Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Surge

Table of Contents

Broadcom's acquisition of VMware has sent shockwaves through the tech industry, but the impact is particularly keenly felt by telecom giants like AT&T. The massive price tag and potential implications for the competitive landscape have led to an extreme price surge in related services and technologies. This article explores the key aspects of this seismic event and how AT&T's experience reflects a broader trend impacting the future of cloud computing and enterprise software within the telecom sector.

The Astronomical Price Tag and its Implications

Broadcom's Massive Investment

The Broadcom-VMware merger, finalized in late 2023, carries a staggering price tag of approximately $61 billion. This makes it one of the largest technology acquisitions in history, dwarfing previous major deals such as Microsoft's acquisition of LinkedIn ($26.2 billion) and Salesforce's acquisition of MuleSoft ($6.5 billion). This immense investment represents a significant commitment from Broadcom, demonstrating their ambition to become a dominant player in the enterprise software and cloud computing markets.

- Financial Details: The acquisition was financed through a combination of cash, debt, and Broadcom's own stock, highlighting the substantial financial resources required to complete such a large-scale transaction. Specific financing details were publicly disclosed through SEC filings (Source: [Insert Link to Relevant SEC Filing]).

- Market Capitalization Impact: The acquisition significantly impacted both Broadcom's and VMware's market capitalization, leading to substantial changes in the valuations of both companies. (Source: [Insert Link to Financial News Source]).

Antitrust Concerns and Regulatory Scrutiny

The sheer size of the Broadcom-VMware deal has naturally raised significant antitrust concerns. Regulatory bodies worldwide, including the US Federal Trade Commission (FTC), the European Commission, and other international competition authorities, are scrutinizing the potential for monopolistic practices resulting from this merger.

- Potential Antitrust Issues: Concerns center around Broadcom's potential to leverage its control over VMware's virtualization technology to stifle competition in the enterprise software market, potentially leading to higher prices and reduced innovation.

- Regulatory Hurdles: The merger faced intense scrutiny and potential delays, with investigations focusing on the competitive impact across various sectors, including cloud computing, networking, and data center infrastructure. (Source: [Insert Link to News Article on Regulatory Scrutiny]).

- Potential Delays or Modifications: While the acquisition was ultimately completed, regulatory hurdles could have led to delays or even forced modifications to the deal structure.

AT&T's Perspective: A Case Study in Price Increases

Direct Impact on AT&T's Infrastructure and Services

AT&T, like many other large telecom companies, heavily relies on VMware's virtualization technology for its network infrastructure and cloud services. VMware's vSphere, vSAN, and NSX are crucial components of AT&T's data centers, enabling efficient management and utilization of resources.

- VMware Products Used by AT&T: AT&T utilizes various VMware products for server virtualization, storage virtualization, and network virtualization, ensuring the smooth operation of its extensive network.

- Quantifying Price Increases: The Broadcom acquisition has directly translated into significant price increases for AT&T's VMware licensing and support contracts. While precise figures aren't publicly available due to confidentiality agreements, industry analysts suggest substantial increases in the range of [Insert Percentage Range or Estimate] (Source: [Insert Link to Analyst Report or News Article]).

Ripple Effect on AT&T's Pricing Strategy

The increased costs faced by AT&T due to the Broadcom-VMware acquisition are likely to ripple through its pricing strategy. This may lead to higher prices for its customers, impacting both its residential and business offerings.

- Consequences for Competitiveness: Increased costs could diminish AT&T's competitiveness, especially against rivals that are less reliant on VMware's solutions or have negotiated more favorable terms.

- Impact on Customer Loyalty: Higher prices could erode customer loyalty and potentially lead to customer churn.

- Financial Performance Impact: The impact on AT&T's financial performance is multifaceted, potentially affecting profitability margins and potentially impacting investor confidence.

Broader Market Impacts: Beyond AT&T

Increased Prices Across the Telecom Sector

The price surge experienced by AT&T isn't isolated. Other telecom companies that heavily rely on VMware's virtualization technologies are also experiencing similar cost pressures following the Broadcom acquisition.

- Examples of Affected Telecom Providers: [Insert Examples of other Telecom providers and brief description of their situation].

- Industry Consolidation: The increased cost of enterprise software could accelerate industry consolidation, with smaller telecom companies potentially being absorbed by larger ones to gain economies of scale.

