Should Investors Be Concerned About Current Stock Market Valuations? BofA Weighs In.

Table of Contents

BofA's Assessment of Current Stock Market Valuations

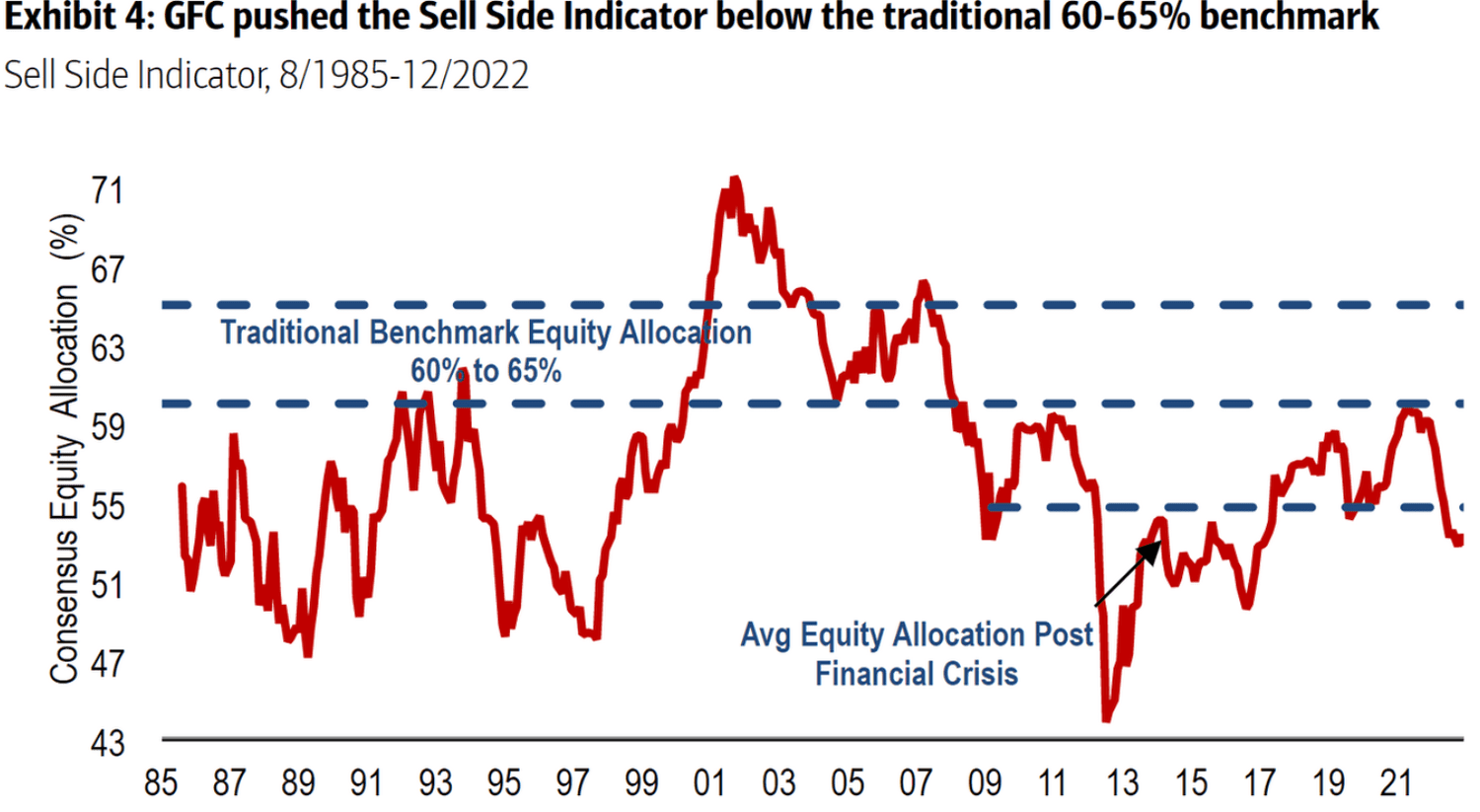

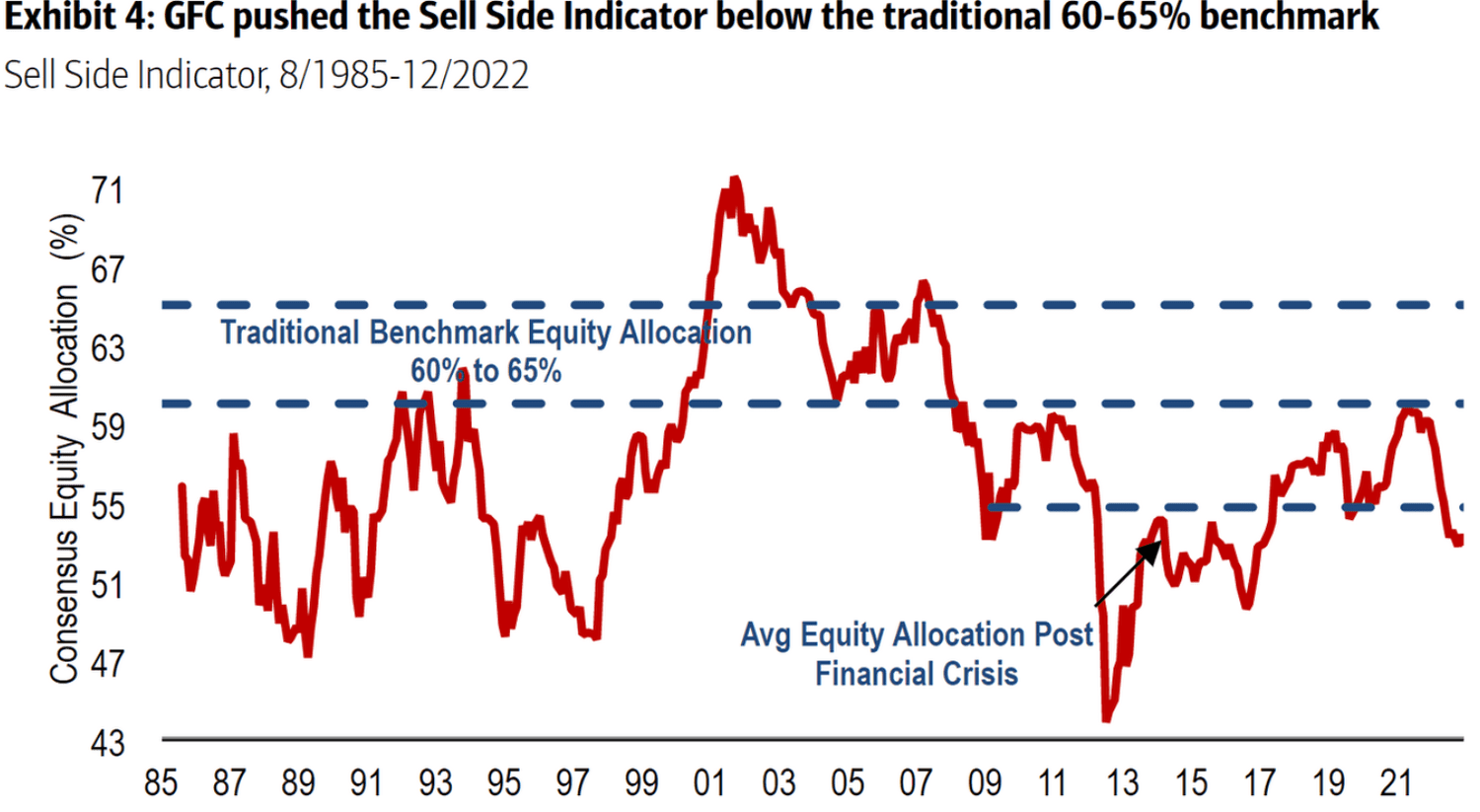

Bank of America's recent reports have provided a nuanced assessment of current stock market valuations, analyzing key metrics to gauge market health and potential risks. Their analysis frequently incorporates traditional valuation metrics like Price-to-Earnings (P/E) ratios and the cyclically adjusted price-to-earnings ratio (Shiller PE), often comparing current levels to historical averages.

