BofA's View: Understanding And Addressing High Stock Market Valuations

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's assessment of the current equity market hinges on a careful analysis of various valuation metrics. Understanding these metrics is key to grasping their concerns about high valuations.

Metrics Used by BofA

BofA likely employs a range of valuation metrics to gauge the market's overall health. These include:

- Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. BofA's analysis likely reveals current P/E ratios compared to historical averages, providing context.

- Shiller P/E (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable measure of valuation. A high Shiller P/E can suggest overvaluation even when short-term earnings look strong. BofA's data on this metric is crucial for a long-term perspective.

- Price-to-Sales Ratio (P/S): This compares a company's stock price to its revenue per share. It's particularly useful for companies with volatile or negative earnings. BofA's assessment likely considers this metric, especially for growth stocks.

According to BofA's recent reports (specific data would need to be referenced from actual BofA publications), these metrics may currently suggest elevated valuations compared to historical averages, raising concerns about potential market risks.

Factors Contributing to High Valuations

Several factors contribute to the high valuations noted by BofA. These include:

- Low Interest Rates: Historically low interest rates make bonds less attractive, pushing investors toward higher-yielding assets like stocks, driving up demand and prices.

- Quantitative Easing (QE): Central bank policies like QE inject liquidity into the market, further fueling asset price inflation.

- Strong Corporate Earnings: Robust corporate profits, particularly in certain sectors, can support higher stock valuations, even if P/E ratios are elevated.

- Technological Advancements: Innovation and technological disruption often lead to higher valuations for companies perceived as leaders in their respective fields.

- Investor Sentiment: Positive investor sentiment and a "fear of missing out" (FOMO) can create a self-reinforcing cycle of rising prices.

- Geopolitical Factors: Global uncertainties can impact investor decisions, sometimes leading to a flight to safety in established markets, pushing up valuations.

BofA's analysis likely weighs the relative importance of each of these factors to explain the current market situation.

BofA's Outlook and Predictions for the Market

BofA's outlook combines their valuation assessment with macroeconomic forecasts and various market scenarios.

Short-Term and Long-Term Projections

BofA's projections (again, referencing specific BofA reports would be necessary here) likely outline several potential scenarios:

- Bullish Scenario: Continued economic growth and strong corporate earnings could sustain, or even increase, current valuations.

- Bearish Scenario: A sharp economic downturn, rising interest rates, or a significant geopolitical event could trigger a market correction.

- Sideways Scenario: A period of consolidation or sideways movement, where valuations remain high but price increases are limited, is also possible.

BofA likely assigns probabilities to each scenario based on their economic forecast and risk assessment.

Sector-Specific Analysis

BofA's research might delve into sector-specific analyses. For instance, certain sectors might be more vulnerable to high valuations than others. Sectors perceived as overvalued might be flagged for potential underperformance, while others, considered undervalued, may be suggested for potential outperformance. (Again, specific sector analysis would require reference to BofA's research.)

Investment Strategies in a High-Valuation Environment

Navigating a market with high valuations requires a cautious approach.

Risk Management Strategies

BofA likely recommends various risk management strategies:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces portfolio risk.

- Hedging Strategies: Employing strategies like options or futures contracts can help protect against potential market downturns.

- Portfolio Rebalancing: Regularly adjusting asset allocation to maintain desired risk levels is crucial in volatile markets.

- Limiting Exposure: Reducing exposure to sectors deemed particularly overvalued is a prudent approach.

- Defensive Investments: Considering investments in less volatile asset classes like high-quality bonds or dividend-paying stocks can provide stability.

BofA's Suggested Portfolio Adjustments

Based on their assessment, BofA might suggest specific portfolio adjustments, possibly including:

- Asset Allocation Changes: Shifting the allocation towards less risky assets or sectors.

- Sector Rotation: Moving investments from overvalued to potentially undervalued sectors.

- Alternative Investments: Considering alternative investments like commodities or infrastructure to diversify the portfolio.

