Colgate's (CL) Financial Performance Suffers From $200 Million Tariff Burden

Table of Contents

Declining Revenue and Profitability Due to Tariffs

The imposition of tariffs has directly impacted Colgate's revenue streams, squeezing profit margins and hindering overall financial growth. These tariffs, primarily affecting imported raw materials and finished goods, have increased the cost of production significantly. This translates to reduced profitability and, in some cases, a necessity to raise prices to maintain margins. Specific product lines, particularly those with a higher proportion of imported components, have been disproportionately affected.

- Specific examples of product cost increases due to tariffs: Increased costs for certain toothpaste ingredients sourced internationally, impacting flagship brands like Colgate Total and Colgate Optic White. Similarly, certain brush components and packaging materials have also experienced increased costs.

- Quantifiable data on revenue decline (e.g., percentage decrease year-over-year): While precise figures may vary depending on the reporting period and specific product categories, analysts have estimated a noticeable decline in revenue growth compared to pre-tariff periods, potentially in the single-digit percentage range depending on the market.

- Impact on gross profit margins: The increased cost of goods sold, directly attributable to tariffs, has led to a compression of gross profit margins, impacting the overall profitability of Colgate's operations.

Colgate's Response to Tariff Challenges

Faced with this substantial tariff burden, Colgate has implemented several strategies to mitigate the negative impact. These measures include price adjustments, cost-cutting initiatives, and supply chain optimizations. However, the effectiveness of these strategies remains a subject of ongoing analysis.

- Examples of price increases implemented: Colgate has implemented strategic price increases in certain markets to offset the increased costs associated with tariffs. However, this strategy requires careful consideration to avoid alienating price-sensitive consumers.

- Specific cost-cutting initiatives: The company has likely explored measures to streamline operations and reduce expenses, potentially focusing on areas like manufacturing efficiency and administrative overhead. Details of specific cost-cutting measures are often not publicly disclosed due to competitive reasons.

- Changes made to sourcing and manufacturing: Colgate may be exploring alternative sourcing options for raw materials and potentially reshoring or nearshore manufacturing to reduce reliance on tariff-affected import routes. This, however, requires significant investment and logistical planning.

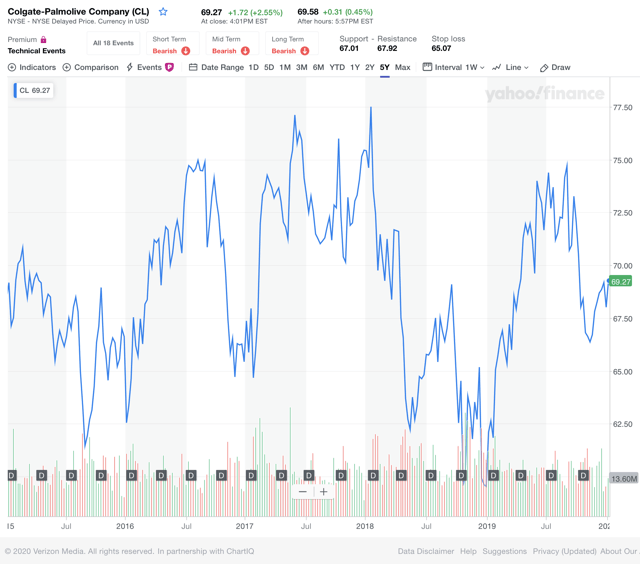

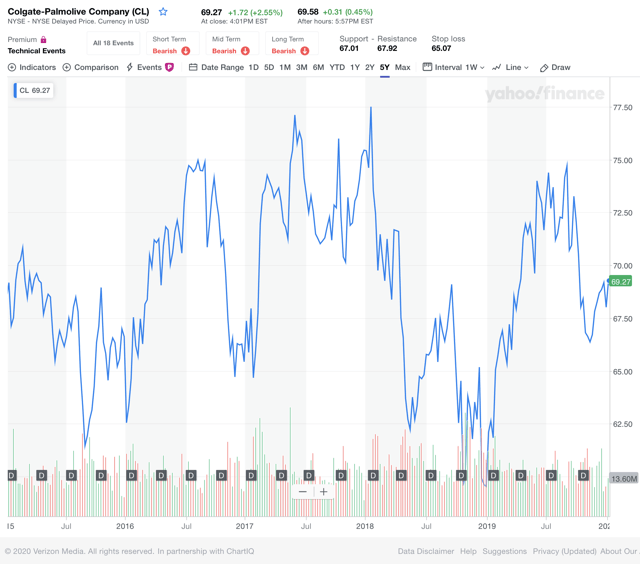

Impact on Colgate's Stock Price and Investor Sentiment

The $200 million tariff burden has undoubtedly had an impact on Colgate's stock price and investor sentiment. The correlation between the imposition of tariffs and fluctuations in the stock price is readily observable. Concerns about reduced profitability and future growth have led to some investor uncertainty.

- Stock price fluctuations since the imposition of tariffs: A detailed analysis of Colgate's stock price performance since the imposition of tariffs would reveal a likely negative correlation – though other macroeconomic factors must also be considered.

- Changes in investor confidence: Investor confidence in Colgate’s ability to navigate these tariff challenges has likely decreased, although the long-term effects are not yet fully apparent.

- Analyst ratings and price targets: Following the announcement of the significant tariff impact, analyst ratings and price targets for Colgate stock may have been adjusted downward by some financial institutions reflecting the increased uncertainty.

Long-Term Implications for Colgate's Growth Strategy

The long-term implications of these tariffs on Colgate's growth strategy are significant and far-reaching. The challenges posed by tariffs force a reevaluation of global expansion plans and necessitate a shift towards more resilient and adaptable strategies.

