Canadian Investment In US Stocks: A New High Despite Trade Tensions

Table of Contents

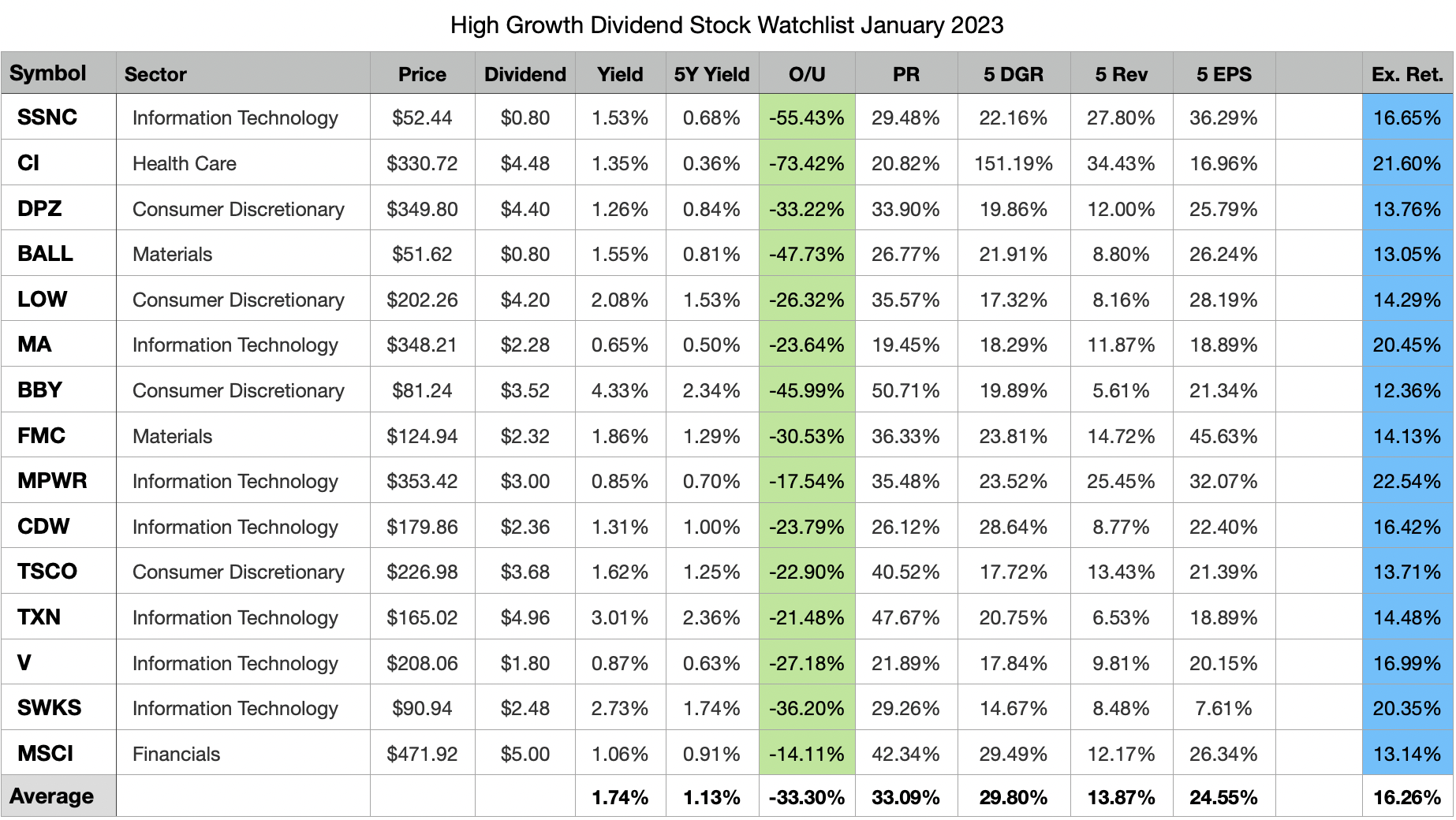

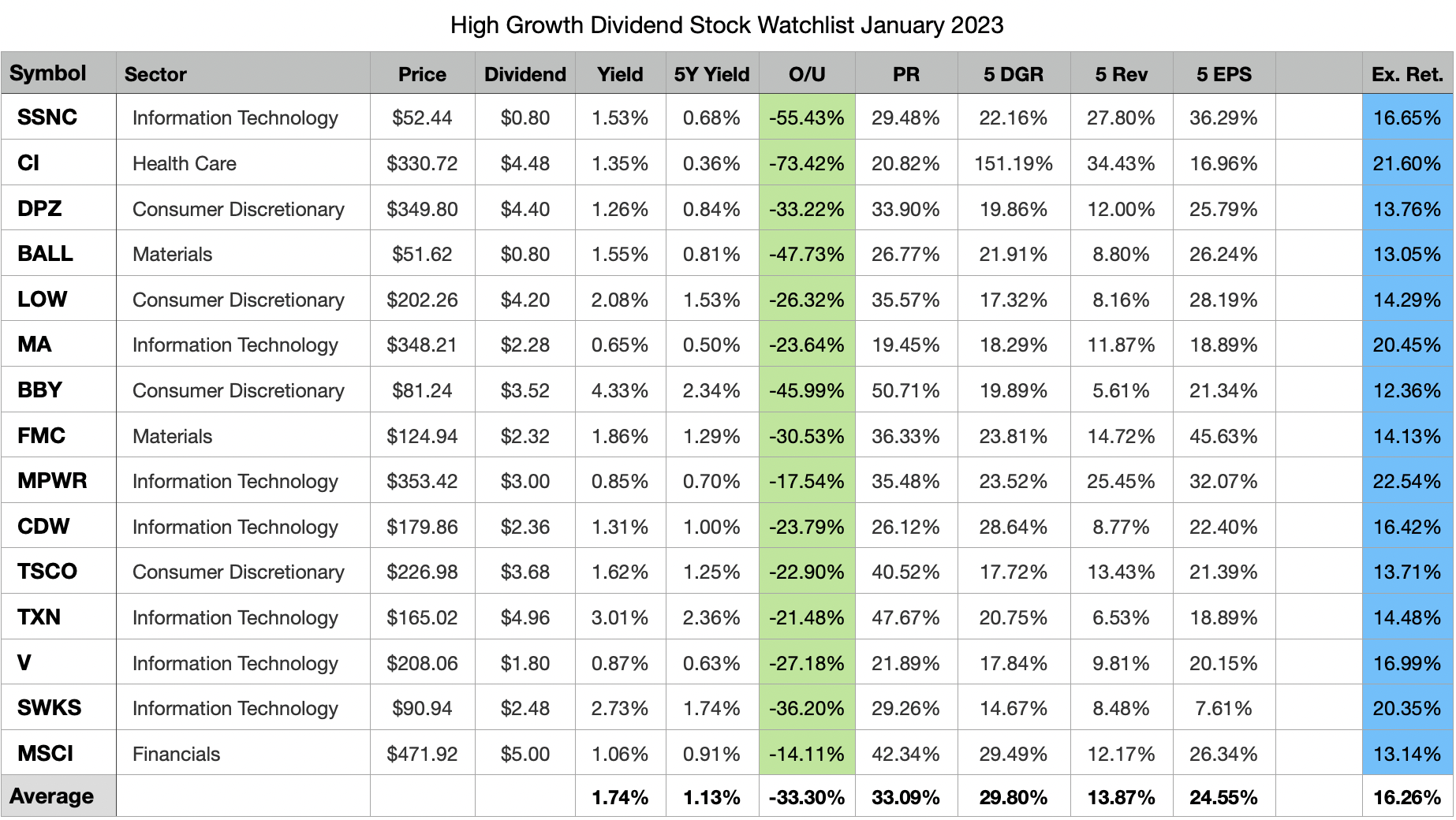

The Unexpected Surge in Canadian Investment

Recent data reveals a dramatic increase in Canadian investment in US equities, reaching unprecedented levels. While precise figures fluctuate depending on the reporting agency and the timeframe considered, several reputable sources confirm a significant upward trend. For example, [Insert Source 1: e.g., Statistics Canada report, a financial news article with data] reported a [Insert Percentage]% increase in Canadian investment in US stocks in [Insert Time Period, e.g., Q3 2023] compared to the same period last year. This translates to a total investment value of approximately [Insert Dollar Amount].

The sectors attracting the most significant Canadian investment include:

- Technology: The booming US tech sector, with its innovative companies and high growth potential, continues to be a major draw for Canadian investors.

