Decoding The China Puzzle: Understanding The Difficulties Faced By International Automakers

Table of Contents

Navigating Regulatory Hurdles and Bureaucracy

Entering the Chinese automotive market requires navigating a complex web of regulations and bureaucratic processes. Foreign automakers face significant hurdles that go beyond those experienced in other major markets.

Stringent Regulations and Certification Processes

China's automotive regulations are stringent, encompassing emission standards, safety requirements, and a lengthy certification process. Meeting these requirements can be time-consuming and costly. For example, the stringent emission standards (GB standards) often necessitate significant modifications to vehicle designs, adding to development costs. The lengthy approval process, which involves multiple government agencies, can significantly delay market entry.

- Lengthy approval times: Obtaining all necessary certifications can take months, even years.

- Rigorous testing requirements: Vehicles must undergo extensive testing to meet safety and emission standards.

- Constantly evolving regulatory landscape: Regulations are frequently updated, demanding continuous adaptation and compliance efforts.

Local Content Requirements and Joint Venture Necessities

China mandates local content requirements, forcing foreign automakers to source a certain percentage of components domestically. Furthermore, foreign companies are often required to establish joint ventures with Chinese partners, limiting foreign ownership and control. These requirements impact investment strategies and operational control.

- Percentage of locally sourced components: The required percentage varies depending on the vehicle type and government policies.

- Limitations on foreign ownership: Foreign companies often have limited control in joint ventures, impacting decision-making.

- Challenges in managing joint ventures: Cultural differences and differing business practices can create difficulties in managing joint ventures effectively.

Understanding the Unique Chinese Consumer

The Chinese automotive market is characterized by diverse consumer preferences and rapid changes in demand. Understanding these nuances is critical for effective marketing and product development.

Diverse Consumer Preferences and Market Segmentation

Chinese consumers exhibit diverse preferences depending on region, income level, and lifestyle. A "one-size-fits-all" approach is unlikely to succeed. Targeted marketing strategies are crucial for reaching specific consumer segments.

- Varying brand loyalty across regions: Consumer preferences and brand loyalty differ significantly across China's diverse regions.

- Preference for specific features and technologies: Certain features and technologies are highly valued in China, such as advanced connectivity and safety features.

- Growing demand for electric vehicles and new energy vehicles (NEVs): The Chinese government actively promotes the adoption of electric vehicles (EVs) and new energy vehicles (NEVs), driving rapid growth in this segment.

The Rise of Domestic Brands and Intense Competition

The Chinese automotive industry boasts increasingly strong domestic brands, creating intense competition for international automakers. These domestic players often leverage aggressive pricing strategies, rapid technological advancements, and effective marketing campaigns.

- Aggressive pricing strategies: Domestic brands often offer competitively priced vehicles, putting pressure on foreign automakers.

- Rapid technological advancements: Chinese automakers are rapidly innovating in areas such as electric vehicles, autonomous driving, and connected car technologies.

- Strong brand building and marketing campaigns: Domestic brands are investing heavily in brand building and targeted marketing, effectively reaching Chinese consumers.

Infrastructure and Supply Chain Challenges

Establishing a successful automotive business in China requires overcoming significant infrastructure and supply chain challenges.

Developing Robust Supply Chains in China

Building reliable and efficient supply chains in China presents unique complexities. Logistics, infrastructure limitations, and potential supply chain disruptions pose considerable challenges.

- Finding reliable suppliers: Identifying and vetting reliable suppliers is critical, especially in a market with a vast number of suppliers of varying quality.

- Managing logistics across vast distances: China's vast geographic area presents logistical challenges in transporting components and finished vehicles.

- Ensuring consistent quality of components: Maintaining consistent quality of components sourced from various suppliers can be challenging.

Adapting to the Evolving EV Landscape

China's electric vehicle (EV) market is booming, presenting both opportunities and challenges. International automakers must adapt to this rapidly evolving landscape.

- Investment in charging infrastructure: Building out a robust charging infrastructure is crucial for the success of EVs in China.

- Competition in battery technology: The competition in battery technology is fierce, requiring continuous innovation and investment.

- Government incentives for EV adoption: The Chinese government provides various incentives for EV adoption, influencing market dynamics and consumer choices.

Conclusion

The Chinese automotive market presents both immense opportunities and significant challenges for international automakers. Successfully navigating this "China puzzle" requires a deep understanding of the regulatory environment, consumer preferences, and the competitive landscape. Foreign companies must adapt their strategies, embrace local partnerships, and invest in technological advancements to thrive in this dynamic market. Mastering the complexities of this market is key to unlocking its vast potential. To succeed in this challenging yet rewarding market, thoroughly understanding the difficulties and adapting your strategy accordingly is paramount. Don't let the China puzzle defeat you; learn to decode it and unlock the potential of the world's largest automotive market.

