AT&T Exposes Extreme Cost Increase In Broadcom's VMware Proposal

Table of Contents

AT&T's Concerns Regarding Increased Costs

AT&T's apprehension stems from a substantial increase in the projected costs associated with Broadcom's takeover of VMware. The telecommunications giant hasn't minced words, highlighting the significant financial burden this cost escalation could represent, not only for itself but also for the broader industry.

-

Specific Cost Increase: While the exact figures remain partially undisclosed, AT&T's statements indicate a percentage increase in the projected costs far exceeding initial estimates. Reports suggest a potential increase in the tens of billions of dollars, a figure that dwarfs earlier projections.

-

Impact on AT&T's Services and Infrastructure: This unexpected cost jump could severely impact AT&T's ability to seamlessly integrate VMware's services into its infrastructure. Potential delays in upgrades and limitations on future expansion are significant concerns.

-

Negative Impact on AT&T's Customers: The increased costs could ultimately trickle down to AT&T's customers, potentially leading to higher prices for services or reduced quality due to budgetary constraints.

-

AT&T's Potential Response: AT&T's response remains to be seen, but it is likely to involve close scrutiny of Broadcom's justifications, potential negotiations for more favorable terms, or even legal challenges if deemed necessary.

Analysis of Broadcom's Justification for Increased Costs

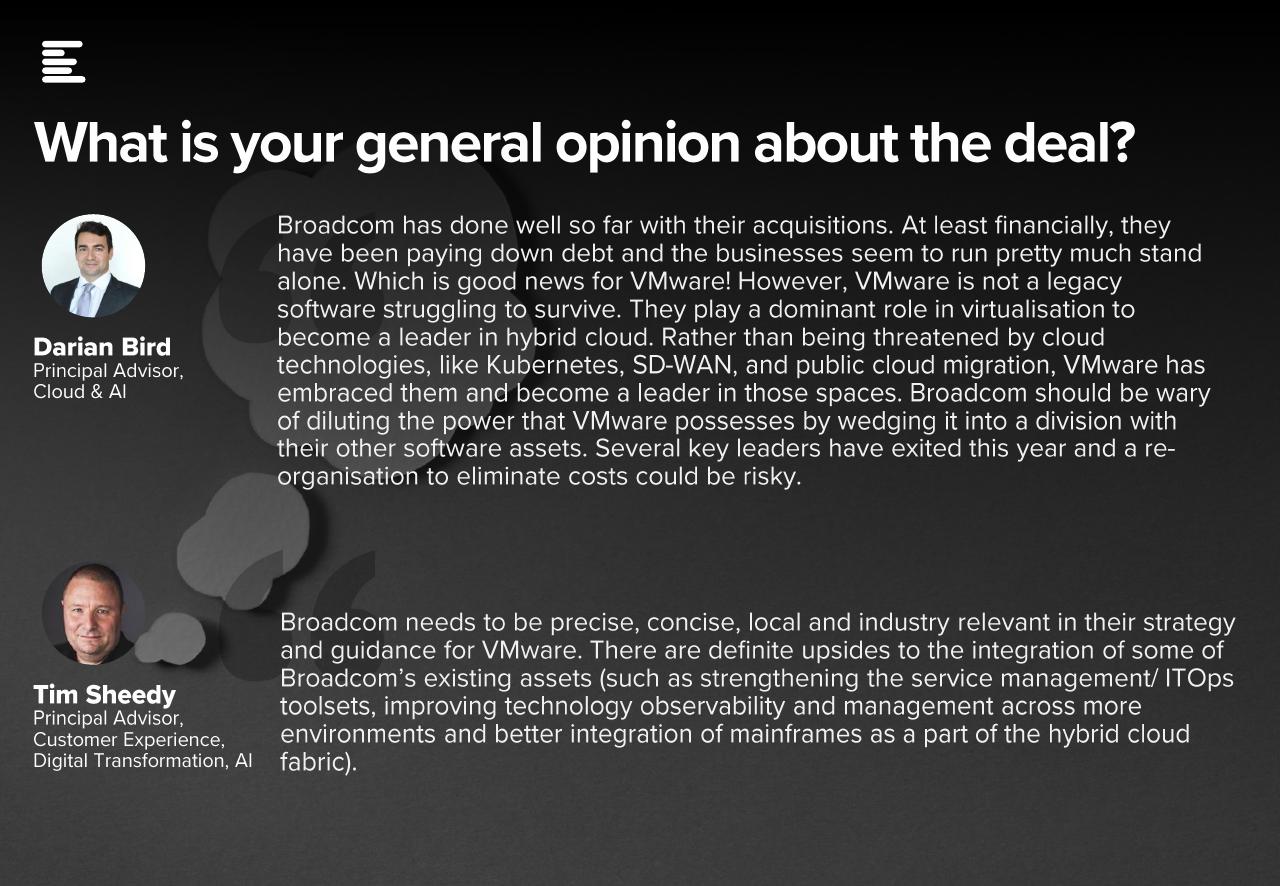

Broadcom has yet to offer a fully transparent explanation for the dramatic cost increase in its VMware proposal. However, initial justifications center around the increased valuation of VMware's assets and market position.

