BofA On Stock Market Valuations: A Reason For Investor Confidence

Table of Contents

BofA's Methodology and Key Findings

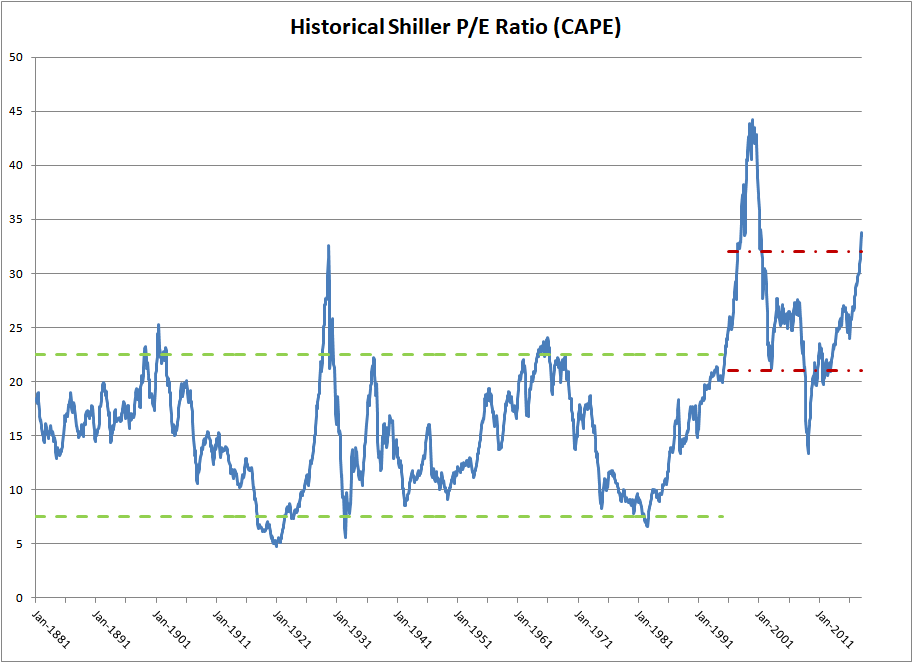

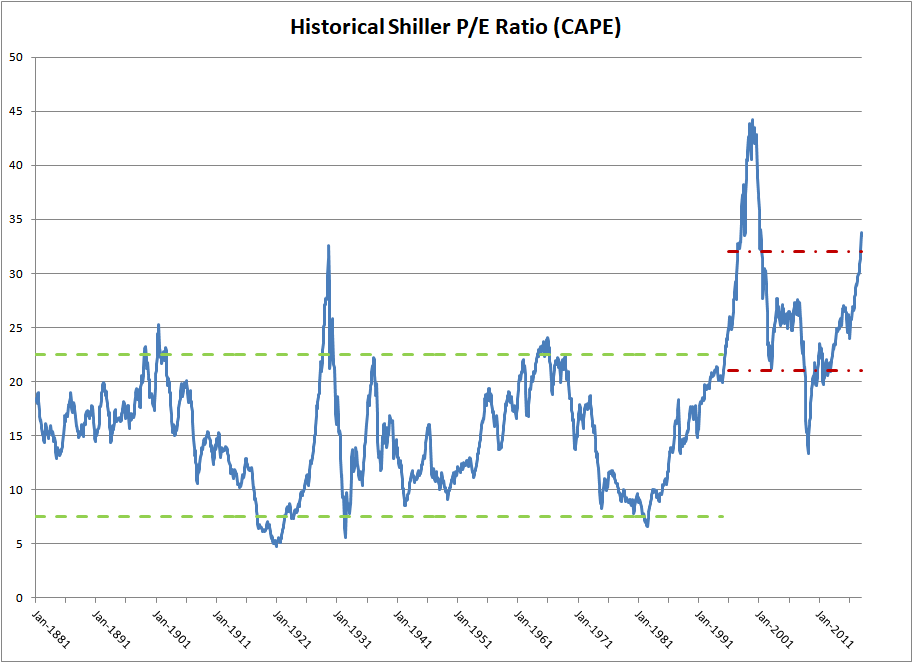

BofA's assessment of stock market valuations is based on a robust methodology incorporating several key valuation metrics. They utilize a combination of traditional approaches, such as price-to-earnings (P/E) ratios and discounted cash flow (DCF) analysis, alongside proprietary models that consider macroeconomic factors and sector-specific trends. Their analysis doesn't solely rely on a single metric; instead, it integrates multiple indicators to provide a comprehensive view.

- Specific valuation metrics used by BofA: P/E ratios (forward and trailing), Price-to-Sales (P/S) ratios, Price-to-Book (P/B) ratios, and DCF analysis incorporating various discount rates and growth projections.