Featured Posts

-

Anti Trump Sentiment Divides Canada Albertas Exception

Apr 27, 2025

Anti Trump Sentiment Divides Canada Albertas Exception

Apr 27, 2025 -

Indian Wells 2024 Eliminacion Temprana De Una De Las Principales Contendientes

Apr 27, 2025

Indian Wells 2024 Eliminacion Temprana De Una De Las Principales Contendientes

Apr 27, 2025 -

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025 -

Understanding Ariana Grandes Recent Image Transformation

Apr 27, 2025

Understanding Ariana Grandes Recent Image Transformation

Apr 27, 2025 -

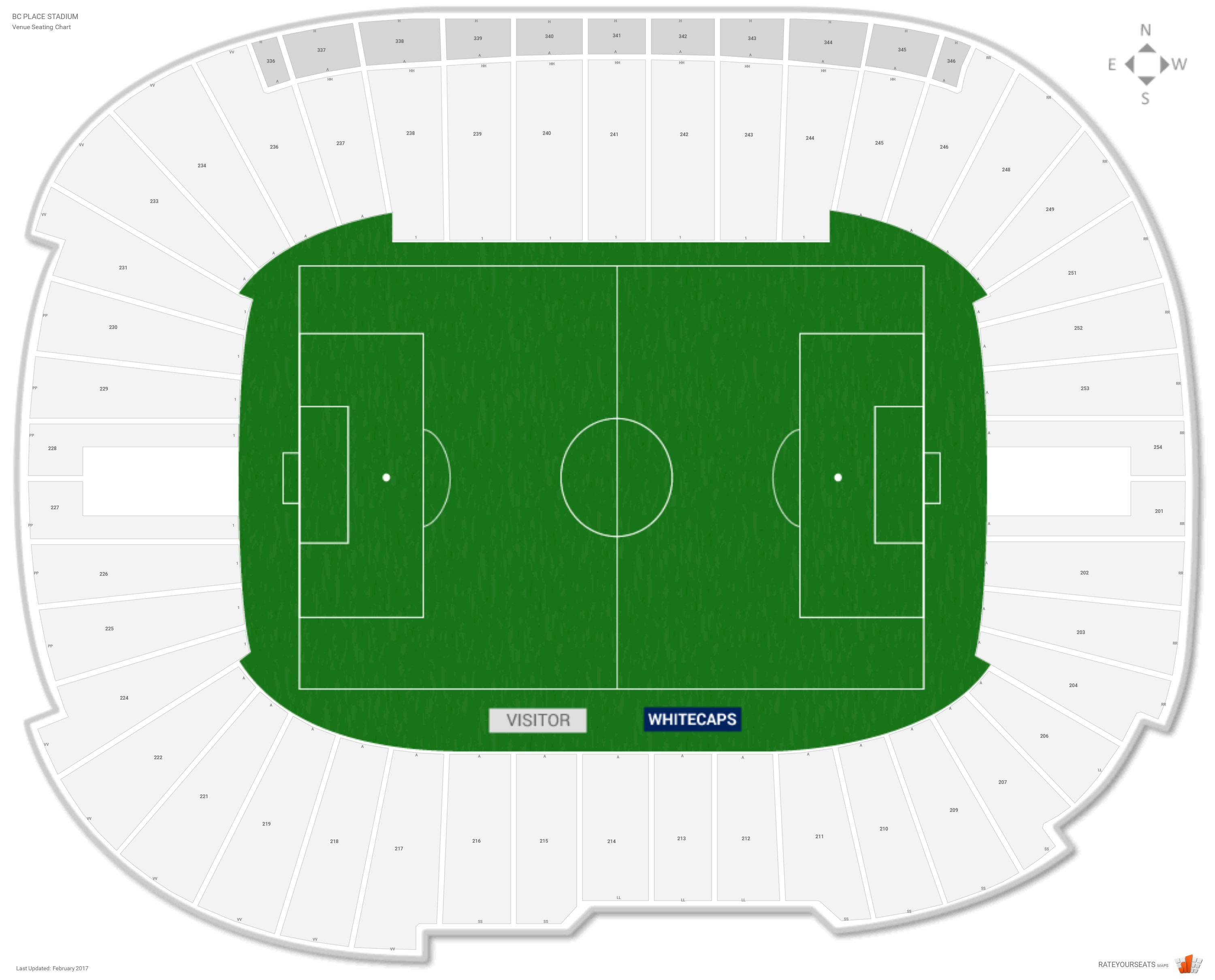

Whitecaps Stadium Talks New Home At Pne Fairgrounds

Apr 27, 2025

Whitecaps Stadium Talks New Home At Pne Fairgrounds

Apr 27, 2025