Bank Of Canada Holds Rates: Insights From FP Video's Economic Experts

Table of Contents

Reasons Behind the Bank of Canada's Rate Hold

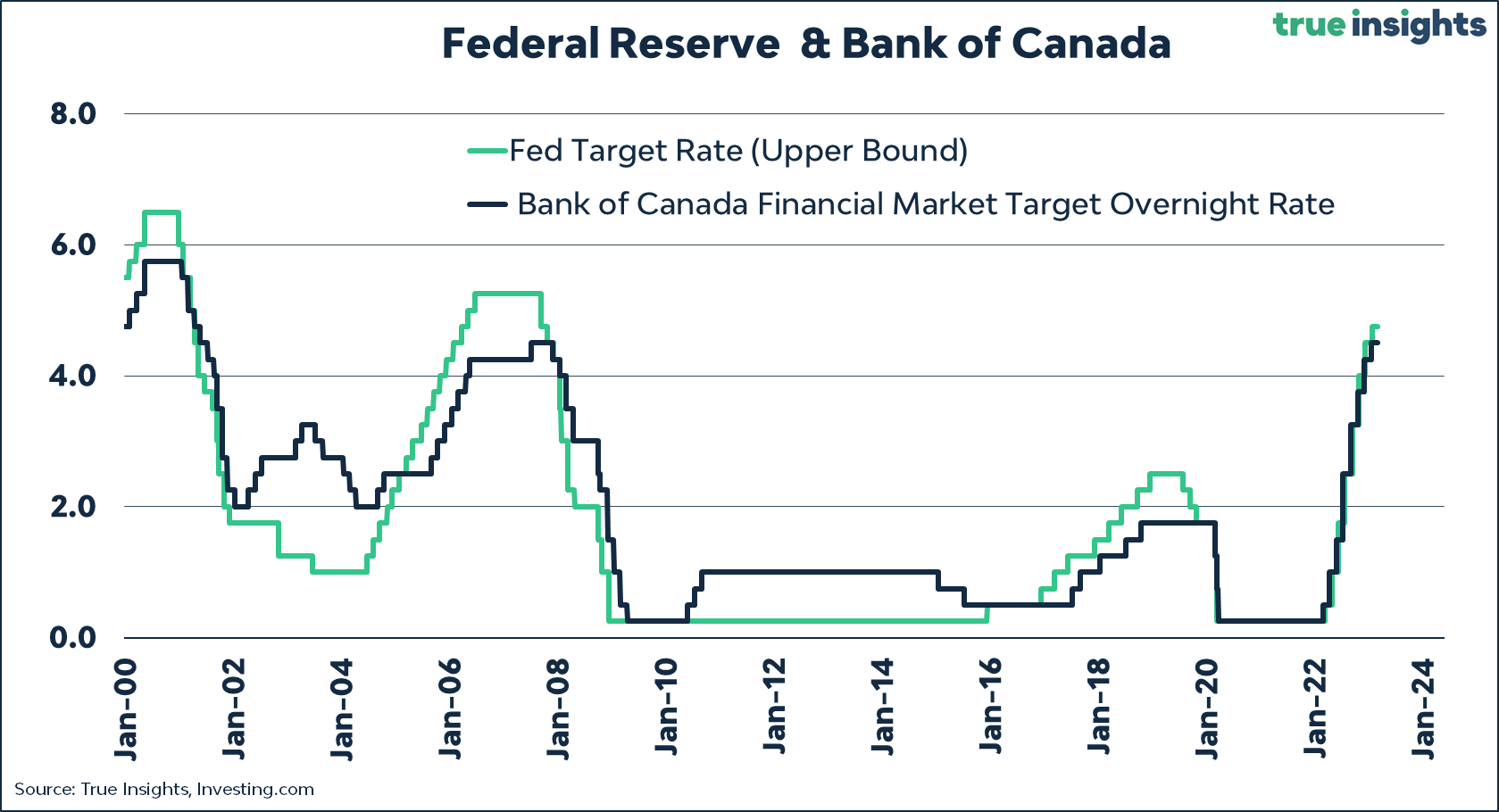

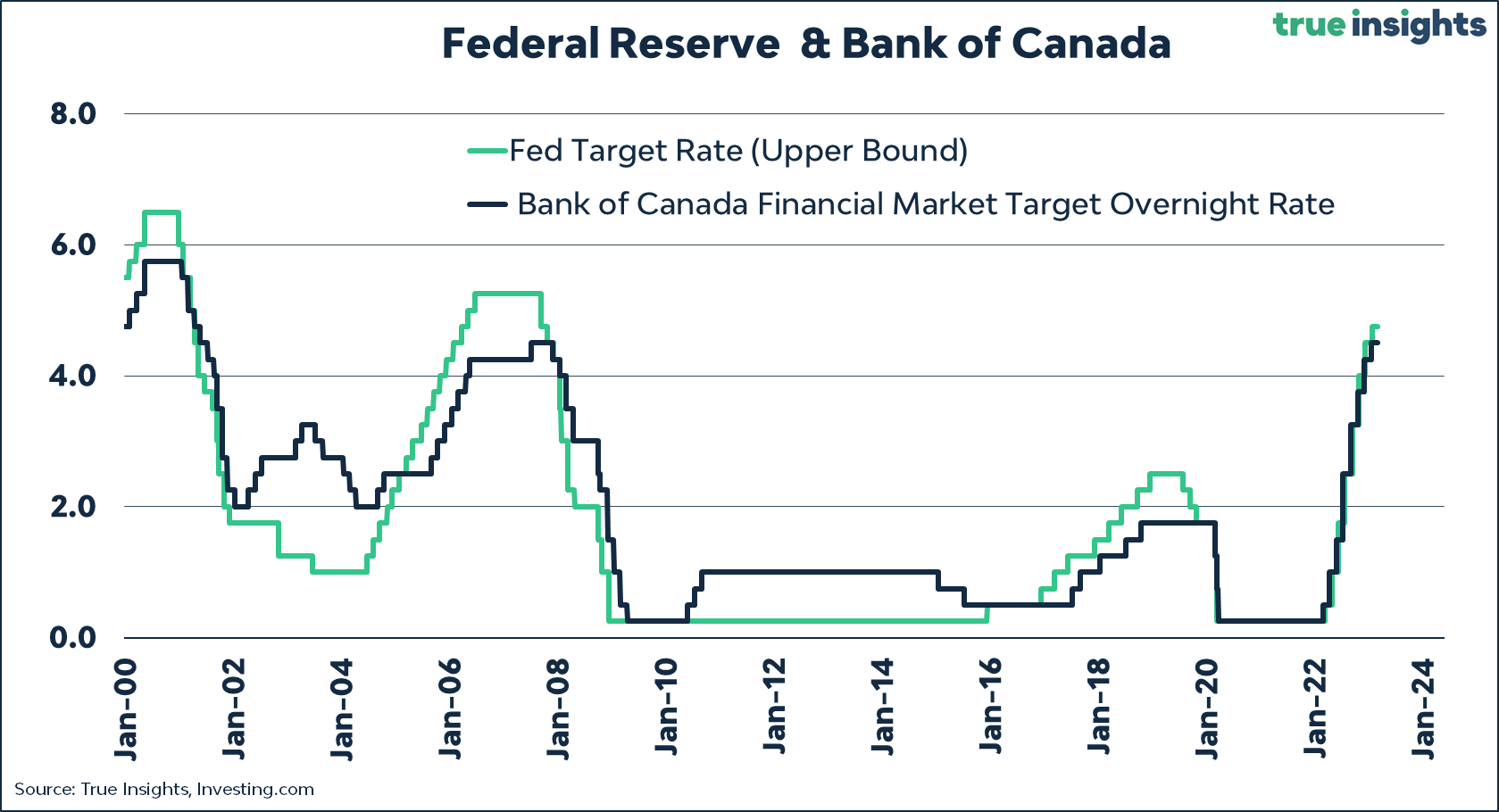

The Bank of Canada's decision to hold interest rates reflects a careful consideration of several key economic indicators. Their monetary policy is guided by factors such as inflation rate, employment rate, and GDP growth. The Bank of Canada statement often provides detailed explanations of these considerations.

