ECB's New Initiative: Simplifying Banking Regulations

Table of Contents

Reduced Regulatory Burden for Smaller Banks

Smaller banks often face a disproportionately high regulatory burden compared to their larger counterparts. This initiative directly addresses this imbalance, aiming to level the playing field and unlock their growth potential. The core objective is to reduce administrative overhead and compliance costs, freeing up resources for investment and expansion.

-

Simplified Reporting Requirements: The initiative simplifies reporting procedures, reducing the time and resources dedicated to data collection and submission. This includes fewer forms, clearer instructions, and potentially the use of standardized reporting templates.

-

Reduced Compliance Costs: By streamlining processes and reducing the complexity of regulations, the initiative significantly reduces the overall compliance costs for smaller banks. This translates to greater profitability and enhanced financial stability.

-

Streamlined Application Processes for Licenses and Approvals: Obtaining licenses and approvals is often a lengthy and complex process. The initiative aims to expedite these procedures, making it easier for smaller banks to enter the market or expand their services.

-

Examples of Specific Regulations Being Simplified: The initiative might target specific regulations related to capital adequacy, liquidity requirements, or anti-money laundering compliance, making them easier to understand and implement. For example, it could involve simplifying the calculation of risk-weighted assets or clarifying the criteria for granting certain exemptions.

Enhanced Digitalization and Innovation in Banking

The ECB's initiative recognizes the transformative power of technology in the banking sector. By fostering a more supportive regulatory environment, it aims to accelerate the adoption of innovative technologies and financial products. This will drive efficiency, enhance customer experience, and create new opportunities for growth.

-

Easing Restrictions on Fintech Collaborations: The initiative aims to create a smoother regulatory pathway for collaborations between traditional banks and fintech companies, encouraging innovation through partnerships and the integration of cutting-edge technologies.

-

Facilitating the Use of Cloud Computing and Data Analytics: By clarifying the regulatory landscape surrounding cloud computing and data analytics, the initiative allows banks to leverage these technologies more effectively for improving operational efficiency, risk management, and customer service.

-

Promoting the Development of Open Banking APIs: Open banking APIs are crucial for facilitating data sharing and innovation in financial services. The initiative supports the wider adoption of secure and standardized APIs, allowing for the development of new and innovative banking products and services.

-

Specific Examples of How This Will Encourage Innovation: The initiative may involve relaxing certain data privacy regulations to facilitate the use of AI and machine learning in credit scoring or fraud detection, creating a more dynamic and innovative banking landscape.

Improved Transparency and Consumer Protection

Simplifying regulations doesn't mean compromising consumer protection. The initiative prioritizes maintaining a strong level of transparency and safeguarding consumer rights while streamlining processes.

-

Clarification of Existing Consumer Protection Rules: The initiative aims to clarify existing rules, ensuring that they are easily understandable for both banks and consumers, and reducing ambiguity that can lead to disputes.

-

Enhanced Mechanisms for Reporting and Addressing Consumer Complaints: Improved mechanisms for reporting and resolving consumer complaints will ensure that consumers have effective avenues to address any concerns they may have.

-

Increased Transparency in Banking Fees and Charges: The initiative aims to enhance transparency in banking fees and charges, empowering consumers to make informed decisions and reducing the potential for hidden costs.

-

Measures to Prevent Fraud and Financial Crime: While simplifying regulations, the initiative maintains a robust approach to fraud prevention and combating financial crime, ensuring the safety and security of the financial system.

Strengthening Financial Stability within the Eurozone

By reducing complexity and improving efficiency, the ECB's initiative contributes to a more resilient and stable financial system across the Eurozone. This benefits banks, consumers, and the wider economy.

-

Improved Bank Resilience to Economic Shocks: Streamlined regulations allow banks to manage risks more effectively and adapt to economic changes with greater agility.

-

Enhanced Risk Management Capabilities: Simplified processes free up resources for banks to invest in advanced risk management tools and strategies.

-

Increased Efficiency in the Supervision of Banks by the ECB: The initiative facilitates more effective supervision by the ECB, improving its ability to monitor risks and maintain financial stability.

-

Positive Impact on the Overall Stability of the Eurozone: A stronger and more stable banking sector contributes to overall economic stability within the Eurozone, fostering economic growth and job creation.

Conclusion: The Future of Banking Regulation with the ECB's New Initiative

The ECB's New Initiative: Simplifying Banking Regulations offers significant benefits: reduced regulatory burden for smaller banks, increased digitalization and innovation, enhanced consumer protection, and strengthened financial stability within the Eurozone. This initiative marks a pivotal step towards a more efficient, resilient, and innovative European banking sector, with long-term positive implications for the broader economy. Stay informed about the ongoing developments of the ECB's new initiative by visiting [link to ECB website] and understanding how these changes will affect your business.

