Canadian Dollar Performance: A Detailed Analysis

Table of Contents

Key Factors Influencing Canadian Dollar Performance

Several interconnected factors influence the Canadian dollar's performance (CAD). Understanding these elements is vital for predicting and navigating currency market trends.

Commodity Prices (Oil and Natural Gas)

Canada is a major exporter of oil and natural gas. Therefore, the price of these commodities has a strong correlation with the CAD's value. Global demand and supply significantly impact these prices.

- Increased oil prices typically strengthen the CAD. Higher prices mean increased revenue for Canadian energy companies, leading to a greater inflow of foreign currency.

- Decreased oil demand weakens the Canadian dollar. Conversely, low oil prices reduce export earnings and negatively affect the CAD's value. The recent volatility in global energy markets serves as a prime example of this impact. For example, during periods of geopolitical instability or reduced global demand, the CAD tends to weaken.

Interest Rate Differentials

The Bank of Canada's monetary policy, specifically its interest rate decisions, plays a crucial role in Canadian dollar performance. These rates are compared to those of other major economies, particularly the United States.

- Higher Canadian interest rates attract foreign investment, strengthening the CAD. Investors seek higher returns, leading to an increased demand for the Canadian dollar.

- Lower interest rates compared to other countries can weaken the CAD. Conversely, lower rates can make the Canadian dollar less attractive to foreign investors, putting downward pressure on its value. The interest rate differential between the CAD and USD is frequently a key driver of exchange rate fluctuations.

Geopolitical Events and Global Economic Conditions

Global uncertainties significantly impact investor confidence and, consequently, the Canadian dollar.

- Global economic uncertainty often leads to a weakening of the CAD. Investors tend to move towards safer haven currencies during times of instability, such as during trade wars or political crises.

- Strong US economic growth can strengthen the CAD through increased demand. A healthy US economy often translates into increased demand for Canadian goods and services, boosting the CAD. However, this relationship is complex and not always straightforward.

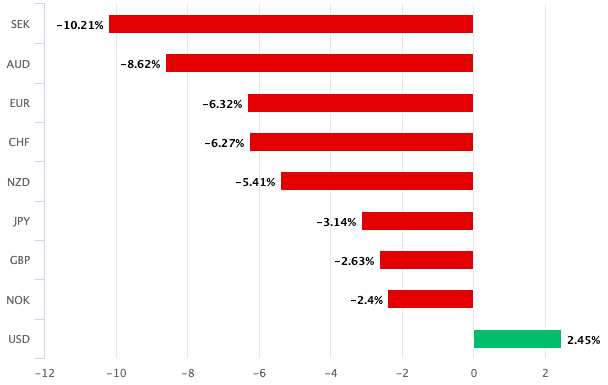

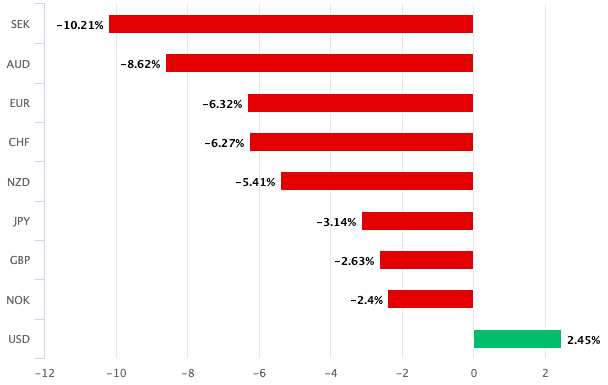

US Dollar Performance

The US dollar (USD) is the world's reserve currency, and its performance heavily influences the Canadian dollar.

- A strengthening US dollar typically weakens the CAD. A stronger USD makes Canadian goods more expensive for US buyers and reduces demand, thus weakening the CAD.

- A weakening US dollar can strengthen the CAD. A weaker USD can conversely increase demand for Canadian goods and bolster the CAD's value. The close economic ties between Canada and the US mean that the USD's movements frequently dictate the direction of the CAD.

Analyzing Recent Canadian Dollar Performance

Understanding both short-term and long-term trends is essential for informed decision-making regarding the Canadian dollar.

Short-Term Trends

Recent performance has shown volatility linked to fluctuating commodity prices, particularly oil. [Insert relevant data and chart here showing recent CAD performance – e.g., a graph showing the CAD/USD exchange rate over the past 3-6 months]. Specific events impacting the CAD should be mentioned here.

Long-Term Trends

Over the past 5-10 years, the Canadian dollar has shown a general trend of [Insert overall long-term trend – e.g., moderate fluctuations around a certain average value against the USD]. [Insert relevant data and chart here showing long-term CAD performance – e.g., a graph showing the CAD/USD exchange rate over the past 5-10 years]. This long-term trend should be analyzed for significant shifts and patterns.

Forecasting Future Performance

Predicting future performance is inherently challenging due to the numerous influencing factors. However, based on the current analysis, [Offer a cautious prediction based on the analysis, including potential risks and opportunities]. For example, discuss the potential impact of future interest rate changes, global economic growth prospects, or oil price forecasts.

Conclusion

The Canadian dollar's performance is a complex interplay of commodity prices (especially oil and natural gas), interest rate differentials relative to other major economies (particularly the US), geopolitical events, and the strength of the US dollar. Monitoring these factors is crucial for making informed decisions concerning investments, international trade, and financial planning that involve the Canadian dollar. Stay informed about the latest developments affecting Canadian dollar performance to make sound financial decisions. Regularly check for updates on economic indicators and currency exchange rates. Future articles will delve deeper into specific aspects of Canadian dollar performance.

Featured Posts

-

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025 -

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025 -

John Travolta Addresses Candid Bedroom Photo Shared From 3 M Home

Apr 24, 2025

John Travolta Addresses Candid Bedroom Photo Shared From 3 M Home

Apr 24, 2025 -

Canadian Auto Industry Unveils Five Point Strategy Amidst Us Trade Tensions

Apr 24, 2025

Canadian Auto Industry Unveils Five Point Strategy Amidst Us Trade Tensions

Apr 24, 2025 -

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 24, 2025