-

Key findings from BofA's research: BofA's findings often highlight a range of perspectives, acknowledging both potential risks and opportunities within the market. Their conclusions aren't always uniformly bullish or bearish, instead reflecting a more complex picture of current market conditions. Specific reports should be referenced for the most up-to-date findings.

-

Specific valuation metrics cited by BofA: BofA analysts frequently reference key metrics like the S&P 500 P/E ratio, comparing it to historical averages to determine whether current valuations are overextended or represent a buying opportunity. The Shiller PE, which accounts for inflation-adjusted earnings over a longer period, is also often used in their analysis.

-

BofA's overall assessment (positive, negative, neutral): BofA's overall assessment varies depending on the specific report and prevailing market conditions. Their analysis typically incorporates a variety of factors, avoiding simplistic positive or negative conclusions. They often caution against overly optimistic or pessimistic outlooks.

-

Comparison to historical valuations: BofA's analysis frequently compares current valuation metrics to historical data, seeking to identify potential overvaluation or undervaluation compared to past market cycles. This historical context is crucial in evaluating whether current valuations represent a cause for concern.

Factors Influencing Current Stock Market Valuations

Several macroeconomic factors significantly influence current stock market valuations and investor sentiment. Understanding these factors is crucial for interpreting BofA's analysis and forming your own investment strategy.

-

Interest rate hikes and their impact: The Federal Reserve's interest rate hikes directly impact borrowing costs for businesses and consumers, influencing corporate profitability and consumer spending. Higher interest rates generally lead to lower stock valuations as future earnings are discounted more heavily.

-

Inflationary pressures and their effect on corporate earnings: Persistent inflation erodes purchasing power and increases input costs for businesses, squeezing profit margins and impacting corporate earnings. This can lead to lower stock prices and increased investor uncertainty.

-

Geopolitical uncertainties and market volatility: Geopolitical events such as wars, trade disputes, and political instability create uncertainty and volatility in the stock market, making accurate valuation challenging and potentially leading to sharp price swings.

-

Supply chain disruptions and their influence: Disruptions to global supply chains can impact corporate profitability and increase input costs, impacting overall economic growth and stock market valuations.

-

Potential recessionary fears: Fears of a potential recession can lead to a flight to safety, causing investors to reduce their exposure to equities and driving down stock prices. This is often reflected in lower valuations and increased volatility.

Analyzing BofA's Recommendations for Investors

Based on their valuation analysis, BofA typically offers investors a range of recommendations designed to navigate the complexities of the current market.

-

Suggested investment strategies: BofA often advocates for diversification across asset classes to reduce risk. They may suggest incorporating defensive stocks (less sensitive to economic downturns) or employing value investing strategies, focusing on undervalued companies.

-

Recommendations on sectors to consider or avoid: Depending on the economic outlook, BofA may recommend specific sectors for investment or advise caution in certain areas. Their recommendations will be directly influenced by their valuation analysis and broader economic forecasts.

-

Advice on risk management and portfolio adjustments: BofA emphasizes the importance of risk management, advising investors to adjust their portfolios based on their risk tolerance and the prevailing market conditions. This may involve rebalancing or adjusting asset allocation.

-

Any warnings or cautions issued by BofA: BofA often issues cautions regarding potential risks, emphasizing the need for investors to remain vigilant and adapt their strategies as market conditions change.

Alternative Perspectives on Stock Market Valuations

It's crucial to remember that BofA's perspective is just one of many. Other financial institutions and analysts may hold differing views on current stock market valuations.

-

Mention other financial institutions or analysts with contrasting views: Other major financial firms, such as Goldman Sachs or JPMorgan Chase, will also produce market analysis, often with differing conclusions or perspectives than BofA.

-

Highlight the key differences in their analysis and conclusions: Differences often arise from varying methodologies, interpretations of economic data, or differing assumptions about future economic growth.

-

Explain the reasoning behind these differing perspectives: Understanding these differing viewpoints helps investors form a more comprehensive understanding of the market and make more informed investment decisions.

