Grim Retail Sales Data: Pressure Mounts On Bank Of Canada To Cut Rates

Table of Contents

Main Points:

2.1. Weakening Consumer Spending: A Key Indicator of Economic Slowdown

H3: Declining Consumer Confidence: Falling consumer confidence is a major driver of the weak retail sales figures. Several factors contribute to this decline, including persistent inflation, rising interest rates, and concerns about job security.

- Bullet points: The Consumer Confidence Index (CCI) has fallen for three consecutive months, reaching its lowest point in two years. The Conference Board of Canada's index also shows a significant drop in consumer optimism.

- Data points: Spending in key retail sectors is down significantly. Automotive sales are down 8%, furniture sales have dropped 5%, and clothing sales have fallen by 4%. This paints a concerning picture of consumer spending habits.

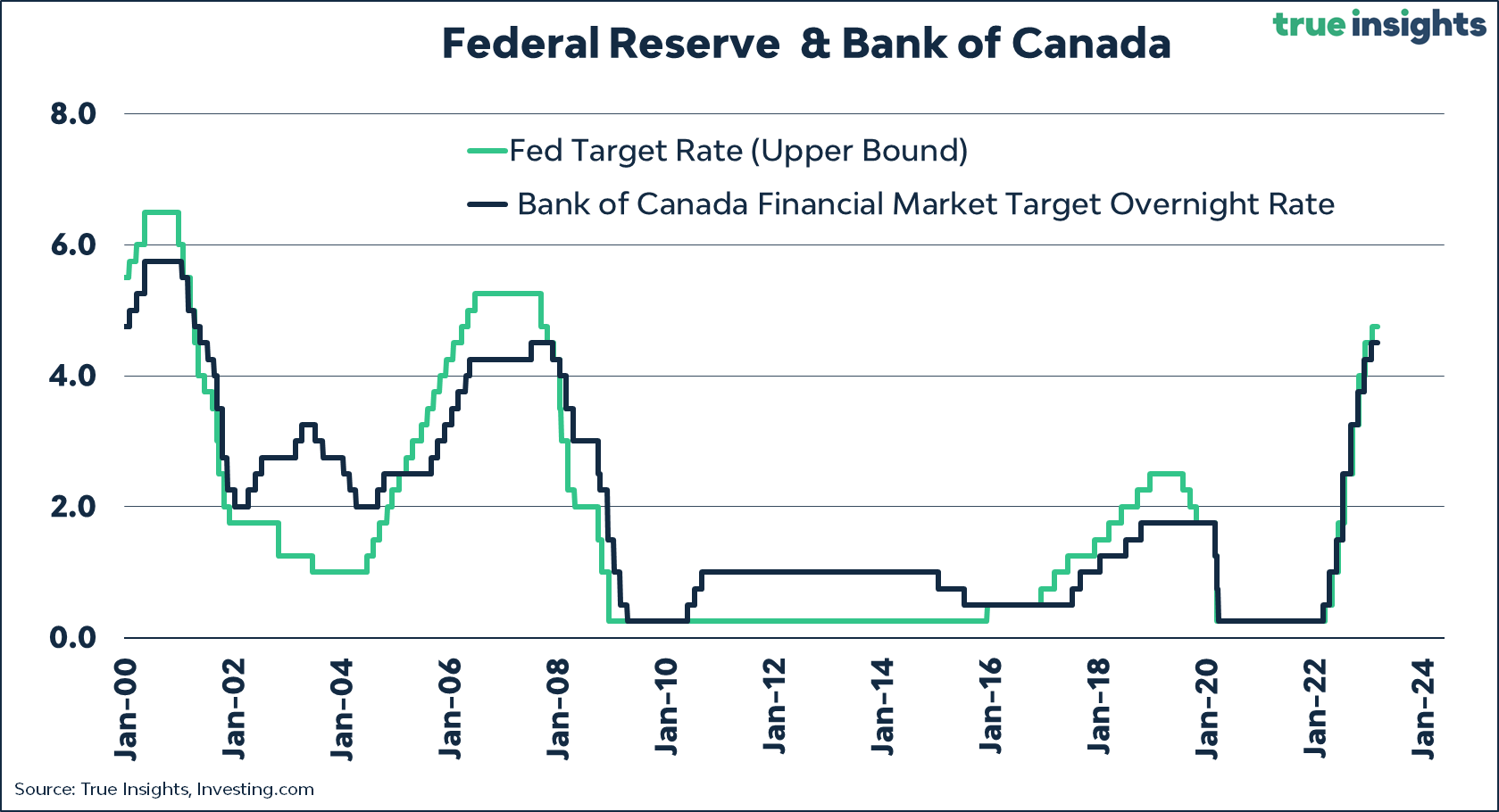

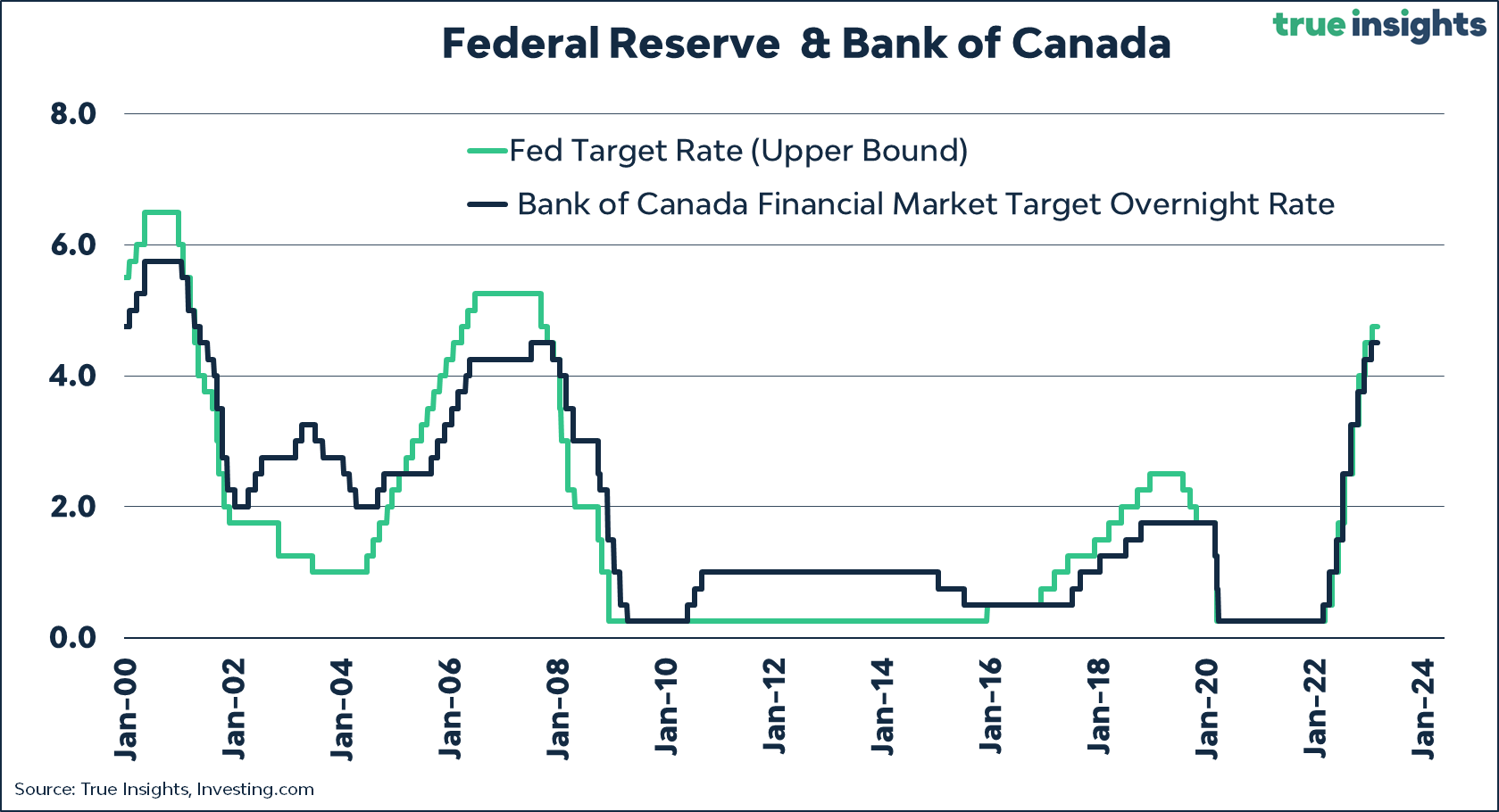

H3: Impact of High Interest Rates: The Bank of Canada's recent interest rate hikes are significantly impacting consumer borrowing and spending power. Higher rates increase the cost of borrowing, reducing disposable income.

- Bullet points: Higher interest rates lead to increased mortgage payments, higher loan repayments, and more expensive credit card debt. This leaves less money for discretionary spending.

