Investor Concerns Over High Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's stance on current market valuations is nuanced, reflecting a blend of cautious optimism and underlying concerns. While acknowledging the impressive run-up in certain indices, they haven't declared a full-blown bubble. Their analysis points to pockets of overvaluation within specific sectors, while others appear more reasonably priced.

BofA utilizes several key valuation metrics to support their analysis. These include:

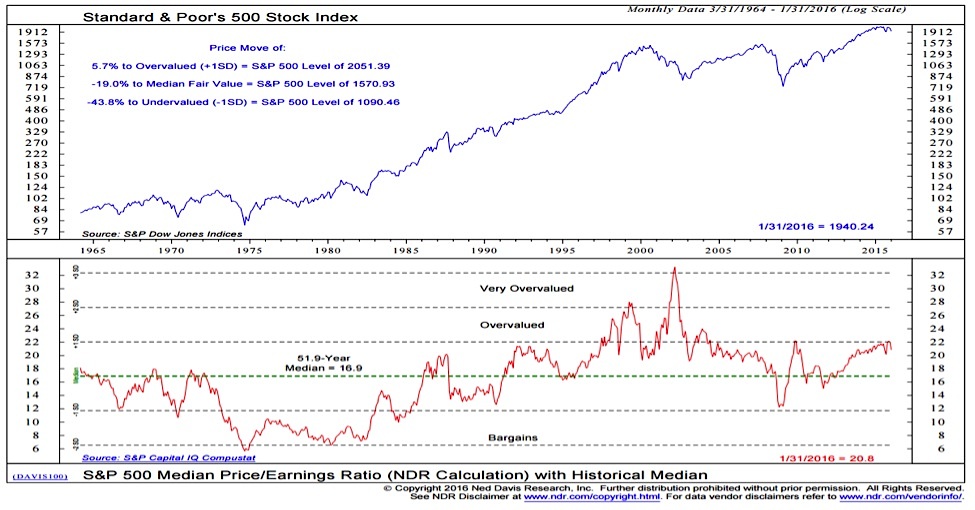

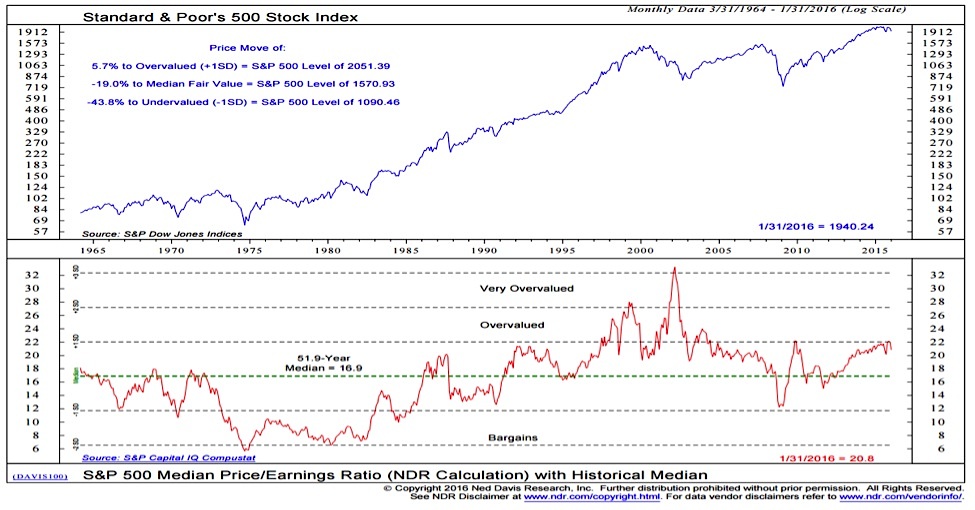

- Price-to-Earnings (P/E) ratios: BofA's analysis considers both trailing and forward P/E ratios across various sectors, comparing them to historical averages and industry benchmarks. They've flagged sectors with significantly elevated P/E ratios as potentially overvalued.

- Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): This metric, which smooths out short-term earnings fluctuations, provides BofA with a longer-term perspective on market valuations, helping identify potential bubbles or undervaluation.

- Other valuation metrics: BofA also incorporates other quantitative and qualitative factors into its valuation assessments such as dividend yields, revenue growth rates, and future earnings projections.