- Potential impact on market share: Increased costs could make Colgate's products less competitive in certain markets, potentially leading to a decline in market share.

- Revised growth projections: The company's long-term growth projections may need revision to account for the persistent impact of tariffs and the need for increased operational efficiency and strategic adjustments.

- Changes in future expansion plans: Colgate might need to reassess its geographical expansion plans, prioritizing markets less affected by tariffs or focusing on organic growth strategies within existing markets.

Conclusion: Understanding the Impact of Tariffs on Colgate's (CL) Financial Future

The $200 million tariff burden has undeniably impacted Colgate's (CL) financial performance, leading to declining revenue and profitability. While the company has responded with strategic initiatives like price adjustments and cost-cutting measures, the long-term effects remain uncertain. The impact on Colgate's stock price and investor sentiment underscores the seriousness of this challenge. To stay informed about Colgate's (CL) financial performance and the ongoing impact of tariffs, subscribe to reputable financial news sources and follow updates on Colgate stock. Stay informed on how tariffs impact Colgate-Palmolive (CL) financial news and the tariff impact on Colgate to make informed investment decisions.

Featured Posts

-

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025 -

The Worlds Richest Man And The American Battleground A Power Struggle

Apr 26, 2025

The Worlds Richest Man And The American Battleground A Power Struggle

Apr 26, 2025 -

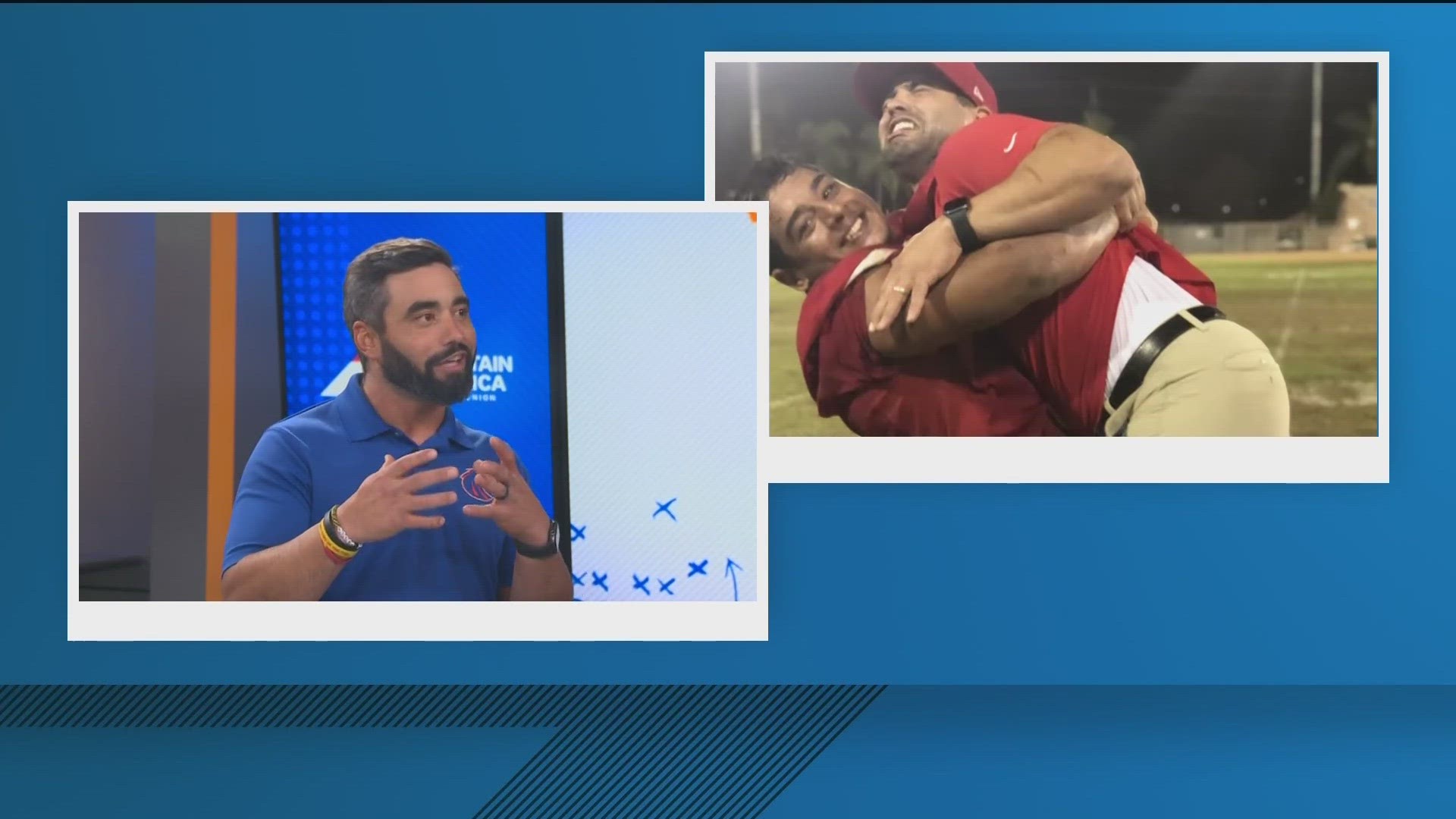

Will Ahmed Hassanein Achieve An Egyptian Nfl First

Apr 26, 2025

Will Ahmed Hassanein Achieve An Egyptian Nfl First

Apr 26, 2025 -

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025 -

American Battleground Taking On A Billionaire The Inside Story

Apr 26, 2025

American Battleground Taking On A Billionaire The Inside Story

Apr 26, 2025