Deloitte's Prediction: A Significant Slowdown In US Economic Growth

Table of Contents

Keywords: Deloitte, US economic growth, economic slowdown, economic forecast, recession, inflation, interest rates, business impact, consumer spending, investment

Deloitte's recent economic forecast paints a concerning picture: a significant slowdown in US economic growth is on the horizon. This prediction carries substantial weight, impacting businesses, consumers, and the overall economic landscape. Understanding the factors driving this slowdown and its potential consequences is crucial for navigating the challenges ahead. This article delves into Deloitte's findings, exploring the underlying causes and outlining the implications for both businesses and consumers.

Deloitte's Key Findings and Methodology

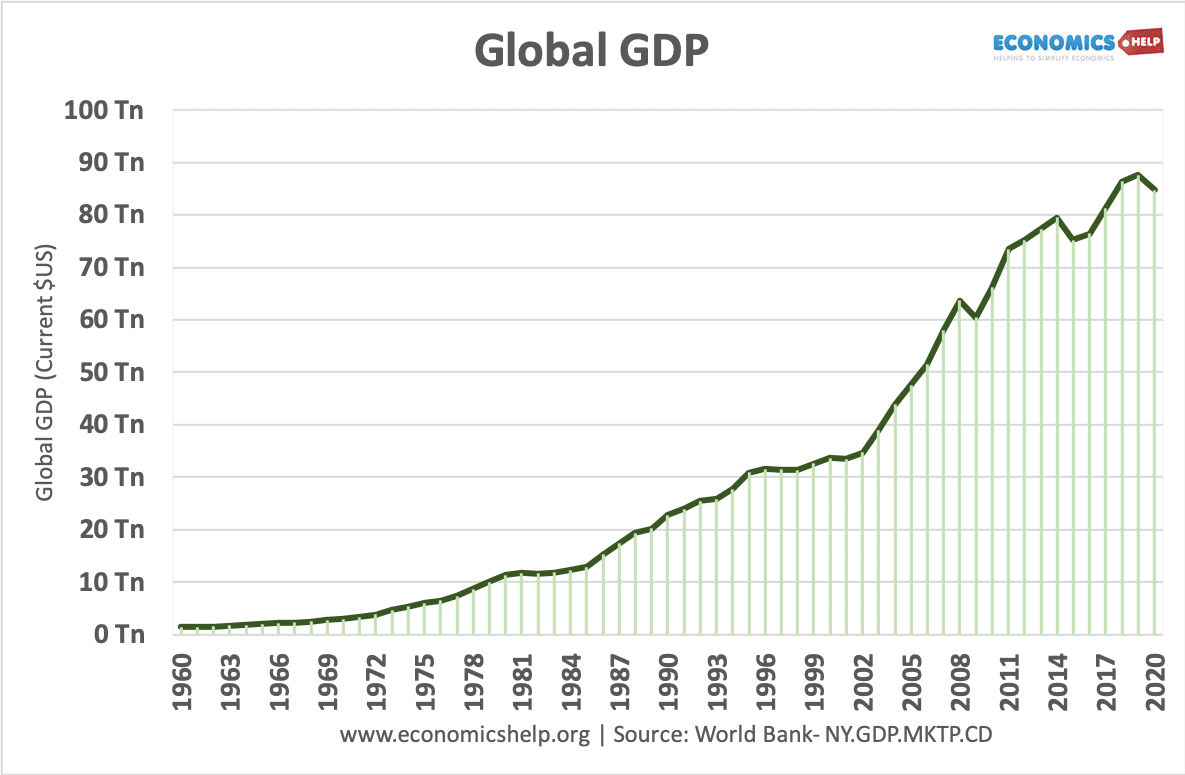

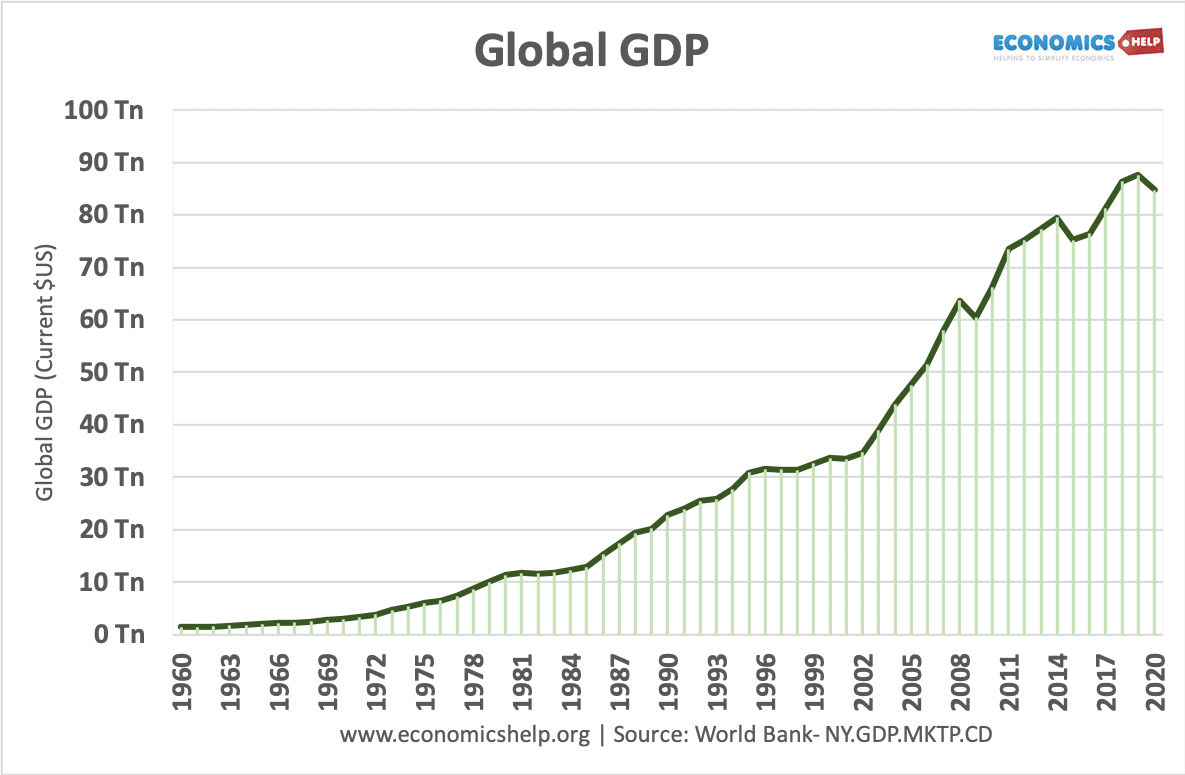

Deloitte's forecast utilizes sophisticated econometric models and a comprehensive analysis of leading economic indicators to predict future trends. Their methodology considers a wide range of data points, including inflation rates, consumer spending, business investment, and geopolitical factors. The report projects a notable decrease in US economic growth.

-

Projected GDP growth rate for the next 1-2 years: Deloitte's report projects a GDP growth rate significantly below previous years' averages, potentially falling into the low single digits or even negative territory, depending on the unfolding economic situation. The exact figures are subject to ongoing analysis and revision as new data becomes available.

-

Specific sectors expected to be most significantly affected: Sectors like housing, highly sensitive to interest rate changes, and manufacturing, vulnerable to supply chain disruptions and reduced consumer demand, are expected to experience the most significant negative impacts. Other sectors may see reduced growth as well.

-

Explanation of the methodology used in arriving at the prediction: Deloitte's analysis incorporates a diverse set of leading indicators and econometric models, rigorously tested and validated, to generate the forecast. Transparency regarding methodology is a key component of Deloitte's commitment to producing reliable economic analysis.

Underlying Factors Contributing to the Slowdown

Several interconnected factors contribute to Deloitte's prediction of a US economic slowdown.

Inflation and Interest Rate Hikes

Persistent inflation remains a major concern. The Federal Reserve's response, involving aggressive interest rate hikes, aims to curb inflation but also risks slowing economic activity.

-

Relationship between inflation and consumer spending: High inflation erodes purchasing power, forcing consumers to cut back on spending, reducing overall economic demand.

-

How higher interest rates affect borrowing and investment: Increased interest rates make borrowing more expensive, discouraging businesses from investing and consumers from making large purchases like homes or cars.

