BofA Analyzes High Stock Market Valuations: Should Investors Be Worried?

Table of Contents

BofA's Key Findings on High Stock Market Valuations

BofA's recent report expresses significant concern about current stock market valuations, suggesting they are stretched and potentially unsustainable. Their analysis utilizes several key metrics to arrive at this conclusion.

-

Specific Valuation Metrics: BofA's analysis likely incorporates several widely used valuation metrics, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), and potentially other measures like the price-to-sales ratio (P/S) and price-to-book ratio (P/B). These metrics compare current market prices to historical earnings and other fundamentals to gauge whether stocks are trading at a premium or discount.

-

Overvalued Sectors and Stocks: While the specific stocks and sectors identified as overvalued may not be publicly detailed in every BofA report, their analysis generally points towards certain areas exhibiting particularly high valuations. These may include sectors that have experienced rapid growth recently, leading to inflated expectations baked into stock prices. Tech stocks, for example, are often subject to this scrutiny during periods of high market valuations.

-

Overall Assessment: BofA's overall assessment, while varying slightly depending on the report, generally indicates a cautious outlook. The bank likely emphasizes the increased risk associated with investing in a market where valuations are historically high compared to various economic indicators. This doesn't necessarily predict an immediate crash, but rather signals a higher probability of market corrections and lower potential for future returns.

Understanding the Risks Associated with High Valuations

Investing in a market with high valuations carries inherent risks. While past performance is not indicative of future results, history offers valuable lessons.

-

Increased Risk of Market Corrections or Crashes: High valuations often precede market corrections or even crashes. When prices are detached from fundamentals, even a relatively small negative catalyst can trigger a sharp sell-off as investors reassess their holdings.

-

Lower Potential for Future Returns: Stocks purchased at high valuations generally offer lower potential for future returns compared to those bought at lower valuations. The inherent risk is that the return on investment may not meet expectations.

-

Vulnerability to Negative Economic News or Interest Rate Hikes: High-valuation markets are particularly vulnerable to negative economic news, such as rising inflation or slowing growth. Similarly, interest rate hikes can negatively impact stock prices, especially those of growth companies that rely on low borrowing costs.

-

Mean Reversion: The concept of "mean reversion" suggests that market valuations tend to revert to their historical averages over time. While this isn't a guaranteed outcome, it highlights the potential for a significant price correction if current high valuations prove unsustainable.

Factors That Could Support Current High Valuations

While BofA's analysis points towards elevated risk, certain factors could potentially justify, at least partially, the current high valuations.

-

Low Interest Rates: Persistently low interest rates can drive investors towards riskier assets like stocks, potentially pushing valuations higher. This increased demand for equities can inflate prices beyond what fundamental analysis would suggest.

-

Strong Corporate Earnings Growth: If corporate earnings are growing at a rapid pace, higher valuations might be more justifiable. However, sustainable earnings growth is crucial; a temporary surge in earnings won't justify persistently high valuations in the long term.

-

Technological Innovation and Disruption: Breakthrough technological advancements can lead to sustained periods of strong growth and higher valuations for companies in innovative sectors. This can temporarily support high market valuations, but careful analysis is still necessary.

-

Long-Term Economic Growth Prospects: Positive long-term economic growth prospects can bolster investor confidence and support higher stock prices. However, this needs to be carefully evaluated; short-term gains don't necessarily translate into a permanent elevation of market valuations.

Strategies for Investors to Consider in a High-Valuation Market

Given BofA's concerns and the overall market situation, investors should adopt a cautious yet proactive approach.

-

Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors can help mitigate risk. Don't put all your eggs in one basket.

-

Value Investing: Focus on identifying undervalued companies or sectors that are trading below their intrinsic value. This approach can offer better risk-adjusted returns in a high-valuation market.

-

Defensive Stocks and Asset Classes: Consider investing in defensive stocks (e.g., consumer staples, utilities) or asset classes (e.g., government bonds) that tend to perform relatively well during market downturns.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is crucial. Short-term market fluctuations should not dictate your long-term investment strategy.

-

Regular Portfolio Rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation. This helps to prevent excessive exposure to any single asset class or sector.

Conclusion

BofA's analysis of high stock market valuations underscores the potential risks for investors. While certain factors may support current prices, the elevated valuations increase the probability of corrections or lower future returns. The strategies outlined above – diversification, value investing, defensive positions, a long-term horizon, and regular rebalancing – can help investors navigate this potentially challenging market environment. Don't let high valuations leave you worried; proactively manage your portfolio based on these insights and consult with a financial advisor to develop a plan that aligns with your risk tolerance and investment goals. Learn more about managing risk in high valuation markets and understand how to tailor your investment strategy to navigate uncertainty.

