Power Finance Corporation's FY25 Dividend Announcement: March 12th

Table of Contents

PFC's Financial Performance in FY24

Before diving into the dividend specifics, understanding PFC's FY24 financial performance is critical. The corporation's financial results will directly influence the dividend payout. Analyzing key financial metrics like revenue growth, profitability, and earnings per share (EPS) paints a clear picture of the company's overall health and capacity for dividend distribution. Strong financial performance typically translates to a higher dividend payout. Let's examine some key figures:

- Net Profit Growth Percentage: [Insert Percentage - Replace with actual data when available]. This reflects PFC's ability to generate profits and manage its operational expenses effectively.

- Revenue Growth Percentage: [Insert Percentage - Replace with actual data when available]. A robust revenue growth signifies a healthy expansion in the company's business and its ability to secure new projects.

- Significant projects undertaken during FY24: [List major projects and their contribution to the financial results. For example: "Successful completion of the [Project Name] power plant contributed significantly to the revenue increase."]

- Earnings Per Share (EPS): [Insert EPS data - Replace with actual data when available] This is a crucial indicator of profitability for individual shareholders.

Analyzing these Power Finance Corporation financials provides a strong foundation for understanding the context of the upcoming dividend announcement.

Dividend Declaration Details

The eagerly awaited Power Finance Corporation FY25 Dividend announcement on March 12th will detail the specifics of the payout. Key details to watch out for include:

- Dividend amount per share: [Insert amount per share - Replace with actual data when available]. This is the amount each shareholder will receive for each share held.

- Record date for dividend eligibility: [Insert date - Replace with actual data when available]. Shareholders holding shares on or before this date will be eligible for the dividend.

- Payment date for the dividend: [Insert date - Replace with actual data when available]. This is the date when the dividend will be credited to shareholders' accounts.

- Comparison to previous year’s dividend: [Insert comparison - Replace with actual data when available]. Comparing this year's Power Finance Corporation dividend payout to the previous year helps assess the trend and the company's financial health. A significant increase could suggest robust financial performance and increased confidence in the future. A decrease might indicate challenges faced during the year. The dividend payout ratio, if disclosed, offers valuable insight into the portion of profits distributed as dividends.

Impact on Investors and Market

The Power Finance Corporation FY25 Dividend announcement will undoubtedly have a significant impact on both investors and the broader market.

- Potential short-term and long-term impact on stock price: A higher-than-expected dividend could lead to a short-term boost in the Power Finance Corporation stock price. However, the long-term impact depends on the company's future prospects and overall market conditions.

- Comparison of dividend yield to similar companies: Analyzing the dividend yield compared to other companies in the same sector helps determine the attractiveness of the investment. A higher yield can attract investors seeking income.

- Expected investor reaction: The market's reaction will depend largely on whether the dividend meets or exceeds investor expectations. Positive sentiment will likely translate to a favorable investor sentiment and potentially increased demand for PFC shares. The market impact will depend on several interacting factors.

Future Outlook and Growth Projections

The Power Finance Corporation future is inextricably linked to the growth of India's power sector. The company's strategic plans for the coming years will significantly shape its performance and consequently its future dividend payouts.

- Key initiatives for future growth: [Outline PFC's strategic initiatives for growth, e.g., expansion into new areas, technological upgrades, etc.]

- Potential risks and mitigation strategies: [Discuss any potential risks – regulatory changes, competition, financial risks – and the strategies to mitigate them.]

- Projected financial performance for the coming years (if available): [If any projections are available, include them here. This information will enhance the long-term investment strategy analysis for potential investors.] Analyzing these factors provides a comprehensive view of the Power Finance Corporation future and its potential for continued success.

Power Finance Corporation FY25 Dividend: Key Takeaways and Next Steps

The Power Finance Corporation FY25 Dividend announcement on March 12th will be a key event for investors. The announced dividend amount, the payment date, and the broader context of PFC's financial performance and future outlook will collectively shape investor decisions. The dividend amount will provide critical information regarding the corporation's financial strength and the return on investment for shareholders.

