Private Credit Jobs: 5 Do's And Don'ts To Boost Your Application

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do 1: Tailor Your Resume and Cover Letter to Each Private Credit Job Application

Generic applications rarely impress. To succeed in the competitive world of private credit, your resume and cover letter must be meticulously tailored to each specific job description. This demonstrates your genuine interest and understanding of the role's requirements.

- Highlight relevant skills and experiences: Carefully review the job description and emphasize the skills and experiences that directly align with their needs. Don't just list your responsibilities; showcase how your accomplishments demonstrate these skills.

- Quantify your achievements: Instead of stating "managed a portfolio," say "managed a $50 million portfolio, resulting in a 15% increase in returns." Numbers speak volumes in finance.

- Incorporate keywords: Use keywords directly from the job description in your resume and cover letter. Applicant Tracking Systems (ATS) often scan for these keywords, so including them is crucial.

- Showcase your understanding: Demonstrate your knowledge of private credit markets, investment strategies (direct lending, mezzanine financing, etc.), and relevant financial regulations.

- Proofread carefully: Typos and grammatical errors are immediate red flags. Always have a fresh pair of eyes review your application before submission.

Do 2: Network Strategically Within the Private Credit Industry

Networking is paramount in the private credit world. Building relationships can open doors to opportunities that aren't publicly advertised.

- Attend industry events: Conferences and networking events are excellent places to meet professionals, learn about new opportunities, and expand your network.

- Utilize LinkedIn: Actively engage on LinkedIn. Connect with professionals, join relevant groups, and participate in discussions.

- Conduct informational interviews: Reach out to individuals working in private credit for informational interviews. This allows you to learn more about specific roles and companies, and make valuable connections.

- Join professional organizations: Membership in relevant organizations can provide access to networking opportunities and industry insights.

- Leverage your existing network: Don't underestimate the power of your existing contacts. Inform them of your job search and ask if they know anyone in the private credit industry.

Do 3: Showcase Your Financial Modeling and Analytical Skills

Private credit roles demand strong financial modeling and analytical skills. Demonstrating your proficiency is crucial.

- Proficiency in Excel and other software: Highlight your expertise in Excel, including advanced functions like VBA, and other relevant financial modeling software.

- Valuation methodologies: Showcase your understanding of various valuation techniques, such as discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and comparable company analysis.

- Credit analysis and due diligence: Demonstrate your experience with credit analysis, due diligence processes, and risk assessment.

- Include projects and case studies: Your resume should include relevant projects or case studies that showcase your analytical abilities. Be prepared to discuss them in detail during interviews.

- Articulate your approach: During interviews, clearly explain your analytical approach and decision-making process.

Do 4: Prepare Thoroughly for Private Credit Job Interviews

Preparation is key to acing private credit job interviews.

- Research the firm and interviewer: Thoroughly research the firm's investment strategies, recent deals, and the interviewer's background.

- Practice answering common questions: Practice answering behavioral questions (e.g., "Tell me about a time you failed") and technical questions related to financial modeling, valuation, and credit analysis.

- Prepare for case studies: Be ready to tackle case studies involving credit analysis, investment decisions, and financial modeling.

- Develop insightful questions: Asking thoughtful questions demonstrates your engagement and interest in the role and the firm.

- Professionalism is essential: Dress professionally and arrive on time (or early for virtual interviews).

Do 5: Highlight Your Understanding of Private Credit Market Trends

Demonstrating knowledge of current market trends shows your passion and commitment to the industry.

- Stay updated: Stay informed about current events and trends impacting the private credit market, including interest rate changes, regulatory updates, and evolving investment strategies.

- Interest rate dynamics: Understand how interest rate changes influence private credit investments and risk assessment.

- Regulations and compliance: Demonstrate awareness of relevant regulations and compliance requirements within the private credit industry.

- Investment strategies: Discuss your understanding of various private credit investment strategies, including direct lending, mezzanine financing, and distressed debt.

- Articulate your perspective: Be able to clearly articulate your perspective on the current state of the market and future trends.

5 Don'ts That Can Hurt Your Private Credit Job Application

Mirroring the structure above, here are five crucial "Don'ts" to avoid:

Don't 1: Submit a Generic Resume and Cover Letter

Avoid using a generic template. Every application should be unique and reflect the specific requirements of the job.

Don't 2: Neglect Networking Opportunities

Don't underestimate the value of networking. Building relationships is crucial for securing a private credit job.

Don't 3: Underestimate the Importance of Financial Modeling Skills

Strong financial modeling skills are essential. Ensure you demonstrate your proficiency through projects and interview preparation.

Don't 4: Go Unprepared for Private Credit Job Interviews

Thorough preparation is crucial for success. Research the firm, practice your answers, and prepare for case studies.

Don't 5: Appear Uninformed About Current Market Dynamics

Stay informed about current market trends and demonstrate your understanding during interviews.

Conclusion

Securing a private credit job requires a multifaceted approach. By following the five "Do's" and avoiding the five "Don'ts" outlined above, you can significantly improve your chances of landing your dream private credit role. Remember to tailor your application, network strategically, showcase your skills, prepare thoroughly for interviews, and stay informed about market trends. Find your perfect private credit role by applying these tips today! Boost your private credit job application today and start your journey to a successful career in private credit.

