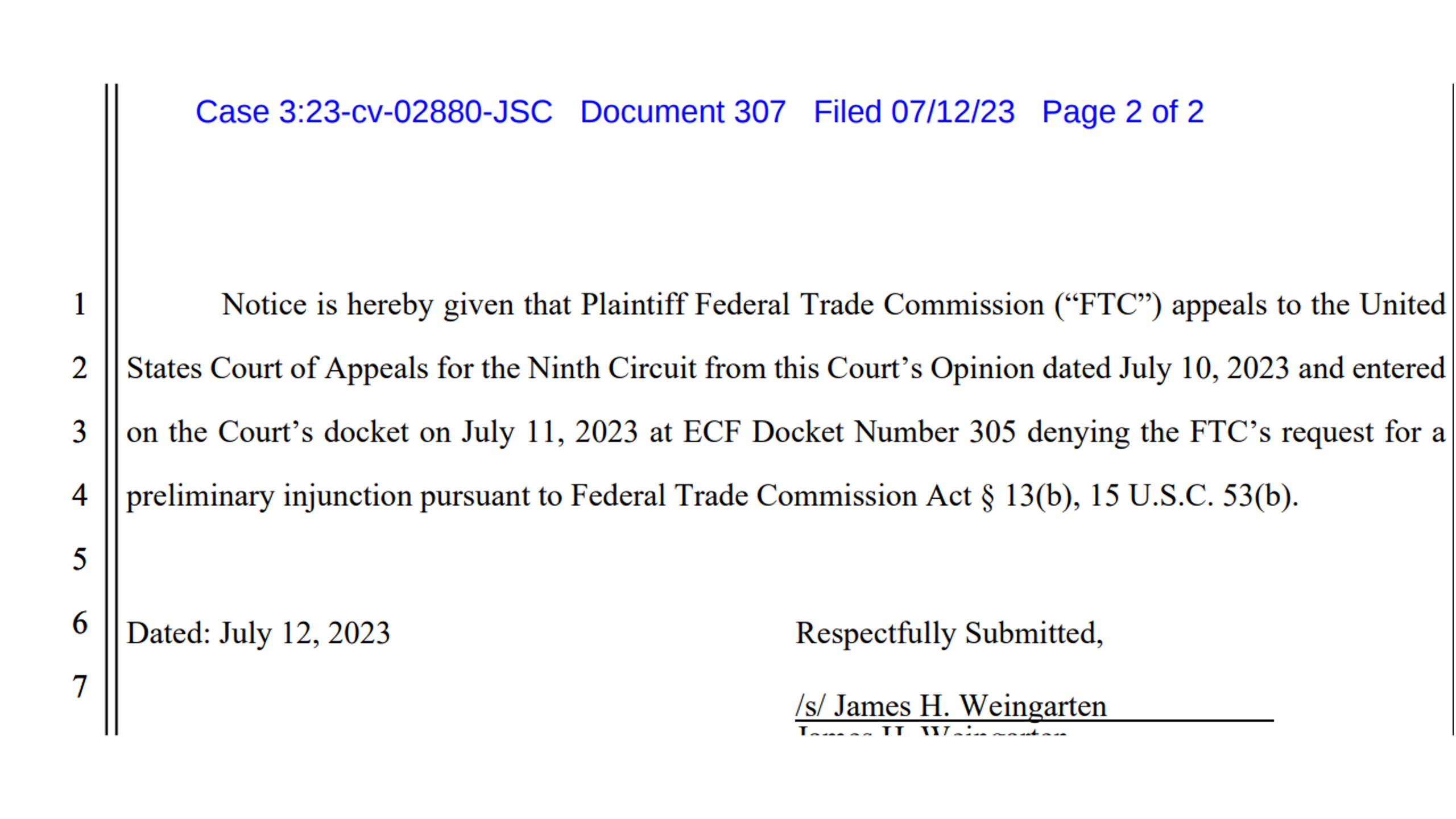

Microsoft-Activision Deal: FTC's Appeal And Future Implications

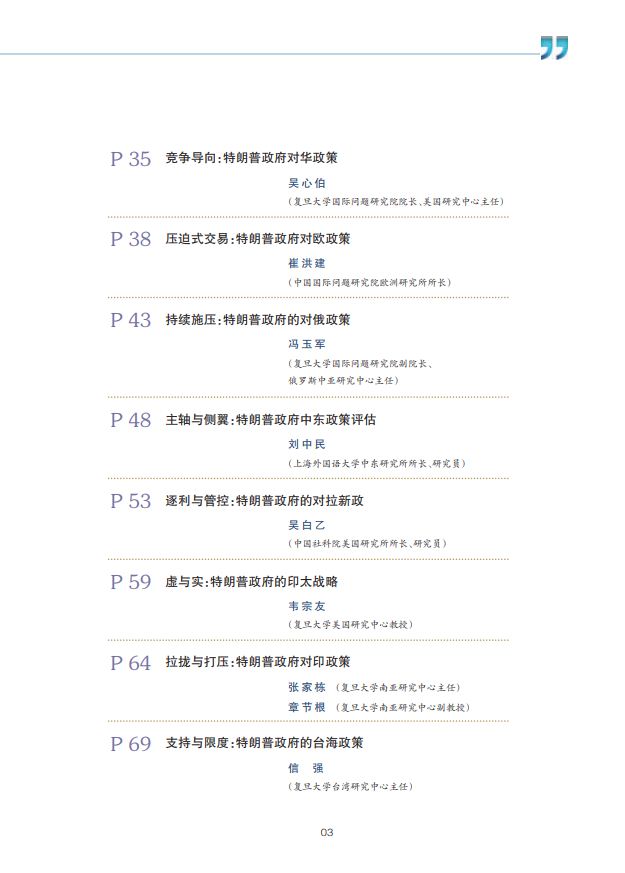

Table of Contents

The FTC's Arguments Against the Merger

The FTC's core argument centers on the belief that the Microsoft-Activision Blizzard merger will create a monopoly, harming consumers through anti-competitive practices.

Concerns about Anti-competitive Practices

The FTC contends that the merger will significantly reduce competition in the gaming market, leading to several negative consequences:

- Reduced choice: Consumers will have fewer options for game purchases and subscriptions.

- Higher prices: The lack of competition could lead to artificially inflated prices for games and gaming services.

- Stifled innovation: A lack of competitive pressure may discourage innovation and the development of new gaming technologies.

- Exclusive content on Xbox: The FTC fears Microsoft could leverage its ownership of Activision Blizzard to make popular titles, such as Call of Duty, exclusive to its Xbox console and Game Pass subscription service. This would directly harm Playstation users and other platforms. This concern is central to the antitrust law arguments.

The Call of Duty Controversy

The FTC's concern about Call of Duty exclusivity is a central point of contention. Call of Duty is one of the most popular and profitable video game franchises globally. The FTC argues that:

- Impact on PlayStation users: Making Call of Duty exclusive to Xbox would significantly disadvantage PlayStation users, potentially driving them towards Xbox.

- The importance of Call of Duty in the market: Call of Duty's immense market share makes its exclusivity a significant competitive concern.

- Potential for subscription lock-in: Exclusive content could incentivize gamers to subscribe to Xbox Game Pass, creating a lock-in effect and reducing competition among subscription services. This relates directly to the arguments around market dominance and consumer harm.

FTC's Strategic Approach and Legal Precedents

The FTC's legal strategy relies on establishing that the merger violates antitrust law by substantially lessening competition. They are likely to cite previous cases of successful antitrust litigation to support their arguments. Their approach involves:

- Similar antitrust cases: The FTC will draw parallels to previous successful antitrust lawsuits to demonstrate the precedent for their actions.

- The legal burden of proof: The FTC needs to prove that the merger will harm competition to a significant degree.

- The potential penalties: Should the FTC win, the penalties could include blocking the merger completely or requiring Microsoft to divest certain assets. This involves navigating the complexities of antitrust litigation and regulatory hurdles.

Microsoft's Defense and Counterarguments

Microsoft has vigorously defended the merger, arguing that it will benefit consumers and enhance competition.