Conclusion

BofA's analysis of current stock market valuations provides valuable insight, but it's essential to consider it within the broader context of various macroeconomic factors and other expert opinions. Their findings often highlight both potential risks and opportunities, emphasizing the importance of a diversified investment strategy and proactive risk management. Understanding current stock market valuations is crucial for making informed investment decisions. Stay informed about BofA's ongoing analysis and other expert opinions to effectively manage your investment portfolio in light of current market conditions and changing stock market valuations. Consider consulting a financial advisor to discuss your specific investment strategy and tailor a plan that aligns with your financial goals and risk tolerance.

Featured Posts

-

The Closure Of Anchor Brewing Company What This Means For Craft Beer

Apr 26, 2025

The Closure Of Anchor Brewing Company What This Means For Craft Beer

Apr 26, 2025 -

Ai Regulation Showdown Trump Administration Vs Europe

Apr 26, 2025

Ai Regulation Showdown Trump Administration Vs Europe

Apr 26, 2025 -

The Long Reach Of The Presidency A Rural School 2700 Miles From Dc And Trumps Impact

Apr 26, 2025

The Long Reach Of The Presidency A Rural School 2700 Miles From Dc And Trumps Impact

Apr 26, 2025 -

Analyzing Trumps Remarks On Ukraines Nato Membership

Apr 26, 2025

Analyzing Trumps Remarks On Ukraines Nato Membership

Apr 26, 2025 -

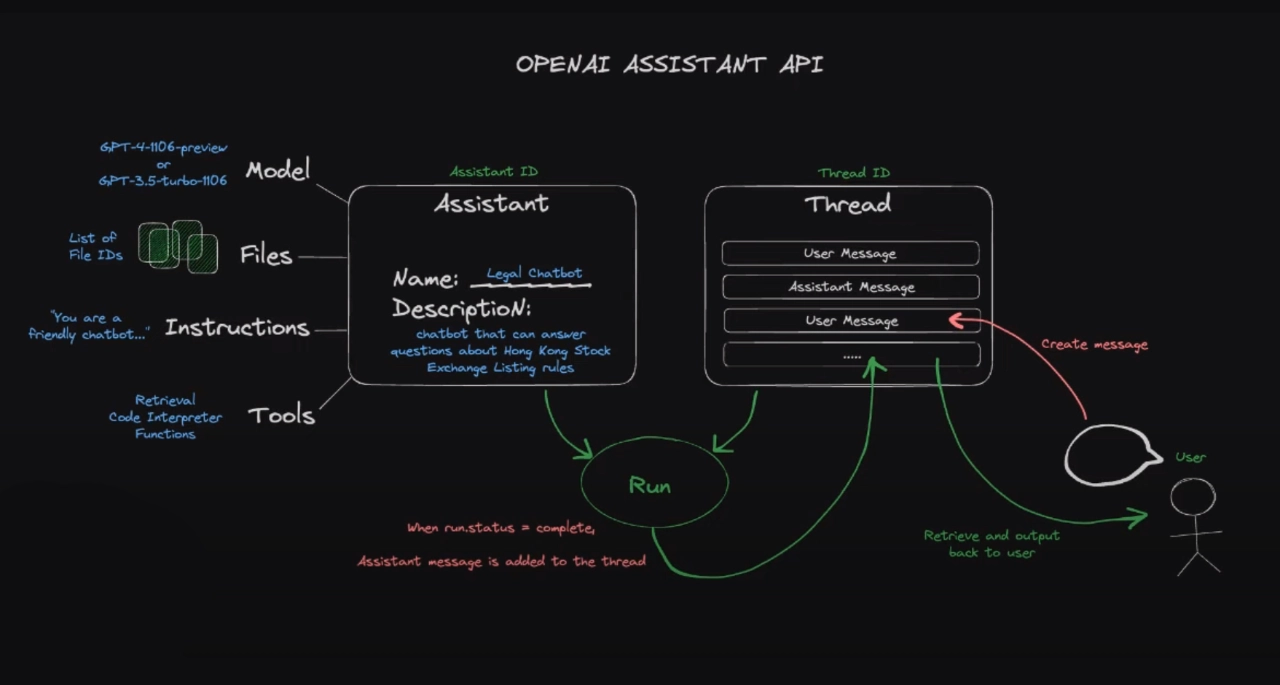

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 26, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 26, 2025