Recent Market Volatility And The Shift In Investor Behavior

Table of Contents

Increased Risk Aversion and the Flight to Safety

Increased market volatility invariably leads to heightened risk aversion. Investors, faced with potential losses, instinctively seek safety. This "flight to safety" manifests in several ways:

-

Shift towards Safe Haven Assets: Capital flows significantly into perceived safe haven assets like government bonds, particularly those issued by countries with strong economies and stable political environments. Gold, a traditional safe haven, also experiences increased demand during periods of uncertainty. The appeal lies in their perceived stability and ability to retain value even when other assets decline.

-

Impact of Rising Bond Yields: While traditionally considered low-risk, rising bond yields can impact investor choices. Higher yields can attract investors seeking income, potentially offsetting the appeal of other safe haven assets. However, rising yields can also signal concerns about future inflation, further complicating investment decisions.

-

The VIX as a Market Fear Gauge: The Volatility Index (VIX), often referred to as the "fear gauge," provides a key indicator of market sentiment. A rising VIX signifies increased market uncertainty and fear, directly correlating with a stronger flight to safety.

-

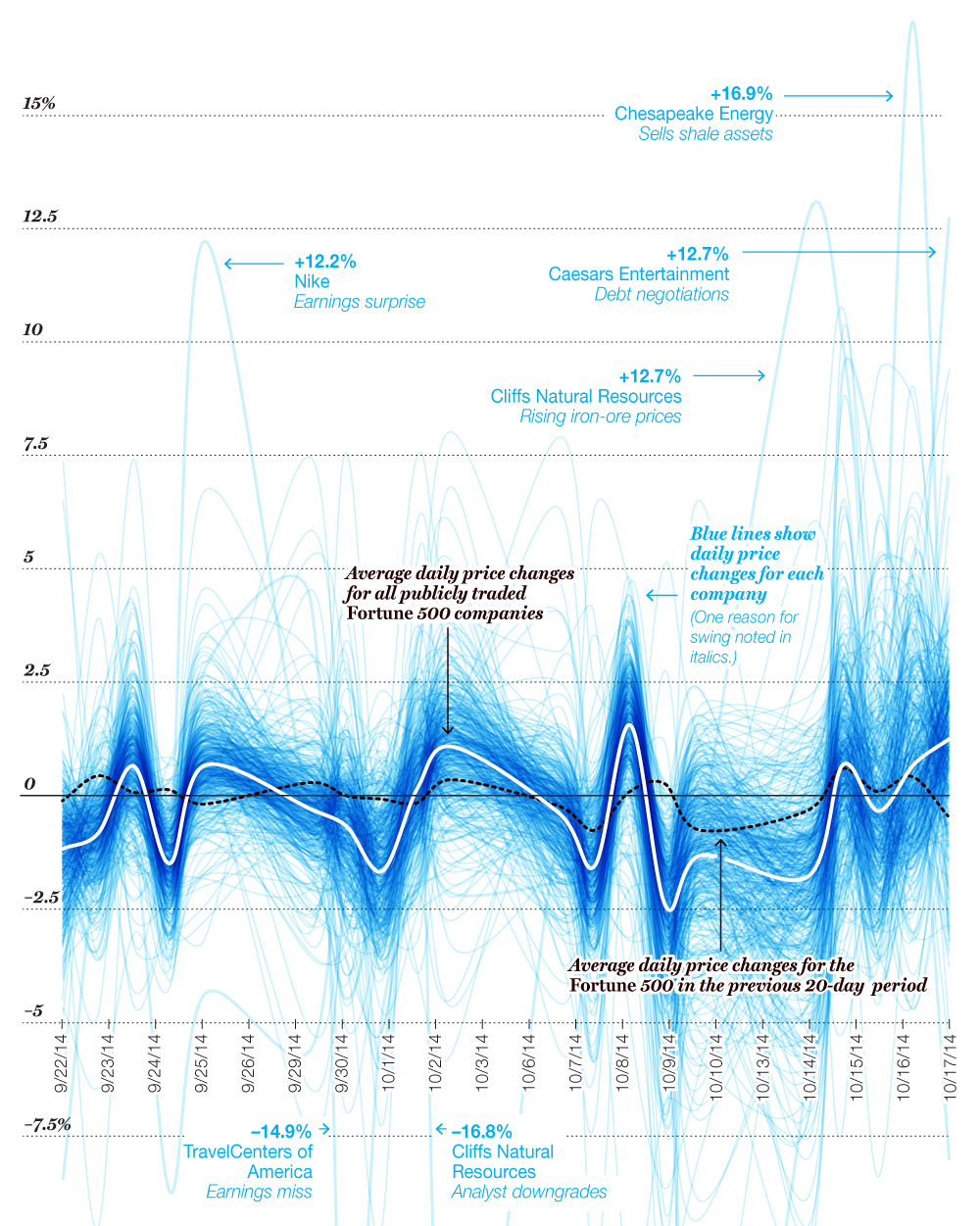

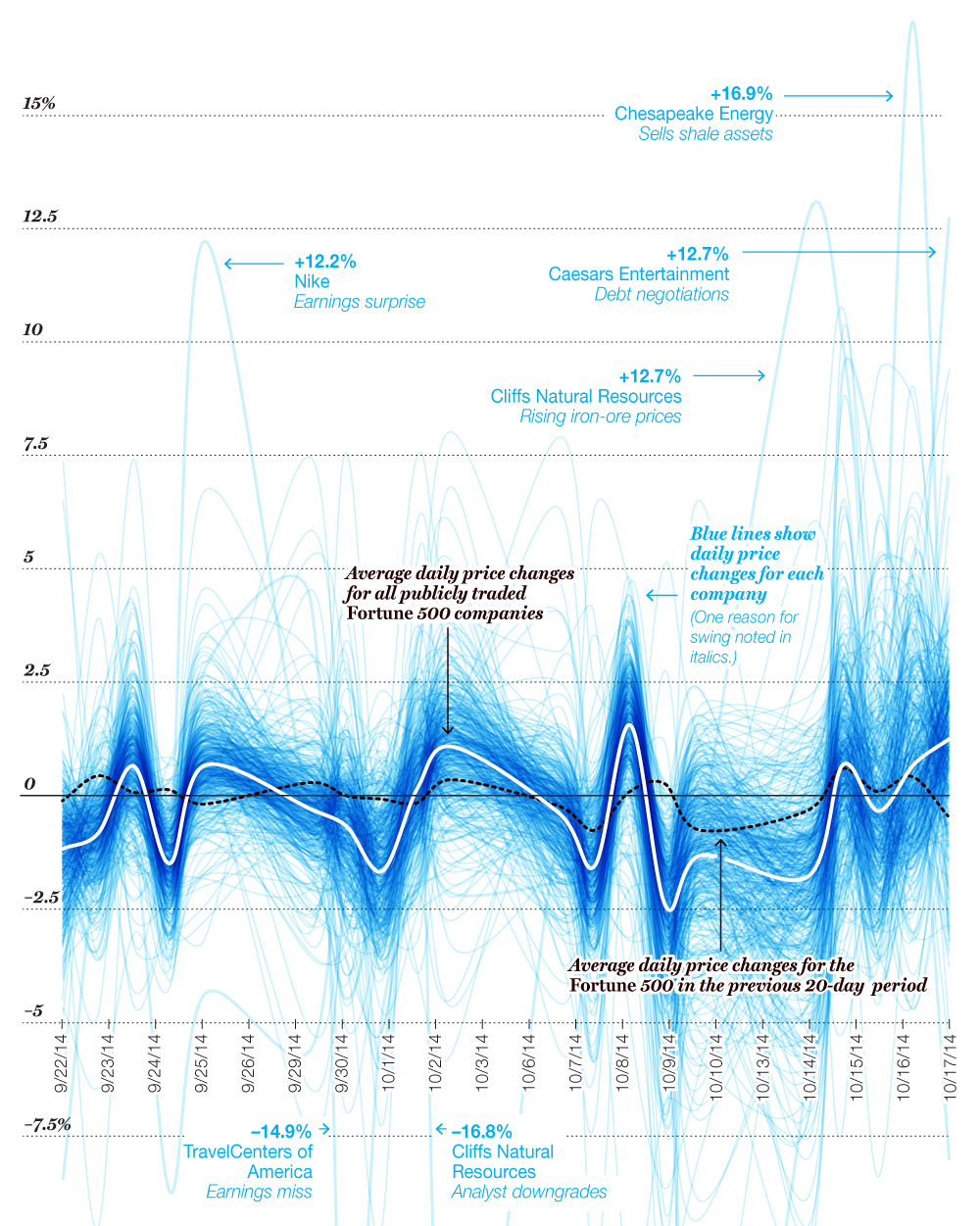

Data and Examples: Recent market downturns have consistently shown massive capital inflows into government bonds and gold, clearly demonstrating the shift towards risk-averse strategies during periods of volatility. For instance, [insert example of capital flows into safe haven assets during a specific period of market volatility with a credible source].

A Shift Towards More Conservative Investment Strategies

The response to market volatility often involves a shift towards more conservative investment strategies. This reflects a recalibration of risk tolerance and a focus on preserving capital.