Featured Posts

-

Analysis Bubba Wallaces Second Place Slip At Martinsville Restart

Apr 28, 2025

Analysis Bubba Wallaces Second Place Slip At Martinsville Restart

Apr 28, 2025 -

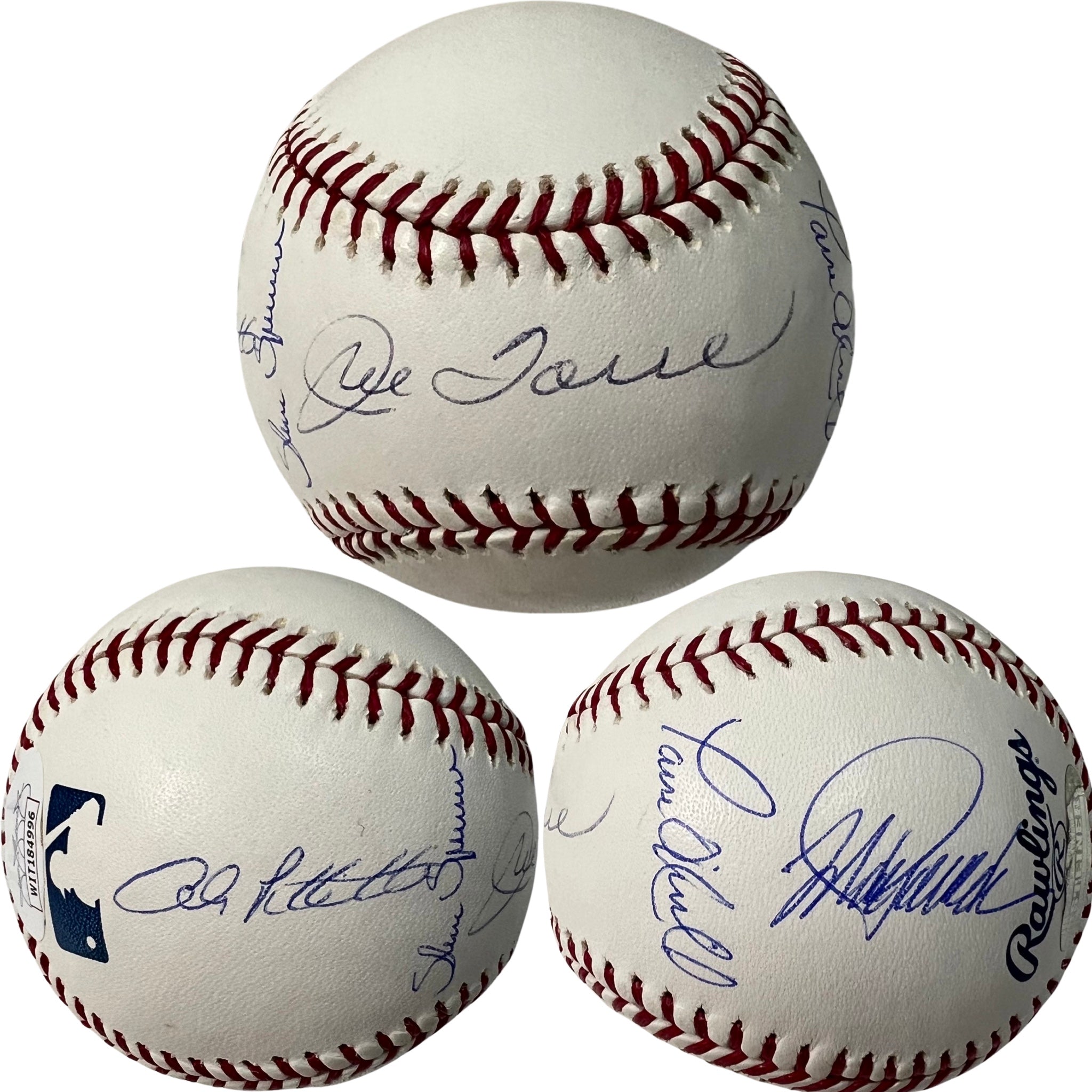

Remembering 2000 Key Moments Featuring Joe Torre And Andy Pettitte

Apr 28, 2025

Remembering 2000 Key Moments Featuring Joe Torre And Andy Pettitte

Apr 28, 2025 -

Mhrjan Abwzby Almwsyqy 22 Eama Mn Alibdae Alfny Alealmy

Apr 28, 2025

Mhrjan Abwzby Almwsyqy 22 Eama Mn Alibdae Alfny Alealmy

Apr 28, 2025 -

Watch Blue Jays Vs Yankees Free Mlb Spring Training Live Stream March 7 2025

Apr 28, 2025

Watch Blue Jays Vs Yankees Free Mlb Spring Training Live Stream March 7 2025

Apr 28, 2025 -

Virginia Giuffre A Look Back At Her Life And Accusations

Apr 28, 2025

Virginia Giuffre A Look Back At Her Life And Accusations

Apr 28, 2025