High Stock Market Valuations: Why BofA Says Investors Shouldn't Worry

Table of Contents

Keywords: High stock market valuations, stock market valuation, BofA, Bank of America, investor sentiment, market outlook, stock market predictions, investment strategy, long-term investing, economic growth

High stock market valuations often trigger anxiety among investors. The fear of a market correction or crash is understandable, especially when price-to-earnings ratios appear elevated. However, Bank of America (BofA) offers a reassuring perspective, suggesting that current valuations aren't necessarily a cause for alarm. This article explores BofA's rationale and provides insights into navigating this potentially volatile market environment.

BofA's Rationale: Why Current Valuations Aren't Necessarily Overvalued

BofA's argument against viewing current high stock market valuations as solely negative rests on several key factors that extend beyond the simplistic price-to-earnings (P/E) ratio. Their analysis suggests that robust economic fundamentals justify the current market levels.

-

Strong Corporate Earnings Growth: BofA points to consistently strong corporate earnings growth as a primary driver of current valuations. Companies are demonstrating impressive profitability, and this positive trend is expected to continue, supporting higher stock prices. This sustained growth offsets concerns about potentially high P/E ratios.

-

Low Interest Rates: The prevailing low interest rate environment plays a significant role in supporting stock valuations. Low borrowing costs make investing in equities relatively more attractive compared to fixed-income instruments. This increased demand contributes to higher stock prices.

-

Robust Economic Growth Projections: BofA’s economic forecasts predict continued robust growth, fueling investor confidence and further supporting elevated stock market valuations. Positive economic outlooks tend to correlate with higher stock prices.

-

Supporting Data and Reports: BofA's conclusions are backed by comprehensive research and data analysis from its in-house economists and market strategists. Specific reports and analyses detailing these findings should be consulted for a complete understanding of their perspective.

Addressing Common Concerns About High Stock Market Valuations

Many investors harbor anxieties about high stock market valuations, often fueled by fears of an imminent market crash. Let's address some of these common concerns:

-

High Valuations Don't Automatically Predict a Crash: It's crucial to understand that periods of high valuations don't automatically translate into immediate market crashes. History is replete with instances of sustained market growth following periods of elevated valuations. The key is to maintain a long-term perspective.

-

Long-Term Investing vs. Short-Term Fluctuations: The importance of long-term investing cannot be overstated. Short-term market volatility is inherent in the market; focusing on the long-term potential of your investments helps mitigate the impact of these fluctuations.

-

Historical Data and Sustained Growth: Analyzing historical market cycles reveals numerous instances where high valuations were followed by extended periods of sustained growth. While past performance doesn't guarantee future results, it provides valuable context and perspective.

-

Examples of Past Market Cycles: Studying historical market data, including the tech bubble of the late 1990s and the subsequent recovery, can help investors appreciate the cyclical nature of market valuations and the potential for long-term growth even after periods of high valuations.

Alternative Factors Influencing Stock Market Performance

Beyond valuations, BofA considers a range of macroeconomic factors influencing stock market performance:

-

Global Economic Growth: The strength of global economic growth significantly impacts the US stock market. Positive global economic indicators generally support higher stock valuations.

-

Technological Innovation: Technological advancements drive innovation and create new investment opportunities, affecting company valuations and overall market performance.

-

Geopolitical Events: Geopolitical events and uncertainties can influence investor sentiment and create market volatility, impacting stock prices.

-

Inflation and Monetary Policy: Factors like inflation rates and central bank monetary policies significantly impact interest rates and subsequently influence investment decisions and stock valuations. BofA's outlook likely considers the current trajectory of these factors.

The Importance of Diversification in a High-Valuation Market

Diversification remains a crucial strategy for mitigating risks associated with high stock market valuations.

-

Benefits of a Diversified Portfolio: Spreading your investments across various asset classes – stocks, bonds, real estate, commodities – reduces the impact of any single asset's underperformance.

-

Asset Classes for Diversification: Consider diversifying your portfolio with a mix of domestic and international stocks, government and corporate bonds, real estate investment trusts (REITs), and other alternative investments.

-

Seeking Professional Advice: Consult a financial advisor to create a personalized investment portfolio that aligns with your risk tolerance and financial goals. A professional can help you navigate complex market conditions and develop a robust risk management strategy.

Conclusion

BofA's analysis suggests that while high stock market valuations are a valid consideration, they shouldn't trigger panic selling. The bank points to strong corporate earnings, low interest rates, and positive economic growth projections as justifying factors. Remember that market cycles are inherent; focusing on long-term investing and employing a well-diversified portfolio are key strategies to navigate periods of high stock market valuations. While acknowledging the inherent risks, don't let anxieties about high stock market valuations dictate your long-term investment plans. Consider seeking professional advice to develop a robust strategy that aligns with your risk tolerance and financial goals. Learn more about managing your investments during periods of high stock market valuations and building a resilient portfolio for the long term.

