SK Hynix Overtakes Samsung In DRAM Market: AI's Role

Table of Contents

SK Hynix's Strategic Moves

SK Hynix's rise to the top wasn't accidental. A combination of shrewd investments, a focus on high-value segments, and robust supply chain management has propelled the company to new heights.

Increased Investment in R&D

SK Hynix has aggressively invested in research and development, pushing the boundaries of DRAM technology and manufacturing processes. This commitment to innovation has yielded significant results:

- 1α nm process node: This advanced process node allows for higher density and lower power consumption, crucial for maximizing performance and efficiency in data centers.

- High-Bandwidth Memory (HBM): SK Hynix is a major player in the HBM market, a crucial technology for AI applications requiring massive data throughput. This investment has paid off handsomely as demand for HBM skyrockets.

- Improved Production Capacity: These advancements have translated into increased production capacity and improved manufacturing efficiency, allowing SK Hynix to meet the growing global demand for DRAM.

Focus on High-Value DRAM Segments

Recognizing the burgeoning AI market, SK Hynix strategically focused on high-margin DRAM segments catering to the specific needs of AI applications. This includes:

- HBM (High-Bandwidth Memory): Essential for accelerating AI workloads in GPUs and AI servers, HBM offers significantly higher bandwidth compared to traditional DRAM.

- GDDR (Graphics Double Data Rate): Used in high-performance graphics cards and gaming systems, GDDR DRAM benefits from increased demand driven by AI-powered gaming and simulations.

- Market Share Gains: SK Hynix has significantly increased its market share in these high-value segments, outpacing Samsung's growth in these critical areas. This targeted approach has been a key differentiator.

Enhanced Supply Chain Management

In addition to technological advancements, SK Hynix has prioritized enhancing its supply chain resilience and efficiency. This includes:

- Optimized Logistics: Streamlined logistics and efficient transportation networks ensure timely delivery of DRAM chips to clients globally.

- Strategic Partnerships: Collaborations with key partners across the supply chain strengthen resilience and mitigate potential disruptions.

- Technology Integration: Implementing advanced technologies for inventory management, forecasting, and demand planning further improves supply chain efficiency.

The Booming Demand for AI-Powered Solutions

The meteoric rise of AI is the driving force behind the increased demand for DRAM. AI's insatiable hunger for data fuels this growth.

AI's Insatiable Hunger for DRAM

Data centers are experiencing exponential growth, driven by the increasing adoption of AI across various sectors. This leads to a significant increase in demand for high-bandwidth memory (HBM) and other specialized DRAM chips:

- Growing AI Market: The global AI market is expanding at an unprecedented rate, projected to reach [insert projected market size and source]. This translates to a corresponding surge in demand for memory solutions.

- AI Applications: Machine learning, deep learning, natural language processing, and computer vision – these AI applications require massive amounts of data processing power, creating an insatiable appetite for DRAM.

The AI-DRAM Synergy

The relationship between AI and DRAM is symbiotic. Advancements in AI algorithms require ever-increasing data processing capabilities, and DRAM technology must keep pace:

- Massive Data Processing: Sophisticated AI models necessitate processing enormous datasets, demanding high-bandwidth, high-capacity DRAM solutions.

- HBM's Crucial Role: HBM, with its superior bandwidth, is crucial for accelerating the training and inference phases of AI workloads. This makes it a particularly attractive investment for chipmakers.

Samsung's Challenges and Future Strategies

While SK Hynix has surged ahead, Samsung's position in the DRAM market requires careful analysis.

Analysis of Samsung's Market Position

Samsung's loss of market share to SK Hynix can be attributed to several factors:

- Supply Chain Disruptions: Potential supply chain disruptions may have impacted Samsung's ability to meet the ever-increasing demand.

- Technological Challenges: While Samsung remains a technological leader, SK Hynix's targeted investments in specific AI-related DRAM technologies might have given them an edge.

- Market Analysis Data: [Insert market share data comparing Samsung and SK Hynix – source needed].

Potential Counter-Strategies

Samsung is likely to employ various counter-strategies to regain its market leadership:

- Increased R&D Investment: Increased investment in advanced DRAM technologies, including HBM and other high-bandwidth memory solutions.

- Strategic Partnerships: Forging strategic alliances with key players in the AI industry to strengthen its market position.

- Manufacturing Improvements: Optimizing manufacturing processes to improve efficiency and reduce costs.

Conclusion: SK Hynix's DRAM Leadership in the Age of AI

SK Hynix's dominance in the DRAM market is a result of a multi-pronged strategy that includes significant R&D investment, a targeted focus on high-value DRAM segments crucial for AI applications, and a highly efficient supply chain. The explosive growth of the AI market, with its insatiable demand for high-bandwidth memory, has been a pivotal factor in this shift. The future of the DRAM market will likely remain dynamic, with both SK Hynix and Samsung vying for dominance. The ongoing demand fueled by AI innovation will continue to shape this competitive landscape. Stay informed about the dynamic DRAM market and the continuing impact of AI. Follow us for more insights on SK Hynix, Samsung, and the future of memory technology.

