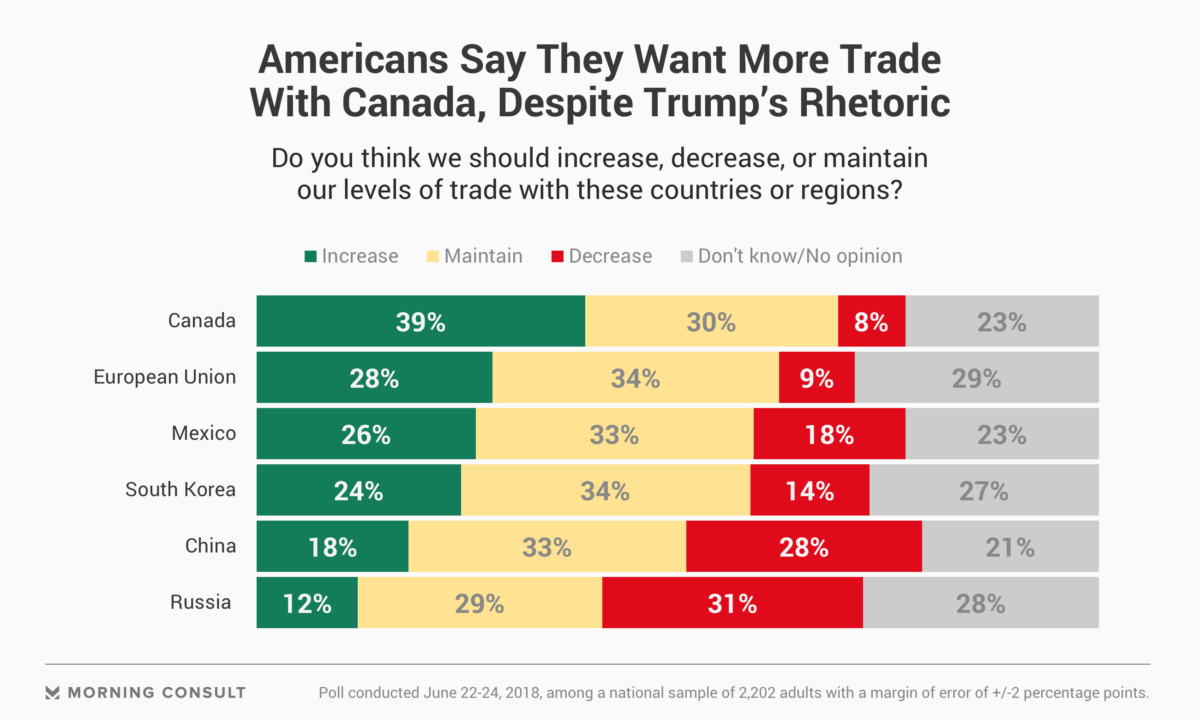

April 23rd Stock Market Summary: Dow, S&P 500, And Key Indicators

Table of Contents

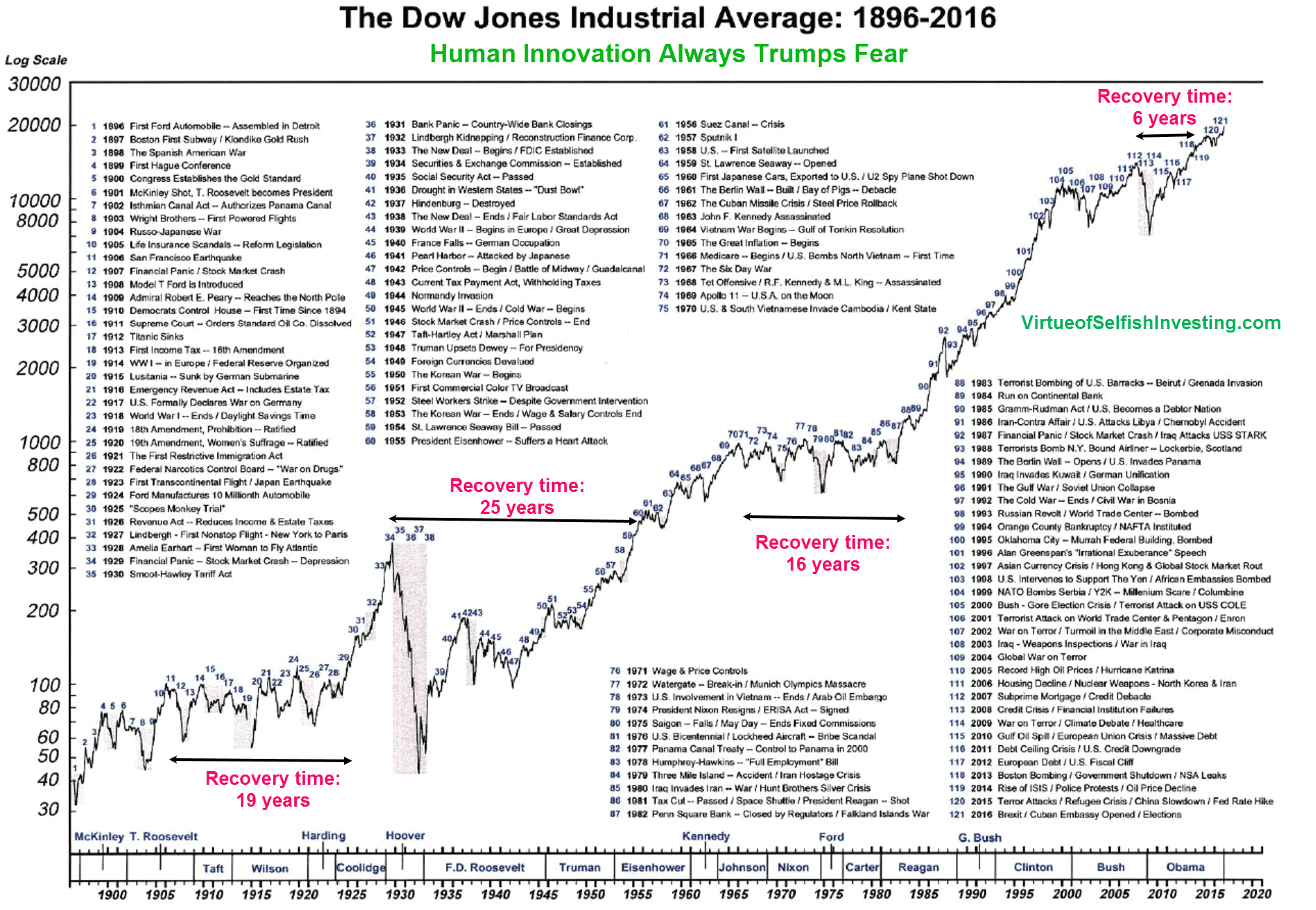

Dow Jones Industrial Average (DJIA) Performance on April 23rd

Opening, High, Low, and Closing Prices:

The Dow Jones Industrial Average opened at 33,820.68. Throughout the day, it reached a high of 34,050.22 and a low of 33,770.85, eventually closing at 33,973.49. This represents a positive percentage change of approximately 0.45%. This positive close, however, masked some underlying volatility.

Factors Influencing the Dow's Movement:

Several factors contributed to the Dow's movement on April 23rd. These included:

- Positive Earnings Reports: Strong earnings reports from several key Dow components, particularly in the technology and consumer discretionary sectors, boosted investor confidence.

- Easing Inflation Concerns: Recent economic data suggested a potential slowdown in inflation, leading to a more optimistic market outlook. This eased concerns about aggressive interest rate hikes from the Federal Reserve.

- Geopolitical Developments: Ongoing geopolitical events continued to cast a shadow, creating some uncertainty in the market. However, their impact was less pronounced than in previous days.

Sector Performance within the Dow:

Sector performance within the Dow was mixed:

- Best Performing Sectors: Technology and consumer discretionary sectors outperformed, fueled by strong earnings and positive investor sentiment.

- Worst Performing Sectors: Energy and materials sectors experienced slight declines, potentially reflecting concerns about global economic growth.

S&P 500 Performance on April 23rd

Opening, High, Low, and Closing Prices:

The S&P 500 opened at 4,141.73, reached a high of 4,161.12, and a low of 4,133.58 before closing at 4,150.07. This represents a positive percentage change of approximately 0.20%.

Comparison with Dow Performance:

Both the Dow and the S&P 500 showed positive movement on April 23rd, although the Dow experienced a slightly more significant increase. This divergence highlights that the broader market, reflected in the S&P 500, moved less dramatically than the specific 30 companies that make up the Dow Jones Industrial Average.

- Similarities: Both indices reflected a positive response to easing inflation concerns and positive corporate earnings.

- Differences: The Dow's greater percentage increase could be attributed to the weight of its high-performing technology components.

Broader Market Trends Reflected in the S&P 500:

The S&P 500's performance reflects a cautious optimism in the market. While positive economic data and earnings boosted investor confidence, concerns about ongoing geopolitical risks and potential future interest rate hikes remain.

- Market Sentiment: Overall, market sentiment remained relatively positive but with continued underlying volatility.