-

Portfolio Diversification: Investors are increasingly emphasizing portfolio diversification across different asset classes to mitigate risk. This might involve reducing exposure to individual stocks and increasing allocations to bonds, real estate, or alternative investments.

-

Conservative Asset Allocation: A more conservative asset allocation is becoming the norm, with a reduced emphasis on high-risk, high-reward investments like emerging market equities or speculative tech stocks. Investors are prioritizing capital preservation over aggressive growth.

-

Long-Term Investing and Value Investing: There's a renewed focus on long-term investment horizons and value investing strategies. This approach involves identifying undervalued assets with strong fundamentals, aiming for consistent, long-term growth rather than short-term gains.

-

Portfolio Adjustments: Many investors are actively adjusting their portfolios, selling off higher-risk assets and reinvesting in more defensive positions. This proactive approach aims to limit potential losses and enhance portfolio resilience during volatile periods.

The Growing Importance of Active vs. Passive Management

Market volatility sparks debate regarding active versus passive investment management.

-

Active Investing: Proponents of active investing believe skilled fund managers can navigate volatile markets and outperform passive strategies by identifying undervalued assets and timing the market. However, consistently outperforming the market is challenging even for experienced managers.

-

Passive Investing: Passive investment vehicles like index funds and ETFs have gained significant popularity. These track market indices, offering broad diversification and lower expense ratios, making them attractive during periods of uncertainty.

-

The Role of Active Management: Actively managed funds can potentially offer a degree of protection during downturns through skillful stock selection and hedging strategies.

-

Passive Vehicles: Index funds and ETFs provide broad market exposure at lower costs, which can be advantageous when market timing is difficult.

The Rise of ESG Investing Amidst Uncertainty

Even amidst market volatility, Environmental, Social, and Governance (ESG) factors are increasingly influencing investor behavior.

-

ESG Considerations: Investors are incorporating ESG criteria into their decision-making, even during market downturns. This reflects a growing awareness of the long-term risks associated with unsustainable business practices.

-

Sustainable and Responsible Investments: The demand for sustainable and responsible investments is rising, demonstrating a commitment to aligning financial goals with societal and environmental values.

-

Long-Term Portfolio Resilience: Many believe that ESG factors can contribute to long-term portfolio resilience by mitigating risks associated with climate change, social unrest, and governance failures.

The Impact of Technology and Fintech on Investor Behavior

Technology and fintech are significantly shaping investor responses to market volatility.

-

Accessibility of Investment Platforms: Online brokerages and mobile investing apps have made accessing investment markets easier than ever, increasing participation and potentially influencing more frequent trading during volatile periods.

-

Robo-Advisors and Algorithmic Trading: Robo-advisors and algorithmic trading strategies automate portfolio management, potentially reducing emotional decision-making during market swings. However, algorithmic trading can also exacerbate volatility in certain circumstances.

-

Impact of Mobile Investing: The ease and immediacy of mobile investing can both empower and potentially endanger investors during volatile times, leading to both swift reactions and potentially rash decisions.

Conclusion

Recent market volatility has driven significant shifts in investor behavior, marked by increased risk aversion, a move towards conservative strategies, and a growing interest in ESG and technology-driven solutions. Understanding these shifts is paramount. The importance of adapting investment strategies to changing market conditions, carefully considering risk tolerance, and embracing portfolio diversification cannot be overstated.

Understanding recent market volatility and adapting your investor behavior is crucial for long-term success. Take control of your financial future today! Review your investment strategy, consider seeking professional financial advice if needed, and prepare for future market fluctuations by diversifying your portfolio and choosing investments aligned with your risk tolerance.

Featured Posts

-

Mlb Recap Twins Top Mets 6 3 In Series Game 2

Apr 28, 2025

Mlb Recap Twins Top Mets 6 3 In Series Game 2

Apr 28, 2025 -

Posadas Blast Fuels Yankees Victory Over Royals In 2000

Apr 28, 2025

Posadas Blast Fuels Yankees Victory Over Royals In 2000

Apr 28, 2025 -

The Agenda Of Luigi Mangiones Supporters A Comprehensive Overview

Apr 28, 2025

The Agenda Of Luigi Mangiones Supporters A Comprehensive Overview

Apr 28, 2025 -

Profitable Prop Bets Nascar Jack Link 500 At Talladega Superspeedway 2025

Apr 28, 2025

Profitable Prop Bets Nascar Jack Link 500 At Talladega Superspeedway 2025

Apr 28, 2025 -

10 Gb Uae Tourist Sim Card Save 15 On Abu Dhabi Attractions

Apr 28, 2025

10 Gb Uae Tourist Sim Card Save 15 On Abu Dhabi Attractions

Apr 28, 2025