Brace For More Market Volatility: Investors Buy Despite Rising Risks

Table of Contents

Understanding the Current Market Volatility

Market volatility refers to the rate and extent of price fluctuations in financial markets. High market volatility means prices are changing rapidly and dramatically, creating both opportunities and risks for investors. Currently, several key factors are driving this heightened volatility:

- Inflation: Persistent inflation erodes purchasing power and forces central banks to raise interest rates, impacting borrowing costs for businesses and consumers.

- Interest Rate Hikes: Aggressive interest rate increases by central banks aim to curb inflation but can also slow economic growth, potentially triggering a recession and impacting market sentiment.

- Geopolitical Tensions: Global conflicts and political instability create uncertainty, impacting supply chains, energy prices, and investor confidence.

- Supply Chain Disruptions: Ongoing disruptions in global supply chains lead to shortages, price increases, and further fuel inflation and economic uncertainty.

Specific examples of recent volatile market events include:

- Recent sharp drops and rebounds in major stock indices like the S&P 500 and NASDAQ.

- Increased volatility in the bond market, with yields fluctuating significantly.

- Fluctuations in commodity prices, particularly oil and natural gas, driven by geopolitical events and supply concerns.

- Geopolitical events like the war in Ukraine significantly impacting global markets and investor sentiment.

Why Investors are Buying Despite Rising Risks

The continued buying despite rising market volatility stems from a combination of psychological factors and strategic considerations:

- Fear of Missing Out (FOMO): Investors fear missing out on potential gains, leading them to buy even in uncertain markets.

- Belief in Long-Term Growth Potential: Many investors maintain a long-term perspective, believing that current market corrections are temporary and that underlying economic growth will eventually prevail.

- Contrarian Investing: Some investors actively seek opportunities during periods of market volatility, buying assets at discounted prices in anticipation of future recovery.

Investors are also driven by:

- Search for Higher Returns: Despite the risks, some investors believe they can achieve higher returns by taking advantage of market downturns.

- Belief in Market Recovery: A prevailing belief that the market will eventually recover encourages investors to maintain their positions or even increase their investments.

- Diversification Strategies: Diversification across asset classes is a core strategy to mitigate risk during periods of market volatility.

Investors employ various strategies:

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of market fluctuations.

- Value investing: Identifying undervalued assets and buying them with the expectation that their price will eventually rise.

- Diversification across asset classes: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) to reduce risk.

- Hedging strategies: Using financial instruments to protect against potential losses.

Strategies for Navigating Market Volatility

Successfully navigating market volatility requires a proactive and well-defined approach:

- Well-defined investment strategy: Having a clear understanding of your investment goals, risk tolerance, and time horizon is crucial.

- Risk tolerance assessment: Knowing your comfort level with potential losses is vital to making informed decisions.

- Portfolio diversification: Spreading your investments across different asset classes, geographies, and sectors can significantly reduce the impact of market fluctuations.

- Regular portfolio review and rebalancing: Periodically reviewing your portfolio and adjusting your asset allocation to maintain your desired risk level.

- Hedging strategies: Employing financial instruments like options or futures contracts to protect against potential losses.

- Staying informed: Keeping abreast of market trends, economic indicators, and geopolitical events is essential.

- Seeking professional advice: Consulting with a qualified financial advisor can provide valuable guidance and personalized strategies.

The Role of Diversification in Managing Market Volatility

Diversification is paramount in managing market volatility. It involves spreading investments across various assets to reduce the impact of any single asset's underperformance. This can include:

- Asset class diversification: Investing in a mix of stocks, bonds, real estate, and other assets.

- Geographic diversification: Spreading investments across different countries or regions.

- Sector diversification: Investing in companies across various industries to reduce exposure to sector-specific risks.

The Importance of Risk Tolerance in Volatile Markets

Understanding your risk tolerance is critical during periods of market volatility. Your risk tolerance determines your comfort level with potential investment losses. High-risk tolerance may lead to investments in volatile assets with higher potential returns, while low-risk tolerance often dictates a preference for more stable, lower-return investments. Assessing your risk tolerance requires careful consideration of your financial goals, time horizon, and personal circumstances.

