Stock Market Outlook: Dow Futures Reaction To China's Economic Support Measures

Table of Contents

Understanding China's Economic Support Measures

China's economic slowdown has been a significant concern for global investors. To counter this, the Chinese government unveiled a substantial stimulus package aimed at boosting economic growth. Understanding the details of this package is crucial to predicting its impact on Dow Futures.

Details of the Stimulus Package

The stimulus package includes a range of measures designed to address various aspects of the Chinese economy. Key components include:

- Increased Infrastructure Spending: Significant investment in infrastructure projects like roads, railways, and renewable energy. This aims to create jobs and stimulate economic activity.

- Tax Cuts for Businesses: Reductions in corporate taxes and other tax incentives to encourage business investment and expansion.

- Support for Specific Industries: Targeted support for key sectors like technology, manufacturing, and consumer goods to foster growth and competitiveness.

- Financial Sector Reforms: Measures to improve the efficiency and stability of the financial system, encouraging lending and investment.

The scale of this package is substantial, potentially representing a significant injection of capital into the Chinese economy. Its potential impact is widely debated, with economists offering varying forecasts for its effectiveness. For further details, refer to official announcements from the People's Bank of China and the National Development and Reform Commission. [Insert links to relevant sources here].

Why these Measures Matter Globally

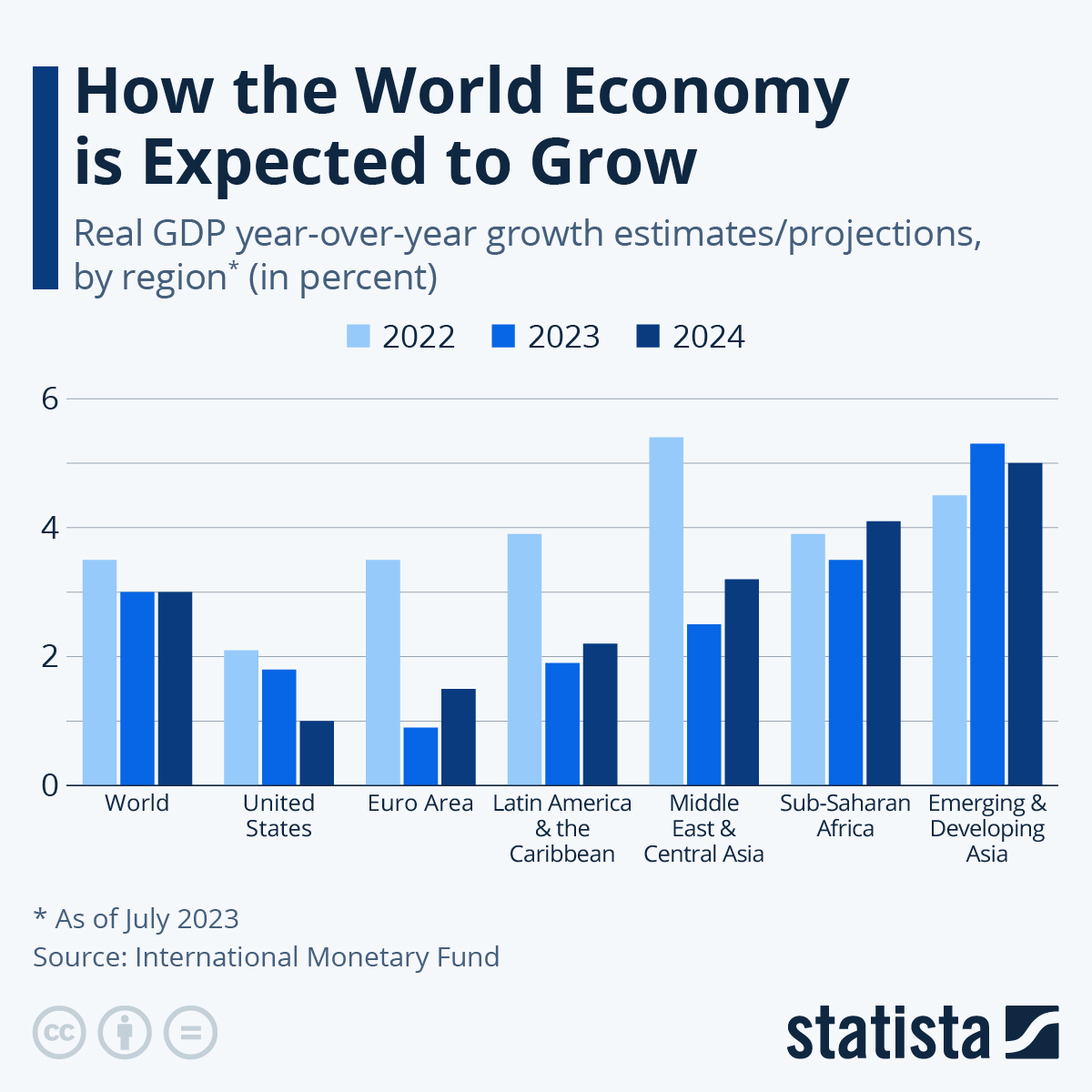

China's economic health significantly impacts the global economy. Its role as a major trading partner and consumer of goods from various countries, including the US, makes its economic performance a key driver of global market trends.

