BofA's Argument Against High Stock Market Valuations: A Guide For Investors

Table of Contents

BofA's Core Concerns Regarding High Stock Market Valuations

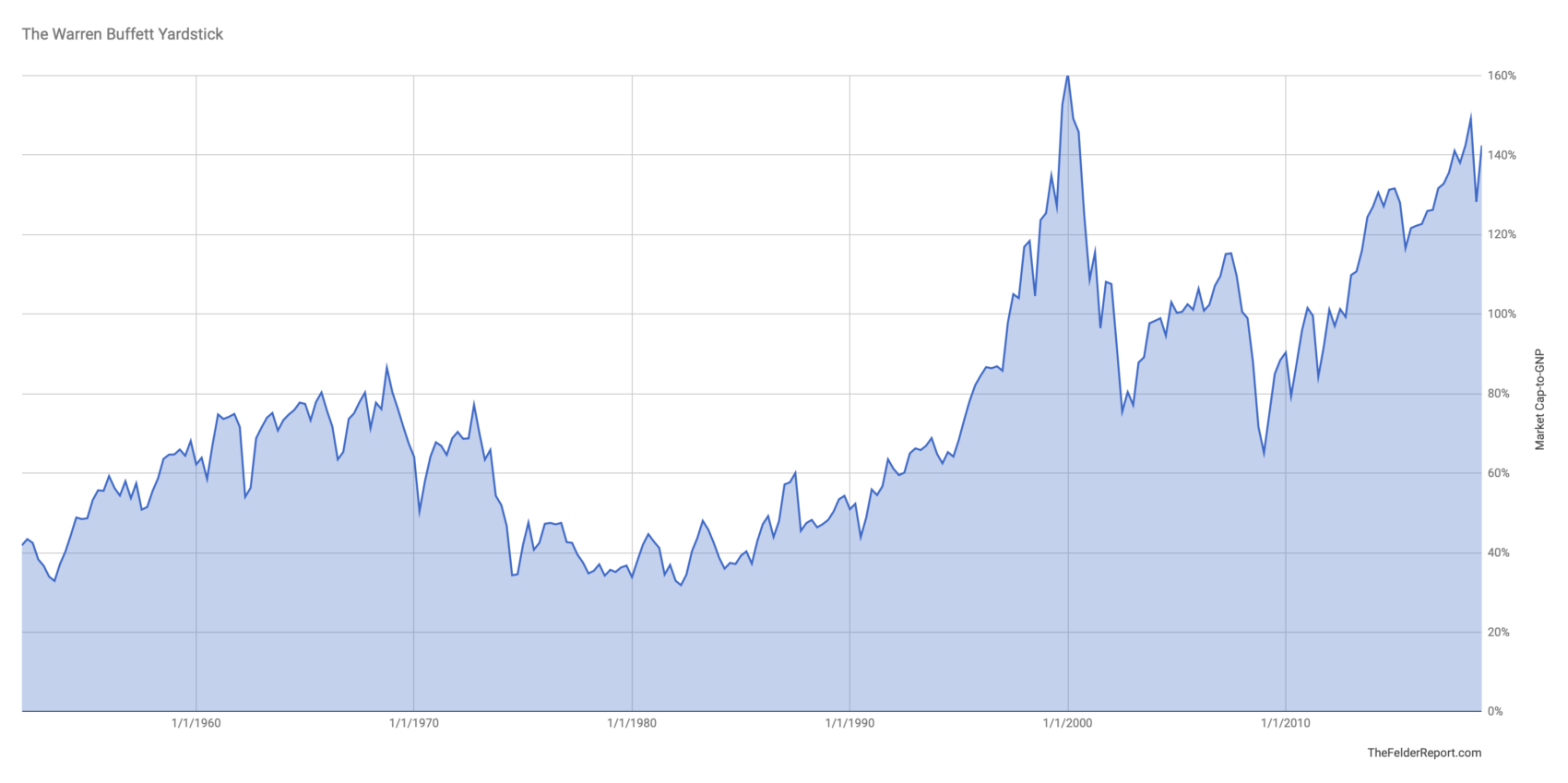

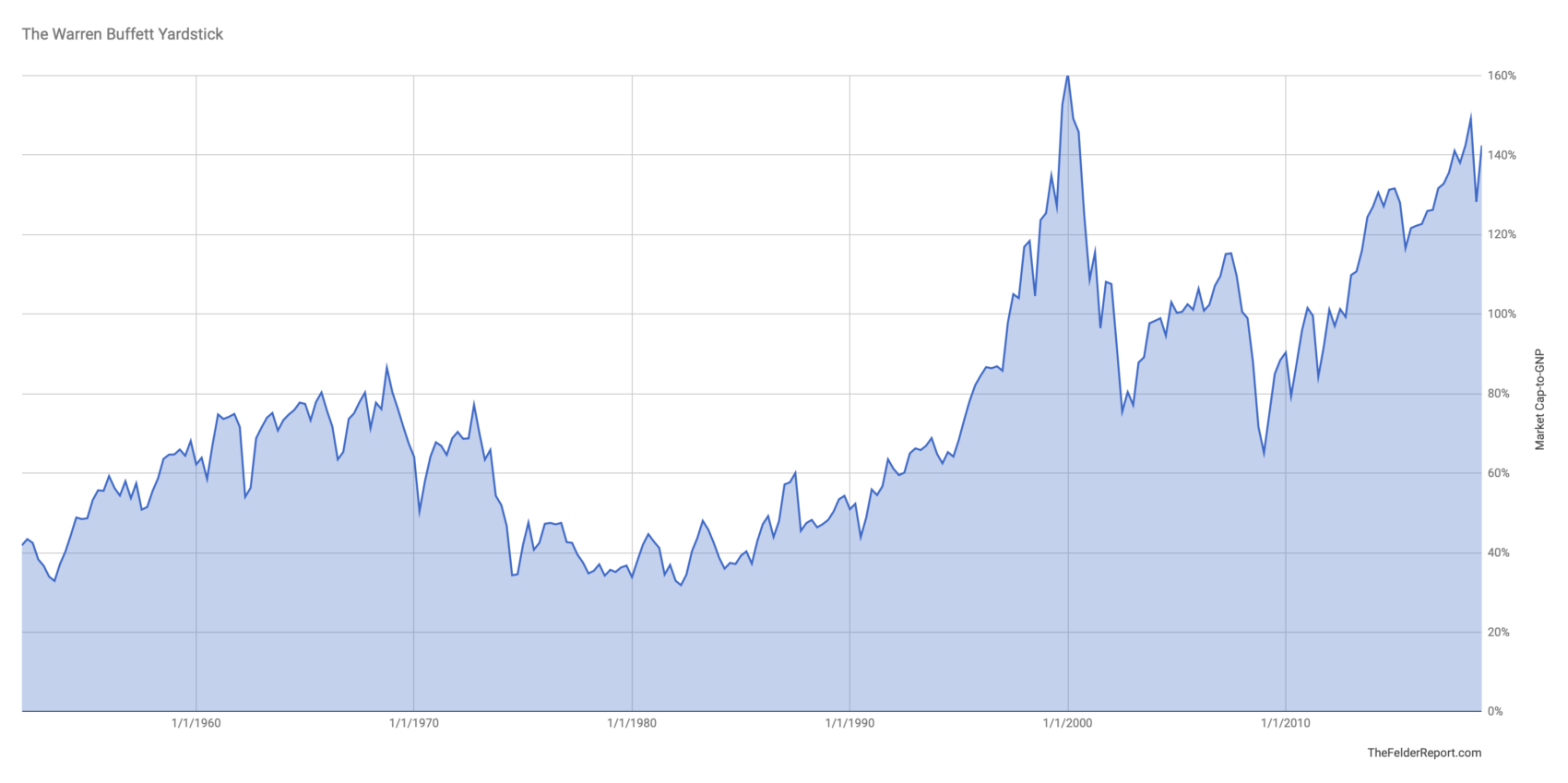

BofA expresses considerable caution regarding current market valuations, believing them to be stretched relative to historical norms and future earnings potential. They frequently utilize metrics like the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio) to assess market valuations. These ratios compare current stock prices to historical earnings, helping to gauge whether the market is overvalued or undervalued.

- Key Arguments: BofA's arguments often center on the disconnect between current high prices and projected future earnings growth. They warn that inflated valuations leave little room for error, making the market vulnerable to negative economic shocks.

- Overvalued Sectors: While BofA's reports don't always specify individual companies, they often highlight specific sectors, such as technology or certain consumer discretionary stocks, as potentially overvalued. Their research frequently pinpoints areas where exuberance may have outpaced fundamental growth.

- Supporting Publications: BofA regularly publishes research notes, investment strategy outlooks, and market commentaries detailing their views on market valuations. These publications are typically accessible to clients and often cited by financial news outlets.

