Credit Card Industry Faces Headwinds Amidst Consumer Spending Slowdown

Table of Contents

H2: Decreased Consumer Spending and its Impact on Credit Card Usage

The slowdown in consumer spending is a primary driver of the headwinds facing the credit card industry. This decreased spending directly translates to lower transaction volumes and reduced revenue for credit card companies.

H3: Reduced Discretionary Income

Inflation continues to erode purchasing power, leaving consumers with less discretionary income for non-essential purchases. Simultaneously, rising interest rates increase the cost of borrowing, further dampening consumer confidence and spending. This double whammy is forcing consumers to prioritize essential expenses over discretionary spending.

- Examples of reduced spending: Travel, dining out, entertainment, and retail goods are among the areas seeing the most significant cuts.

- Statistics on decreased credit card transaction volumes: Recent reports indicate a noticeable decline in credit card transaction volumes, reflecting the overall reduction in consumer spending. (Note: Insert relevant statistics and cite sources here).

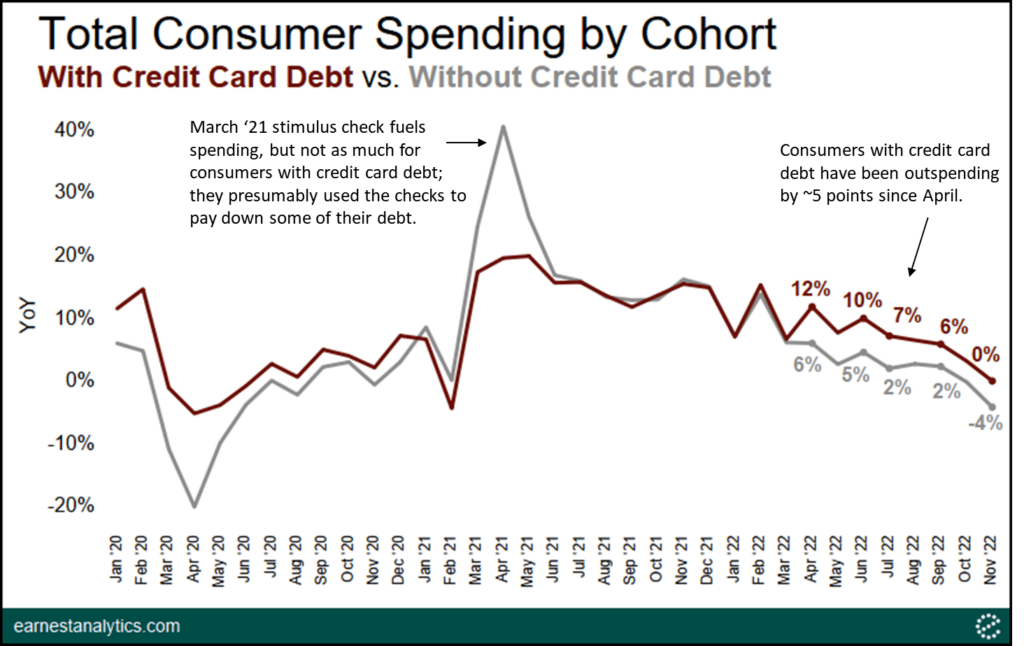

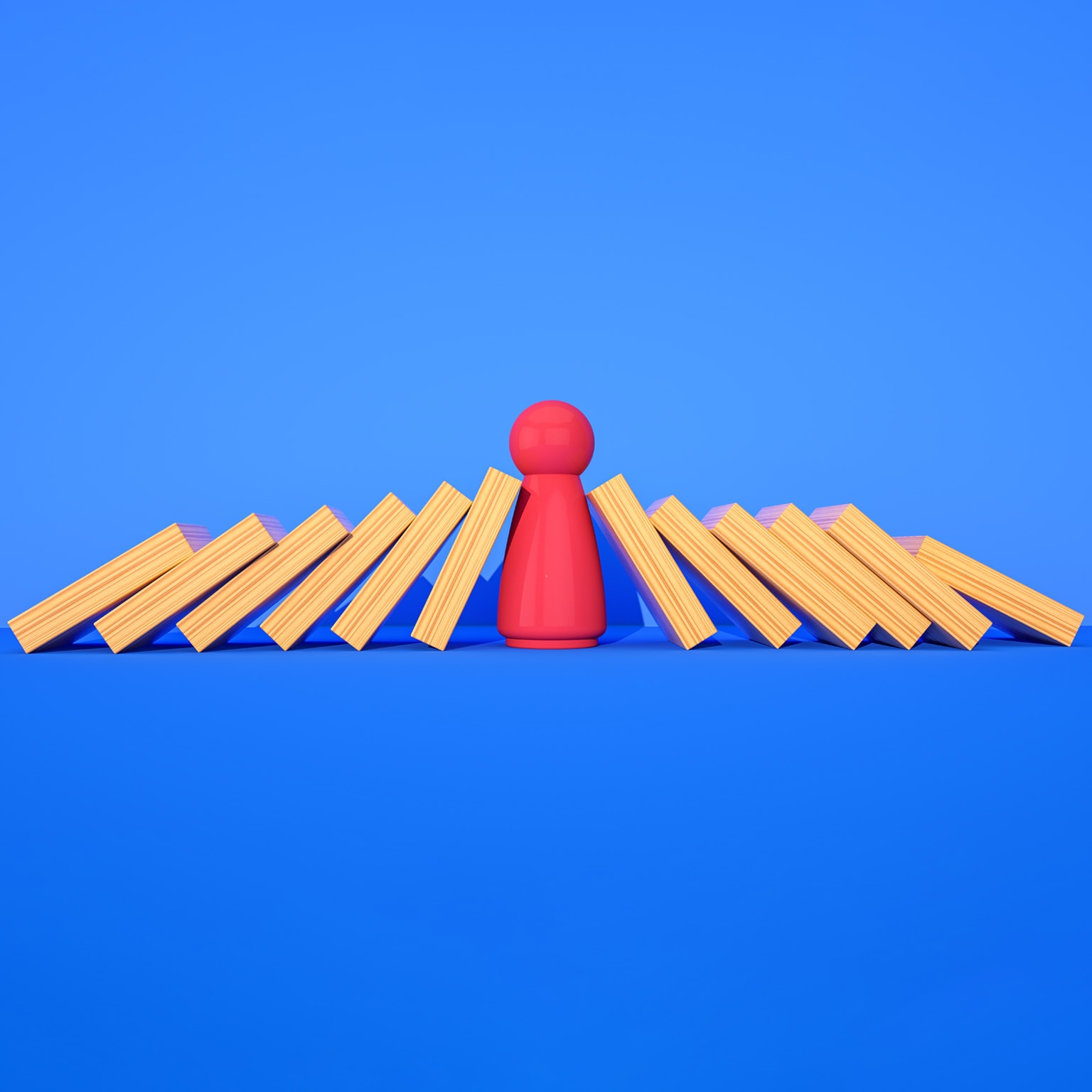

H3: Increased Savings and Debt Consolidation

Facing economic uncertainty, many consumers are prioritizing saving and paying down existing debt over new credit card spending. This shift in consumer behavior reflects a focus on cost-cutting measures and responsible budget management.

- Data on rising savings rates and decreased credit card balances: Data suggests a correlation between rising savings rates and a decrease in outstanding credit card balances, indicating a conscious effort by consumers to reduce their debt burden. (Note: Insert relevant statistics and cite sources here).

- Analysis of consumer debt management strategies: Consumers are increasingly seeking strategies to manage their debt more effectively, including debt consolidation and budgeting apps.

H2: Rising Credit Card Debt and Delinquency Rates

Despite the decrease in overall spending, credit card debt is increasing for many, contributing to higher delinquency rates and presenting challenges for the industry.

H3: Impact of High Interest Rates

Increased interest rates on outstanding credit card balances lead to higher minimum payments, making it more difficult for consumers to manage their debt. This, in turn, contributes to rising delinquency rates and increased losses for credit card companies.

- Statistics on rising credit card interest rates and delinquency rates: Data shows a clear link between increasing interest rates and a rise in credit card delinquencies. (Note: Insert relevant statistics and cite sources here).

- Analysis of the impact on credit card companies' profitability: The rise in delinquencies directly impacts the profitability of credit card companies due to increased losses from bad debts and the need for increased loan loss provisions.

H3: The Growing Burden of Debt

Consumers are carrying higher levels of credit card debt due to increased reliance on credit during periods of economic uncertainty. This growing burden of debt has significant implications for both personal finances and mental health.

- Data on the average credit card debt per household: (Note: Insert relevant statistics and cite sources here). This statistic illustrates the extent of the problem.

