FTC Challenges Court Ruling On Microsoft-Activision Deal

Table of Contents

FTC's Arguments Against the Merger

The FTC's core argument rests on the potential anti-competitive effects of the Microsoft-Activision merger, particularly within the console gaming market. They fear the acquisition will stifle competition and harm consumers. Their key arguments include:

- Reduced Competition: The merger would consolidate significant market power, leaving fewer major players in the console gaming market and potentially leading to higher prices and reduced innovation.

- Call of Duty Exclusivity: A major concern is Microsoft's potential to make Call of Duty, one of the most popular gaming franchises, exclusive to its Xbox platform, significantly harming competitors like PlayStation and Nintendo. This would give Microsoft an unfair advantage and potentially lock out millions of players.

- Pricing and Availability Concerns: The FTC worries that the merger could lead to increased prices and reduced availability of Activision Blizzard games across different platforms, limiting consumer choice.

- Impact on Innovation: The FTC claims that the reduced competition could stifle innovation within the gaming industry, leading to less diverse and less engaging game experiences for players.

The FTC's challenge is based on Section 7 of the Clayton Act, which prohibits mergers and acquisitions that substantially lessen competition.

The Court's Initial Ruling and its Rationale

A federal judge initially ruled in favor of Microsoft, allowing the merger to proceed. The court's decision hinged on its assessment of the evidence presented by both sides. Key aspects of the ruling included:

- Insufficient Evidence of Anti-Competitive Behavior: The court found insufficient evidence to support the FTC's claims of substantially lessened competition resulting from the merger.

- Market Dynamics and Anti-Competitive Outcomes: The court analyzed the market dynamics of the gaming industry and concluded that the likelihood of significant anti-competitive outcomes was low.

- Microsoft's Commitments Regarding Call of Duty: The court considered Microsoft's commitments to maintain Call of Duty availability across various platforms, including PlayStation, as a significant factor in its decision.

While the initial ruling was in Microsoft's favor, dissenting opinions within the court highlighted the complexity and ongoing debate surrounding the potential long-term impacts of the merger.

Implications of the FTC's Appeal

The FTC's appeal holds significant implications for the gaming industry and beyond. Potential outcomes and their ramifications include:

- Delay or Reversal of the Merger: The appeal could delay or even entirely reverse the merger, forcing Microsoft to reconsider its acquisition strategy.

- Setting Precedents for Future Mergers: The outcome will set a significant precedent for future merger approvals, particularly within the rapidly evolving tech industry.

- Impact on Microsoft's Gaming Strategy: A successful appeal could significantly alter Microsoft's gaming strategy and market position, potentially hindering its ambition to become a leading player in the gaming space.

- Effect on Activision Blizzard Share Value: The appeal's outcome will undoubtedly impact the value of Activision Blizzard shares, creating uncertainty for investors.

The appeal process is expected to take several months, with a final decision potentially impacting the industry for years to come.

Expert Opinions and Industry Analysis

Gaming industry experts and economists offer diverse perspectives on the FTC's arguments and the potential impact of the merger. Some analysts support the FTC's concerns regarding reduced competition and the potential for Call of Duty exclusivity. Others argue that the market is dynamic enough to absorb the merger without significant negative consequences. The debate highlights the complexity of antitrust analysis in a rapidly changing digital landscape and the challenges in predicting long-term effects.

Conclusion: The Future of the Microsoft-Activision Deal Remains Uncertain

The FTC's challenge to the Microsoft-Activision merger represents a pivotal moment in the gaming industry. The appeal's outcome will have far-reaching consequences, impacting competition, innovation, and consumer choice. While the court initially approved the merger, the FTC's concerns regarding anti-competitive behavior and the potential for Call of Duty exclusivity remain central to the debate. The ongoing legal battle underscores the importance of antitrust regulation in the tech sector and the need for careful consideration of the potential implications of large-scale mergers and acquisitions. To stay updated on further developments regarding the FTC's challenge to the Microsoft-Activision merger and its impact on the future of the gaming industry, follow reputable news sources and regulatory announcements.

