New ECB Task Force To Tackle Banking Regulatory Complexity

Table of Contents

The European Central Bank (ECB) faces a growing challenge: the overwhelming complexity of banking regulations. This complexity burdens banks, hindering efficiency and potentially impacting financial stability across the Eurozone. To address this, the ECB has announced the formation of a new task force dedicated to tackling banking regulatory complexity. This article delves into the task force's objectives, its potential impact on the banking sector, and the wider implications for the European economy. We will explore the specific challenges the task force aims to address and what its success could mean for the future of banking regulation within the EU.

The Scope of the Problem: Why Banking Regulation Needs Simplification

The current landscape of banking regulation within the EU is undeniably complex. This complexity presents significant challenges for banks and the broader financial system.

Overburdened Banks and Reduced Efficiency

Overly complex regulations place a significant burden on banks, leading to several negative consequences:

- Increased compliance costs: Navigating intricate rules and reporting requirements demands substantial investment in personnel, technology, and legal expertise, diverting resources from core banking activities.

- Hindering innovation: The administrative burden associated with compliance can stifle innovation, preventing banks from developing new products and services.

- Administrative delays: The complex nature of regulations can lead to delays in processing transactions and approvals, impacting customer service and operational efficiency.

- Reduced competitiveness: High compliance costs can reduce the competitiveness of European banks, particularly smaller institutions, compared to those in jurisdictions with simpler regulatory environments.

- Potential for errors and inconsistencies: The sheer volume and intricacy of regulations increase the risk of errors and inconsistencies in compliance, potentially leading to penalties and reputational damage.

Potential Risks to Financial Stability

Ironically, overly complex regulations can themselves create vulnerabilities within the banking system:

- Increased risk of regulatory arbitrage: Complex rules can create loopholes that banks might exploit, undermining the intended regulatory objectives.

- Difficulties in effective supervision: Supervisory authorities face challenges in effectively monitoring compliance with complex regulations, potentially leading to oversight failures.

- Potential for unintended consequences: Complex regulations can have unintended consequences, creating new risks or exacerbating existing ones.

- Hindering early risk detection: The complexity of the regulatory landscape can obscure early warning signs of potential financial instability.

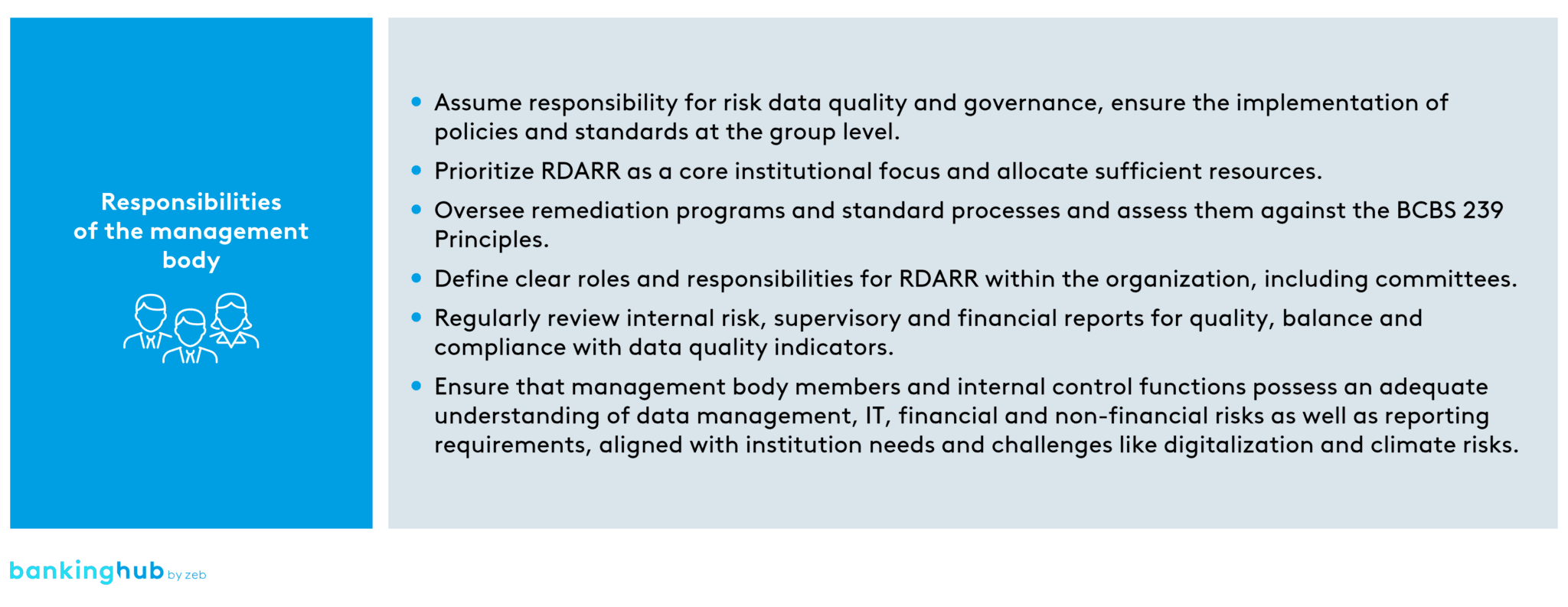

The ECB Task Force: Objectives and Strategies

The newly formed ECB task force aims to address these challenges through a multi-pronged strategy.