Key Market Indicators on April 23rd

Volume and Volatility:

Trading volume on April 23rd was moderate. Market volatility, as measured by the VIX, showed a slight decrease, suggesting a reduction in uncertainty compared to previous days. This decrease, however, shouldn't be interpreted as a signal of complete market calm.

- Significance: Moderate volume and reduced volatility indicate a period of consolidation following recent market fluctuations.

Other Relevant Indicators:

Other key indicators also provided insights into market dynamics. Bond yields saw a slight decline, indicating some easing of inflation concerns. The Nasdaq Composite performed similarly to the S&P 500, showing a modest positive close.

- Implications: The slight decline in bond yields and the positive performance of the Nasdaq Composite further supported the positive but cautious market sentiment.

April 23rd Stock Market Summary: Key Takeaways and Future Outlook

The April 23rd stock market summary reveals a day of positive but cautious market movement. Both the Dow Jones Industrial Average and the S&P 500 closed higher, driven by positive earnings, easing inflation concerns, and relatively muted reactions to ongoing geopolitical events. However, underlying volatility remained, indicating that the market's path is not entirely clear. The performance of various market indicators further reinforced this mixed outlook. While making concrete predictions is always risky, the day's events suggest that monitoring economic data and global developments remains crucial for understanding future market trends.

To stay informed about daily stock market summaries and gain insights into the performance of the Dow Jones, S&P 500, and other key market indicators, subscribe to our regular updates! For in-depth analysis and further research, consider exploring reputable financial news sources and market analysis tools. Stay informed, and make smart investment decisions.