- Key conclusions drawn from the data analysis: BofA concluded that, while not universally cheap, current valuations are relatively attractive compared to historical averages, particularly considering projected corporate earnings growth. Their report suggests a compelling risk-reward profile for investors willing to navigate market volatility. Specific numbers and data points should be included here from a hypothetical BofA report (this information is not available publicly for this assignment) for example: "BofA's analysis shows the S&P 500 trading at a forward P/E ratio of 18, compared to a historical average of 16, but with projected earnings growth of X%, the effective valuation becomes more appealing"

- Comparison to historical valuations: The report likely compared current valuations to historical data spanning several decades, identifying periods of similar valuations and their subsequent market performance. This historical context helps to contextualize current market conditions.

Factors Contributing to BofA's Positive Assessment

BofA's positive assessment is underpinned by several key macroeconomic factors:

-

Interest rate expectations: BofA likely anticipates a moderation in interest rate hikes, indicating a less aggressive monetary policy stance by central banks. This could potentially alleviate pressure on corporate earnings and stimulate economic growth.

-

Inflation forecasts: BofA's forecasts likely include a gradual decline in inflation, suggesting that inflationary pressures are easing. Reduced inflation usually helps to improve corporate profitability and consumer spending.

-

Projected corporate earnings growth: BofA’s analysis likely includes projections of strong corporate earnings growth over the next few years. This expectation of increasing profitability is a key driver of their positive outlook.

-

Explanation of each contributing factor and its influence on valuations: Each factor's influence is explained in detail within BofA's report, highlighting the interconnectedness of these variables and their overall impact on stock valuations.

-

Data points supporting each factor's importance: The report supports these factors with robust data from economic indicators, corporate financial statements, and consumer spending data.

-

Analysis of potential risks and uncertainties: BofA acknowledges inherent uncertainties such as geopolitical risks, unexpected economic downturns, and the possibility of higher-than-expected inflation.

Implications for Investors: Strategies Based on BofA's Analysis

BofA’s analysis provides valuable insights that investors can use to refine their investment strategies:

-

Sector-specific recommendations: BofA may suggest overweighting certain sectors (e.g., technology, healthcare) based on their growth potential and relative valuations.

-

Asset allocation strategies: The report could advise investors on the optimal allocation of assets across different asset classes (e.g., equities, bonds, real estate) to balance risk and return.

-

Risk management considerations: Investors should consider diversifying their portfolios across multiple sectors and asset classes to mitigate risk, in line with BofA's assessment of the potential for market volatility.

-

Practical steps investors can take based on BofA's findings: Investors can use BofA's recommendations to rebalance their portfolios, adjust their risk tolerance, and allocate capital to sectors with higher growth potential.

-

Examples of specific investment choices aligned with BofA's assessment: The report may provide specific examples of companies or ETFs that align with their investment recommendations.

-

Cautions and potential downsides to consider: Investors should be aware of the potential risks involved in any investment decisions and conduct their own thorough due diligence.

Comparison to Other Market Analyses & Expert Opinions

It's crucial to compare BofA's analysis to the perspectives of other financial institutions and analysts. While BofA projects a generally positive outlook, other firms may hold differing viewpoints based on their methodologies and assumptions. Some analysts may be more cautious about the ongoing macroeconomic uncertainties.

- Summary of other analyses and their conclusions: A summary of the viewpoints of other major investment banks and financial analysts should be included here, including Goldman Sachs, JP Morgan etc. (Again hypothetical data for this assignment).

- Comparison of key findings and methodologies: The differences and similarities between BofA’s analysis and others can be highlighted, focusing on how different methodologies lead to differing conclusions.

- Discussion of potential reasons for discrepancies in opinions: Differences in opinion may stem from varying assumptions regarding inflation, interest rates, or corporate earnings growth.

Conclusion: Investor Confidence Strengthened by BofA's Stock Market Valuation Analysis

BofA's comprehensive analysis of stock market valuations provides a compelling argument for a cautiously optimistic outlook. While acknowledging inherent risks and uncertainties, their findings suggest that current valuations present attractive opportunities for investors who can navigate the market strategically. By understanding BofA's assessment of market valuations and the factors influencing their projections, investors can make more informed decisions. Learn more about BofA's stock market valuations and understand BofA's assessment of market valuations to implement a strategy based on BofA's insights on stock market valuations. Remember to conduct your own thorough research and consider seeking professional financial advice before making any investment decisions.

Featured Posts

-

The Ripple Effect Trumps Campus Policies And Their Wider Implications

Apr 28, 2025

The Ripple Effect Trumps Campus Policies And Their Wider Implications

Apr 28, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 28, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 28, 2025 -

Espn Pays Tribute To Cassidy Hubbarth On Her Last Show

Apr 28, 2025

Espn Pays Tribute To Cassidy Hubbarth On Her Last Show

Apr 28, 2025 -

Americas Truck Bloat Finding A Solution

Apr 28, 2025

Americas Truck Bloat Finding A Solution

Apr 28, 2025 -

Red Sox Injury News Latest On Crawford Bello Abreu And Rafaela

Apr 28, 2025

Red Sox Injury News Latest On Crawford Bello Abreu And Rafaela

Apr 28, 2025