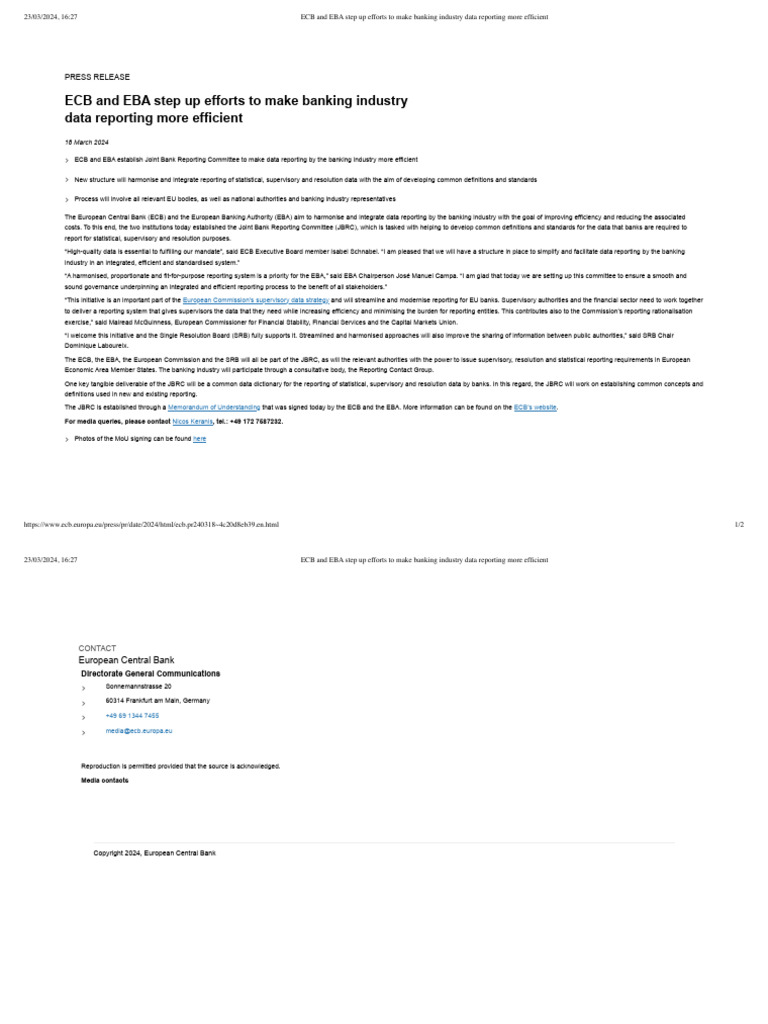

ECB Forms New Task Force To Streamline Banking Regulation

Table of Contents

The Rationale Behind the New Task Force

The ECB's decision to establish a task force dedicated to streamlining banking regulation stems from several pressing challenges within the current regulatory framework. The current system suffers from fragmentation, leading to inconsistencies in enforcement across different jurisdictions within the Eurozone. This inconsistency creates a significant burden for banks operating across multiple countries, requiring them to navigate diverse rules and regulations. Furthermore, the increasing complexity of the financial system, driven by technological advancements and globalization, necessitates a more efficient and effective supervisory framework.

The overarching goal is to enhance the stability and efficiency of the Eurozone’s financial system. This requires a more unified and streamlined approach to banking regulation. The current situation presents several key issues:

- Increased regulatory burden on banks: The sheer volume of regulations places a significant administrative and financial burden on banks, diverting resources from core business activities.

- Inconsistent application of rules across different jurisdictions: Variations in interpretation and enforcement across member states create a level playing field disadvantage and increase compliance costs.

- Need for improved efficiency and effectiveness in supervision: The current system may lack the efficiency and effectiveness needed to effectively oversee a complex and evolving financial landscape.

- Desire to foster a more competitive and resilient banking sector: Streamlined regulation can foster greater competition and resilience, benefiting both banks and consumers.

Composition and Mandate of the Task Force

The task force comprises representatives from various ECB departments, bringing together a wealth of expertise in banking supervision, legal affairs, and economics. The inclusion of external experts with relevant experience in banking and regulation further strengthens the task force's capabilities. Their collective knowledge and experience will be crucial in identifying areas for improvement and developing practical solutions.