Conclusion

BofA's analysis of high stock market valuations provides investors with a crucial perspective on the current market climate. Their assessment, based on various valuation metrics and macroeconomic factors, suggests a potentially risky environment. Their outlook includes various scenarios, highlighting potential risks and opportunities. BofA's recommended investment strategies emphasize risk management and proactive portfolio adjustments to navigate the challenges presented by high valuations. To gain a deeper understanding of BofA's complete analysis and develop a well-informed investment strategy, we strongly recommend reviewing their latest research reports and publications. Understanding BofA's complete view on high stock market valuations is essential for effective portfolio management in the current market.

Featured Posts

-

The Worlds Richest Man And The American Battleground A Power Struggle

Apr 26, 2025

The Worlds Richest Man And The American Battleground A Power Struggle

Apr 26, 2025 -

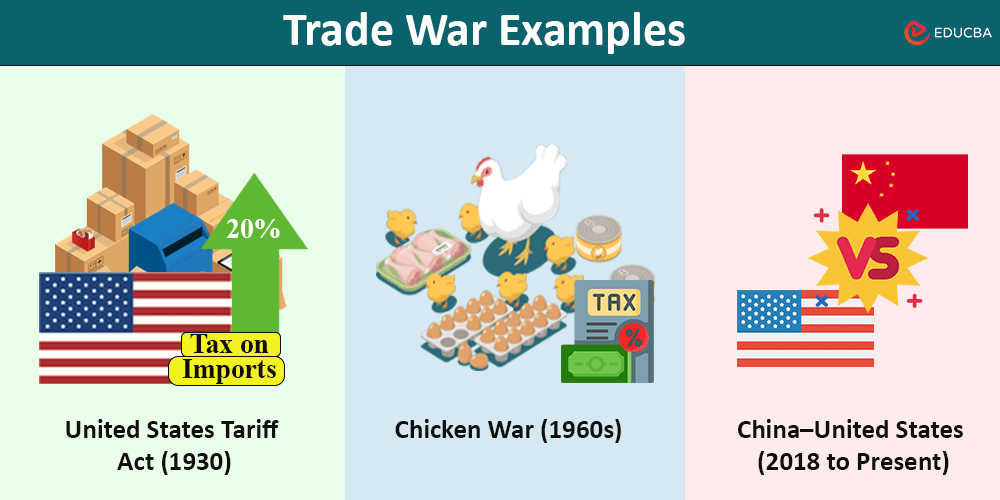

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025 -

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025 -