- Discussion of the implications for financial well-being: High levels of credit card debt can significantly impact financial well-being, leading to stress, anxiety, and difficulty in achieving financial goals.

H2: Challenges for Credit Card Companies and the Payment Processing Industry

The combination of decreased spending and rising delinquencies creates a significant challenge for credit card companies and the broader payment processing industry.

H3: Reduced Profitability

Lower consumer spending translates directly into reduced transaction fees for credit card companies. Coupled with increased delinquency rates, this leads to a significant reduction in overall profitability.

- Analysis of the impact on credit card company revenue and profits: (Note: Insert relevant data and analysis here showing the financial impact on credit card companies).

- Discussion of potential cost-cutting measures: Credit card companies are likely to explore cost-cutting measures to mitigate the impact of reduced profitability.

H3: Adapting to Changing Consumer Behavior

Credit card companies must adapt their strategies to cater to evolving consumer needs and preferences. This includes addressing increased competition from alternative payment methods such as buy now, pay later (BNPL) services.

- Examples of innovative strategies employed by credit card companies: (Note: Discuss examples of how credit card companies are adapting, such as offering more flexible repayment options, loyalty programs, and personalized rewards).

- Discussion of the future of payment processing: The future of payment processing will likely involve a greater integration of technology and a focus on providing more personalized and flexible financial solutions.

3. Conclusion:

The credit card industry is undeniably facing significant headwinds due to the consumer spending slowdown. Decreased consumer spending, rising credit card debt, and increased delinquency rates present considerable challenges. Adapting to changing consumer behavior and mitigating the impact of economic uncertainty will be crucial for navigating this turbulent period. Understanding the complexities of the credit card industry and its response to the consumer spending slowdown is vital for businesses and consumers alike. Stay informed on the latest developments in the credit card industry and proactively manage your personal finances to weather this economic storm. Take control of your credit card debt and explore strategies for responsible financial management.

Featured Posts

-

Hield And Paytons Bench Heroics Lead Warriors To Victory Over Blazers

Apr 24, 2025

Hield And Paytons Bench Heroics Lead Warriors To Victory Over Blazers

Apr 24, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 24, 2025

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 24, 2025 -

Chat Gpt Ceo Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025

Chat Gpt Ceo Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025 -

Microsoft Activision Deal Ftcs Appeal Challenges Regulatory Approval

Apr 24, 2025

Microsoft Activision Deal Ftcs Appeal Challenges Regulatory Approval

Apr 24, 2025 -

Why Investing In Middle Management Improves Company Performance

Apr 24, 2025

Why Investing In Middle Management Improves Company Performance

Apr 24, 2025