Market Rally Defies Concerns: Are Investors Too Optimistic?

Table of Contents

Persistent Inflation and the Market Rally

Inflation remains a persistent concern, eroding purchasing power and impacting corporate profitability. A continued market rally in the face of high inflation might seem counterintuitive. Historically, high inflation has been associated with market downturns, as rising prices squeeze consumer spending and increase business costs. However, the current situation is more nuanced. While inflation remains elevated, recent data suggests a potential slowing in the rate of increase.

- Impact of inflation on corporate earnings: Companies are facing increased pressure to manage costs and maintain profit margins in an inflationary environment. This can lead to reduced earnings growth, potentially impacting stock valuations.

- Consumer spending patterns and inflation's influence: High inflation can curb consumer spending as individuals become more price-sensitive. This reduced demand can negatively impact businesses and their stock prices.

- The Federal Reserve's response and its effect on the market: The Federal Reserve's actions to combat inflation, primarily through interest rate hikes, significantly influence market sentiment and volatility. Aggressive rate hikes can dampen economic growth, potentially leading to a market correction.

The question remains: is the current inflation rate and trajectory sustainable with the ongoing market rally, or is this just a temporary reprieve? Only time will tell.

Interest Rate Hikes and Market Sentiment

The Federal Reserve's aggressive interest rate hikes aim to curb inflation, but they also have significant implications for the stock market. Higher interest rates increase borrowing costs for businesses, potentially slowing investment and economic growth. This can negatively impact corporate earnings and lead to lower stock valuations. Furthermore, higher interest rates make bonds more attractive to investors, potentially diverting funds away from the stock market.

- How higher interest rates affect borrowing costs for businesses: Increased borrowing costs can hinder expansion plans, reduce hiring, and ultimately impact profitability, potentially leading to a decrease in stock prices.

- The influence of interest rates on bond yields: As interest rates rise, bond yields also increase, making bonds a more competitive investment compared to stocks. This can lead to a shift in investor allocation away from equities.

- Investor strategies in a high-interest-rate environment: Investors often adjust their portfolios in response to rising interest rates, potentially shifting towards more conservative investments like bonds or cash.

A rate hike pause or reversal could significantly impact market sentiment. However, the Federal Reserve's future actions will depend largely on inflation data and economic indicators.