- Energy: Despite fluctuating energy prices, the US energy sector remains a substantial target for Canadian investment, driven by opportunities in renewable energy and traditional fossil fuels.

- Healthcare: The growing US healthcare sector, with its robust pharmaceutical and biotechnology industries, is also attracting significant Canadian capital.

This surge is particularly noteworthy given the ongoing trade tensions between the two countries. It presents a compelling counter-narrative to the assumption that trade disputes automatically stifle cross-border investments.

Factors Driving the Investment Despite Trade Uncertainty

Several key factors contribute to the robust Canadian investment in US stocks, even amidst trade uncertainties.

Attractive US Market Opportunities

The US stock market remains exceptionally attractive to foreign investors, including Canadians. Its sheer size and depth offer unparalleled diversification opportunities.

- Higher Returns: Historically, the US stock market has generated higher returns compared to Canadian markets, making it a tempting prospect for investors seeking greater potential profits.

- Market Diversification: Investing in the US market allows Canadian investors to diversify their portfolios beyond the Canadian economy, reducing their overall risk.

- Access to Innovation: The US is a global hub for innovation, giving Canadian investors access to cutting-edge companies and technologies not readily available in Canada.

Currency Exchange Rates

The relative value of the Canadian dollar (CAD) against the US dollar (USD) significantly influences investment decisions. A weaker CAD relative to the USD makes US assets cheaper for Canadian investors, boosting the attractiveness of US stocks.

- Historical Data: [Insert historical exchange rate data and source to illustrate the impact of CAD/USD fluctuations].

- Impact on Returns: Fluctuations in exchange rates can significantly impact the overall return on investment, either positively or negatively. A strengthening CAD can reduce the realized gains from US stock investments.

- Future Projections: [Insert cautiously optimistic or pessimistic projections for future CAD/USD exchange rates and their likely effect on investment decisions – cite a reputable source].

Diversification Strategies

Canadian investors utilize US stocks as a crucial component of their portfolio diversification strategies. This approach aims to mitigate risk by reducing overall portfolio volatility.

- Reduced Volatility: Investing in a geographically diverse portfolio helps to smooth out the impact of market downturns in either country.

- Protection Against Market Downturns: If the Canadian market experiences a downturn, a well-diversified portfolio with US stocks can provide a degree of insulation.

- Exposure to Different Economic Cycles: The US and Canadian economies don't always move in sync. Investing in both markets exposes investors to different economic cycles, potentially enhancing overall returns over the long term.

The Impact of Trade Tensions on Investment Decisions

While trade tensions between Canada and the US undeniably exist, their impact on Canadian investment in US stocks seems to be less significant than initially anticipated. However, these tensions shouldn't be ignored.

- Specific Trade Disputes: [Mention specific trade disputes, such as lumber or dairy, and discuss their potential (even if limited) influence on investment decisions].

- Investor Sentiment: Despite the ongoing trade disagreements, investor confidence in the long-term prospects of the US market remains relatively high.

- Long-Term vs. Short-Term Strategies: Many investors adopt long-term investment strategies, viewing short-term trade fluctuations as less relevant to their overall goals.

Conclusion

The record-high level of Canadian investment in US stocks, despite persistent trade tensions, highlights the compelling allure of the US market. Attractive investment opportunities, favorable currency exchange rates, and robust diversification strategies are key drivers of this trend. While trade tensions continue to exist, they haven't significantly dampened the enthusiasm of Canadian investors seeking growth and diversification in the US stock market.

For those interested in exploring the opportunities in the US stock market, consider consulting with a financial advisor specializing in cross-border investments to understand the risks and rewards of Canadian investment in US stocks. Learn more about how you can benefit from strategic Canadian investment in US stocks today!

