Hudson's Bay: 65 Leases Attract Significant Interest

Table of Contents

The Allure of Prime Retail Locations

The 65 Hudson's Bay leases up for grabs represent a highly desirable collection of prime retail spaces across Canada. This makes them incredibly attractive to investors seeking established, high-performing retail locations.

Strategic Locations and High Foot Traffic

These leases are strategically located in high-traffic areas across major Canadian cities. This translates to significant advantages for potential buyers.

- Locations in major cities: Many leases are situated in bustling urban centers, guaranteeing consistent customer flow.

- Proximity to transportation hubs: Convenient access to public transit and major roadways ensures high accessibility for customers.

- High pedestrian counts: The leases are in areas with demonstrably high pedestrian traffic, maximizing exposure to potential shoppers.

- Established customer bases: Years of operation have built up loyal customer bases for these locations, providing a solid foundation for future success.

For example, several leases are located in downtown Toronto, known for its dense population and significant tourist traffic. Others are situated near major shopping malls and other retail anchors, creating a synergistic effect and boosting customer traffic. The demographics surrounding these locations are also favorable, reflecting strong purchasing power and consumer demand.

Strong Anchor Tenants and Established Brands

Many of the 65 leases include established anchor tenants, providing stability and predictable income streams for investors. This significantly reduces risk associated with property investment.

- Examples of strong anchor tenants (where publicly available): While specific tenant names may not be publicly disclosed at this stage, the presence of well-known and reputable brands is a key attraction.

- The value of established brands: Established brands attract consistent customer traffic, reducing the risk of vacancy and ensuring a steady flow of rental income. This predictability is highly valued by investors seeking stability in their portfolios.

Market Demand and Investment Opportunities

The intense interest in these Hudson's Bay leases reflects both the strength of the Canadian real estate market and the attractive nature of the properties themselves.

Growing Interest in Canadian Real Estate

The Canadian real estate market continues to show robust growth, making these Hudson's Bay leases even more attractive to both domestic and international investors.

- Current market trends: Low interest rates and a growing population continue to fuel demand in the Canadian commercial real estate sector.

- Investor confidence: The stability of the Canadian economy and its resilient retail sector further enhance investor confidence in these properties. Statistics from reputable sources like the Canadian Real Estate Association could be cited here to support these claims.

Potential for Redevelopment and Value Enhancement

Some of the leases present exciting opportunities for redevelopment or repositioning, offering significant potential for value enhancement.

- Potential redevelopment strategies: Mixed-use developments incorporating residential or office spaces could significantly increase property value.

- Modernization and strategic repositioning: Updating existing retail spaces with modern designs and amenities can attract new tenants and command higher rental rates. This is particularly relevant in a competitive retail landscape. The potential for increased property values through these strategies is significant, making these leases particularly attractive to investors looking for long-term returns.

Financial Implications and Future of Hudson's Bay

The sale of these 65 Hudson's Bay leases carries significant financial implications for the company, impacting its debt load and strategic direction.

Strategic Asset Sales and Debt Reduction

The sale proceeds will allow Hudson's Bay to significantly reduce its debt burden and improve its overall financial health.

- Potential financial benefits: Reduced debt levels will lead to improved financial ratios and a stronger credit rating, attracting further investment.

- Impact on stock price: A successful sale is likely to positively impact Hudson's Bay's stock price, boosting investor confidence and signaling a renewed commitment to financial stability.

Focus on Core Business and Omnichannel Strategy

The capital generated from the lease sales provides Hudson's Bay with the opportunity to reinvest in its core business and strengthen its omnichannel strategy.

- Potential investments: Funds could be allocated to enhance its e-commerce platform, optimize its supply chain, and improve its overall customer experience.

- Long-term benefits: This strategic realignment towards core competencies and omnichannel capabilities will enhance the company's long-term competitiveness and profitability.

Conclusion

The considerable interest in the 65 Hudson's Bay leases underscores the attractiveness of prime Canadian retail real estate and the potential for significant value creation. For Hudson's Bay, the sale represents a crucial step towards financial stability, allowing the company to focus on its core business and future growth. This strategic move is poised to revitalize the iconic retailer and position it for a new era of success. Stay informed about further developments regarding these Hudson's Bay leases and their impact on the company's future. Learn more about the Hudson's Bay real estate portfolio and other Canadian retail property investments by [link to relevant resource/contact information].

