Live Stock Market Updates: Dow's 1000-Point Rally And Market Analysis

Table of Contents

Understanding the 1000-Point Dow Rally

Key Factors Driving the Surge:

Today's remarkable 1000-point jump in the Dow wasn't a random event. Several converging factors contributed to this significant market surge. Analyzing these factors is crucial for understanding the current market dynamics and anticipating future trends in live stock market updates.

-

Positive Economic Indicators: Stronger-than-expected employment data released this morning significantly boosted investor confidence. The unemployment rate fell to a new low, indicating a robust labor market and fueling optimism about future economic growth. Positive consumer sentiment surveys also contributed to the positive market sentiment.

-

Impact of Policy Announcements: The Federal Reserve's recent decision to maintain its current interest rate policy, coupled with hints of a potential pause in future rate hikes, eased concerns about aggressive monetary tightening. This fostered a more risk-on environment, encouraging investors to allocate more capital into the stock market.

-

Sector-Specific Performance: The technology sector was a major driver of the rally, with several tech giants reporting better-than-expected earnings and providing positive outlooks for the coming quarters. Strong performance in the technology sector often serves as a bellwether for the overall market.

-

Geopolitical Influences:

- Easing tensions in a specific geopolitical hotspot contributed to decreased risk aversion among investors.

- Positive developments in international trade negotiations also helped to improve market sentiment.

-

(Insert relevant chart/graph here illustrating the Dow's performance)

Technical Analysis of the Rally:

Analyzing the technical aspects of the rally provides further insights into its sustainability.

-

High Trading Volume: The significant increase in trading volume accompanying the rally suggests strong conviction behind the price increase, making it less likely to be a short-lived, purely speculative move. High volume confirms the strength of the upward trend.

-

Price Movements and Chart Patterns: The Dow's breakout above a key resistance level is a bullish signal, suggesting further upward momentum. The chart shows a clear upward trend, with minimal pullbacks.

-

Technical Indicators: Both the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are currently exhibiting bullish signals, reinforcing the positive outlook. These stock chart analysis tools indicate strong upward momentum.

-

Implications for Future Price Movements: While the rally is impressive, it's crucial to remain cautious. Sustained gains will depend on continued positive economic news and the absence of unforeseen negative events.

Market Sector Performance: Winners and Losers

Top Performing Sectors:

The technology, consumer discretionary, and industrial sectors were among the top performers today.

-

Technology: Companies like Apple, Microsoft, and Google experienced significant gains, driven by strong earnings reports and positive future guidance.

-

Consumer Discretionary: Increased consumer spending contributed to strong performance in this sector, reflecting the positive consumer sentiment discussed earlier.

-

Reasons for Strong Performance: A combination of positive economic indicators, easing regulatory concerns, and robust corporate earnings fueled these sectors’ success.

Underperforming Sectors:

While the overall market surged, some sectors lagged behind.

-

Utilities: The utility sector, traditionally considered a defensive investment, underperformed, possibly reflecting a shift towards more growth-oriented sectors.

-

Real Estate: Concerns about rising interest rates may have weighed on the real estate sector's performance.

-

Reasons for Weaker Performance: Sector-specific challenges and headwinds contributed to the underperformance of these sectors relative to the broader market.

Impact on Investors and Investment Strategies

Implications for Long-Term Investors:

The 1000-point rally presents both opportunities and challenges for long-term investors.

-

Sustainable Trend or Fluctuation?: While the rally is significant, it's crucial to assess whether this represents a sustainable long-term trend or a short-term market correction.

-

Long-Term Investment Strategies: Long-term investors should maintain a diversified portfolio and remain disciplined in their investment approach, regardless of short-term market volatility.

Strategies for Short-Term Traders:

Short-term traders can capitalize on the rally's momentum, but it's crucial to manage risk.

-

Opportunities and Risks: The increased volatility can create both opportunities and heightened risks for short-term trading strategies.

-

Short-Term Trading Strategies: Traders might consider employing strategies such as taking profits on previous investments or focusing on sectors exhibiting strong momentum.

-

Risk Management: Strict risk management techniques, including stop-loss orders, are essential to mitigate potential losses.

Conclusion

Today's Dow's 1000-point rally was a significant event driven by a confluence of positive economic data, favorable policy announcements, and strong sector performance. Analyzing live stock market updates and understanding the contributing factors is crucial for making informed investment decisions. While this rally is impressive, it's essential to consider the potential for future volatility and maintain a diversified investment approach. Remember to always assess risk carefully.

Call to Action: Stay informed about the latest live stock market updates to make the most of potential opportunities. Subscribe to our newsletter for daily market analysis and insights to help you navigate the ever-changing world of stock market investing. Learn more about effective investment strategies by exploring our comprehensive resources on live stock market updates and develop your understanding of live stock market analysis techniques.

