China's Energy Strategy: Middle Eastern LPG As US Alternative

Table of Contents

Declining Reliance on US LPG Imports

Geopolitical tensions and fluctuating market prices have significantly impacted China's reliance on US LPG imports. This shift towards diversification highlights the complexities of international energy trade and China's strategic pursuit of energy security.

Geopolitical Tensions and Trade Wars

The escalating US-China trade war and broader geopolitical instability have played a crucial role in China's decision to diversify its LPG sources.

- Increased Tariffs: Imposed tariffs on US LPG imports increased the cost, making them less competitive compared to Middle Eastern alternatives.

- Trade Disputes: Ongoing trade disputes created uncertainty and supply chain disruptions, pushing China to seek more reliable and stable supply partners.

- Supply Chain Disruptions: The unpredictable nature of the US-China relationship led to concerns about the reliability of US LPG supplies, prompting China to explore alternative sources.

Data from [cite relevant source, e.g., a reputable market research firm] shows a [percentage]% decline in US LPG imports to China between [year] and [year], highlighting the growing shift away from US dependence.

Price Volatility and Market Fluctuations

The price volatility of US LPG in the global market has also contributed to China's decision to diversify its energy imports.

- Comparison of US LPG Prices vs. Middle Eastern Prices: Middle Eastern LPG has often been more price-competitive, offering greater stability and predictability. [Cite price indices or market reports to support this claim].

- Impact on Chinese Energy Costs: Fluctuating US LPG prices create uncertainty in China's energy planning and budgeting, making stable, lower-priced alternatives more appealing.

The Rise of Middle Eastern LPG as a Key Supplier

The Middle East is rapidly emerging as a dominant supplier of LPG to China, driven by increased production capacity, strategic partnerships, and efficient transportation logistics.

Increased Production Capacity in the Middle East

Significant investments in LPG production infrastructure across the Middle East have boosted export capabilities dramatically.

- Specific Countries: Saudi Arabia, Qatar, and other GCC nations have made substantial investments in expanding their LPG production facilities and export terminals.

- New Infrastructure Developments: New pipelines, liquefaction plants, and export terminals have significantly increased the region's LPG export capacity. [Cite data on production figures from reputable sources].

- Production Figures: [Insert statistics on LPG production increases in specific Middle Eastern countries]. [Include a map or chart visually illustrating production and export routes].

Strategic Partnerships and Trade Agreements

China has actively pursued strategic energy partnerships with Middle Eastern countries to secure long-term LPG supplies.

- Bilateral Agreements: Numerous bilateral agreements have been signed, ensuring preferential access to Middle Eastern LPG resources. [Give specific examples of agreements].

- Long-Term Supply Contracts: China has secured long-term supply contracts, providing price stability and supply predictability.

- Joint Ventures in Energy Infrastructure: Joint ventures in pipeline construction and other energy infrastructure projects are further strengthening energy ties.

Transportation and Logistics

The efficient and cost-effective transportation of LPG from the Middle East to China is a key factor in the success of this shift.

- Seaborne Transportation Routes: Seaborne transportation via large LPG carriers offers a reliable and cost-effective method of transporting LPG across vast distances.

- Pipeline Infrastructure (Future Possibilities): Future development of pipeline infrastructure could further enhance the efficiency and security of LPG transportation.

- Efficiency Compared to US Imports: Shipping times and costs from the Middle East are often more competitive than those from the US, bolstering the appeal of this alternative.

Implications for China's Energy Security and Geopolitics

The shift to Middle Eastern LPG has significant implications for China's energy security, geopolitical standing, and environmental sustainability.

Diversification of Energy Sources

This diversification strategy is a cornerstone of China's energy security policy.

- Improved Resilience Against Geopolitical Risks: Reducing dependence on a single supplier mitigates risks associated with geopolitical instability and trade disputes.

- Enhanced Bargaining Power in Global Energy Markets: Access to multiple suppliers gives China greater bargaining power in negotiating prices and securing favorable terms.

Geopolitical Implications

China's strengthened energy ties with Middle Eastern countries have notable geopolitical implications.

- Strengthened Ties with Middle Eastern Countries: This shift strengthens diplomatic and economic ties with key players in the Middle East, reshaping regional power dynamics.

- Potential Impact on US Influence in the Region: China's growing energy independence from the US could diminish US influence in the region.

Environmental Considerations

While LPG is a relatively cleaner-burning fossil fuel compared to coal, its increased consumption raises environmental concerns.

- Carbon Emissions Associated with LPG: The combustion of LPG still produces greenhouse gas emissions, contributing to climate change.

- Potential for Cleaner LPG Technologies: Investing in and adopting cleaner technologies, such as carbon capture and storage, is crucial to mitigate the environmental impact.

Conclusion

China's strategic shift towards Middle Eastern LPG as a key energy source represents a significant development in global energy markets. The decreasing reliance on US supplies is driven by geopolitical factors, price volatility, and the growing production capacity and strategic partnerships in the Middle East. This diversification strategy enhances China's energy security and geopolitical standing, although it also presents environmental considerations that require careful attention. Understanding China's energy strategy, particularly its embrace of Middle Eastern LPG as a US alternative, is crucial for navigating the evolving dynamics of the global energy landscape. Further research into the long-term implications of this shift, including technological advancements and environmental impact assessments, is vital to gain a complete understanding of China's energy future and its impact on the global market. Stay informed about developments in China's energy strategy and the growing role of Middle Eastern LPG.