Featured Posts

-

Mets Send Nez To Syracuse Megill Earns Rotation Spot

Apr 28, 2025

Mets Send Nez To Syracuse Megill Earns Rotation Spot

Apr 28, 2025 -

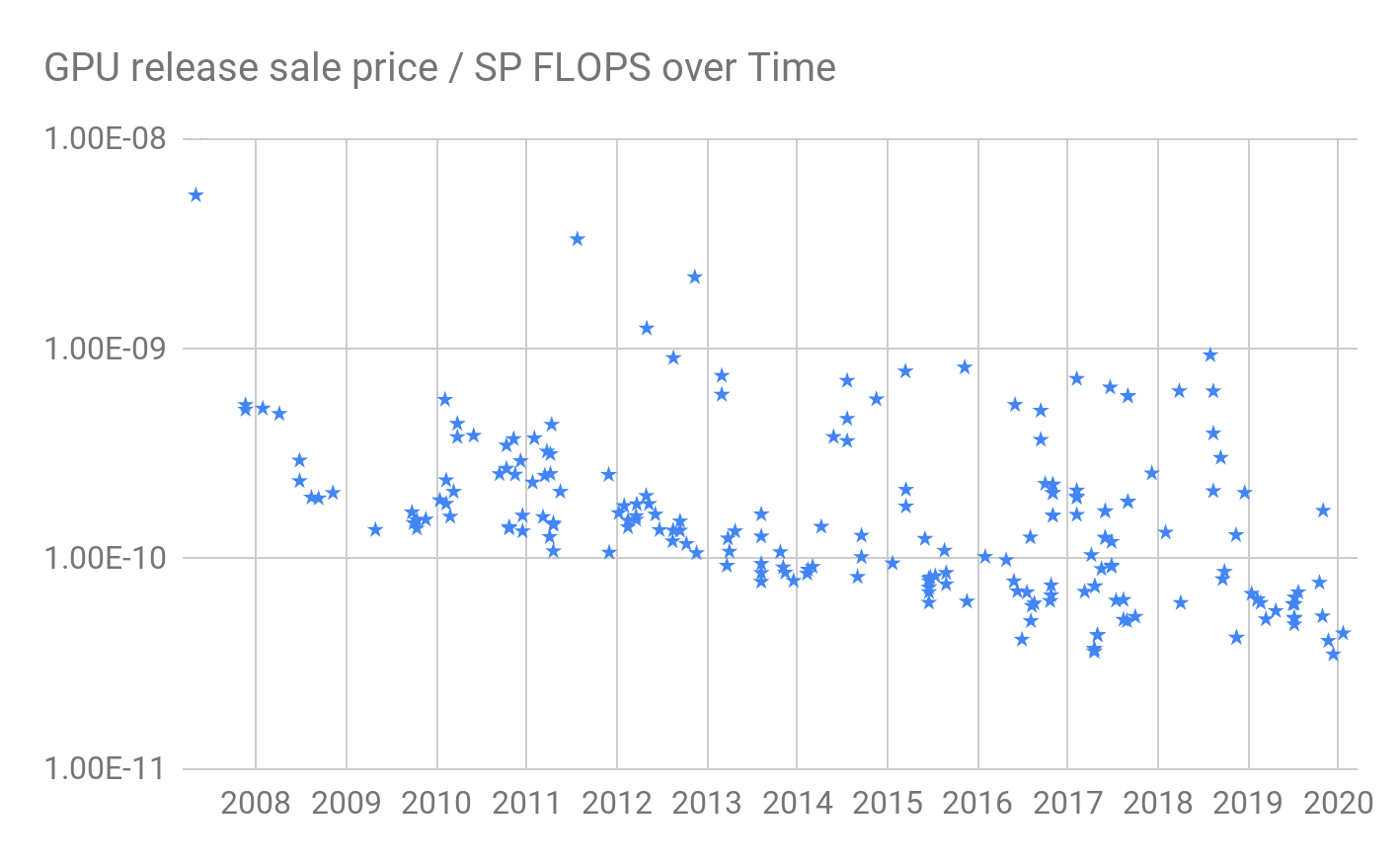

Gpu Prices Soar Are We Facing Another Crisis

Apr 28, 2025

Gpu Prices Soar Are We Facing Another Crisis

Apr 28, 2025 -

Jj Redick On Espn And Richard Jefferson A Positive Reaction

Apr 28, 2025

Jj Redick On Espn And Richard Jefferson A Positive Reaction

Apr 28, 2025 -

Tyran Alerbyt Ydyf Kazakhstan Ila Wjhath Mn Abwzby

Apr 28, 2025

Tyran Alerbyt Ydyf Kazakhstan Ila Wjhath Mn Abwzby

Apr 28, 2025 -

Understanding The Recent Surge In Gpu Prices

Apr 28, 2025

Understanding The Recent Surge In Gpu Prices

Apr 28, 2025