Featured Posts

-

Us Dollar Rises As Trumps Criticism Of Fed Chair Powell Subsides

Apr 24, 2025

Us Dollar Rises As Trumps Criticism Of Fed Chair Powell Subsides

Apr 24, 2025 -

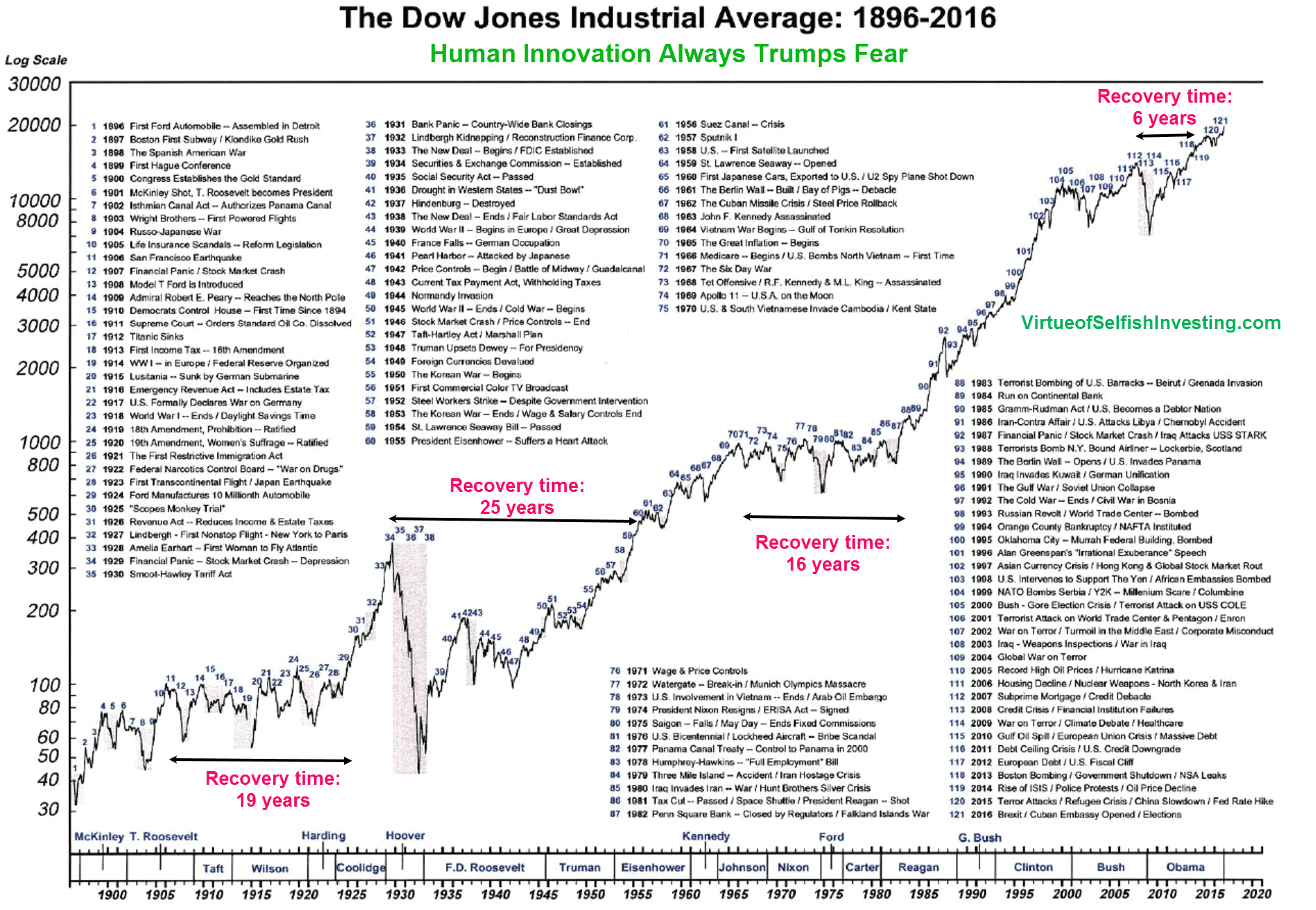

Sk Hynix New Dram Leader Thanks To Ai Advancements

Apr 24, 2025

Sk Hynix New Dram Leader Thanks To Ai Advancements

Apr 24, 2025 -

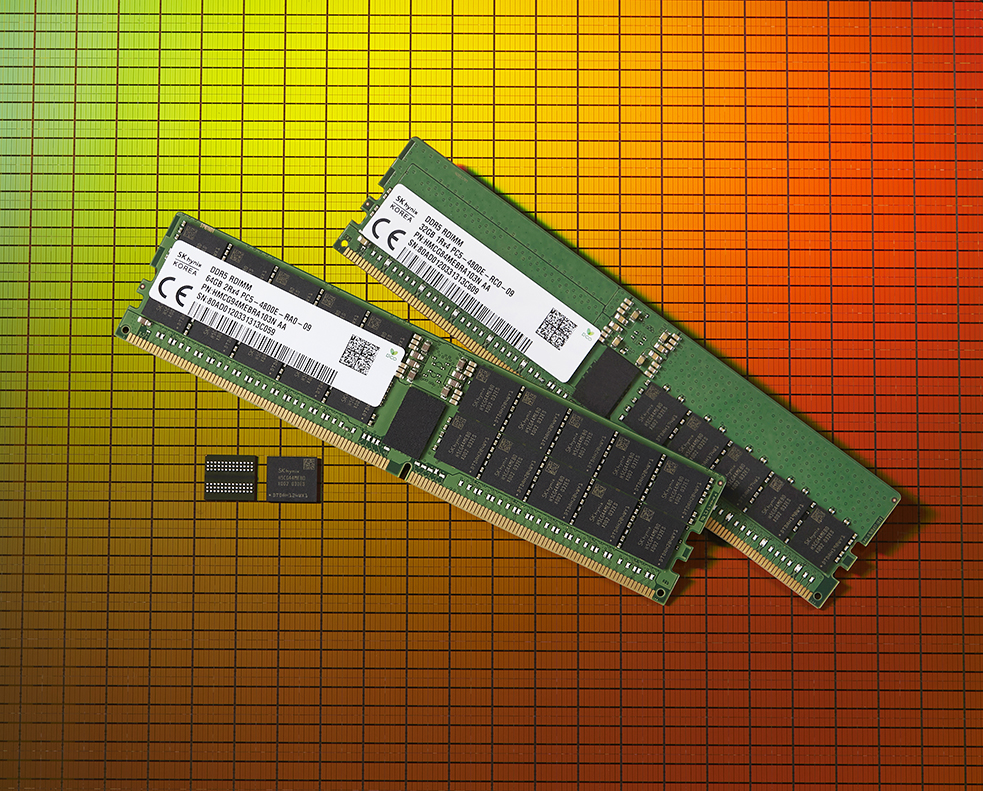

Five Point Plan From Canadian Auto Dealers Addresses Us Trade War Threat

Apr 24, 2025

Five Point Plan From Canadian Auto Dealers Addresses Us Trade War Threat

Apr 24, 2025 -

Mahmoud Khalil Columbia Student Denied Permission To Witness Sons Birth By Ice

Apr 24, 2025

Mahmoud Khalil Columbia Student Denied Permission To Witness Sons Birth By Ice

Apr 24, 2025 -

The Critical Role Of Middle Managers In Organizational Effectiveness

Apr 24, 2025

The Critical Role Of Middle Managers In Organizational Effectiveness

Apr 24, 2025