Is Gold A Safe Haven? Analyzing Bullion's Performance During Trade Disputes

Table of Contents

Historical Performance of Gold During Trade Disputes

Examining Past Trade Wars

Analyzing historical data on gold prices during significant trade disputes offers valuable insights. Let's consider two prominent examples:

-

The Smoot-Hawley Tariff Act (1930): This act, designed to protect American industries, led to a sharp decline in global trade and contributed to the Great Depression. While the correlation isn't perfectly linear, gold prices did see a period of relative strength during this period, reflecting a flight to safety as investors sought refuge from economic uncertainty. Charts from this era show a generally upward trend in gold prices, albeit influenced by numerous factors beyond trade.

-

The US-China Trade War (2018-2020): This recent trade conflict saw significant tariff increases and retaliatory measures between the world's two largest economies. Gold prices initially responded positively to the escalating tensions, with a noticeable price increase. However, the relationship wasn't strictly linear; other factors like interest rates and global economic growth also influenced gold's price movements.

Charts and graphs illustrating gold price movements against the backdrop of these trade disputes would be included here. It's important to note that while gold often shows strength during times of trade uncertainty, the relationship is complex and influenced by multiple variables. These variables include:

- Inflationary pressures: Gold is often seen as a hedge against inflation.

- Currency fluctuations: Changes in the value of major currencies can significantly impact gold's price.

- Geopolitical events: Events unrelated to trade can also affect gold's performance.

Case Studies: Specific Trade Disputes and Gold's Response

Examining individual trade disputes in detail allows for a more nuanced understanding. For example, analyzing the impact of the EU-US Airbus-Boeing dispute on gold prices reveals a less dramatic response than seen during the US-China trade war. This highlights the importance of considering the specific circumstances of each trade dispute, the overall global economic climate, and investor sentiment. Each case study would require a detailed examination of data points and analysis to fully understand the correlation between trade tensions and the gold market's reaction.

Factors Influencing Gold's Role as a Safe Haven Asset During Trade Disputes

Investor Sentiment and Market Psychology

Fear and uncertainty are powerful drivers of investment decisions. During trade disputes, investors often flock to perceived safe havens like gold as a means of preserving capital. News coverage and media narratives play a significant role in shaping investor sentiment. Negative headlines about trade tensions can trigger a surge in gold demand, pushing prices higher. Speculation and hedging strategies also contribute to price fluctuations. Sophisticated investors use gold as a hedge against potential losses in other asset classes.

Macroeconomic Factors and Geopolitical Risks

Gold's attractiveness as a safe haven is also influenced by broader economic conditions and geopolitical events. The relationship between inflation, interest rates, and gold prices is well-established. During periods of high inflation, gold tends to perform well as it maintains its value while fiat currencies depreciate. Similarly, geopolitical instability can drive increased demand for gold. Currency devaluations and global uncertainty often lead to increased investment in this precious metal.