Underlying Economic Factors Influencing BofA's Analysis

BofA's assessment of market valuations isn't made in isolation. It considers a range of macroeconomic factors that significantly influence stock prices and future earnings potential.

- Inflationary Pressures: Persistent inflation erodes corporate profit margins and reduces consumer spending, impacting earnings growth and thus justifying lower stock valuations. BofA carefully monitors inflation data and its potential impact on future earnings forecasts.

- Interest Rate Hikes: The Federal Reserve's interest rate hikes increase borrowing costs for businesses, potentially slowing economic growth and reducing corporate investment. Higher interest rates also make bonds more attractive, drawing investment away from equities.

- Geopolitical Risks: Geopolitical instability, such as wars or trade disputes, introduces uncertainty and risk into the market, potentially leading to sharp market corrections. BofA incorporates geopolitical risks into its broader economic outlook.

- Recessionary Fears: The potential for a recession looms large in BofA's analysis. A recession significantly impacts corporate earnings, potentially leading to a substantial decline in stock prices.

The Role of Earnings Growth in BofA's Valuation Model

BofA's valuation model heavily relies on projected earnings growth. They use sophisticated econometric models and fundamental analysis to forecast future earnings.

- Earnings Growth Forecasting Methodology: BofA employs a combination of top-down macroeconomic analysis and bottom-up company-specific research to estimate future earnings. They consider factors like industry trends, competitive landscapes, and regulatory changes.

- Discrepancies Between Valuations and Earnings Growth: A key concern for BofA is the apparent disconnect between current high valuations and the projected pace of earnings growth. They often highlight situations where valuations appear unsustainable given expected future earnings.

- Impact of Earnings Disappointments: BofA emphasizes that any significant shortfall in earnings relative to market expectations could trigger a substantial market correction. This highlights the risk inherent in current valuations.

Alternative Investment Strategies Suggested by BofA

Given their concerns about high stock market valuations, BofA often suggests diversifying portfolios beyond equities.

- Asset Class Recommendations: BofA may recommend allocating a portion of investments to bonds, real estate, or commodities, depending on the overall market outlook and individual investor risk tolerance. These asset classes may offer better risk-adjusted returns in a high-valuation environment.

- Diversification and Risk Management: BofA stresses the importance of diversification to mitigate risks. A diversified portfolio can help reduce the impact of any single asset class underperforming. Robust risk management strategies are also crucial.

- Rationale for Alternative Investments: The rationale behind these suggestions is to reduce overall portfolio volatility and to potentially capture returns from asset classes that are less correlated with equity markets.

Interpreting BofA's Predictions and Their Practical Implications for Investors

Understanding and applying BofA's analysis requires careful interpretation and independent research.

- Navigating Market Volatility: Investors should develop strategies to manage portfolio risk during periods of market volatility, such as dollar-cost averaging or utilizing stop-loss orders.

- Independent Research: Investors should always conduct thorough due diligence and not rely solely on the opinions of any single financial institution.

- Long-Term Perspective: Maintaining a long-term investment perspective is crucial. Short-term market fluctuations are normal, and focusing on long-term goals can help navigate periods of uncertainty.

Conclusion

BofA's arguments against high stock market valuations highlight significant risks stemming from inflated valuations, inflationary pressures, rising interest rates, geopolitical uncertainties, and the potential for a recession. Their analysis underscores the importance of a diversified investment strategy that incorporates alternative asset classes and robust risk management. Remember, understanding the nuances of BofA’s analysis and conducting your own thorough research is paramount to making informed investment decisions. Learn more about managing your portfolio in the face of high stock market valuations and stay informed on BofA’s outlook to adjust your investment strategy accordingly.

Featured Posts

-

Nba All Star Weekend Herros 3 Pointer And Cavs Skills Challenge Win

Apr 24, 2025

Nba All Star Weekend Herros 3 Pointer And Cavs Skills Challenge Win

Apr 24, 2025 -

The End Of Ryujinx A Nintendo Contact Aftermath

Apr 24, 2025

The End Of Ryujinx A Nintendo Contact Aftermath

Apr 24, 2025 -

Canadian Dollar Slides Despite Us Dollar Gains

Apr 24, 2025

Canadian Dollar Slides Despite Us Dollar Gains

Apr 24, 2025 -

Increased Investment In Chinese Stocks Hong Kong Markets Positive Outlook

Apr 24, 2025

Increased Investment In Chinese Stocks Hong Kong Markets Positive Outlook

Apr 24, 2025 -

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025