Emerging Markets Rally: Outpacing US Stock Market Performance

Table of Contents

Factors Driving the Emerging Markets Rally

Several key factors contribute to the current Emerging Markets Rally and the impressive emerging market growth we're witnessing.

Economic Recovery in Key Emerging Markets

Several emerging economies are experiencing robust economic recoveries, fueling the overall rally.

- India: The Indian IT sector boom, coupled with strong domestic consumption and infrastructure development, has propelled its GDP growth.

- China: Despite recent economic challenges, China continues significant infrastructure investments, supporting overall growth and contributing to the emerging market investment narrative.

- Brazil: A surge in commodity exports, driven by global demand, has significantly boosted Brazil's economy, impacting emerging market currencies positively.

These successes are reflected in positive economic indicators. India's GDP growth has consistently outperformed expectations, while inflation in several emerging markets, while present, is generally under control. Analyzing GDP growth and inflation emerging markets is key to understanding this ongoing rally.

Favorable Global Macroeconomic Conditions

The global macroeconomic environment also plays a significant role in the Emerging Markets Rally.

- Lower Interest Rates: Lower interest rates in developed countries have encouraged investors to seek higher returns in emerging markets, boosting emerging market investment.

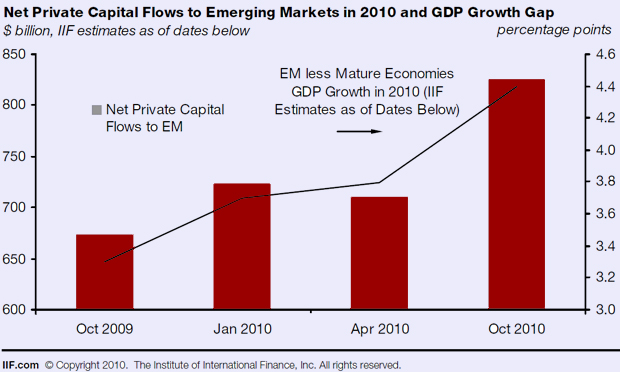

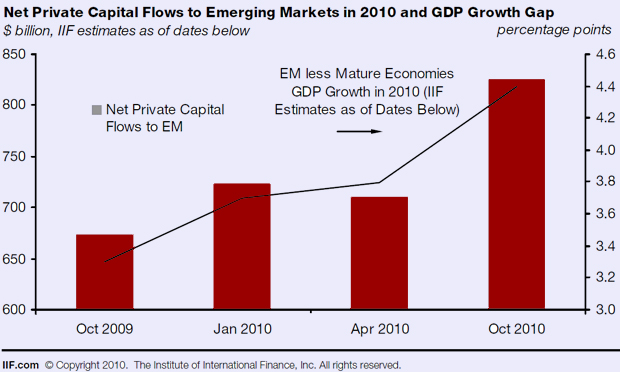

- Increased Foreign Direct Investment (FDI): A rise in FDI flows into emerging economies signifies growing confidence in their long-term growth prospects. This increased foreign direct investment is a major catalyst for this emerging market growth.

These factors influence emerging market currencies, making them more attractive to investors seeking diversification and higher returns. The stability of the global macroeconomic environment plays a vital role in the sustainability of this rally.

Increased Investor Interest in Emerging Markets

Investors are increasingly drawn to emerging markets due to several factors.

- Higher Growth Potential: Emerging markets generally offer significantly higher growth potential than developed economies.

- Diversification Benefits: Investing in emerging markets provides diversification benefits, reducing overall portfolio risk. This diversification is particularly attractive in a volatile global market.

The rise of emerging market ETFs and other investment vehicles has made it easier for investors to access this market. Emerging market ETFs are becoming increasingly popular as a straightforward way to participate in this growth. The ease of access through these vehicles further fuels the emerging market investment trend.

Comparing Emerging Markets Rally to US Stock Market Performance

A direct comparison reveals the significant outperformance of emerging markets.

Performance Benchmarks

Data from major indices highlights the stark contrast. The MSCI Emerging Markets Index, a key benchmark for emerging market performance, has significantly outpaced the S&P 500 in recent months. Charts and graphs clearly illustrate this difference, showing the emerging markets rally in strong contrast to the comparatively slower growth of the US market. This market comparison highlights the attractive returns currently available in emerging markets.

Risk Factors to Consider

While the Emerging Markets Rally presents significant opportunities, it's crucial to acknowledge the inherent risks.

- Political Instability: Political uncertainty in some emerging market countries can significantly impact investment returns. Political risk assessment is crucial before investing.

- Currency Fluctuations: Significant currency volatility can negatively affect returns for international investors. This is a key risk to consider when assessing emerging market investment opportunities.

- Regulatory Uncertainty: Changes in regulations can create unexpected challenges for investors. Careful due diligence is vital to mitigate these emerging market risks.

Investment Strategies for Capitalizing on the Emerging Markets Rally

Successfully navigating this rally requires a strategic approach.

Diversification Strategies

Diversifying a portfolio with emerging market assets is key to capitalizing on the growth potential while mitigating risks. This can involve investing in emerging market ETFs, mutual funds focusing on specific regions, or carefully selected individual stocks. Effective portfolio diversification is crucial to manage risk and exposure.

Risk Management Techniques

Mitigating risk is essential. Strategies include:

- Currency Hedging: Reducing exposure to currency fluctuations through hedging strategies can protect investment returns.

- Geographic and Sector Diversification: Spreading investments across different emerging markets and sectors reduces exposure to region-specific risks. Emerging market risk mitigation is critical for long-term success.

Conclusion: Navigating the Emerging Markets Rally

The Emerging Markets Rally is driven by a combination of strong economic recoveries in key regions, favorable global macroeconomic conditions, and increased investor interest. While offering substantial opportunities, it’s crucial to be aware of the inherent risks. Don't miss out on the exciting opportunities presented by this emerging markets rally. Learn more about how to strategically invest in emerging markets and diversify your portfolio today!

Featured Posts

-

Death Of Sophie Nyweide Mammoth And Noah Actress Passes Away At 24

Apr 24, 2025

Death Of Sophie Nyweide Mammoth And Noah Actress Passes Away At 24

Apr 24, 2025 -

Covid 19 Pandemic Lab Owners Guilty Plea For Fake Test Results

Apr 24, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For Fake Test Results

Apr 24, 2025 -

Toxic Chemicals From Ohio Train Derailment Building Contamination And Its Duration

Apr 24, 2025

Toxic Chemicals From Ohio Train Derailment Building Contamination And Its Duration

Apr 24, 2025 -

Herro Takes 3 Point Crown Garland And Okoro Win Skills Challenge

Apr 24, 2025

Herro Takes 3 Point Crown Garland And Okoro Win Skills Challenge

Apr 24, 2025 -

Quentin Tarantino Zasto Je Odbio Gledati Film S Johnom Travoltom

Apr 24, 2025

Quentin Tarantino Zasto Je Odbio Gledati Film S Johnom Travoltom

Apr 24, 2025