BofA's predicted market movements are cautiously optimistic, anticipating moderate growth but acknowledging the potential for increased volatility. They've identified the technology and consumer discretionary sectors as potentially overvalued, while certain value-oriented sectors, like energy and financials, appear relatively undervalued based on their current analysis.

Identifying the Sources of Investor Anxiety

The apprehension surrounding high stock market valuations stems from several interconnected factors:

- Rising Interest Rates: The Federal Reserve's interest rate hikes aim to curb inflation but also increase borrowing costs for companies, potentially impacting corporate profits and reducing the attractiveness of equities relative to bonds. This directly impacts discounted cash flow models used in stock valuation.

- Inflation Concerns: Persistent inflation erodes purchasing power and increases uncertainty about future corporate earnings, making investors hesitant to commit significant capital to the market. Inflation expectations are a key driver in setting discount rates used in stock valuation.

- Geopolitical Uncertainty: Global events, such as the ongoing war in Ukraine and escalating geopolitical tensions, inject uncertainty into the markets, leading to increased volatility and risk aversion among investors. Geopolitical risk is often reflected in market-wide risk premiums, which affect valuations.

BofA's Recommendations for Investors

In response to the high valuations and investor anxieties, BofA is advising a cautious yet strategic approach:

- Portfolio Diversification: BofA emphasizes the importance of diversifying portfolios across different asset classes, including equities, bonds, real estate, and alternative investments. This reduces exposure to any single sector or market segment.

- Risk Management: Investors are encouraged to assess their risk tolerance and adjust their portfolios accordingly, potentially shifting towards less volatile investments if concerned about market corrections.

- Strategic Asset Allocation: BofA advocates for a long-term investment strategy based on individual financial goals and risk tolerance. This involves regularly reviewing and adjusting the asset allocation based on changing market conditions and economic forecasts.

Specific asset class recommendations include increased allocations to high-quality bonds to counterbalance equity exposure and careful consideration of real estate and alternative investments for long-term growth and diversification.

Alternative Perspectives and Criticisms of BofA's Stance

While BofA's perspective is widely respected, it's crucial to consider alternative viewpoints. Some analysts argue that current valuations are justified by strong corporate earnings growth and technological advancements. This is particularly relevant in growth stocks, a perspective that contradicts BofA’s more cautious evaluation in certain growth sectors.

- Points of Disagreement: Some critics argue that BofA's valuation models may not fully account for long-term growth potential, particularly in innovative technology sectors. They believe that the use of traditional valuation metrics might underestimate the future value of these companies.

- Alternative Valuation Models: Other analysts utilize different valuation models, such as discounted cash flow analysis with varying discount rates, leading to different conclusions about market valuations.

- Potential Risks: A potential limitation of BofA’s recommendations is the inherent difficulty in predicting future market movements. Economic forecasts are not always accurate.

Conclusion: Addressing Investor Concerns Over High Stock Market Valuations – Key Takeaways and Call to Action

BofA's assessment of investor concerns over high stock market valuations highlights a complex situation. While pockets of overvaluation exist, the overall market isn't necessarily in bubble territory. However, investor anxiety is fueled by rising interest rates, inflation, and geopolitical uncertainty. BofA recommends portfolio diversification, risk management, and a long-term investment strategy. It's crucial to remember that alternative perspectives exist, and different valuation models can yield varied results. Understanding investor concerns over high stock market valuations is crucial. Consult with a financial advisor to develop a strategy that aligns with your risk tolerance and investment goals, ensuring your portfolio is positioned to navigate the complexities of the current market landscape.

Featured Posts

-

Cassidy Hutchinson Jan 6th Hearing Star To Publish Memoir

Apr 28, 2025

Cassidy Hutchinson Jan 6th Hearing Star To Publish Memoir

Apr 28, 2025 -

First Look Aaron Judge And Samantha Bracksiecks Newborn Baby

Apr 28, 2025

First Look Aaron Judge And Samantha Bracksiecks Newborn Baby

Apr 28, 2025 -

2000 Yankees Season Joe Torres Managerial Decisions And Pettittes Dominance

Apr 28, 2025

2000 Yankees Season Joe Torres Managerial Decisions And Pettittes Dominance

Apr 28, 2025 -

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025