Geopolitical Risks and Market Stability

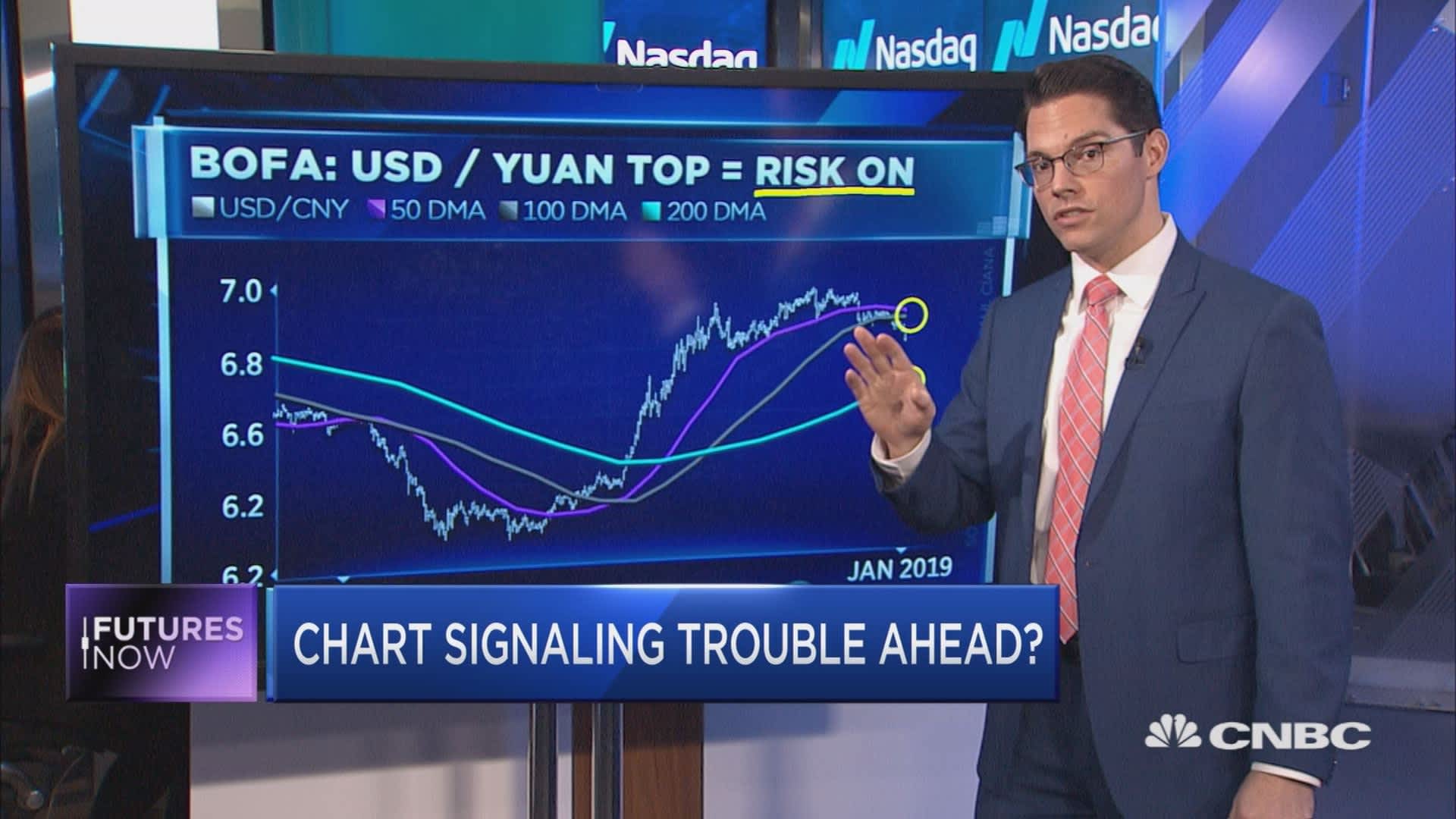

Geopolitical events, such as the ongoing war in Ukraine and the evolving relationship between the US and China, inject significant uncertainty into the global economy and financial markets. These events can disrupt supply chains, increase energy prices, and negatively impact investor confidence, leading to market volatility.

- Examples of recent geopolitical events and their market impact: The war in Ukraine has caused significant energy price spikes and supply chain disruptions, impacting global markets. Escalations in US-China relations also contribute to uncertainty.

- The role of uncertainty in market volatility: Geopolitical uncertainty is a major driver of market volatility. Investors react to unexpected events and potential risks, leading to fluctuations in stock prices.

- Investor strategies for managing geopolitical risk: Diversification, hedging strategies, and careful monitoring of geopolitical developments are crucial for managing risks associated with global events.

The potential for further geopolitical instability remains a significant concern, and its impact on the market is difficult to predict.

Analyzing Investor Behavior and Market Indicators

Understanding current investor behavior and analyzing key market indicators is crucial for assessing the sustainability of the market rally. Increased retail investor participation and shifts in asset allocation are noteworthy developments. Examining metrics like the VIX volatility index, P/E ratios, and other relevant data can help determine whether the current optimism is justified.

- Discussion of specific market indicators and their current values: Analyzing current VIX levels, P/E ratios across various sectors, and other relevant economic data paints a clearer picture of market health and potential risks.

- Analysis of investor sentiment data (surveys, polls): Surveys and polls gauging investor confidence can provide valuable insight into market sentiment and potential shifts in investor behavior.

- Comparison of current market conditions with past market rallies: Historical data can help provide context and perspective on the current situation, aiding in the assessment of the rally's sustainability.

The combination of these indicators helps build a more comprehensive understanding of the current market environment and the underlying factors driving the rally.

Conclusion: Market Rally – A Cautious Outlook or Undue Optimism?

In summary, the current market rally presents a complex picture. While positive economic data exists, persistent inflation, rising interest rates, and ongoing geopolitical risks create considerable uncertainty. The analysis of investor behavior and key market indicators provides a mixed signal, making it challenging to determine whether the current optimism is justified or excessive. Is the current market rally a sustainable bull market, or a temporary surge before a correction?

The answer isn't clear-cut. While the potential for continued growth exists, investors must remain cautious and aware of the inherent risks. Conduct your own thorough market rally analysis, carefully assess investor optimism, and make informed investment decisions. Further research into market analysis and investment strategies will provide you with the tools to navigate these complex market conditions. Understanding the potential for future market volatility is crucial for success in the current climate.

Featured Posts

-

Fsu Security Gap Fuels Student Anxiety Following Rapid Police Action

Apr 22, 2025

Fsu Security Gap Fuels Student Anxiety Following Rapid Police Action

Apr 22, 2025 -

New Security Agreements Between China And Indonesia

Apr 22, 2025

New Security Agreements Between China And Indonesia

Apr 22, 2025 -

Are High Stock Market Valuations A Concern Bof A Says No

Apr 22, 2025

Are High Stock Market Valuations A Concern Bof A Says No

Apr 22, 2025 -

The Future Of Nordic Defense The Pan Nordic Military Strategy

Apr 22, 2025

The Future Of Nordic Defense The Pan Nordic Military Strategy

Apr 22, 2025 -

Escalating Tensions A Deep Dive Into The Breakdown Of U S China Relations And The Potential For Conflict

Apr 22, 2025

Escalating Tensions A Deep Dive Into The Breakdown Of U S China Relations And The Potential For Conflict

Apr 22, 2025