Impact Of US Tariffs: China Turns To Middle East For LPG Imports

Table of Contents

US Tariffs and their Impact on China's LPG Supply Chain

US tariffs imposed on various goods, including some energy products, have had a significant impact on China's LPG supply chain. While precise tariff rates fluctuate and can be complex, the imposition of these tariffs resulted in a considerable increase in the cost of importing LPG from the US and other countries affected by these trade measures. Previously, China had relied, to some extent, on US LPG supplies or on suppliers whose costs were indirectly affected by the tariffs.

This increased reliance on alternative suppliers, however, immediately exposed the Chinese market to higher costs and supply chain disruptions. The additional tariffs essentially added a substantial premium to the already existing cost of importation, reducing the competitiveness of Chinese companies in the global LPG market.

- Increased import prices: Tariffs directly increased the cost of LPG imports from affected regions, making them less attractive compared to alternatives.

- Supply chain disruptions: The uncertainty and added complexities created by tariffs led to disruptions in the established supply chains, impacting the timely delivery of LPG.

- Reduced competitiveness: Higher import costs made Chinese companies less competitive in the global LPG market, affecting their profitability and market share.

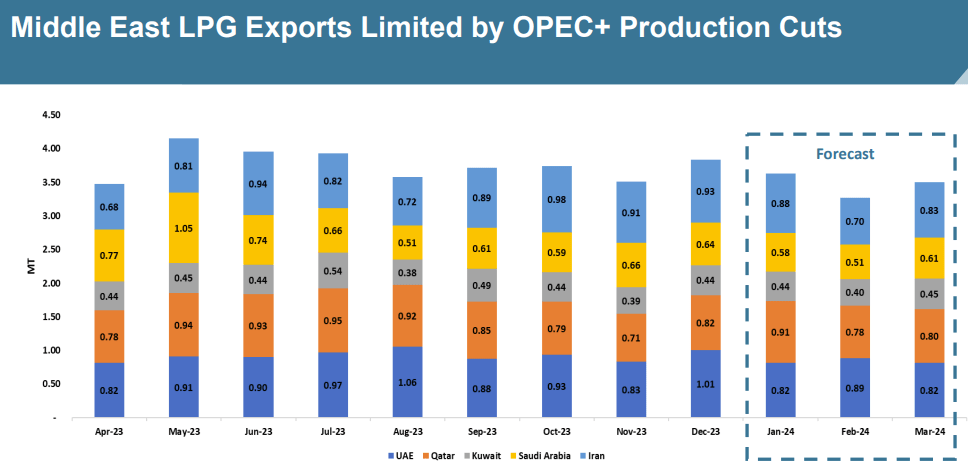

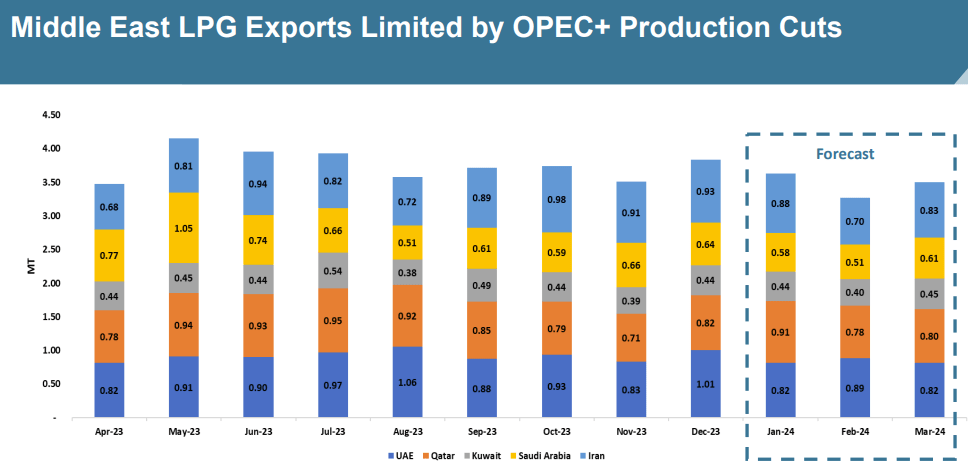

The Rise of the Middle East as an Alternative LPG Supplier for China

Faced with increased costs and potential supply instability from traditional sources, China has increasingly turned to the Middle East for its LPG needs. Countries like Saudi Arabia and Qatar, with their substantial LPG production capacity and geographical proximity to China, have emerged as key alternative suppliers. The shorter shipping distances translate into significantly lower transportation costs, making Middle Eastern LPG a more economically viable option. Furthermore, favorable trade agreements and competitive pricing strategies offered by Middle Eastern nations further incentivized this shift.

- Reduced shipping costs: The geographical proximity of Middle Eastern LPG producers significantly reduces shipping costs and transit times.

- Increased trade volume: The shift in import strategy has led to a substantial increase in LPG trade volume between China and Middle Eastern countries.

- New strategic partnerships: This increased trade has fostered the development of new strategic partnerships and energy agreements between China and Middle Eastern nations.

Geopolitical Implications of China's LPG Import Diversification

China's decision to diversify its LPG import sources has significant geopolitical implications. The shift represents a clear change in the dynamics of US-China trade relations, highlighting the impact of tariffs on strategic decision-making. This realignment has concurrently strengthened China's ties with Middle Eastern nations, potentially creating new power balances within the energy sector. The increased competition among global LPG suppliers could also reshape market dynamics, leading to fluctuating prices and potentially impacting the overall stability of the global energy market. For both China and the Middle East, energy security is further enhanced through this diversification.

