Grim Retail Sales: Are Rate Cuts On The Horizon?

Table of Contents

Declining Retail Sales: A Deeper Dive

Factors Contributing to Weak Retail Sales

Several intertwined factors have contributed to the disappointing retail sales figures. Persistent inflationary pressures have significantly eroded consumer spending power, leaving less disposable income for non-essential purchases. Simultaneously, rising interest rates, implemented to combat inflation, have increased borrowing costs, impacting both consumer spending and business investment. This double whammy has led to a noticeable shift in consumer behavior, with many prioritizing saving over spending.

- Inflationary Pressures: The persistent rise in the cost of goods and services has significantly reduced consumer purchasing power. For example, the Consumer Price Index (CPI) in [insert country/region] rose by [insert percentage]% in [insert month/year], exceeding expectations and squeezing household budgets.

- Rising Interest Rates: The increase in interest rates, intended to curb inflation, has made borrowing more expensive. This has dampened consumer confidence and reduced demand for credit-financed purchases like homes and automobiles.

- Shifting Consumer Behavior: Consumers are increasingly prioritizing savings and debt reduction in response to economic uncertainty. This shift towards cautious spending is reflected in decreased discretionary spending across various retail sectors.

- Supply Chain Disruptions: Lingering effects of supply chain disruptions continue to impact product availability and pricing, contributing to weaker retail sales in certain sectors.

Geographic Variations in Retail Sales

The decline in retail sales is not uniform across all regions. [Insert region A] has experienced a sharper contraction than [Insert region B], potentially due to [explain specific regional economic factors, e.g., reliance on specific industries]. Visualizing these regional differences with charts and graphs can provide a clearer understanding of the nuanced impact of the downturn. [Insert link to relevant data visualization or chart, if applicable].

Central Bank Response: The Probability of Rate Cuts

Analyzing Current Monetary Policy

Central banks worldwide are carefully monitoring the grim retail sales data and its implications for overall economic health. The [mention specific central bank, e.g., Federal Reserve] has indicated [mention their current stance on interest rates and monetary policy]. However, the persistent weakness in retail sales raises the possibility that further interest rate hikes could unnecessarily stifle already fragile economic growth.

Economic Indicators Beyond Retail Sales

While grim retail sales are a significant concern, central banks also consider a range of other key economic indicators before making interest rate decisions. These include:

- Inflation: The rate of inflation remains a critical factor influencing monetary policy. High inflation necessitates higher interest rates, while a slowdown in inflation could pave the way for rate cuts. Current inflation figures stand at [insert data and source].

- Unemployment: The unemployment rate provides insights into labor market conditions and consumer spending potential. A rising unemployment rate typically signals weakening economic activity. The current unemployment rate is [insert data and source].

- GDP Growth: Gross Domestic Product (GDP) growth provides a comprehensive measure of overall economic activity. Slowing GDP growth often precedes retail sales declines and can pressure central banks to act. The latest GDP growth figures are [insert data and source].

Market Expectations and Predictions

Market analysts are divided on the likelihood of imminent rate cuts. Some predict that central banks will maintain their current course, prioritizing inflation control over economic growth. Others anticipate that the grim retail sales data will force a reassessment of monetary policy, leading to rate cuts in the near future. These predictions are often reflected in market movements and investor sentiment.

The Implications of Rate Cuts (or Lack Thereof)

Positive Impacts of Rate Cuts

Rate cuts, if implemented, could stimulate economic growth by:

- Increasing Consumer Spending: Lower interest rates make borrowing cheaper, encouraging increased consumer spending and investment.

- Stimulating Business Investment: Reduced borrowing costs incentivize businesses to invest in expansion and job creation.

- Reducing Borrowing Costs: Lower interest rates reduce the cost of debt for both consumers and businesses, freeing up funds for other activities.

Potential Drawbacks of Rate Cuts

However, rate cuts also carry potential risks:

- Increased Inflation: Lower interest rates can fuel inflation if the economy is already operating at or near full capacity.

- Asset Bubbles: Lower interest rates can inflate asset prices, potentially creating unsustainable bubbles in the housing market or other asset classes.

- Impact on Currency Exchange Rates: Rate cuts can weaken a nation's currency, potentially leading to increased import costs and inflation.

The "No Rate Cut" Scenario

If central banks choose to maintain current interest rates despite grim retail sales, the economy could face a prolonged period of slow or stagnant growth. This scenario could lead to further declines in consumer confidence and increased unemployment.

Conclusion: Grim Retail Sales and the Outlook for Interest Rates

Grim retail sales figures are a clear sign of economic weakness, raising serious questions about the future path of interest rates. Several factors, including high inflation, rising interest rates, and shifting consumer behavior, have contributed to this decline. Central banks are weighing the risks and rewards of potential rate cuts, considering a complex interplay of economic indicators. The implications of both rate cuts and a continued period of high interest rates are significant, potentially influencing consumer spending, business investment, and overall economic growth. Understanding grim retail sales data is crucial for navigating the current economic climate. Stay tuned for further updates on grim retail sales and the potential for future interest rate adjustments.

Featured Posts

-

Gpu Market Volatility Analyzing The Current Price Trends

Apr 28, 2025

Gpu Market Volatility Analyzing The Current Price Trends

Apr 28, 2025 -

Espn Predicts Red Sox Future A 2025 Season Analysis

Apr 28, 2025

Espn Predicts Red Sox Future A 2025 Season Analysis

Apr 28, 2025 -

The Return Of High Gpu Prices Causes And Potential Solutions

Apr 28, 2025

The Return Of High Gpu Prices Causes And Potential Solutions

Apr 28, 2025 -

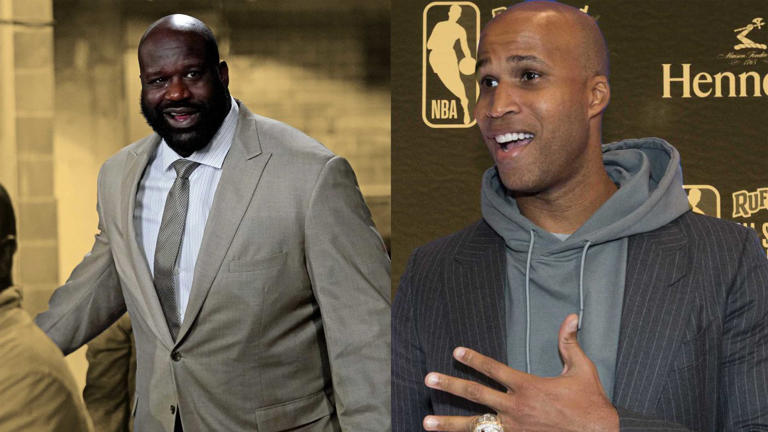

Richard Jeffersons Jabs At Shaquille O Neal A Timeline Of Their Public Exchanges

Apr 28, 2025

Richard Jeffersons Jabs At Shaquille O Neal A Timeline Of Their Public Exchanges

Apr 28, 2025 -

Cassidy Hutchinson Jan 6th Hearing Star To Publish Memoir

Apr 28, 2025

Cassidy Hutchinson Jan 6th Hearing Star To Publish Memoir

Apr 28, 2025