Featured Posts

-

Is The Lg C3 77 Inch Oled Worth The Hype A User Review

Apr 24, 2025

Is The Lg C3 77 Inch Oled Worth The Hype A User Review

Apr 24, 2025 -

Stock Market Overview Dow S And P 500 April 23rd 2024

Apr 24, 2025

Stock Market Overview Dow S And P 500 April 23rd 2024

Apr 24, 2025 -

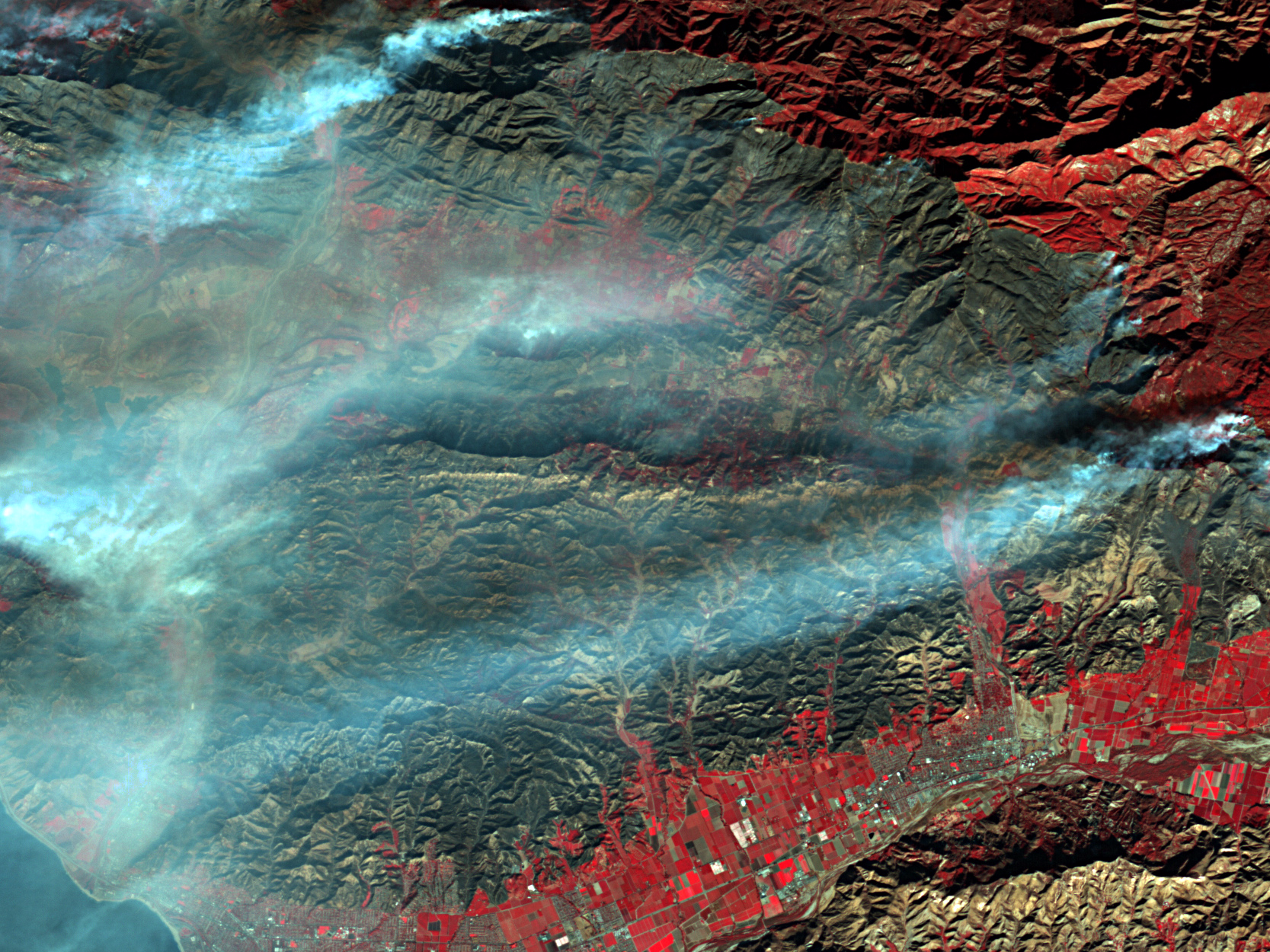

Los Angeles Wildfires The Dark Side Of Disaster Speculation

Apr 24, 2025

Los Angeles Wildfires The Dark Side Of Disaster Speculation

Apr 24, 2025 -

Is Instagrams New Video Editing App A Tik Tok Killer

Apr 24, 2025

Is Instagrams New Video Editing App A Tik Tok Killer

Apr 24, 2025 -

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 24, 2025

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 24, 2025