To stay abreast of the latest developments and understand the implications fully, it's crucial to continue monitoring PFC's official announcements and financial reports. Stay informed about future Power Finance Corporation dividend updates and financial news to make informed investment decisions. Regularly reviewing financial news and official company releases will help you make well-informed decisions regarding Power Finance Corporation's financial news.

Featured Posts

-

Patrick Schwarzeneggers Forgotten Ariana Grande Music Video Role A White Lotus Connection

Apr 27, 2025

Patrick Schwarzeneggers Forgotten Ariana Grande Music Video Role A White Lotus Connection

Apr 27, 2025 -

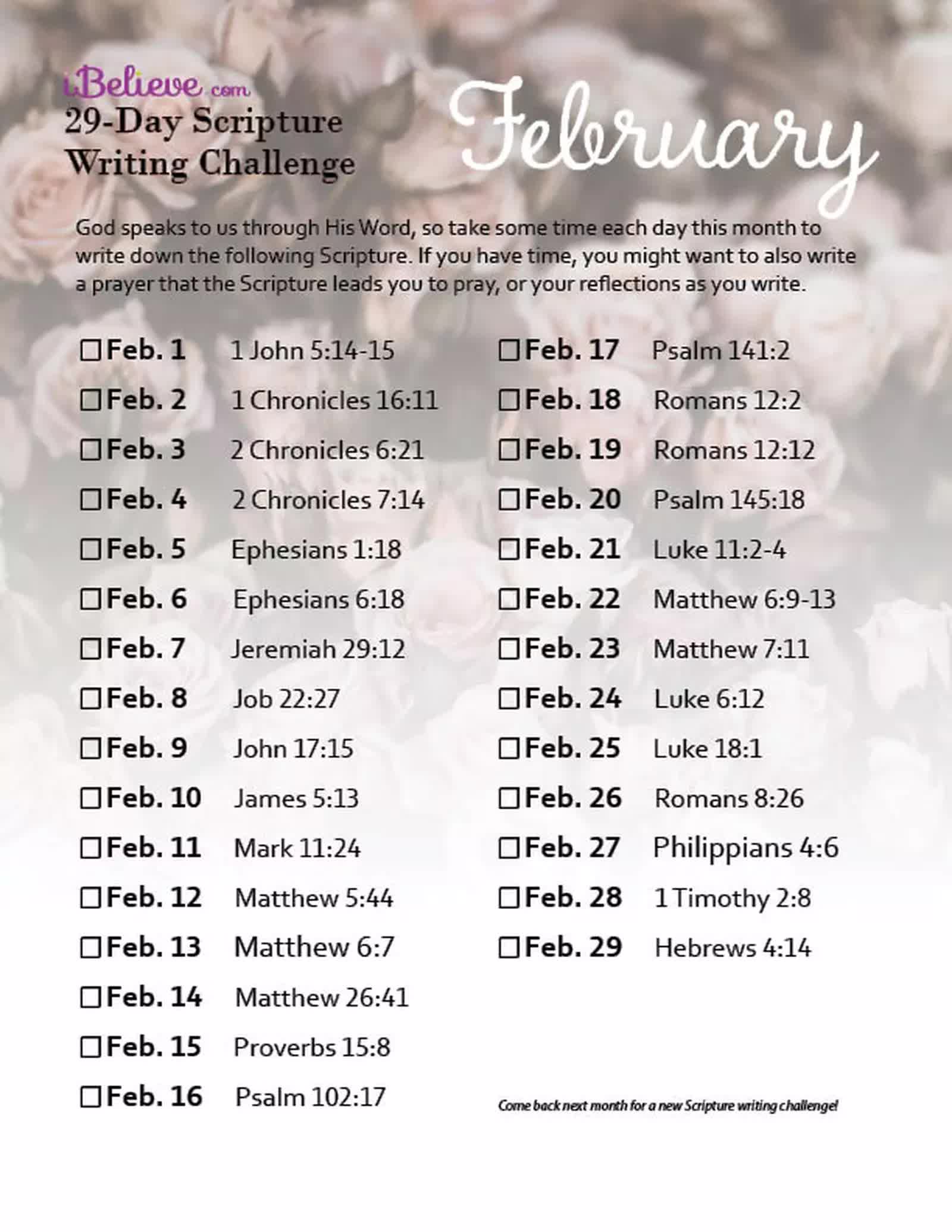

Open Thread Community February 16 2025 Updates

Apr 27, 2025

Open Thread Community February 16 2025 Updates

Apr 27, 2025 -

High Profile Office365 Accounts Breached Millions Stolen

Apr 27, 2025

High Profile Office365 Accounts Breached Millions Stolen

Apr 27, 2025 -

Motherhood Milestone Belinda Bencics Return To Wta Success

Apr 27, 2025

Motherhood Milestone Belinda Bencics Return To Wta Success

Apr 27, 2025 -

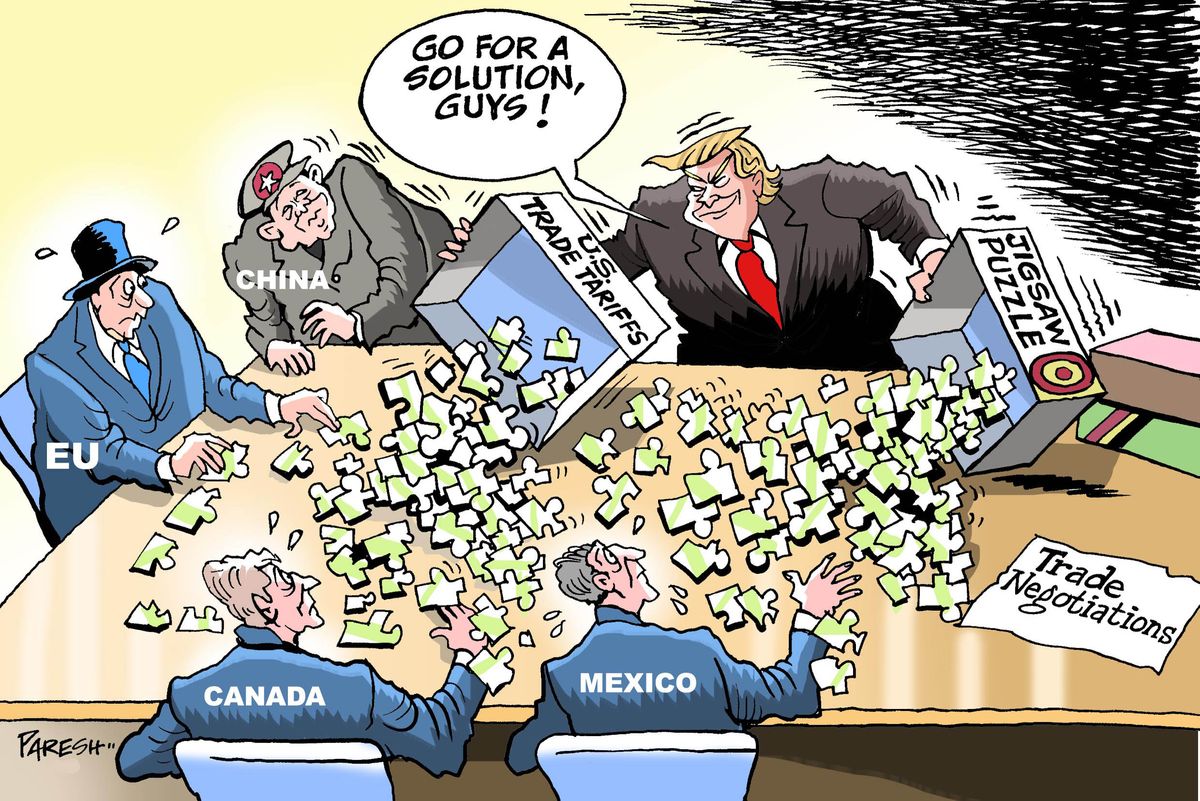

Political Polarization In Canada The Trump Factor And Albertas Resistance

Apr 27, 2025

Political Polarization In Canada The Trump Factor And Albertas Resistance

Apr 27, 2025