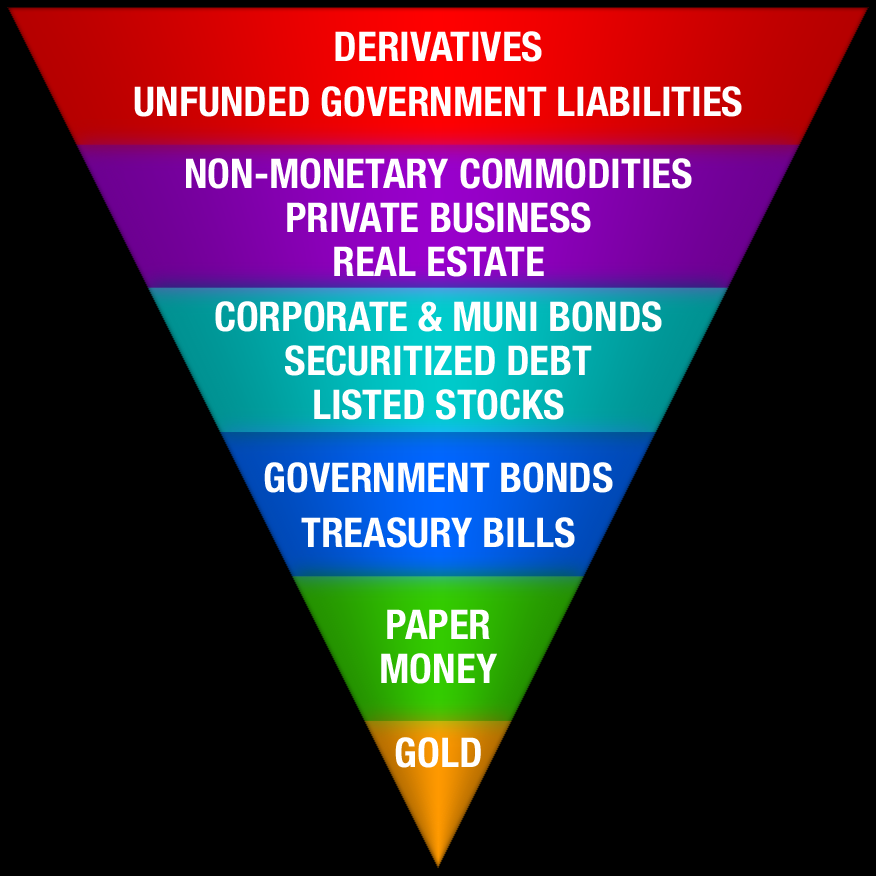

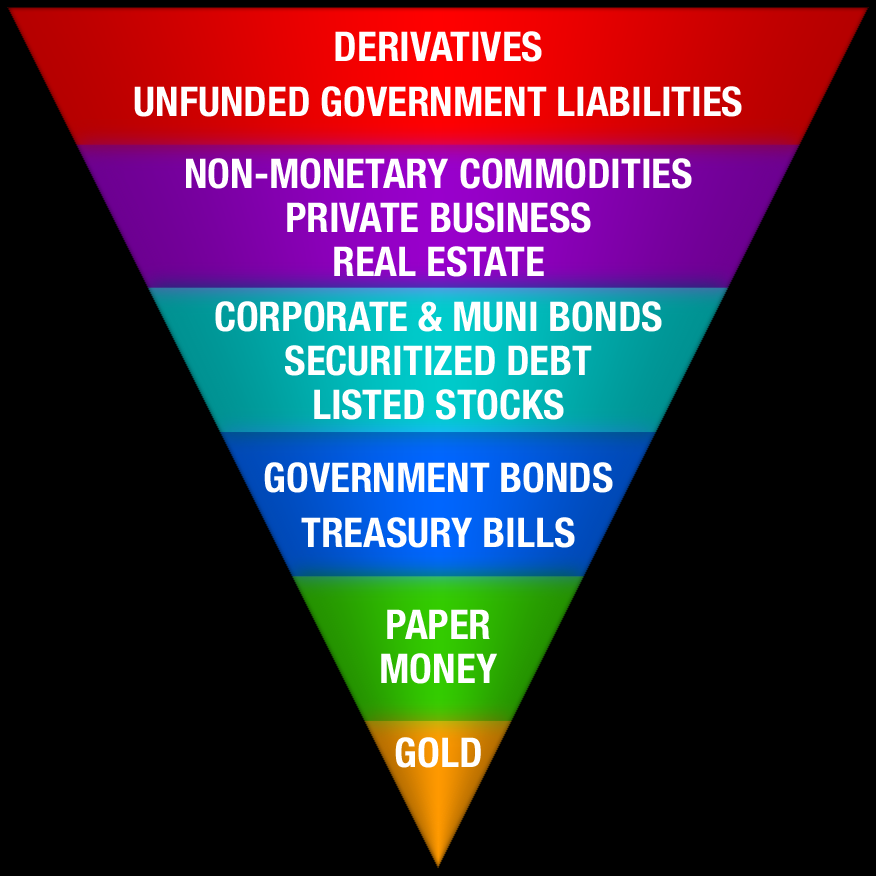

Alternative Safe Haven Assets

It's crucial to compare gold's performance with other safe haven assets. The US dollar, government bonds, and the Swiss Franc are frequently considered alternatives. While each asset class has its strengths and weaknesses, the optimal strategy often involves diversification. Including different safe haven assets in a portfolio helps manage risk effectively during periods of trade tension.

The Future of Gold as a Safe Haven Asset in an Era of Trade Uncertainty

Predicting Future Performance

Predicting gold's future performance is challenging, given the complexity of global economic and geopolitical factors. While historical data provides valuable insights, it's not always a reliable predictor of future performance. Future trade disputes and their intensity remain uncertain.

Assessing Gold's Continued Relevance

Gold's continued relevance as a premier safe haven asset is a subject of ongoing debate. Technological advancements, including the rise of cryptocurrencies and digital assets, could potentially reshape investment preferences. Central bank policies and the broader adoption of digital currencies will also impact the gold market.

Conclusion: Is Gold Still a Safe Haven in the Face of Trade Conflicts?

Our analysis reveals that while gold has historically shown strength during periods of heightened trade tensions, its performance is influenced by a complex interplay of factors. It’s crucial to recognize that gold is not a guaranteed safe haven, and its price can fluctuate significantly based on various economic and geopolitical conditions. Therefore, considering gold as part of a diversified investment strategy remains vital for mitigating risk. Learn more about incorporating gold as a safe haven asset into your portfolio today, and consult with a financial advisor to determine if a gold safe haven strategy aligns with your specific investment goals.

