Are Stretched Stock Market Valuations Justified? BofA Weighs In.

Table of Contents

Keywords: Stretched stock market valuations, BofA, stock market valuation, justified stock prices, market outlook, investment strategy, stock market analysis, high stock valuations, valuation multiples, economic growth, interest rates, inflation

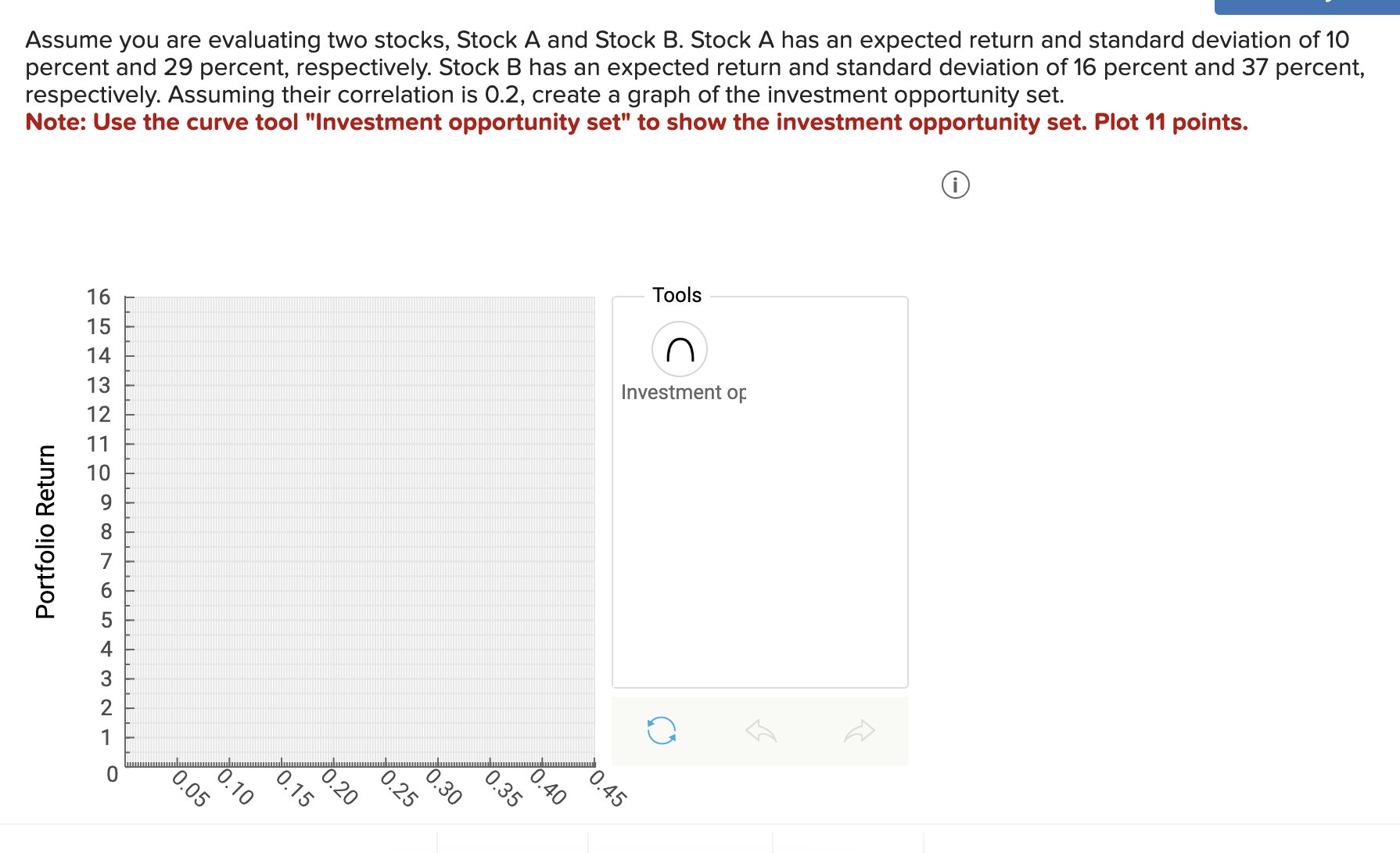

The question on every investor's mind: are current high stock market valuations justified? Bank of America (BofA), a financial giant with significant market insight, recently weighed in on this crucial issue. Understanding BofA's perspective, along with the supporting arguments and potential risks, is vital for navigating the current market landscape and making informed investment decisions. This article delves into the complexities of stretched stock market valuations and offers a path toward a more strategic investment approach.

BofA's Assessment of Current Market Valuations

BofA's assessment of current market valuations is nuanced, reflecting the inherent complexities of the situation. While they haven't explicitly declared a blanket "overvalued" or "undervalued" verdict, their analysis points towards a market exhibiting signs of being stretched. Their cautious outlook highlights the need for investors to proceed with prudence.

- Key Metrics BofA Uses: BofA employs various valuation multiples to gauge market health, including:

- Price-to-Earnings (P/E) ratios: Comparing a company's stock price to its earnings per share. Elevated P/E ratios often suggest higher valuations.