-

Broadcom's Arguments: Broadcom's arguments largely revolve around the strategic value of VMware's technology portfolio and its potential for future growth and synergies within Broadcom's existing business.

-

Credibility of Justification: The credibility of Broadcom's justifications is currently being debated by analysts and industry experts. The sheer magnitude of the cost increase raises skepticism regarding the transparency and accuracy of Broadcom's valuation.

-

Potential Loopholes and Inconsistencies: Concerns exist regarding potential inconsistencies in Broadcom’s financial modeling and the lack of detailed disclosure regarding the factors contributing to the massive cost increase.

-

Expert Opinions: Several industry analysts have expressed reservations about the justification provided by Broadcom, highlighting potential overestimation of VMware's future value and a lack of clear synergies that could justify such a dramatic cost increase.

Potential Impact on the VMware Acquisition

AT&T's objections and the revealed cost increase have cast a significant shadow over the future of Broadcom's VMware proposal.

-

Renegotiation or Failure of the Deal: The possibility of renegotiation or even the failure of the deal is now a very real prospect. AT&T's public concerns could embolden other stakeholders to question the deal's terms.

-

Impact on VMware's Shareholders: VMware shareholders, initially anticipating a significant payout, now face uncertainty, with the potential for a lower offer price or a complete collapse of the deal.

-

Effects on the Broader Technology Market and Competition: The outcome of this acquisition will significantly shape the competitive landscape of the enterprise software market. A failed deal could benefit competitors, while a finalized deal under revised terms could still create a dominant player.

-

Regulatory Scrutiny: The dramatic cost increase may invite increased regulatory scrutiny from antitrust authorities, who will carefully examine the deal's implications for competition and market dominance.

The Broader Implications of this Deal for the Tech Industry

Regardless of the ultimate outcome, the Broadcom's VMware proposal and its associated cost escalation highlights significant issues within the tech industry’s mergers and acquisitions landscape.

-

Future M&A Activity: This situation serves as a cautionary tale for future large-scale tech mergers and acquisitions, underscoring the importance of thorough due diligence and transparent cost projections.

-

Pricing and Competition: The deal's final terms, whatever they may be, will send a signal about the acceptable level of premiums in future tech acquisitions and the extent to which antitrust regulators will allow consolidation in the sector.

Conclusion: The Future of Broadcom's VMware Proposal and Cost Implications

AT&T's concerns regarding the dramatic cost increase in Broadcom's VMware proposal highlight significant risks associated with the deal. The potential impact on the acquisition process, the broader technology market, and the financial well-being of stakeholders is undeniable. The significant financial implications revealed by AT&T raise serious questions about the transparency and fairness of Broadcom's valuation. To stay informed about the ongoing developments in this crucial acquisition, follow the latest updates on the Broadcom VMware acquisition and learn more about the escalating costs involved in Broadcom's bid for VMware.

Featured Posts

-

Nancy Mace Faces Heated Confrontation With Constituent In South Carolina

Apr 24, 2025

Nancy Mace Faces Heated Confrontation With Constituent In South Carolina

Apr 24, 2025 -

Liberal Spending Habits Is Canada On A Sustainable Path

Apr 24, 2025

Liberal Spending Habits Is Canada On A Sustainable Path

Apr 24, 2025 -

Elite Colleges Respond To Potential Funding Losses Under The Trump Presidency

Apr 24, 2025

Elite Colleges Respond To Potential Funding Losses Under The Trump Presidency

Apr 24, 2025 -

Is The Lg C3 77 Inch Oled Worth The Hype A User Review

Apr 24, 2025

Is The Lg C3 77 Inch Oled Worth The Hype A User Review

Apr 24, 2025 -

Investigation Into Persistent Toxic Chemicals Following Ohio Train Derailment

Apr 24, 2025

Investigation Into Persistent Toxic Chemicals Following Ohio Train Derailment

Apr 24, 2025