Emerging Market Stocks: A Year Of Growth Despite US Slump

Table of Contents

What are Emerging Market Stocks?

Before delving into the reasons for their recent success, let's define "emerging market stocks." Emerging markets are countries with rapidly developing economies, often characterized by high growth potential but also higher levels of risk compared to developed markets like the US or Europe. These markets encompass a wide range of companies across various sectors, from technology giants to resource producers, offering investors exposure to diverse economic landscapes.

1. Resilience of Emerging Markets Amidst Global Uncertainty

The robust performance of emerging market stocks in 2023, despite the US market downturn, underscores their resilience and underscores the benefits of diversification.

Diversification Benefits

Investing in emerging markets offers a powerful hedge against US market volatility. Diversification reduces portfolio risk by spreading investments across geographically diverse economies with less correlation to the US market's performance.

- Examples of contrasting economic cycles: While the US faced inflation and interest rate hikes, some emerging markets, like India, experienced robust domestic growth driven by strong consumer demand. Conversely, when the US economy falters, emerging markets may offer a relative haven.

- Lower correlation: Studies consistently show lower correlation between emerging market and US stock performance, meaning their ups and downs are not always synchronized. This reduces overall portfolio volatility and enhances risk-adjusted returns.

Strong Domestic Growth Drivers in Emerging Markets

Many emerging markets boast compelling domestic growth stories, largely independent of US economic conditions.

- Technological advancements in India: India's booming tech sector, driven by a large and young population, fuels significant economic growth and creates numerous investment opportunities. Companies like Infosys and TCS are prime examples of success stories.

- Infrastructure development in Southeast Asia: Massive investments in infrastructure projects across Southeast Asia are creating jobs, stimulating economic activity, and attracting substantial foreign investment. This is further bolstered by robust growth in e-commerce and digitalization.

- GDP Growth Rates: Several emerging markets consistently report impressive GDP growth rates, significantly outpacing developed economies. For example, several nations in Southeast Asia have reported consistent GDP growth exceeding 5% annually.

2. Identifying Promising Emerging Market Investment Opportunities

The diverse landscape of emerging markets presents numerous investment opportunities across various sectors.

Sector-Specific Analysis

Several sectors within emerging markets show exceptionally high growth potential:

- Technology: The burgeoning tech sectors in countries like India and China offer substantial growth opportunities. Companies focused on software development, e-commerce, and fintech are particularly attractive.

- Renewable Energy: The global shift towards renewable energy sources presents significant opportunities in emerging markets with abundant solar, wind, and hydropower resources.

- Consumer Goods: The growing middle class in many emerging markets fuels increased demand for consumer goods, creating promising investment prospects in this sector.