Featured Posts

-

Nine Home Runs One Night Yankees Offensive Explosion Starts 2025 Season

Apr 23, 2025

Nine Home Runs One Night Yankees Offensive Explosion Starts 2025 Season

Apr 23, 2025 -

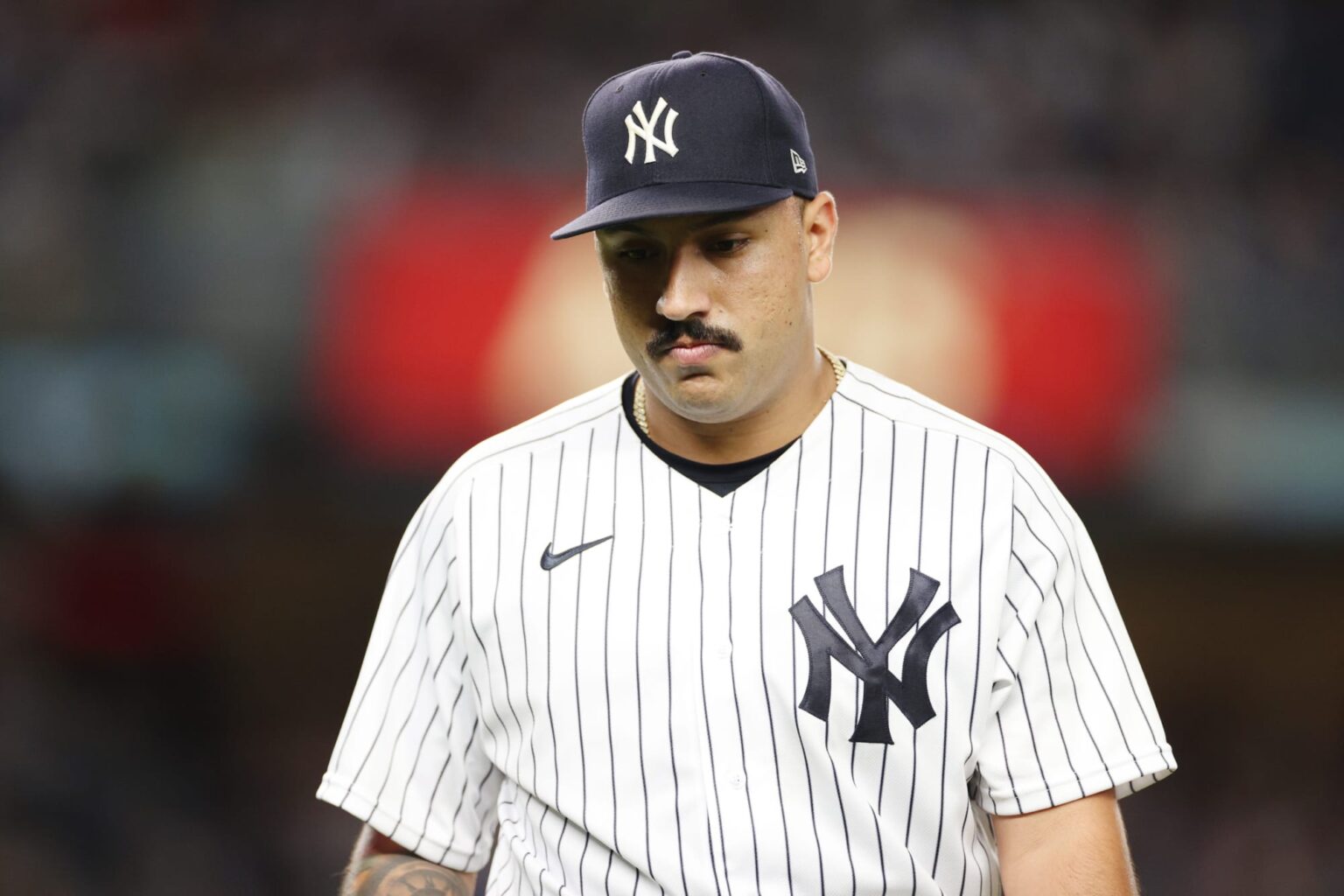

Nestor Cortes Shutout Performance Against The Reds A Strong Rebound

Apr 23, 2025

Nestor Cortes Shutout Performance Against The Reds A Strong Rebound

Apr 23, 2025 -

Pentrich Brewing At The Factory History Tours And Tasting

Apr 23, 2025

Pentrich Brewing At The Factory History Tours And Tasting

Apr 23, 2025 -

11 1 Blowout Royals Dominate Brewers In Home Opener

Apr 23, 2025

11 1 Blowout Royals Dominate Brewers In Home Opener

Apr 23, 2025 -

Spartak Razgromil Rostov V 23 M Ture Rpl Podrobniy Otchet O Matche

Apr 23, 2025

Spartak Razgromil Rostov V 23 M Ture Rpl Podrobniy Otchet O Matche

Apr 23, 2025