Microsoft's Commitment to Fair Competition

Microsoft counters the FTC's claims by emphasizing its commitment to fair competition:

- Promises to keep Call of Duty multi-platform: Microsoft has repeatedly stated its intention to keep Call of Duty available on PlayStation and other platforms.

- Investment in game development: Microsoft argues the merger will lead to increased investment in game development, creating more high-quality titles for gamers.

- Commitment to fair pricing: Microsoft aims to maintain competitive pricing for its games and services. These are important arguments that affect the competitive landscape and market access.

The broader gaming market perspective

Microsoft highlights the competitive nature of the broader gaming market, arguing that:

- Competition from Sony, Nintendo, and other gaming publishers: The gaming industry is not a monopoly, with significant competition from Sony, Nintendo, and other major publishers.

- The merger wouldn't create a monopoly, and will ultimately enhance competition and innovation within the gaming industry.

Microsoft's proposed solutions and concessions

To address the FTC's concerns, Microsoft has offered several concessions:

- Long-term contracts: Microsoft has proposed long-term agreements to ensure Call of Duty remains available on PlayStation for years to come.

- Licensing agreements: Microsoft may offer licensing agreements to make Activision Blizzard's intellectual property available to other platforms. These concessions are attempts at regulatory compliance and represent potential settlement negotiations.

Potential Outcomes and Future Implications

The outcome of the FTC's appeal remains uncertain, with several possibilities:

Scenarios following the appeal

- FTC Win: The FTC could successfully block the merger, setting a significant precedent for future mergers and acquisitions in the gaming industry.

- Microsoft Win: A victory for Microsoft would potentially pave the way for similar large-scale mergers in the tech industry.

- Settlement: Both parties might reach a settlement, with Microsoft agreeing to certain concessions to appease the FTC. This could influence future acquisition strategies. Regulatory uncertainty will remain until a final decision is reached.

Long-term effects on the gaming industry

Regardless of the outcome, the Microsoft-Activision deal will have long-term implications for the gaming industry:

- Changes in game pricing: The merger's success or failure could influence the pricing strategies of major gaming companies.

- Distribution models: The case highlights the ongoing debate over digital distribution and subscription services.

- Content accessibility: The focus on Call of Duty's accessibility sets a precedent for future discussions about content exclusivity. These factors will shape the game industry future.

Conclusion: The Microsoft-Activision Deal: A Pivotal Moment for Gaming

The Microsoft-Activision Blizzard merger represents a pivotal moment for the gaming industry. The FTC's appeal highlights the crucial debate surrounding antitrust regulations and their impact on competition and innovation. The arguments presented by both sides underscore the complex interplay between market dominance, consumer welfare, and the future direction of the gaming landscape. The potential outcomes—whether a complete block, a conditional approval, or a revised deal—will shape the competitive dynamics of the gaming sector for years to come. Stay informed about further developments in the Microsoft-Activision deal and the ongoing debate around antitrust regulation in the gaming industry. The future of gaming hangs in the balance.

Featured Posts

-

The Economic Fallout Of Trumps Trade Actions Assessing The Risk To Americas Financial Primacy

Apr 22, 2025

The Economic Fallout Of Trumps Trade Actions Assessing The Risk To Americas Financial Primacy

Apr 22, 2025 -

1 Billion Funding Cut Harvard And The Trump Administrations Bitter Feud

Apr 22, 2025

1 Billion Funding Cut Harvard And The Trump Administrations Bitter Feud

Apr 22, 2025 -

Antitrust Scrutiny Intensifies Is A Google Breakup Inevitable

Apr 22, 2025

Antitrust Scrutiny Intensifies Is A Google Breakup Inevitable

Apr 22, 2025 -

Investigation Into Hegseths Signal App Military Plans And Family Connections

Apr 22, 2025

Investigation Into Hegseths Signal App Military Plans And Family Connections

Apr 22, 2025 -

The Passing Of Pope Francis His Enduring Message Of Compassion

Apr 22, 2025

The Passing Of Pope Francis His Enduring Message Of Compassion

Apr 22, 2025