"Just Contact Us": Analyzing TikTok's Tariff Circumvention Tactics

Table of Contents

The Ambiguity of "Just Contact Us" as a Trade Strategy

The phrase "Just Contact Us," while seemingly innocuous, can be a powerful tool for obfuscation within the context of international trade. Vague communication like this creates loopholes in trade compliance, allowing companies to potentially avoid scrutiny and minimize the impact of tariffs. This strategy relies on the ambiguity to delay or deflect questions about crucial details related to tariff calculations.

How might this approach be used to avoid or minimize tariffs?

- Lack of clear pricing and sourcing information: By omitting precise details on the origin of goods and their manufacturing costs, TikTok could potentially underreport the value of imported products, leading to lower tariff assessments.

- Delayed or obfuscated responses to tariff inquiries: The "Just Contact Us" approach allows TikTok to postpone providing necessary documentation or information to customs authorities, potentially delaying or preventing proper tariff calculations.

- Exploiting inconsistencies in international trade regulations: Different countries have varying interpretations and enforcement of trade regulations. Ambiguous communication could exploit these inconsistencies to gain a competitive advantage.

Analyzing TikTok's Supply Chain and Sourcing Practices

Understanding TikTok's global supply chain is crucial to assessing the potential for tariff circumvention. The company's reliance on a vast network of manufacturers and suppliers across multiple countries creates inherent vulnerabilities to tariff regulations. The complexity of this network allows for opportunities to utilize intermediaries or shell companies to mask the true origin of goods and obscure the actual costs associated with production and importation.

- TikTok's manufacturing partners and their locations: Identifying the precise locations of TikTok's manufacturing partners is essential. If manufacturing occurs in countries with preferential trade agreements, this information might not be readily disclosed.

- Potential offshore manufacturing practices: The use of offshore manufacturing in countries with lower labor costs or more lenient trade regulations could lead to underreporting of the final product's value, impacting tariff assessments.

- Reported instances of non-compliance: Any past instances of reported non-compliance with international trade regulations or investigations into TikTok's trade practices need to be examined carefully.

The Legal and Ethical Implications of TikTok's Approach

The use of ambiguous communication to circumvent tariffs carries significant legal and ethical implications. Intentionally providing misleading or incomplete information to customs authorities is a serious offense that can result in substantial penalties. Furthermore, even if not intentionally illegal, the practice raises ethical concerns about fair trade and market competition.

- Potential fines and penalties for tariff evasion: Depending on the jurisdiction and the severity of the infraction, TikTok could face hefty fines and penalties for any proven attempts at tariff evasion.

- Reputational damage to TikTok's brand image: Any suggestion of tariff circumvention can severely damage TikTok's reputation, impacting consumer trust and investor confidence.

- Comparison to similar cases of tariff circumvention: Comparing TikTok's practices to those of other companies facing similar accusations of tariff circumvention will provide valuable context.

Alternative Strategies for Navigating International Trade Regulations

There are ethical and transparent methods for navigating complex tariff structures. Proactive engagement with authorities, alongside comprehensive documentation, are key to compliance.

- Proactive engagement with customs authorities: Open communication and collaboration with customs authorities can ensure accurate tariff assessments and avoid potential disputes.

- Detailed documentation of sourcing and pricing: Maintaining meticulous records of sourcing, manufacturing, and transportation costs is essential for demonstrating compliance with trade regulations.

- Implementation of robust compliance programs: Establishing internal compliance programs ensures adherence to international trade laws and reduces the risk of non-compliance.

The Future of "Just Contact Us" and TikTok's Trade Practices

Our analysis suggests that TikTok's use of "Just Contact Us" could represent a deliberate strategy to create ambiguity and potentially minimize tariff payments. The legal and ethical implications of such a strategy are significant, potentially leading to substantial penalties and reputational damage. Understanding TikTok's tariff strategies and analyzing "Just Contact Us" approaches is crucial for ensuring fair trade practices. We must encourage further discussion and research to promote transparency and improve international trade compliance. We need greater scrutiny of corporate strategies that may exploit loopholes in international trade regulations, ultimately fostering a level playing field for all businesses operating in the global market. Improving international trade compliance requires collective effort and vigilance.

Featured Posts

-

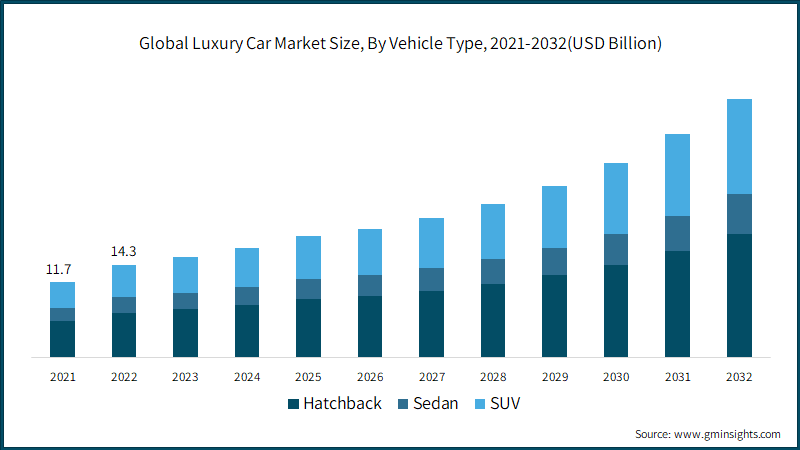

Bmw Porsche And The Shifting Sands Of The Chinese Automotive Market

Apr 22, 2025

Bmw Porsche And The Shifting Sands Of The Chinese Automotive Market

Apr 22, 2025 -

Chinas Impact On Luxury Car Sales Bmw Porsche And Beyond

Apr 22, 2025

Chinas Impact On Luxury Car Sales Bmw Porsche And Beyond

Apr 22, 2025 -

Florida State University Security Breach Student Fears Despite Swift Police Response

Apr 22, 2025

Florida State University Security Breach Student Fears Despite Swift Police Response

Apr 22, 2025 -

The Disturbing Trend Of Betting On The Los Angeles Wildfires

Apr 22, 2025

The Disturbing Trend Of Betting On The Los Angeles Wildfires

Apr 22, 2025 -

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025