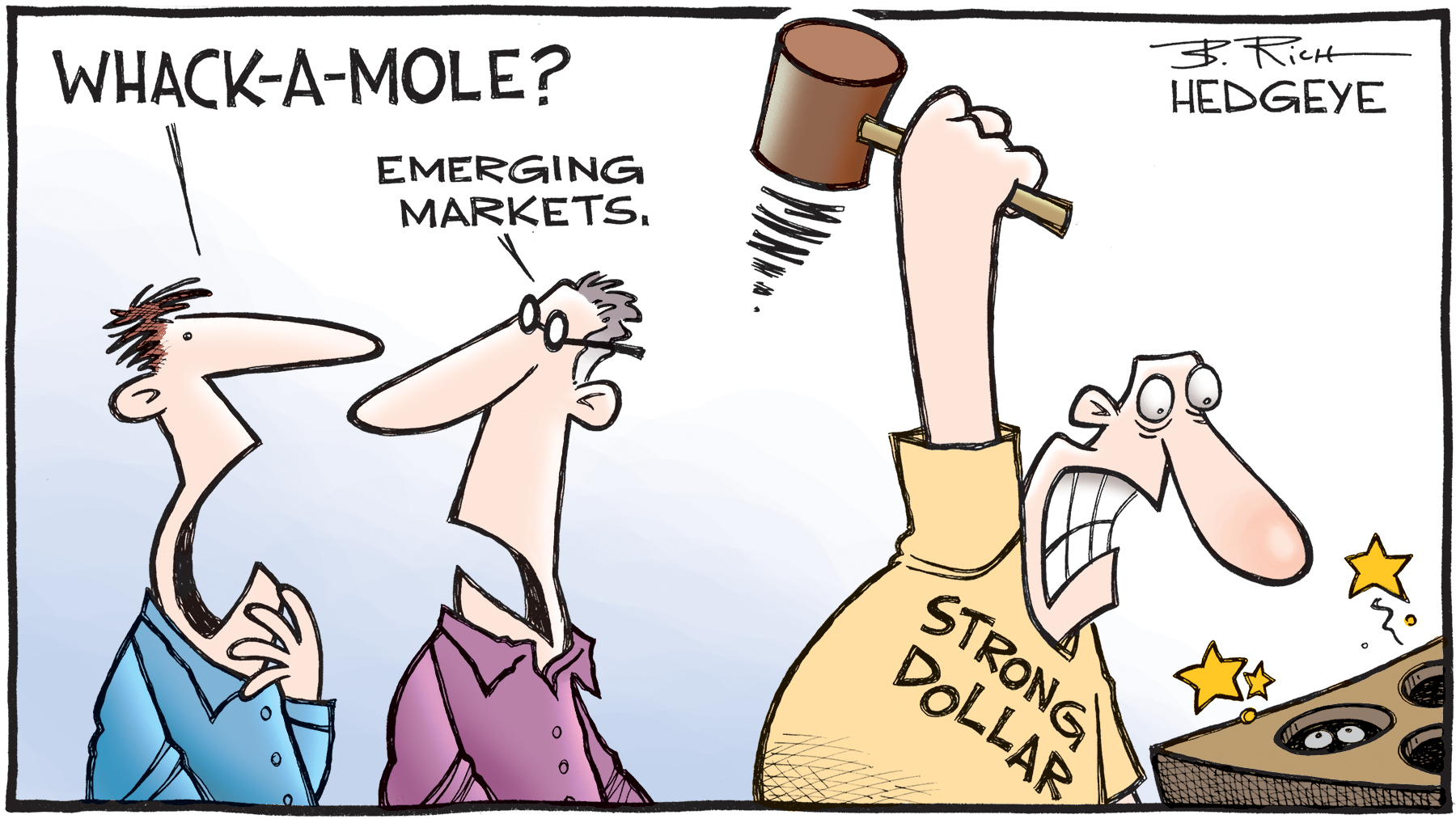

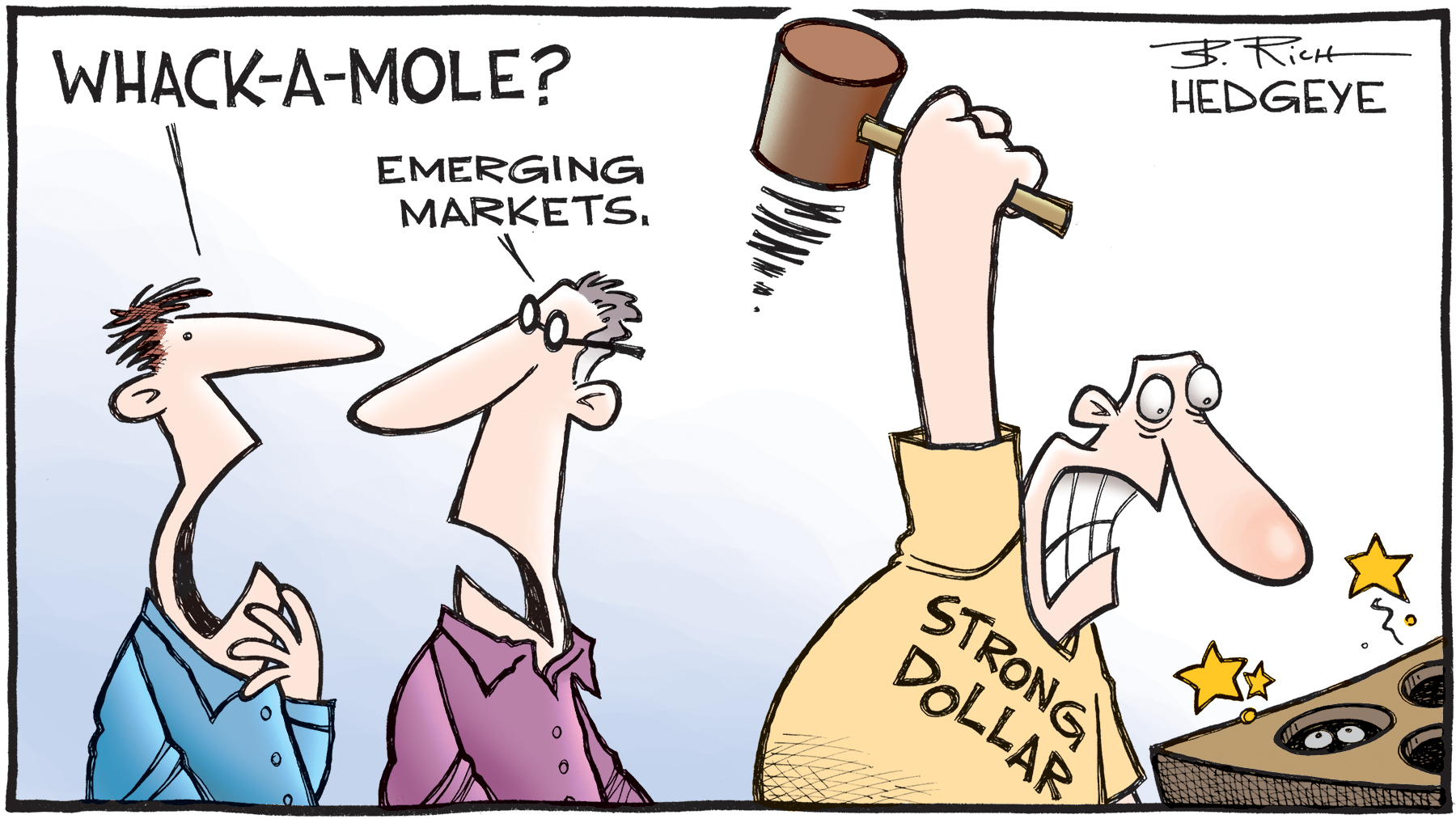

Evaluating Risk and Reward

While emerging markets offer significant growth potential, they also present inherent risks:

- Political instability: Political risks, such as sudden regime changes or policy shifts, can negatively impact investment returns.

- Currency fluctuations: Changes in exchange rates can significantly influence the value of investments in foreign currencies.

Risk mitigation strategies:

- Diversification across countries and sectors: Spreading investments across multiple countries and sectors minimizes the impact of localized events.

- Investment tools: Exchange-traded funds (ETFs) and mutual funds focused on emerging markets provide convenient and diversified access to these markets, managing risk more efficiently.

3. The Future Outlook for Emerging Market Stocks

The long-term prospects for emerging market stocks remain positive, driven by several factors:

Long-Term Growth Potential

- Demographic trends: Many emerging markets have young and growing populations, providing a large workforce and a significant consumer base.

- Technological advancements: Rapid technological adoption fuels economic growth and creates new investment opportunities.

- Economic reforms: Many emerging markets are actively implementing economic reforms aimed at boosting growth and attracting foreign investment.

Factors to Consider Before Investing

Despite the positive outlook, investors must consider potential headwinds:

- Inflation: High inflation can erode purchasing power and negatively impact investment returns.

- Geopolitical risks: Global political tensions and conflicts can create uncertainty and volatility in emerging markets.