Featured Posts

-

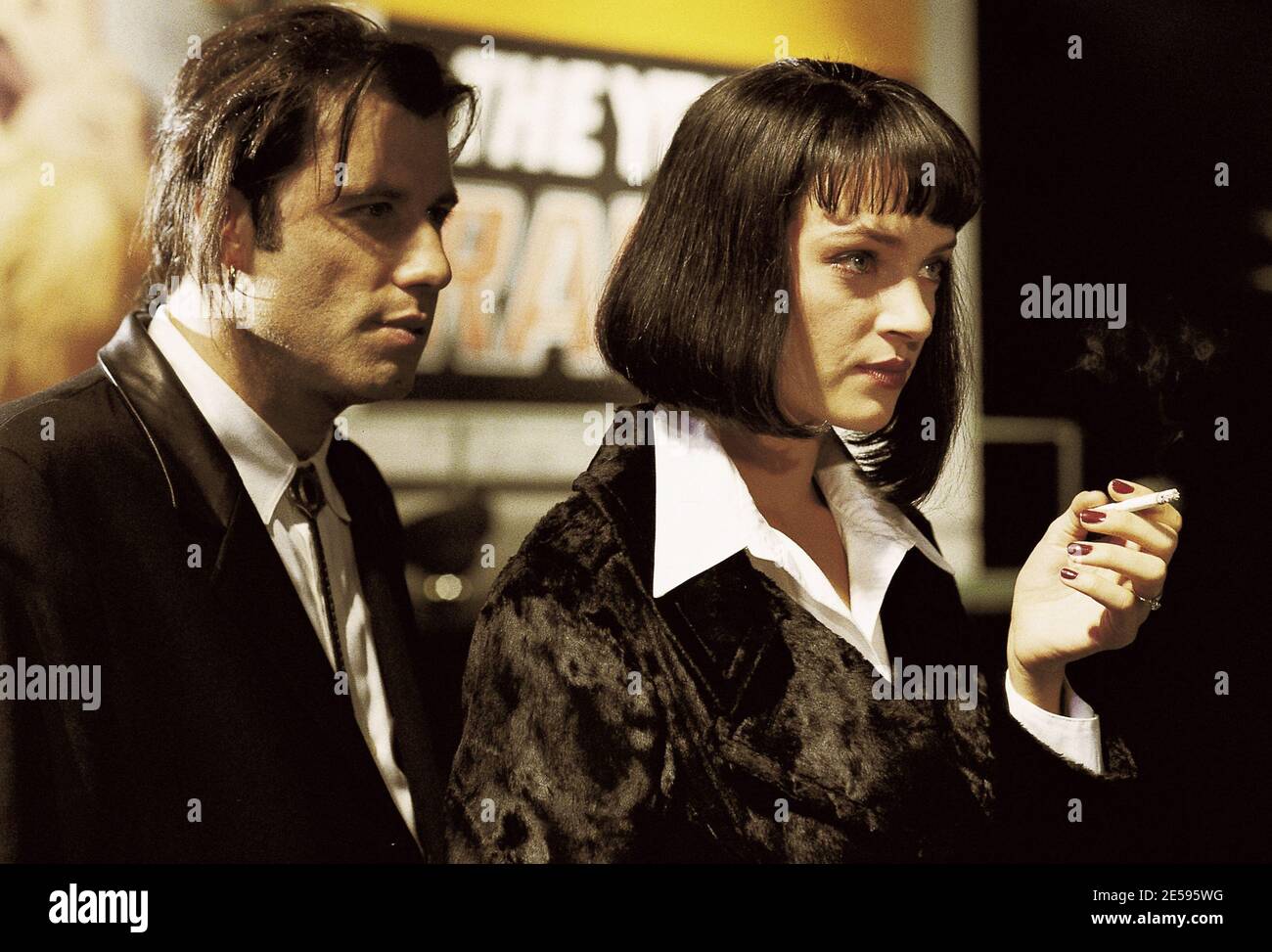

Video John Travolta Indulges In A Pulp Fiction Steak In Miami

Apr 24, 2025

Video John Travolta Indulges In A Pulp Fiction Steak In Miami

Apr 24, 2025 -

John Travoltas New Action Film Exclusive High Rollers Poster And Photo Preview

Apr 24, 2025

John Travoltas New Action Film Exclusive High Rollers Poster And Photo Preview

Apr 24, 2025 -

High Gas Prices In California Governor Newsom Urges Oil Companies To Collaborate

Apr 24, 2025

High Gas Prices In California Governor Newsom Urges Oil Companies To Collaborate

Apr 24, 2025 -

Increased Tornado Risks Amidst Trumps Budget Cuts Expert Analysis

Apr 24, 2025

Increased Tornado Risks Amidst Trumps Budget Cuts Expert Analysis

Apr 24, 2025 -

Hield And Payton Fuel Warriors Win Against Blazers

Apr 24, 2025

Hield And Payton Fuel Warriors Win Against Blazers

Apr 24, 2025