Cassidy Hutchinson To Publish Memoir Detailing Jan 6 Experience

Apr 26, 2025

Cassidy Hutchinson To Publish Memoir Detailing Jan 6 Experience

Apr 26, 2025 -

Green Bays Nfl Draft First Round Predictions And Analysis

Apr 26, 2025

Green Bays Nfl Draft First Round Predictions And Analysis

Apr 26, 2025

Latest Posts

-

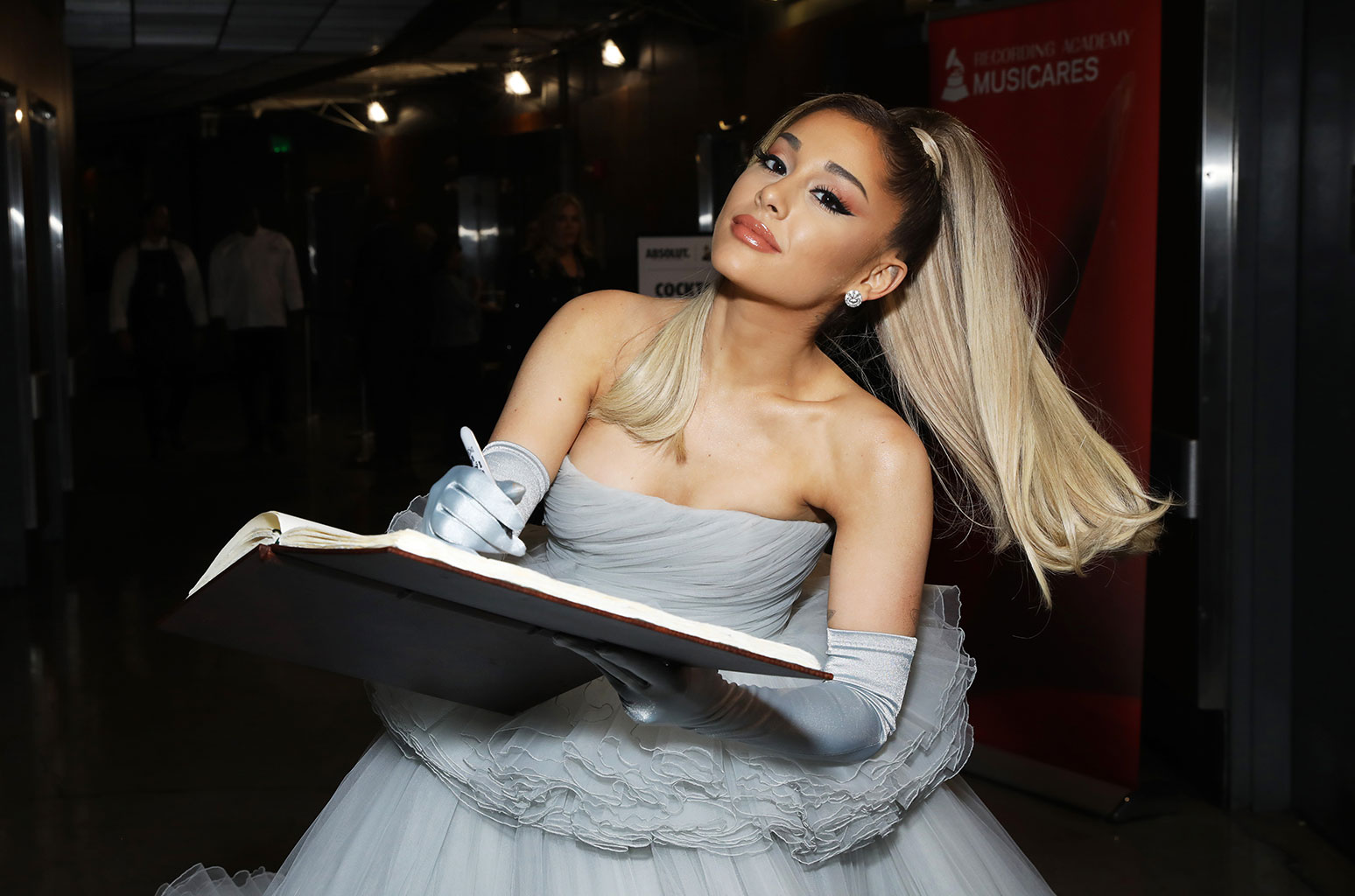

Ariana Grandes Bold New Style A Look At Her Hair And Tattoos

Apr 27, 2025

Ariana Grandes Bold New Style A Look At Her Hair And Tattoos

Apr 27, 2025 -

Analyzing Ariana Grandes New Look Hair Tattoos And Professional Styling

Apr 27, 2025

Analyzing Ariana Grandes New Look Hair Tattoos And Professional Styling

Apr 27, 2025 -

Understanding Ariana Grandes Recent Image Transformation

Apr 27, 2025

Understanding Ariana Grandes Recent Image Transformation

Apr 27, 2025 -

The Story Behind Ariana Grandes Drastic Hair And Tattoo Changes

Apr 27, 2025

The Story Behind Ariana Grandes Drastic Hair And Tattoo Changes

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Makeover A Professionals Perspective

Apr 27, 2025

Ariana Grandes Hair And Tattoo Makeover A Professionals Perspective

Apr 27, 2025