- Global Trade Interdependence: The US and China are deeply intertwined economically. A stronger Chinese economy can lead to increased demand for US goods and services, benefiting American businesses.

- Commodity Demand: Increased infrastructure spending in China often leads to higher demand for raw materials and commodities, positively affecting US-based companies involved in their production and export.

- Supply Chain Impacts: Economic recovery in China can alleviate some of the supply chain disruptions that have impacted global markets in recent years.

Therefore, understanding China’s economic support measures is critical for assessing the potential impact on the US stock market and Dow Futures.

Dow Futures Initial Reaction and Analysis

The announcement of China's economic support measures has prompted an immediate reaction in the Dow Futures market.

Immediate Market Response

The initial market response was largely positive, with Dow Futures showing a noticeable increase following the announcement. [Insert chart or graph showcasing Dow Futures price movements around the announcement date here]. However, this initial optimism was followed by some volatility, as investors digested the details of the plan and assessed its potential effectiveness.

Factors Influencing the Reaction

Several factors beyond the stimulus package itself are influencing the Dow Futures reaction:

- Investor Confidence and Risk Appetite: Global investor sentiment plays a crucial role. If broader market confidence is high, the positive impact of the Chinese stimulus might be amplified.

- Geopolitical Factors: International tensions and geopolitical uncertainties can influence investor behavior and affect market reaction to the stimulus.

- Existing Market Trends: The pre-existing trend in the Dow Futures market will influence how the news is received. A market already experiencing significant upward momentum might react less dramatically than a market already facing downward pressure.

- Sector-Specific Impacts: Certain sectors within the US economy are more sensitive to changes in the Chinese economy. Companies heavily reliant on exports to China might see a more pronounced positive reaction than others.

Predicting Future Trends and Investment Strategies

While the initial reaction is positive, predicting the long-term impacts requires careful consideration.

Potential Long-Term Impacts

The long-term impact of China's economic support measures on Dow Futures remains uncertain.

- Sustained Growth Potential: If the stimulus is successful in boosting Chinese economic growth, it could lead to sustained positive effects on the US stock market and Dow Futures through increased trade and demand.

- Temporary Boost Possibility: Alternatively, the impact could be a temporary boost followed by a return to previous trends, depending on the effectiveness of the stimulus and other global economic factors.

- Downside Risks: There are potential downsides. The effectiveness of the stimulus might be limited, or unforeseen challenges could emerge. Global economic conditions and geopolitical events could also negate or diminish the positive impact.

Investment Strategies for Navigating Uncertainty

Navigating this uncertainty requires a cautious and strategic approach:

- Diversification: Diversifying your investment portfolio across different asset classes and sectors is crucial to mitigate risks.

- Risk Management: Employing risk management techniques, such as stop-loss orders, can help protect your investments against potential market downturns.

- Monitoring Key Economic Indicators: Closely monitor key economic indicators related to both the Chinese and US economies to gauge the effectiveness of the stimulus and its impact on Dow Futures.

Conclusion

China's economic support measures have created a ripple effect in global markets, with the Dow Futures showing an initial positive reaction. However, the long-term impact remains uncertain, dependent on the success of the stimulus, global economic conditions, and investor sentiment. It's crucial to understand the interconnectedness of the global economy and the various factors influencing Dow Futures.

Call to Action: Stay informed on the evolving stock market outlook, particularly concerning Dow Futures and China's economic policies. Continuously monitor the news and economic indicators for updates on this important market driver. Consider consulting a financial advisor to develop an appropriate investment strategy based on your risk tolerance and financial goals regarding Dow Futures and the impact of China's economy. Understanding the interplay between China's economic actions and the Dow Futures is key to effective investment planning in today's global market.

Featured Posts

-

My Nintendo Switch 2 Pre Order A Game Stop Line Wait Story

Apr 26, 2025

My Nintendo Switch 2 Pre Order A Game Stop Line Wait Story

Apr 26, 2025 -

Trump Supporter Ray Epps Defamation Suit Against Fox News Details On The January 6th Falsehoods Claim

Apr 26, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Details On The January 6th Falsehoods Claim

Apr 26, 2025 -

Cassidy Hutchinson To Publish Memoir Detailing Jan 6 Experience

Apr 26, 2025

Cassidy Hutchinson To Publish Memoir Detailing Jan 6 Experience

Apr 26, 2025 -

Layoff To Rehire How To Respond To Your Former Employer

Apr 26, 2025

Layoff To Rehire How To Respond To Your Former Employer

Apr 26, 2025 -

Selling Sunset Star Highlights Landlord Price Gouging Following La Fires

Apr 26, 2025

Selling Sunset Star Highlights Landlord Price Gouging Following La Fires

Apr 26, 2025

Latest Posts

-

Controversy Cdcs Vaccine Study And The Questionable Hire Of A Misinformation Agent

Apr 27, 2025

Controversy Cdcs Vaccine Study And The Questionable Hire Of A Misinformation Agent

Apr 27, 2025 -

Cdcs New Vaccine Study Hire A Discredited Misinformation Agent

Apr 27, 2025

Cdcs New Vaccine Study Hire A Discredited Misinformation Agent

Apr 27, 2025 -

Cdc Vaccine Study Hire Concerns Over Misinformation Agent

Apr 27, 2025

Cdc Vaccine Study Hire Concerns Over Misinformation Agent

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025