- Data points: Since the last interest rate hike, retail sales have fallen by 2%, strongly suggesting a direct correlation between interest rate increases and reduced consumer activity.

H3: Inflation's Persistent Bite: Stubborn inflation continues to erode real wages and disposable income, leaving consumers with less purchasing power.

- Bullet points: The cost of essential goods like groceries and energy continues to rise, leaving less money for non-essential purchases. Inflation is outpacing wage growth, squeezing household budgets.

- Data points: Inflation currently sits at 4%, while average wage growth is only at 2%. This widening gap directly impacts consumer spending capacity.

2.2. The Bank of Canada's Tightrope Walk: Balancing Inflation and Economic Growth

H3: Inflation Target and Monetary Policy: The Bank of Canada's primary mandate is to control inflation and maintain price stability. It uses interest rate adjustments as its primary monetary policy tool to achieve this goal.

- Bullet points: The Bank of Canada's inflation target is 2%. Current inflation is significantly above this target.

- Data points: The Bank of Canada has raised interest rates five times in the past year, attempting to curb inflation.

H3: The Risks of Further Rate Hikes: Continued interest rate increases risk pushing the economy into a recession. This would lead to job losses and further dampen consumer spending.

- Bullet points: Higher interest rates can stifle business investment and consumer spending, ultimately leading to a contraction in economic activity.

- Data points: Unemployment figures are already showing signs of rising, indicating a potential slowdown in the job market.

H3: Pressure for Rate Cuts: The grim retail sales data, combined with other softening economic indicators, is putting immense pressure on the Bank of Canada to consider cutting interest rates.

- Bullet points: Economists and financial analysts are increasingly calling for a rate cut to stimulate economic activity and support consumer spending.

- Data points: Forecasts for economic growth in the next quarter are down, indicating a possible contraction if interest rates remain high.

2.3. Potential Implications of Rate Cuts (or Lack Thereof)

H3: Impact on the Housing Market: Rate cuts could potentially stimulate the housing market by making mortgages more affordable, while continued high rates could further depress the market.

- Bullet points: Lower interest rates usually lead to increased demand and higher house prices.

- Data points: The housing market is already showing signs of cooling due to high interest rates.

H3: Effects on Business Investment: Lower interest rates would reduce borrowing costs for businesses, potentially encouraging investment and economic growth. Continued high rates could lead to reduced investment and job creation.

- Bullet points: Reduced borrowing costs incentivize businesses to invest in expansion and new projects.

- Data points: Business investment is already declining due to high interest rates and economic uncertainty.

H3: Consumer Sentiment and Future Spending: The Bank of Canada's decision regarding interest rates will significantly influence consumer sentiment and future spending patterns.

- Bullet points: Consumer confidence tends to improve when interest rates are cut, leading to increased spending.

- Data points: Consumer sentiment indices are directly correlated to interest rate changes.

Conclusion: Grim Retail Sales Data Demands Careful Consideration

The grim retail sales data highlights a significant slowdown in the Canadian economy, placing immense pressure on the Bank of Canada to respond effectively. The weakening consumer spending, driven by inflation and high interest rates, necessitates a careful balancing act between controlling inflation and supporting economic growth. The potential implications of rate cuts (or the absence thereof) on the housing market, business investment, and consumer sentiment are far-reaching and demand close monitoring. Keep an eye on the latest retail sales data and Bank of Canada announcements to understand how this impacts your finances. Subscribe to our newsletter for regular updates on the evolving economic situation and its effects on "grim retail sales data" and the Canadian economy.

Featured Posts

-

Popes Funeral Trump And Zelenskys Post Oval Office Meeting

Apr 28, 2025

Popes Funeral Trump And Zelenskys Post Oval Office Meeting

Apr 28, 2025 -

Driving The Florida Keys Overseas Highway History Views And Planning Tips

Apr 28, 2025

Driving The Florida Keys Overseas Highway History Views And Planning Tips

Apr 28, 2025 -

Analyzing The Mets Spring Training Performance Week 1 Roster Projections

Apr 28, 2025

Analyzing The Mets Spring Training Performance Week 1 Roster Projections

Apr 28, 2025 -

Aaron Judges 2025 On Field Goal Prediction The Push Up Revelation

Apr 28, 2025

Aaron Judges 2025 On Field Goal Prediction The Push Up Revelation

Apr 28, 2025 -

Redick Supports Espns Choice Regarding Jefferson

Apr 28, 2025

Redick Supports Espns Choice Regarding Jefferson

Apr 28, 2025