Is The U.S. Dollar Headed For Its Worst 100 Days Since Nixon?

Table of Contents

Rising Inflation and the Weakening Dollar

Persistent inflation is significantly eroding the purchasing power of the dollar, a key factor contributing to concerns about a potential downturn.

- The impact of persistent inflation on the purchasing power of the dollar: High inflation means each dollar buys less goods and services. This decrease in purchasing power fuels anxieties about the dollar's long-term value.

- Current inflation rates and projections: Current inflation rates, measured by indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI), remain stubbornly high in many countries, exceeding the targets set by central banks. Future projections vary, but many economists predict continued inflationary pressures, at least in the short term.

- Erosion of dollar value and investor confidence: High inflation leads to decreased investor confidence in the dollar. Investors seek alternative assets to preserve their wealth, potentially leading to capital flight and further weakening the dollar.

- Inflation hedging strategies: As inflation rises, investors often seek "inflation hedges" – assets like gold, real estate, or commodities – which typically appreciate in value during inflationary periods. This shift in investment away from the dollar exacerbates its decline.

The Federal Reserve's Response and its Effects

The Federal Reserve (Fed) is attempting to combat inflation through aggressive monetary policy, but the consequences for the dollar remain uncertain.

- Interest rate hikes and quantitative tightening: The Fed has implemented a series of significant interest rate hikes and begun quantitative tightening (reducing its balance sheet), aiming to cool down the economy and curb inflation.

- Impact on dollar value: While higher interest rates can initially attract foreign investment, making the dollar more attractive, the aggressive approach carries risks. It can slow economic growth, potentially leading to a recession and further weakening the dollar.

- Unintended consequences: The Fed's actions could trigger unforeseen negative consequences, such as a deeper recession or financial market instability, further impacting the dollar's value.

- Expert opinions and differing viewpoints: Economists hold differing views on the effectiveness of the Fed's response. Some believe the measures are necessary to control inflation, while others warn of the potential for severe economic damage.

Geopolitical Instability and its Influence on the Dollar's Value

The current geopolitical landscape is adding to the pressure on the dollar.

- Global events impacting the dollar: The war in Ukraine, escalating tensions between the US and China, and volatile energy prices are creating significant global uncertainty.

- Negative impact on investor sentiment: This uncertainty fuels risk aversion among investors, leading them to seek safer havens, potentially reducing demand for the dollar.

- Dollar as a global reserve currency: The dollar's role as the world's primary reserve currency makes it vulnerable to geopolitical shifts. Any erosion of confidence in the US's stability or global influence could negatively affect the dollar's demand.

- Impact of sanctions: The use of financial sanctions by the US and its allies can also impact the dollar's perception as a reliable and freely usable currency in international trade.

Alternative Currencies and the Rise of the Multipolar World

The increasing use of alternative currencies challenges the dollar's dominance.

- Growing popularity of alternative currencies: The Euro, the Chinese Yuan, and other currencies are gaining traction in international trade and finance.

- Increased use in international transactions: More and more countries are conducting trade in currencies other than the dollar, reducing reliance on the US financial system.

- Implications of a move away from dollar dominance: A shift away from dollar hegemony could significantly weaken the dollar's value and influence.

- Role of cryptocurrency: The rise of cryptocurrencies, while still volatile, presents a further challenge to the dollar's supremacy as a medium of exchange and store of value.

Conclusion: The Future of the U.S. Dollar – A Critical Juncture

The factors discussed – rising inflation, the Fed's response, geopolitical instability, and the rise of alternative currencies – suggest a potential for a significant decline in the U.S. dollar's value. While the situation is complex, and predicting the future with certainty is impossible, the parallels with the events surrounding the Nixon Shock, while not exact, are undeniable. The potential for a similarly disruptive period cannot be dismissed. While the dollar may exhibit resilience, understanding the potential for a repeat of the events surrounding the Nixon Shock is crucial for navigating this period of economic uncertainty. Stay informed about the future of the U.S. dollar and take steps to protect your financial future. Diversifying investments to mitigate potential risks associated with a weakening dollar is a prudent strategy.

Featured Posts

-

Confronting Google Perplexitys Ceo On The Future Of Ai Browsers

Apr 28, 2025

Confronting Google Perplexitys Ceo On The Future Of Ai Browsers

Apr 28, 2025 -

Abu Dhabi Pass And 10 Gb Data Your Uae Tourist Sim Card

Apr 28, 2025

Abu Dhabi Pass And 10 Gb Data Your Uae Tourist Sim Card

Apr 28, 2025 -

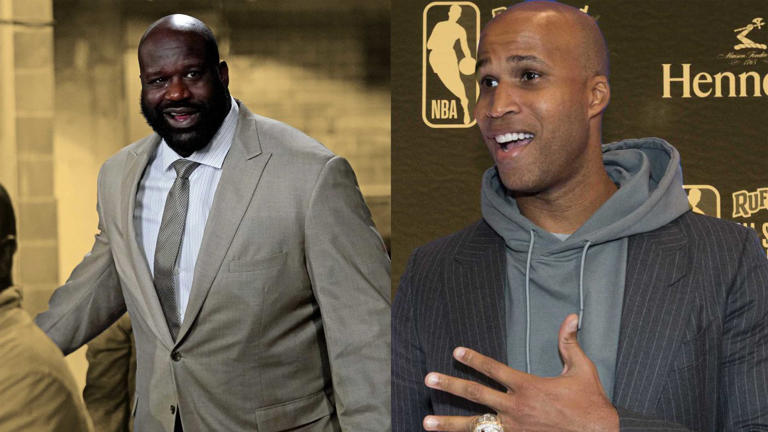

Richard Jeffersons Jabs At Shaquille O Neal A Timeline Of Their Public Exchanges

Apr 28, 2025

Richard Jeffersons Jabs At Shaquille O Neal A Timeline Of Their Public Exchanges

Apr 28, 2025 -

The Swoon In The Market A Look At Who Bought And Who Sold

Apr 28, 2025

The Swoon In The Market A Look At Who Bought And Who Sold

Apr 28, 2025 -

Mets Option Dedniel Nez To Syracuse Megill Joins Rotation

Apr 28, 2025

Mets Option Dedniel Nez To Syracuse Megill Joins Rotation

Apr 28, 2025