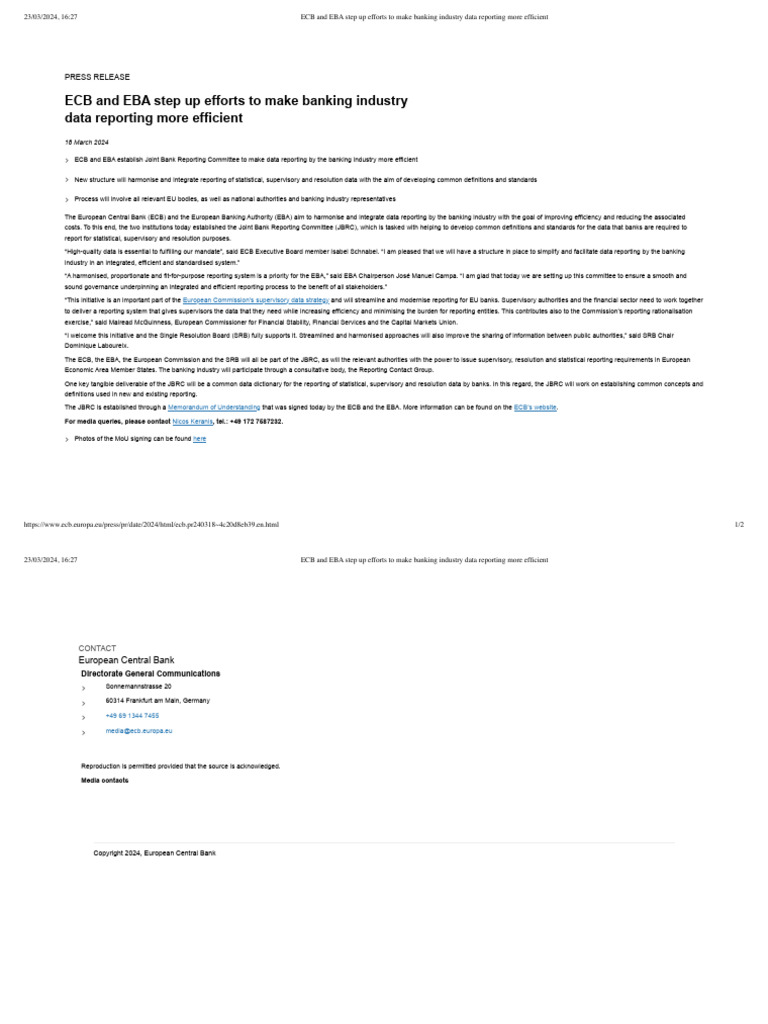

The task force's mandate is clearly defined: to identify areas where banking regulation can be streamlined, simplified, and harmonized across the Eurozone. This will involve a thorough review of existing regulations, identifying overlapping or contradictory rules, and proposing solutions to create a more efficient and consistent regulatory framework. Key focus areas will include:

- Specific areas of focus: Capital requirements, liquidity rules, reporting procedures, and cross-border banking activities.

- Timeline for completing the task force's work: A detailed timeline, including key milestones and deadlines, will be established to ensure timely completion.

- Mechanism for feedback and consultation with stakeholders: The task force will engage in extensive consultation with banks, national authorities, and other stakeholders to gather input and ensure that proposed changes are practical and effective.

Potential Impacts of Streamlined Banking Regulation

The successful implementation of the task force's recommendations holds the potential to significantly benefit the European banking sector and the wider economy. Streamlined regulations can lead to several positive outcomes:

- Reduced compliance costs for banks: Simplifying regulations will reduce the administrative burden on banks, freeing up resources for investment and lending.

- Improved efficiency in regulatory processes: A more streamlined system will improve the efficiency of supervisory processes, allowing regulators to focus on systemic risks.

- Enhanced stability and resilience of the banking system: A more consistent and effective regulatory framework will enhance the stability and resilience of the banking system, protecting depositors and the wider economy.

- Increased competitiveness for European banks: Reducing regulatory complexity will level the playing field for European banks, allowing them to compete more effectively on a global scale.

However, it's crucial to acknowledge potential challenges. Simplifying regulations may unintentionally create loopholes or unintended consequences. Therefore, a careful and comprehensive approach is essential to ensure that any changes enhance rather than undermine the stability and integrity of the financial system.

The ECB's Commitment to Regulatory Reform

The creation of this task force underscores the ECB's broader commitment to regulatory reform within the Eurozone. This initiative aligns with the ECB's ongoing efforts to improve banking supervision and strengthen the resilience of the financial system. The ECB has consistently highlighted the importance of a stable and efficient banking sector for the overall economic health of the Eurozone.

- Mention other initiatives related to banking supervision and regulation: This could include links to relevant ECB publications and statements outlining the ECB’s broader strategic objectives.

- Link to relevant ECB publications and statements: Providing links to relevant ECB publications and statements will enhance the credibility and authority of this article.

Conclusion: The Significance of the ECB's New Task Force

The establishment of the ECB's new task force represents a significant step towards improving banking regulation within the Eurozone. By streamlining regulations, the task force aims to reduce compliance costs for banks, improve the efficiency of supervisory processes, and ultimately enhance the stability and resilience of the European banking system. The potential benefits are substantial, promising improved efficiency, reduced costs, and enhanced stability for the Eurozone's financial landscape. Stay informed about the task force's progress and the evolving landscape of European banking regulation by regularly checking the ECB's website for updates on the "ECB banking regulation" and the ECB’s efforts to improve banking regulation, and to learn more about streamlining banking regulations in the Eurozone. The work of this task force is crucial for the future health and stability of the Eurozone's financial system.

Featured Posts

-

Open Thread Community February 16 2025 Updates

Apr 27, 2025

Open Thread Community February 16 2025 Updates

Apr 27, 2025 -

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025 -

Grand National 2025 Examining Past Horse Fatalities

Apr 27, 2025

Grand National 2025 Examining Past Horse Fatalities

Apr 27, 2025 -

Broadcoms V Mware Deal An Extreme Price Hike Of 1050 According To At And T

Apr 27, 2025

Broadcoms V Mware Deal An Extreme Price Hike Of 1050 According To At And T

Apr 27, 2025 -

Questionable Choice Anti Vaxxer Appointed To Autism Research Role

Apr 27, 2025

Questionable Choice Anti Vaxxer Appointed To Autism Research Role

Apr 27, 2025