Featured Posts

-

Are We Normalizing Disaster The Implications Of Betting On The Los Angeles Wildfires

Apr 27, 2025

Are We Normalizing Disaster The Implications Of Betting On The Los Angeles Wildfires

Apr 27, 2025 -

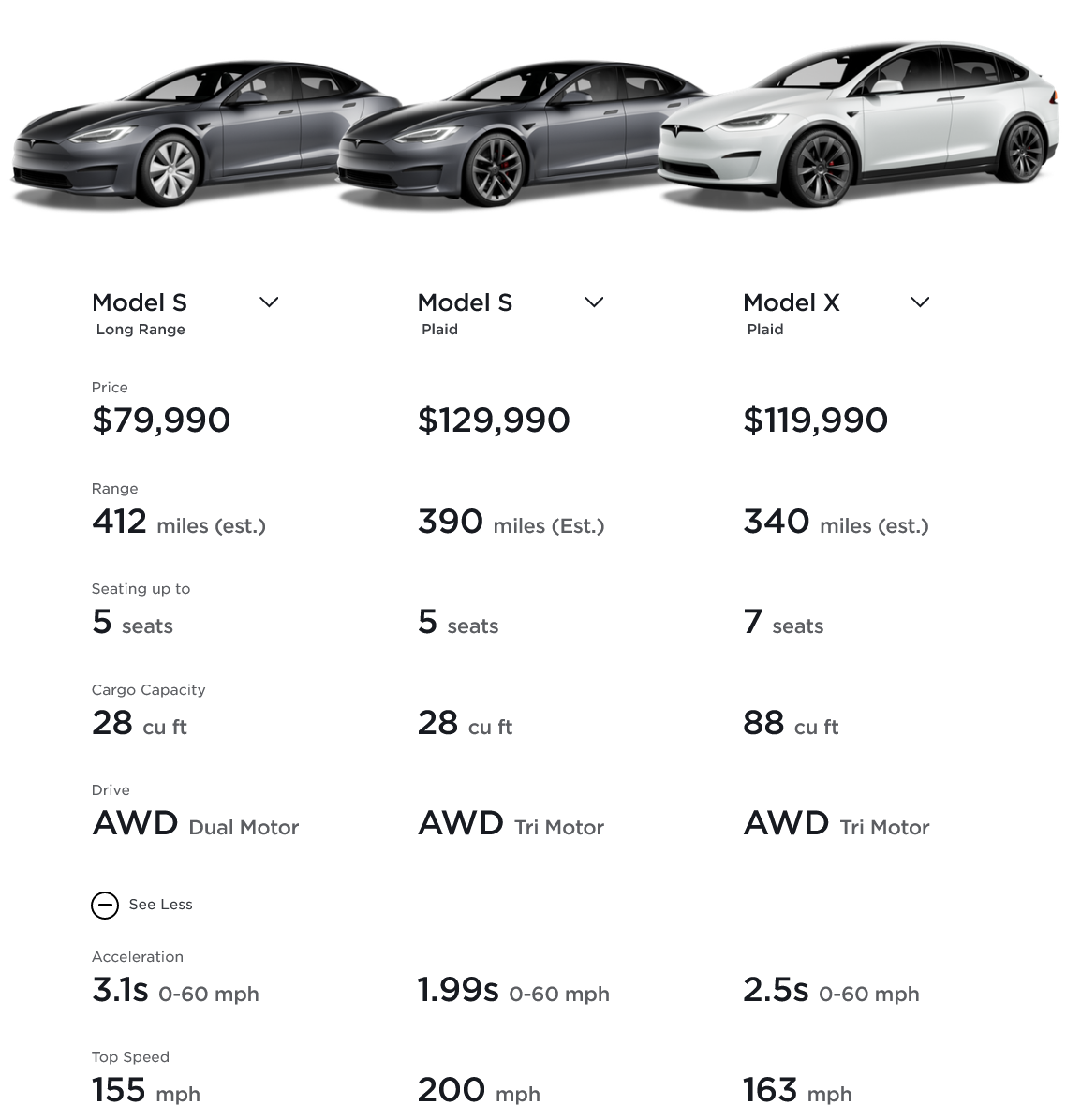

Tesla Canada Price Increase Pre Tariff Inventory Clearance

Apr 27, 2025

Tesla Canada Price Increase Pre Tariff Inventory Clearance

Apr 27, 2025 -

Free Film And Tv On Kanopy What To Watch Today

Apr 27, 2025

Free Film And Tv On Kanopy What To Watch Today

Apr 27, 2025 -

Sister Faith Vs Sister Chance In Andrzej Zulawskis Possession A Deep Dive

Apr 27, 2025

Sister Faith Vs Sister Chance In Andrzej Zulawskis Possession A Deep Dive

Apr 27, 2025 -

Analyzing Ariana Grandes New Look Hair Tattoos And Professional Styling

Apr 27, 2025

Analyzing Ariana Grandes New Look Hair Tattoos And Professional Styling

Apr 27, 2025