- Shifting global power dynamics: This trade shift significantly alters the balance of power in the global energy market.

- Increased regional stability (potentially): Increased economic interdependence could foster greater regional stability in the Middle East.

- New geopolitical alliances: New alliances and dependencies are being forged between China and Middle Eastern nations.

Economic Impacts on China and the Middle East

The economic consequences of this shift are far-reaching. For Middle Eastern LPG-producing nations, the increased demand from China translates into significantly higher revenues, stimulating economic growth and creating jobs within their energy sectors. China, on the other hand, may experience long-term benefits such as greater price stability in its domestic LPG market and enhanced energy security through diversified sourcing.

- Boost to Middle Eastern economies: Increased LPG exports to China are generating substantial revenue for Middle Eastern countries.

- Job creation: The expanded LPG industry is leading to increased employment opportunities in the Middle East's energy sector.

- Potential for long-term price stabilization: Diversified supply sources may contribute to price stability in China's LPG market.

Conclusion: Understanding the Long-Term Effects of the Shift in China's LPG Imports

The imposition of US tariffs has profoundly impacted China's LPG import strategy, leading to a significant shift towards Middle Eastern suppliers. This realignment has far-reaching geopolitical and economic implications for both China and the Middle East, reshaping the global energy landscape. The long-term consequences of this trade diversification are still unfolding, but the shift underscores the interconnectedness of global markets and the influence of trade policy on strategic decision-making. Understanding these complex dynamics is crucial for navigating the future of global energy trade. Stay updated on the latest developments in the impact of US tariffs on global LPG trade by subscribing to our newsletter!

Featured Posts

-

Steffy And Liams Comfort Finns Warning The Bold And The Beautiful Spoilers For Thursday February 20

Apr 24, 2025

Steffy And Liams Comfort Finns Warning The Bold And The Beautiful Spoilers For Thursday February 20

Apr 24, 2025 -

Ella Travolta Iznenadujuca Ljepota Kceri Johna Travolte

Apr 24, 2025

Ella Travolta Iznenadujuca Ljepota Kceri Johna Travolte

Apr 24, 2025 -

Israeli Beach Years Of Shark Sightings Culminate In Tragedy

Apr 24, 2025

Israeli Beach Years Of Shark Sightings Culminate In Tragedy

Apr 24, 2025 -

High Profile Office365 Hack Leads To Multi Million Dollar Losses

Apr 24, 2025

High Profile Office365 Hack Leads To Multi Million Dollar Losses

Apr 24, 2025 -

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025