Featured Posts

-

John Travoltas Pulp Fiction Steakhouse Visit A Miami Video

Apr 24, 2025

John Travoltas Pulp Fiction Steakhouse Visit A Miami Video

Apr 24, 2025 -

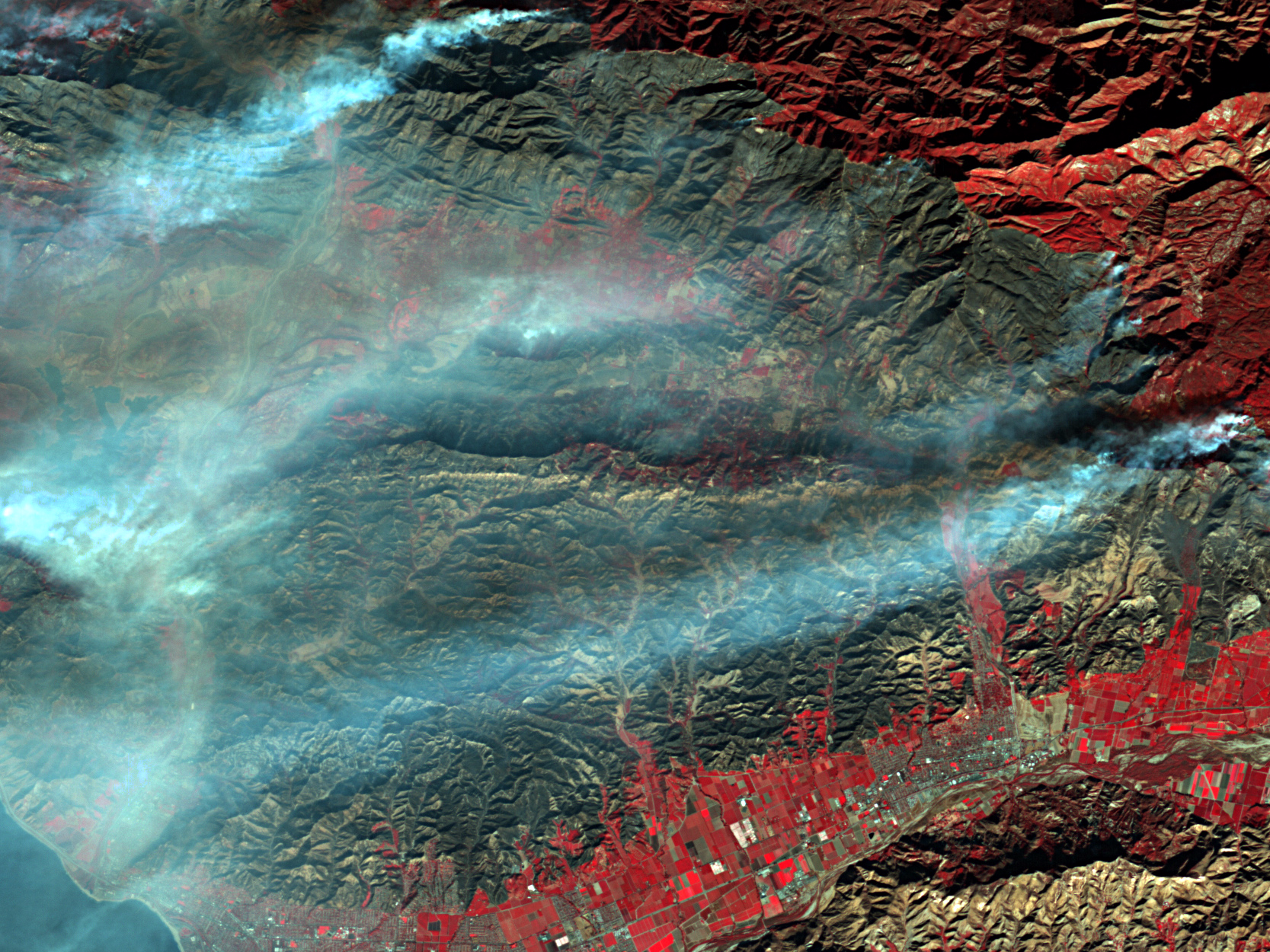

Los Angeles Wildfires The Dark Side Of Disaster Speculation

Apr 24, 2025

Los Angeles Wildfires The Dark Side Of Disaster Speculation

Apr 24, 2025 -

Uil State Bound Hisd Mariachis Whataburger Video Goes Viral

Apr 24, 2025

Uil State Bound Hisd Mariachis Whataburger Video Goes Viral

Apr 24, 2025 -

Nba All Star Weekend Green Moody And Hield Among The Participants

Apr 24, 2025

Nba All Star Weekend Green Moody And Hield Among The Participants

Apr 24, 2025 -

The Canadian Dollar A Current Market Overview

Apr 24, 2025

The Canadian Dollar A Current Market Overview

Apr 24, 2025