Streamlining Regulatory Frameworks

A primary goal of the task force is to simplify existing regulatory frameworks and enhance clarity:

- Identifying areas for simplification: The task force will meticulously analyze current regulations to pinpoint areas where simplification is possible without compromising safety and soundness.

- Developing recommendations for regulatory changes: Based on its analysis, the task force will formulate concrete recommendations for amending or consolidating existing regulations.

- Improving communication and transparency: The task force will strive to improve communication and transparency regarding regulatory requirements, making them easier for banks to understand and comply with.

- Collaboration with other regulatory bodies: Effective simplification requires collaboration. The task force will actively engage with other relevant regulatory bodies, both within the EU and internationally, to ensure a coordinated approach.

Improving Regulatory Technology (RegTech)

The task force recognizes the transformative potential of technology in enhancing regulatory compliance:

- Utilizing data analytics, AI, and automation: Leveraging these technologies can streamline compliance processes, reduce manual effort, and improve the accuracy of regulatory reporting.

- Exploring the use of blockchain technology for regulatory reporting: Blockchain’s inherent transparency and security features could revolutionize regulatory reporting, enhancing efficiency and reducing the risk of errors.

- Improving data sharing and interoperability: Better data sharing and interoperability between banks and regulatory authorities are crucial for effective supervision and compliance.

Enhanced Stakeholder Engagement

The task force emphasizes the importance of involving banks and other stakeholders in the simplification process:

- Conducting consultations: The task force will conduct extensive consultations with banks, industry experts, and other relevant stakeholders to gather feedback and ensure that proposed changes are practical and implementable.

- Gathering feedback from industry experts: Engaging industry experts will provide invaluable insights and help to identify potential challenges and opportunities.

- Ensuring that proposed changes are practical and implementable: The task force will prioritize solutions that are not only theoretically sound but also practical and feasible for banks to implement.

Expected Outcomes and Long-Term Impact

The successful implementation of the ECB task force's initiatives is expected to yield significant benefits.

Increased Efficiency and Reduced Costs

Simplification of banking regulations offers the potential for substantial improvements in efficiency and cost reductions:

- Lower compliance costs: Streamlined regulations will reduce the financial burden on banks, freeing up resources for investment and growth.

- Improved profitability: Reduced compliance costs will directly contribute to improved profitability for banks.

- Increased investment in innovation: Banks will have more resources available to invest in new technologies and products.

- Stronger competitiveness: Reduced regulatory burden will enhance the competitiveness of European banks in the global marketplace.

- Potential for job creation: Increased efficiency and investment can lead to the creation of new jobs within the banking sector.

Enhanced Financial Stability

Streamlined regulations will contribute to a more robust and resilient banking system:

- Reduced systemic risk: Improved clarity and reduced complexity will minimize the risk of unintended consequences and vulnerabilities in the financial system.

- Improved risk management: Simplified regulations will facilitate more effective risk management practices by banks.

- More effective supervision: Simplified regulations will enable supervisory authorities to monitor compliance more effectively.

- Greater transparency and accountability: Increased transparency will enhance accountability and build trust in the financial system.

Conclusion

The establishment of the ECB's new task force represents a significant step towards addressing the growing complexity of banking regulations. By simplifying existing frameworks, leveraging technology, and engaging stakeholders, the task force aims to create a more efficient, stable, and competitive banking sector within the Eurozone. The success of this initiative will have far-reaching implications for the European economy.

Call to Action: Stay informed about the progress of the ECB's task force and its impact on banking regulatory complexity. Follow our updates to stay abreast of the latest developments in simplifying banking regulations within the EU. Learn more about the implications of banking regulatory complexity and its effects on the financial landscape.