Featured Posts

-

Emerging Markets Hedge Fund Shuts Down Point72 Traders Withdraw

Apr 26, 2025

Emerging Markets Hedge Fund Shuts Down Point72 Traders Withdraw

Apr 26, 2025 -

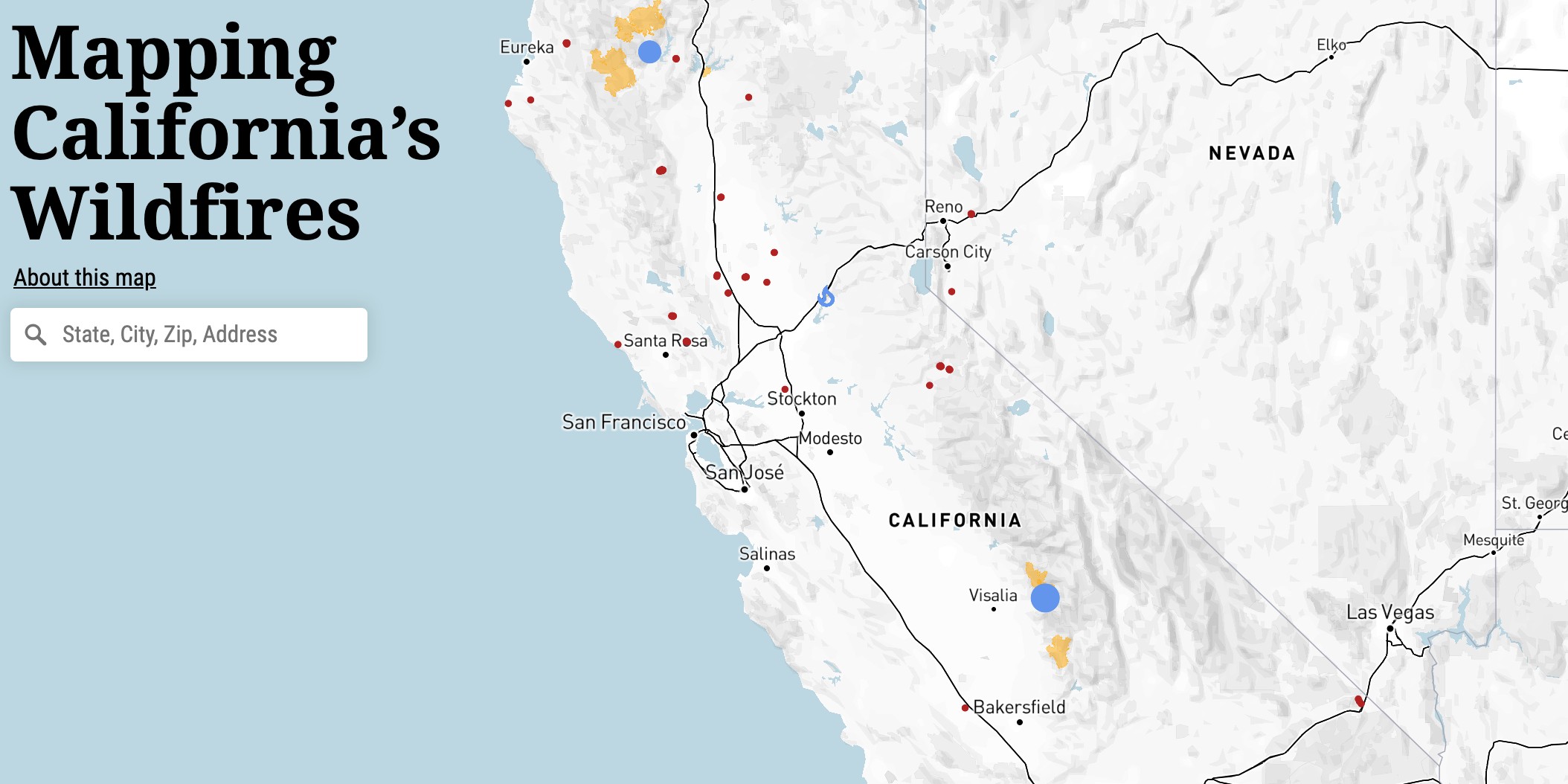

Full List Celebrities Affected By The La Palisades Wildfires

Apr 26, 2025

Full List Celebrities Affected By The La Palisades Wildfires

Apr 26, 2025 -

Economic Power Shift California Overtakes Japan

Apr 26, 2025

Economic Power Shift California Overtakes Japan

Apr 26, 2025 -

American Battleground The High Stakes Fight Against A Billionaire

Apr 26, 2025

American Battleground The High Stakes Fight Against A Billionaire

Apr 26, 2025 -

Ukraines Path To Nato Navigating Trumps Opposition

Apr 26, 2025

Ukraines Path To Nato Navigating Trumps Opposition

Apr 26, 2025