-

Potential for a recession triggered by interest rate hikes: The aggressive interest rate hikes increase the risk of triggering a recession, as the economic slowdown could become severe enough to cause widespread job losses and decreased economic activity.

Geopolitical Uncertainty

Global instability, particularly the war in Ukraine and persistent supply chain disruptions, significantly impacts the US economy.

-

Impact of the war in Ukraine on energy prices and global supply chains: The conflict has dramatically increased energy prices, fueling inflation and disrupting global supply chains, leading to shortages and higher prices for various goods.

-

Effects of supply chain disruptions on inflation and production: Continued supply chain bottlenecks exacerbate inflation and hinder production, limiting economic growth.

-

Other significant geopolitical factors impacting the US economy: Other geopolitical events, such as trade tensions and political instability in various regions, contribute to overall uncertainty and negatively impact economic confidence and investment.

Weakening Consumer Confidence

Declining consumer confidence signals reduced spending and investment, further contributing to the economic slowdown.

-

Statistics on consumer confidence indices: Various consumer confidence indices show a downward trend, reflecting growing pessimism about the economy.

-

Relationship between consumer confidence and spending patterns: Consumer confidence is closely tied to spending habits; decreasing confidence leads to less spending, negatively affecting economic growth.

-

Potential impact on retail sales and service sectors: Reduced consumer spending directly impacts retail sales and the service sectors, which are highly reliant on consumer demand.

Potential Implications for Businesses and Consumers

Deloitte's forecast has significant implications for both businesses and consumers.

Impact on Businesses

Businesses face several challenges, including decreased demand, reduced investment, and potential hiring freezes.

-

Strategies for businesses to navigate the economic slowdown: Businesses need to adopt flexible strategies, including cost-cutting measures, diversification, and innovation to weather the slowdown.

-

Sectors expected to be most vulnerable: Industries heavily reliant on consumer spending or sensitive to interest rate changes are particularly vulnerable.

-

Potential for business closures and job losses: The economic slowdown may unfortunately lead to business closures and job losses in some sectors.

Impact on Consumers

Consumers may face higher prices, reduced purchasing power, and potentially increased unemployment.

-

Strategies for consumers to manage their finances during an economic slowdown: Consumers should prioritize budgeting, saving, and paying down debt to prepare for potential financial challenges.

-

Potential impact on savings and debt levels: The slowdown may negatively impact savings and increase debt levels for some consumers.

-

Expected changes in consumer spending habits: Consumers are likely to reduce discretionary spending and prioritize essential goods and services.

Conclusion

Deloitte's prediction of a significant US economic slowdown is driven by a confluence of factors: persistent inflation, aggressive interest rate hikes, geopolitical uncertainty, and weakening consumer confidence. This slowdown poses significant challenges for businesses, potentially leading to reduced investment, decreased demand, and job losses. Consumers may experience higher prices, reduced purchasing power, and increased unemployment. Staying informed about the evolving economic landscape and Deloitte's future forecasts is crucial. By understanding these potential challenges, businesses and consumers can better prepare themselves and make informed decisions to navigate the predicted US economic slowdown effectively. Learn more about Deloitte's economic analysis and forecasts [link to Deloitte website].

Featured Posts

-

The White Lotus Stars Past Patrick Schwarzeneggers Forgotten Role In An Ariana Grande Music Video

Apr 27, 2025

The White Lotus Stars Past Patrick Schwarzeneggers Forgotten Role In An Ariana Grande Music Video

Apr 27, 2025 -

Canadian Auto Sector Job Losses Trumps Tariffs Deliver A Posthaste Blow

Apr 27, 2025

Canadian Auto Sector Job Losses Trumps Tariffs Deliver A Posthaste Blow

Apr 27, 2025 -

Understanding Ariana Grandes Latest Transformation Hair And Tattoos

Apr 27, 2025

Understanding Ariana Grandes Latest Transformation Hair And Tattoos

Apr 27, 2025 -

Juliette Binoche Cannes Film Festival Jury President 2025

Apr 27, 2025

Juliette Binoche Cannes Film Festival Jury President 2025

Apr 27, 2025 -

Dows Decision To Delay Canadian Project A Sign Of Market Instability

Apr 27, 2025

Dows Decision To Delay Canadian Project A Sign Of Market Instability

Apr 27, 2025