- Currency volatility: Fluctuations in exchange rates represent an inherent risk when investing in foreign markets.

Due diligence: Thorough research and understanding of the specific risks associated with each investment is crucial before allocating capital.

Conclusion: Harnessing the Growth Potential of Emerging Market Stocks

Emerging market stocks have demonstrated remarkable resilience, even during periods of US market weakness. Their strong domestic growth drivers, coupled with opportunities for significant diversification, make them an attractive asset class for long-term investors. By carefully evaluating risk and reward, diversifying investments across countries and sectors, and conducting thorough due diligence, investors can harness the impressive growth potential of emerging market stocks. Don't miss out on the exciting growth potential of emerging market stocks. Start your research today and diversify your portfolio for a brighter financial future.

Featured Posts

-

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025 -

Californias Gas Price Crisis Governor Newsoms Appeal For Industry Cooperation To Ease Burden On Consumers

Apr 24, 2025

Californias Gas Price Crisis Governor Newsoms Appeal For Industry Cooperation To Ease Burden On Consumers

Apr 24, 2025 -

At And T Slams Broadcoms V Mware Price Hike A 1 050 Increase

Apr 24, 2025

At And T Slams Broadcoms V Mware Price Hike A 1 050 Increase

Apr 24, 2025 -

Trump Administration Signals Openness To Harvard Settlement Talks

Apr 24, 2025

Trump Administration Signals Openness To Harvard Settlement Talks

Apr 24, 2025 -

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 24, 2025

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 24, 2025