Featured Posts

-

B And B April 3 Recap Liam Collapses After Major Fight With Bill Full Episode Summary

Apr 24, 2025

B And B April 3 Recap Liam Collapses After Major Fight With Bill Full Episode Summary

Apr 24, 2025 -

Heats Herro Wins 3 Point Contest Cavs Duo Dominates Skills Challenge

Apr 24, 2025

Heats Herro Wins 3 Point Contest Cavs Duo Dominates Skills Challenge

Apr 24, 2025 -

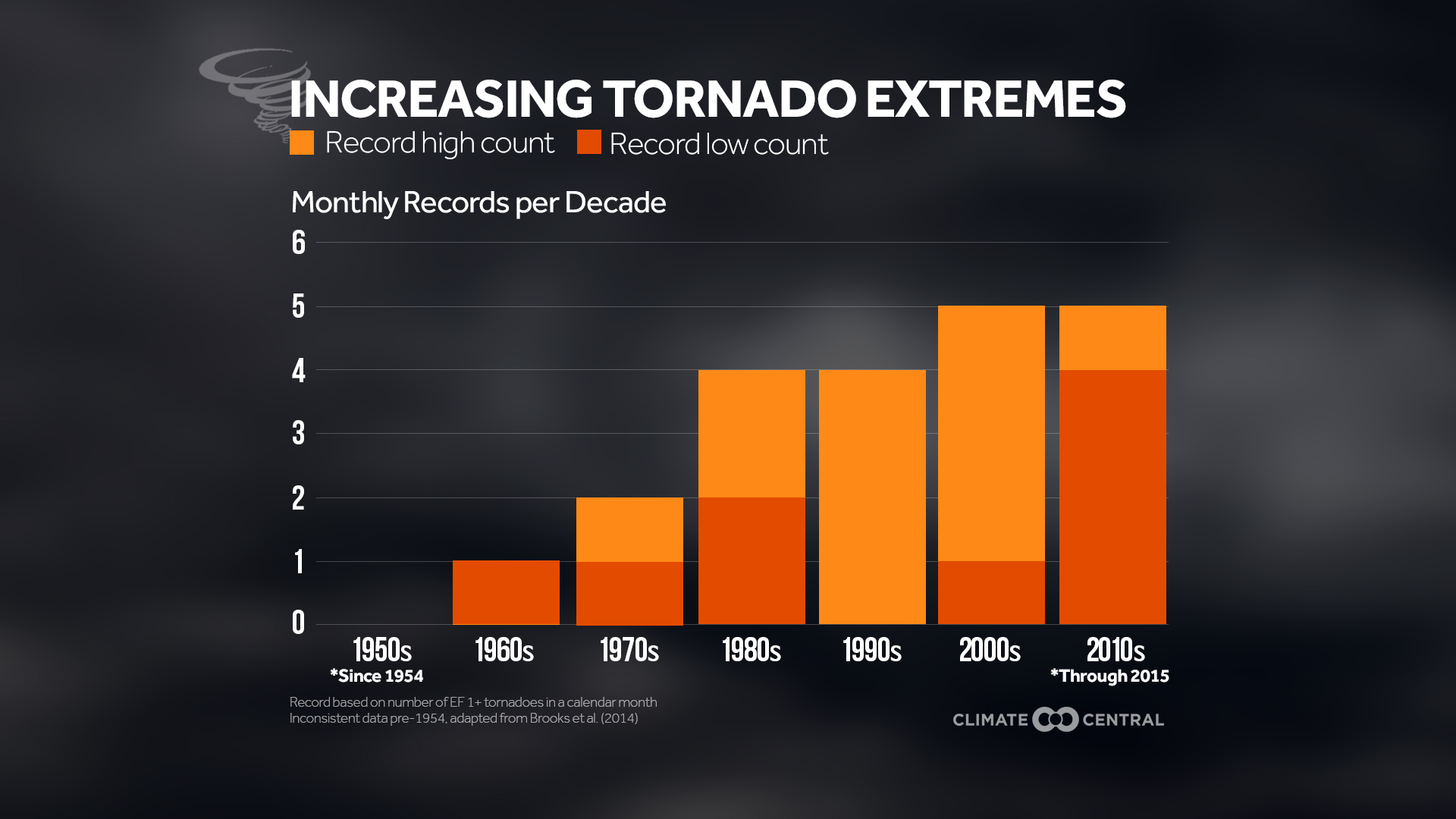

Rising Tornado Season Dangers The Impact Of Trumps Spending Cuts

Apr 24, 2025

Rising Tornado Season Dangers The Impact Of Trumps Spending Cuts

Apr 24, 2025 -

Canadian Dollar A Mixed Bag Up Against The Greenback Down Against Others

Apr 24, 2025

Canadian Dollar A Mixed Bag Up Against The Greenback Down Against Others

Apr 24, 2025 -

Disappearance And Death At Israeli Beach Known For Shark Activity

Apr 24, 2025

Disappearance And Death At Israeli Beach Known For Shark Activity

Apr 24, 2025