Conclusion

Market volatility remains a significant challenge for investors. While several factors contribute to the current heightened uncertainty, investors are buying despite rising risks due to a mix of psychological factors and strategic considerations. To effectively navigate this challenging environment, developing a robust investment strategy that includes diversification, regular portfolio review, and a clear understanding of your risk tolerance is essential. Understanding market volatility and its impact on your portfolio is crucial for long-term success. Don't hesitate to consult a financial advisor to better manage market volatility and craft a plan tailored to your individual needs and goals. Brace for market volatility, but don't let it paralyze your investment decisions.

Featured Posts

-

Gambling On Disaster Analyzing The Los Angeles Wildfire Betting Market

Apr 22, 2025

Gambling On Disaster Analyzing The Los Angeles Wildfire Betting Market

Apr 22, 2025 -

Lab Owner Admits To Faking Covid 19 Test Results During Pandemic

Apr 22, 2025

Lab Owner Admits To Faking Covid 19 Test Results During Pandemic

Apr 22, 2025 -

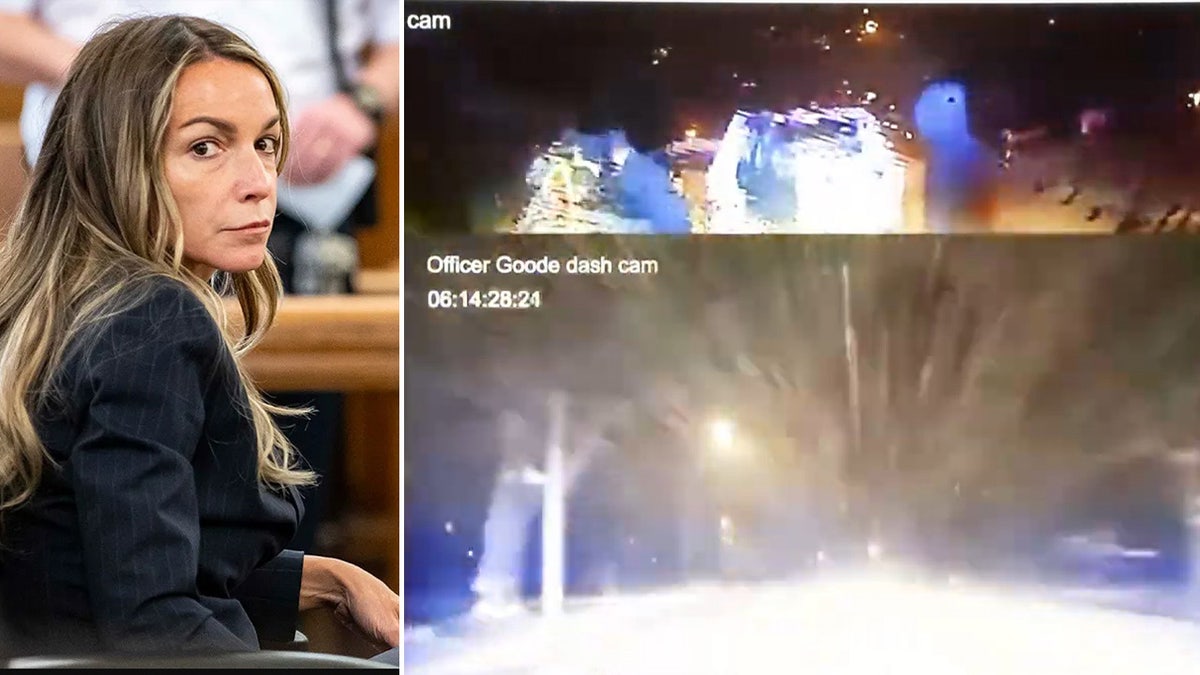

Karen Read Murder Trials A Complete Timeline

Apr 22, 2025

Karen Read Murder Trials A Complete Timeline

Apr 22, 2025 -

Cassidy Hutchinson Jan 6 Hearing Testimony And Upcoming Memoir

Apr 22, 2025

Cassidy Hutchinson Jan 6 Hearing Testimony And Upcoming Memoir

Apr 22, 2025 -

Trumps Ukraine Proposal Kyivs Urgent Response Needed

Apr 22, 2025

Trumps Ukraine Proposal Kyivs Urgent Response Needed

Apr 22, 2025