Featured Posts

-

Cantor Explores 3 Billion Crypto Spac Partnership With Tether And Soft Bank

Apr 24, 2025

Cantor Explores 3 Billion Crypto Spac Partnership With Tether And Soft Bank

Apr 24, 2025 -

Minnesota Ag Preemptively Challenges Trumps Transgender Sports Ban

Apr 24, 2025

Minnesota Ag Preemptively Challenges Trumps Transgender Sports Ban

Apr 24, 2025 -

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025 -

Hield And Paytons Bench Heroics Lead Warriors To Victory Over Blazers

Apr 24, 2025

Hield And Paytons Bench Heroics Lead Warriors To Victory Over Blazers

Apr 24, 2025 -

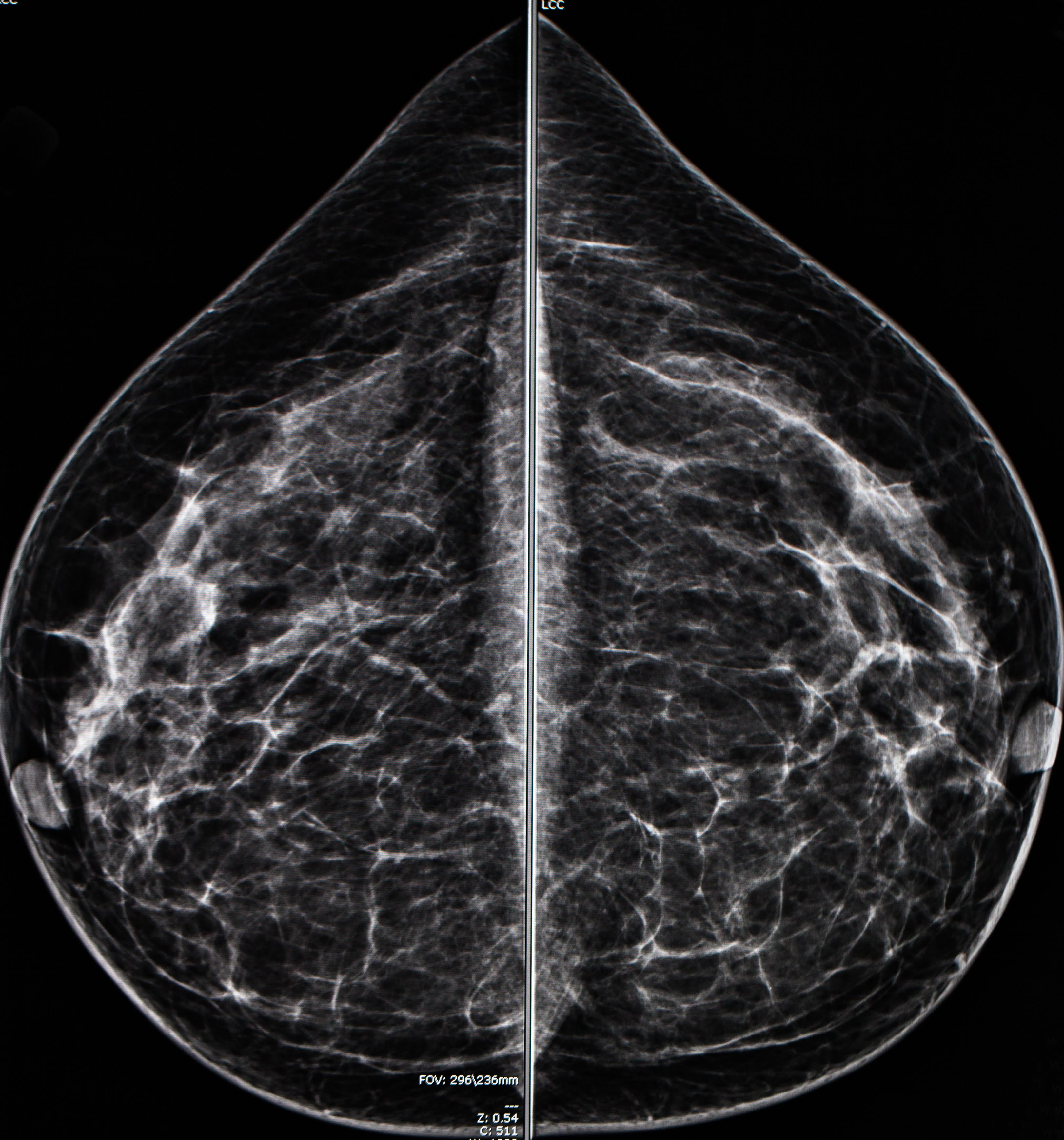

Breast Cancer Diagnosis After Missed Mammogram Learning From Tina Knowles Experience

Apr 24, 2025

Breast Cancer Diagnosis After Missed Mammogram Learning From Tina Knowles Experience

Apr 24, 2025