- Inflation Rate: While inflation remains a concern, recent data suggests a slowing trend. This gives the Bank some breathing room to assess the effectiveness of previous rate hikes and gauge the true trajectory of inflation before implementing further measures.

- Employment Rate: Employment figures have remained relatively stable, indicating a resilient labour market. This stability contributes to the Bank's cautious approach, as a strong job market can sometimes fuel inflationary pressures.

- GDP Growth: Economic growth remains uncertain, with varying projections for the future. This uncertainty necessitates a wait-and-see approach from the Bank, allowing them to gather more data before making significant adjustments to monetary policy.

- Wait-and-See Approach: The Bank of Canada is adopting a strategy of careful observation. They are likely monitoring the impact of previous rate increases and seeking clarity on the evolving economic landscape before deciding on any further rate adjustments. This reflects a measured approach to managing inflation while supporting sustainable economic growth.

Impact on the Canadian Economy

The Bank of Canada's decision to hold rates will have both short-term and long-term impacts on various sectors of the Canadian economy.

- Housing Market Canada: The hold could provide some relief to the housing market, potentially preventing further price declines. However, the long-term effects remain uncertain and depend on other factors influencing the market.

- Consumer Spending: Maintaining current borrowing rates could support consumer spending, as individuals will not face immediate increases in their debt servicing costs. However, persistent inflation may still erode purchasing power.

- Business Investment: Stable interest rates can encourage businesses to proceed with planned investments, fostering economic growth. However, uncertainty around the economic outlook might still temper investment enthusiasm.

- Borrowing and Savings Rates: Existing borrowers will experience no immediate change in their mortgage or loan payments, while savers will continue to receive current interest rates on their deposits.

Expert Opinions from FP Video

FP Video's team of economic experts offers valuable insights into the Bank of Canada's decision and its implications. Their financial analysis provides a comprehensive perspective on the current market outlook.

- Expert 1's viewpoint: [Insert quote from FP Video expert 1 on future rate changes, emphasizing their reasoning and predictions.]

- Expert 2's assessment: [Insert quote from FP Video expert 2 on economic risks, highlighting their concerns and potential scenarios.]

- Expert 3's prediction: [Insert quote from FP Video expert 3 on inflation predictions, providing their forecast for the coming months and the factors influencing their outlook.]

What to Expect Next

Predicting future interest rates is always challenging. The Canadian economic outlook remains subject to a number of uncertainties and potential risks, both domestically and internationally.

- Future Interest Rate Announcements: The next Bank of Canada interest rate announcement is highly anticipated. The decision will likely hinge on the evolving inflation figures, employment data, and overall economic growth.

- Influencing Factors: Several factors could influence future decisions, including global economic conditions, geopolitical events, and changes in domestic consumer and business confidence.

- Potential Challenges: The Canadian economy faces various challenges, such as persistent inflation, supply chain disruptions, and the potential for a global economic slowdown. These factors will play a key role in shaping the Bank's future monetary policy.

Conclusion: Understanding the Bank of Canada's Rate Hold and What's Next

The Bank of Canada's decision to hold interest rates reflects a cautious approach to navigating the current economic climate. Understanding the implications of this decision, as analyzed by FP Video's economic experts, is crucial for both individuals and businesses. The potential impacts on the housing market, consumer spending, and business investment are significant, requiring careful consideration and planning. To stay informed on the evolving situation and the implications of future Bank of Canada interest rate decisions, watch FP Video for more in-depth analysis and insightful commentary. Stay updated on future Bank of Canada announcements and their impact on Bank of Canada interest rates.

Featured Posts

-

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 22, 2025

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 22, 2025 -

Tik Tok And Tariffs Decoding The Just Contact Us Phenomenon

Apr 22, 2025

Tik Tok And Tariffs Decoding The Just Contact Us Phenomenon

Apr 22, 2025 -

Kyivs Response To Trumps Plan For Ending The Ukraine Conflict

Apr 22, 2025

Kyivs Response To Trumps Plan For Ending The Ukraine Conflict

Apr 22, 2025 -

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025 -

Trump Protests A Nationwide Uprising

Apr 22, 2025

Trump Protests A Nationwide Uprising

Apr 22, 2025