Featured Posts

-

Two New Wind Farms Join Pne Groups Growing Portfolio

Apr 27, 2025

Two New Wind Farms Join Pne Groups Growing Portfolio

Apr 27, 2025 -

Wta Finals Roundup Austria And Singapore Host Decisive Matches

Apr 27, 2025

Wta Finals Roundup Austria And Singapore Host Decisive Matches

Apr 27, 2025 -

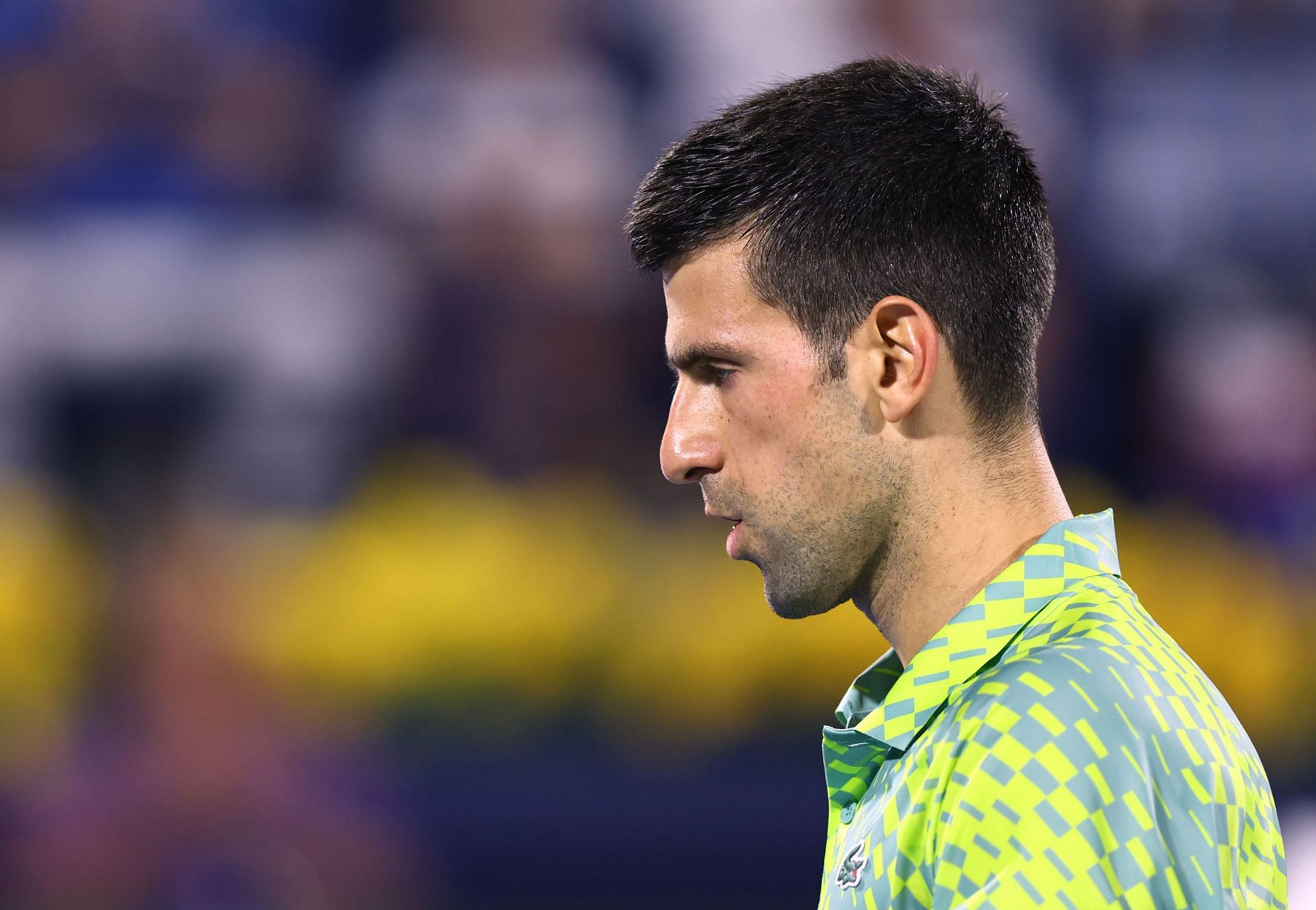

Novak Djokovics Early Exit From Monte Carlo Masters 2025

Apr 27, 2025

Novak Djokovics Early Exit From Monte Carlo Masters 2025

Apr 27, 2025 -

Real Life Sisters To Star In Werner Herzogs Bucking Fastard

Apr 27, 2025

Real Life Sisters To Star In Werner Herzogs Bucking Fastard

Apr 27, 2025 -

Anti Vaccination Activist Appointed To Head Autism Study

Apr 27, 2025

Anti Vaccination Activist Appointed To Head Autism Study

Apr 27, 2025

Latest Posts

-

Louisiana Court To Rule On Harvard Researchers Deportation To Russia

Apr 28, 2025

Louisiana Court To Rule On Harvard Researchers Deportation To Russia

Apr 28, 2025 -

Deportation Case Harvard Researchers Future Hangs In The Balance In Louisiana Court

Apr 28, 2025

Deportation Case Harvard Researchers Future Hangs In The Balance In Louisiana Court

Apr 28, 2025 -

Harvard Researcher Awaits Deportation Ruling In Louisiana

Apr 28, 2025

Harvard Researcher Awaits Deportation Ruling In Louisiana

Apr 28, 2025 -

Louisiana Judge To Decide Fate Of Harvard Researcher Facing Russian Deportation

Apr 28, 2025

Louisiana Judge To Decide Fate Of Harvard Researcher Facing Russian Deportation

Apr 28, 2025 -

Chinas Targeted Tariff Exemptions For Us Made Goods

Apr 28, 2025

Chinas Targeted Tariff Exemptions For Us Made Goods

Apr 28, 2025