Featured Posts

-

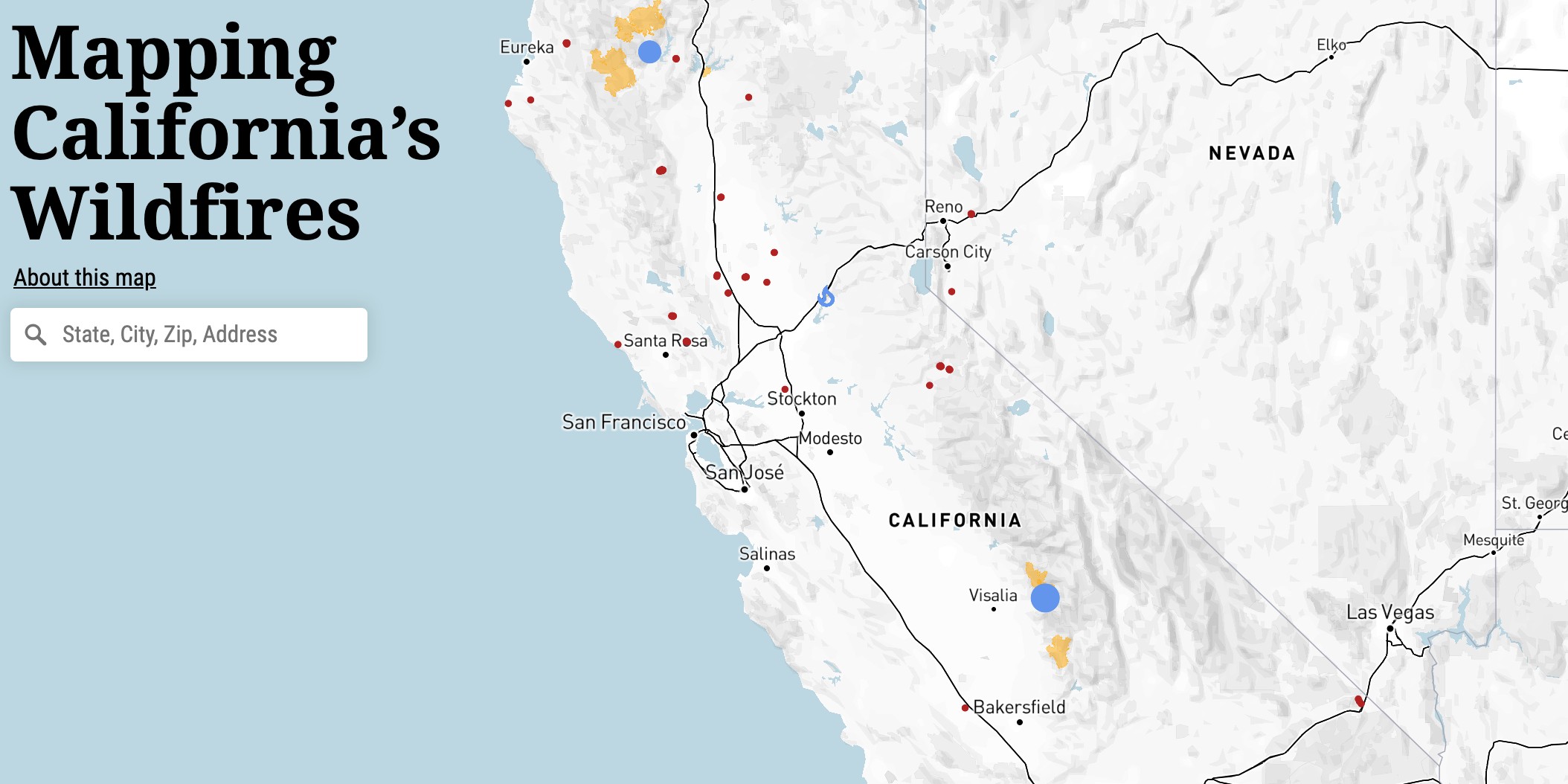

Full List Celebrities Affected By The La Palisades Wildfires

Apr 26, 2025

Full List Celebrities Affected By The La Palisades Wildfires

Apr 26, 2025 -

Russias Disinformation Campaign False Greenland News Fuels Denmark Us Rift

Apr 26, 2025

Russias Disinformation Campaign False Greenland News Fuels Denmark Us Rift

Apr 26, 2025 -

Analyzing Trumps Remarks On Ukraines Nato Membership

Apr 26, 2025

Analyzing Trumps Remarks On Ukraines Nato Membership

Apr 26, 2025 -

La Palisades Fire Which Celebrities Lost Their Homes

Apr 26, 2025

La Palisades Fire Which Celebrities Lost Their Homes

Apr 26, 2025 -

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025