Is Netflix A Safe Haven In The Age Of Big Tech Uncertainty And Tariffs?

Table of Contents

Netflix's Global Reach and Diversification as a Protective Factor

Netflix's success isn't solely based on its vast library of movies and shows; its global presence is a significant factor in its perceived stability. This diversification acts as a powerful buffer against various risks.

Geographic Diversification Mitigates Risk

- Reduced reliance on any single market: Netflix isn't heavily reliant on any single country's performance. A downturn in one region can be offset by growth in another.

- Ability to offset losses in one region with gains in another: This geographical spread significantly reduces the impact of regional economic downturns or policy changes. For example, a slowdown in the US market might be compensated for by strong growth in Asia or Latin America.

- Examples of successful international expansion: Netflix's success in countries like South Korea, Japan, and Brazil showcases the effectiveness of its global strategy. These markets contribute significantly to its overall subscriber base and revenue.

Netflix’s global footprint significantly reduces its vulnerability to localized economic or political instability. A strong presence in multiple regions insulates the company from the risks associated with relying heavily on a single market. This diversified approach is a key element of the "Netflix safe haven" argument.

Content Diversification Beyond Hollywood

Netflix's content strategy further contributes to its perceived stability. It's not just about Hollywood; it's about a globalized approach to entertainment.

- Investment in international productions: Netflix invests heavily in original content from around the world, catering to diverse audiences and tastes. This reduces its dependence on US-produced content.

- Original content across genres: From documentaries and reality TV to stand-up comedy and anime, Netflix’s diverse content library attracts a wider audience, mitigating risk associated with relying on a single genre.

- Licensing agreements with diverse content providers: Netflix doesn’t solely rely on its own productions. Agreements with various studios and content creators provide a continuous stream of new and diverse programming.

This strategic diversification of content significantly lowers the risk linked to any single production’s performance or licensing issues. This broad approach strengthens the "Netflix safe haven" narrative.

The Impact of Tariffs and Trade Wars on Netflix

While Netflix benefits from global diversification, it’s not immune to the impacts of global trade policies.

Potential Tariffs on Content and Infrastructure

- Increased costs for content acquisition: Tariffs on imported content could significantly increase Netflix’s operational costs, impacting its profitability.

- Potential impact on infrastructure investment: Tariffs on imported equipment or infrastructure components could hamper Netflix's expansion and upgrade plans.

- Strategies Netflix might use to mitigate these impacts: Netflix may respond by shifting its content sourcing, negotiating directly with content creators, or seeking alternative infrastructure providers. However, these are costly and complex measures.

The potential imposition of tariffs presents a significant challenge to the "Netflix safe haven" concept. Increased costs could lead to price hikes for consumers or reduced profitability for the company.

Currency Fluctuations and Their Effect on Revenue

International expansion also exposes Netflix to currency risks.

- Impact of fluctuating exchange rates on international subscriptions: Changes in exchange rates directly impact the revenue Netflix receives from international subscriptions.

- Strategies for hedging against currency risk: Netflix likely utilizes various financial instruments to mitigate these risks, but such strategies involve their own costs and complexities.

- Examples of past experiences: Fluctuations in the value of certain currencies have already impacted Netflix's reported financial results, demonstrating the reality of this risk.

Currency volatility undermines the stability associated with the "Netflix safe haven" idea. While mitigation strategies exist, they don't eliminate the inherent risk.

Netflix's Competitive Landscape and Future Uncertainty

Despite its current success, Netflix faces a fiercely competitive landscape and significant uncertainties.

Competition from Streaming Rivals

- Increased competition from Disney+, HBO Max, etc.: The streaming market is becoming increasingly crowded, with established players and new entrants constantly vying for market share.

- Netflix's strategies to maintain its market share: Netflix is investing heavily in original content, improving its user interface, and exploring new features to maintain its competitive edge.

- Analysis of competitive advantages: Netflix's vast global reach, substantial content library, and strong brand recognition remain key competitive advantages.

The intense competition weakens the "Netflix safe haven" proposition. Maintaining market share and profitability in this dynamic environment is not guaranteed.

Regulatory Scrutiny and Antitrust Concerns

Netflix faces increasing regulatory scrutiny worldwide.

- Potential regulatory challenges related to data privacy, content regulation, and antitrust concerns: Data privacy regulations, content censorship policies, and antitrust investigations all pose potential risks.

- Netflix's response to these challenges: Netflix is actively engaging with regulators and adapting its practices to comply with evolving regulations.

Regulatory uncertainty poses a significant threat to the stability often associated with a "safe haven" investment. Navigating this complex regulatory landscape could impact Netflix's operations and profitability.

Conclusion

Is Netflix a safe haven? The answer is nuanced. While Netflix's global reach and diversified content library offer a degree of insulation against certain risks, significant challenges remain. Potential tariffs, currency fluctuations, intense competition, and regulatory uncertainty all pose substantial threats to its long-term stability. While its relative strength compared to other tech companies is undeniable, considering it a true "Netflix safe haven" requires careful consideration of these risks. Further research into the company's financial performance and strategic decisions is crucial before making any investment. Continue your analysis by exploring [link to relevant financial reports/analysis].

Featured Posts

-

Nine Home Runs Three By Judge Yankees Historic Offensive Outburst

Apr 23, 2025

Nine Home Runs Three By Judge Yankees Historic Offensive Outburst

Apr 23, 2025 -

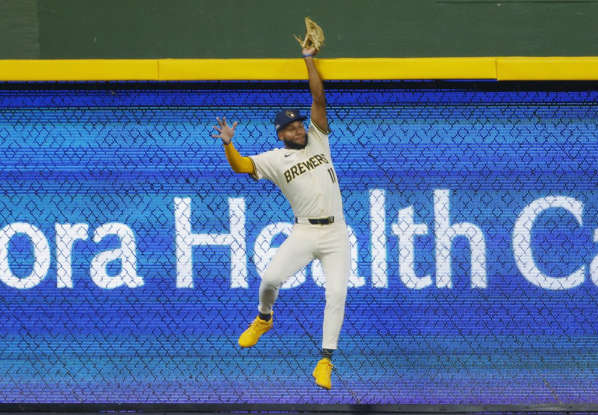

Brewers Record Setting Nine Stolen Bases Power Victory Against As

Apr 23, 2025

Brewers Record Setting Nine Stolen Bases Power Victory Against As

Apr 23, 2025 -

Nationals Reliever Jorge Lopez Receives Three Game Suspension

Apr 23, 2025

Nationals Reliever Jorge Lopez Receives Three Game Suspension

Apr 23, 2025 -

Mlb Daily Player Prop Picks Key Games And Best Bets

Apr 23, 2025

Mlb Daily Player Prop Picks Key Games And Best Bets

Apr 23, 2025 -

Athletics Defeat Brewers 3 1 Game Recap And Highlights

Apr 23, 2025

Athletics Defeat Brewers 3 1 Game Recap And Highlights

Apr 23, 2025