- Price-to-Sales (P/S) ratios: Comparing a company's stock price to its revenue per share. This metric is particularly useful for evaluating companies with low or negative earnings.

- Dividend yields: Examining the dividend payout relative to the stock price. Lower yields can indicate higher valuations.

- Specific Sectors: BofA's research often pinpoints specific sectors showing signs of overvaluation, frequently technology and growth stocks which have seen significant price appreciation. Conversely, some cyclical sectors might be identified as potentially undervalued, depending on the economic forecast.

- BofA's Market Predictions: BofA's market predictions are usually presented with cautionary notes, acknowledging the inherent uncertainties involved. Their forecasts often include scenarios ranging from modest growth to potential corrections, depending on macroeconomic factors and geopolitical events.

Factors Supporting High Stock Market Valuations

Despite BofA's cautious tone, several factors support the currently high stock market valuations:

- Strong Corporate Earnings Growth: Many companies have reported robust earnings growth in recent years, fueled by post-pandemic recovery and increased consumer spending. This positive performance can justify higher stock prices to some extent.

- Low Interest Rates (Historically): While interest rates are rising, historically low interest rates for an extended period made borrowing cheaper for companies and fueled investment, contributing to higher stock valuations. This is less of a factor now with rates rising.

- Technological Innovation: Technological advancements continue to drive growth in specific sectors, leading to increased investor interest and higher valuations for companies at the forefront of innovation. Artificial Intelligence, for example, is a key area driving valuations.

- Government Stimulus Packages: Government stimulus measures, while potentially inflationary, have injected significant capital into the economy, boosting corporate earnings and supporting market growth.

- Increased Investor Confidence (Historically): Periods of increased investor confidence, often driven by positive economic indicators, can lead to higher stock prices as investors become more willing to take on risk. This sentiment can shift rapidly.

The Role of Inflation and Interest Rate Hikes

Inflation and rising interest rates significantly impact stock valuations:

- Inflation's Impact: Inflation erodes the purchasing power of money, reducing the real value of corporate earnings and potentially lowering stock prices. High inflation often leads to central bank intervention.

- Interest Rate Hikes' Impact: Increased interest rates raise borrowing costs for corporations, potentially impacting profitability and slowing down economic growth. This can lead to lower corporate earnings and reduced stock valuations.

- Potential Market Correction: The combined effect of inflation and rising interest rates increases the potential for a market correction or even a more significant downturn, as investors re-evaluate their risk tolerance.

Risks and Potential Drawbacks of High Valuations

Investing in a market with stretched valuations carries significant risks:

- Increased Risk of Market Correction: High valuations often precede market corrections or crashes, as prices become unsustainable. A sharp downturn can lead to significant losses.

- Lower Potential Returns: Investing at high valuations generally leads to lower potential returns compared to investing at lower valuations. The potential for substantial gains is reduced.

- Vulnerability to Economic Downturns: A highly valued market is more vulnerable to economic downturns or unexpected events, as investor sentiment can shift rapidly.

- Impact on Long-Term Strategies: High valuations can disrupt long-term investment strategies, requiring adjustments to portfolio allocation and risk management.

Alternative Investment Strategies in a High-Valuation Market

Investors concerned about stretched stock market valuations should consider alternative strategies:

- Diversification: Diversifying across different asset classes, such as bonds, real estate, and commodities, can reduce overall portfolio risk.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer better risk-adjusted returns in a high-valuation market.

- Defensive Investing: Prioritizing stability and dividend income over high growth can provide downside protection during market corrections.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of market fluctuations, can help mitigate risk and reduce the impact of market volatility.

Conclusion

BofA's perspective on stretched stock market valuations underscores the need for caution and careful consideration. While factors like strong corporate earnings and technological innovation support current prices, the risks associated with inflation, rising interest rates, and the potential for a market correction cannot be ignored. Understanding these opposing forces is key to developing a well-informed investment strategy. Carefully evaluate your investment portfolio in light of BofA's assessment of stretched stock market valuations and the factors discussed in this article. Conduct thorough research and consult with a financial advisor before making any significant investment decisions. Further reading on valuation metrics and economic forecasts will further enhance your understanding of the current market landscape.

Featured Posts

-

Njwm Ealmywn Yushelwn Mhrjan Abwzby Fy Dwrth Al 22

Apr 28, 2025

Njwm Ealmywn Yushelwn Mhrjan Abwzby Fy Dwrth Al 22

Apr 28, 2025 -

What Luigi Mangiones Supporters Want You To Know

Apr 28, 2025

What Luigi Mangiones Supporters Want You To Know

Apr 28, 2025 -

Albertas Dow Project Delay Collateral Damage From Tariffs

Apr 28, 2025

Albertas Dow Project Delay Collateral Damage From Tariffs

Apr 28, 2025 -

Perplexity Ceo The Fight For Ai Browser Dominance Against Google

Apr 28, 2025

Perplexity Ceo The Fight For Ai Browser Dominance Against Google

Apr 28, 2025 -

Vancouver Housing Rent Growth Slowdown High Costs Persist

Apr 28, 2025

Vancouver Housing Rent Growth Slowdown High Costs Persist

Apr 28, 2025