The Future of Cloud Computing and Enterprise Software

The Broadcom-VMware merger represents a significant shift in the landscape of enterprise software and cloud computing. It could lead to substantial changes in market dynamics, competition, and innovation in the years to come.

- Shifts in Market Share: Broadcom's increased market power could lead to shifts in market share, impacting both existing players and potential new entrants.

- Innovation and Technological Advancements: The merger could influence technological advancements in virtualization, cloud computing, and related technologies, both positively and negatively, depending on Broadcom's strategic direction.

Conclusion

The Broadcom-VMware acquisition represents a monumental shift in the tech landscape. The enormous cost of the acquisition, its impact on AT&T's pricing strategies, and its broader implications for the telecom industry and the future of cloud computing and enterprise software cannot be overstated. This merger highlights the escalating costs and potential challenges facing the telecom industry and calls for careful consideration of its long-term effects. Stay informed about further developments and the ongoing impact on Broadcom, VMware, and the telecom sector by following industry news and analysis. Understanding the implications of this monumental Broadcom VMware acquisition is critical for businesses in the telecommunications sector and beyond.

Featured Posts

-

Top Seed Pegula Claims Charleston Title After Collins Match

Apr 27, 2025

Top Seed Pegula Claims Charleston Title After Collins Match

Apr 27, 2025 -

Anti Vaccination Activist Appointed To Head Autism Study

Apr 27, 2025

Anti Vaccination Activist Appointed To Head Autism Study

Apr 27, 2025 -

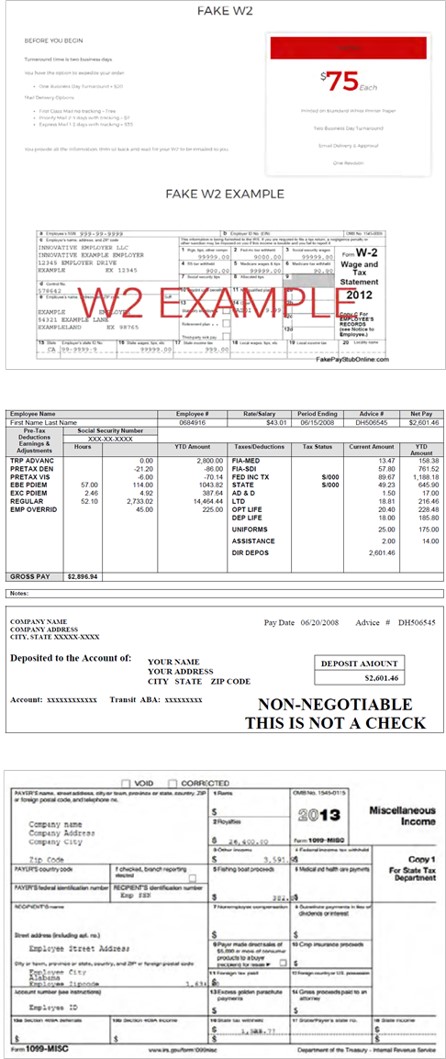

Pfc Investigation Exposes Fake Documents Suspends Gensols Eo W

Apr 27, 2025

Pfc Investigation Exposes Fake Documents Suspends Gensols Eo W

Apr 27, 2025 -

Office365 Security Breach Results In Multi Million Dollar Loss

Apr 27, 2025

Office365 Security Breach Results In Multi Million Dollar Loss

Apr 27, 2025 -

Pfcs Complaint To Eo W Gensol Engineering Accused Of Document Falsification

Apr 27, 2025

Pfcs Complaint To Eo W Gensol Engineering Accused Of Document Falsification

Apr 27, 2025

Latest Posts

-

Jan 6th Falsehoods Ray Epps Defamation Case Against Fox News Explained

Apr 28, 2025

Jan 6th Falsehoods Ray Epps Defamation Case Against Fox News Explained

Apr 28, 2025 -

Federal Trade Commission Appeals Ruling Allowing Microsoft Activision Merger

Apr 28, 2025

Federal Trade Commission Appeals Ruling Allowing Microsoft Activision Merger

Apr 28, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Conspiracy Claims At Issue

Apr 28, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Conspiracy Claims At Issue

Apr 28, 2025 -

Ftc To Challenge Court Decision On Microsoft Activision Deal

Apr 28, 2025

Ftc To Challenge Court Decision On Microsoft Activision Deal

Apr 28, 2025 -

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Alleged

Apr 28, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Alleged

Apr 28, 2025