Stock Market Valuations: BofA Assures Investors, Dispelling Valuation Concerns

Table of Contents

BofA's Key Arguments for a Positive Stock Market Outlook

BofA's optimistic outlook on stock market valuations rests on several key pillars. Their analysis suggests that current valuations aren't as inflated as some believe, primarily due to strong underlying fundamentals.

-

Robust Corporate Earnings Growth: BofA points to consistently strong corporate earnings growth across various sectors. This suggests companies are generating substantial profits, supporting current market prices. They cite specific examples and data points from their analysis showing year-over-year earnings growth exceeding expectations.

-

Resilient Consumer Spending: Despite inflationary pressures, consumer spending remains relatively robust, indicating a healthy economy capable of supporting further market growth. BofA's data on consumer confidence and spending habits are key to this argument.

-

Positive Economic Indicators: Various economic indicators, such as employment figures and manufacturing output, paint a picture of continued, albeit slower, economic expansion. This positive economic backdrop, according to BofA, provides a solid foundation for stock market valuations.

-

Market Multiples Still Within Historical Range: While price-to-earnings ratios (P/E) are higher than historical lows, BofA argues that they are still within a reasonable range compared to previous economic cycles. They use historical data to support their claim that current P/E ratios don't necessarily signal an overvalued market. They also analyze other market multiples, such as Price-to-Sales and Price-to-Book ratios, to support this viewpoint. The use of these different metrics demonstrates a robust and multi-faceted approach to valuing the market.

Addressing Common Valuation Concerns Raised by Investors

Investors have legitimate reasons for concern regarding current stock market valuations. BofA's analysis addresses several key anxieties:

Inflation's Impact on Stock Market Valuations

BofA acknowledges that high inflation poses a risk. However, they argue that the current inflationary pressures are likely to be transitory and that the Federal Reserve's monetary policies will effectively manage inflation without triggering a significant economic downturn. Their forecast for inflation is a crucial element of their argument, projecting a gradual decline in inflation rates over the next 12-18 months.

Rising Interest Rates and Stock Market Valuations

The rise in interest rates is a significant concern, potentially impacting corporate borrowing costs and investor returns on fixed-income instruments. BofA contends that while interest rate hikes will influence market behavior, the current level of rates remains manageable for the overall economy and that companies have adjusted to the new interest rate environment. They emphasize that the impact will be felt sector-specifically, and some sectors are more resilient to interest rate changes than others.

Geopolitical Uncertainty and Stock Market Valuations

Geopolitical risks, such as the ongoing conflict in Ukraine and rising tensions in other regions, inject uncertainty into the market. BofA acknowledges these risks but maintains that their impact on overall stock market valuations is likely to be limited, assuming that these risks don't escalate dramatically and trigger a major global crisis. Their analysis carefully weighs these geopolitical factors and integrates them into their broader market outlook.

Analyzing BofA's Methodology and Potential Limitations

BofA's analysis relies on robust financial modeling and comprehensive data analysis, incorporating macroeconomic indicators, corporate earnings data, and market sentiment. However, it's crucial to acknowledge potential limitations.

-

Predictive Modeling Limitations: All economic forecasts and market predictions are subject to inherent uncertainty. BofA's models, while sophisticated, cannot perfectly predict future events.

-

Data Bias: The data used in BofA's analysis might reflect a certain bias, potentially influencing their conclusions. It's essential to consider potential alternative data sources and interpretations.

-

External Factors: Unforeseen external events, like a major global recession or a significant geopolitical shift, could drastically alter the predicted trajectory. BofA’s analysis likely doesn't account for unforeseen "black swan" events.

Practical Implications for Investors Based on BofA's Assessment

Based on BofA's relatively optimistic assessment, investors might consider the following strategies:

-

Maintain a Balanced Portfolio: Portfolio diversification remains crucial. Investors should maintain a well-diversified portfolio across different asset classes and sectors to mitigate risk.

-

Long-Term Investment Strategy: A long-term investment horizon is advisable, as short-term market fluctuations are less relevant to long-term investment goals. BofA's analysis is clearly aimed at long-term investors, not short-term traders.

-

Careful Risk Management: While BofA presents a positive outlook, investors should still assess their risk tolerance and adjust their investment strategies accordingly. This might involve reviewing asset allocation to ensure it aligns with their comfort level.

Conclusion: Understanding Stock Market Valuations and Making Informed Decisions

BofA's analysis offers a relatively positive outlook on stock market valuations, highlighting strong corporate earnings, resilient consumer spending, and positive economic indicators. However, potential limitations, including the inherent uncertainties of economic forecasting and the impact of unforeseen events, must be considered. The arguments both for and against BofA's positive outlook on stock market valuations need careful evaluation. Investors should conduct thorough due diligence, incorporating diverse sources of information and potentially seeking professional financial advice before making any significant investment decisions. Understanding stock market valuations requires a multifaceted approach. Stay informed about current market trends, assess your risk tolerance, and develop a sound investment strategy tailored to your individual financial goals. To gain a deeper understanding of BofA's complete analysis, we strongly recommend reading their full report.

Featured Posts

-

The Business Of Deportation How One Startup Airline Is Leveraging Charter Flights

Apr 24, 2025

The Business Of Deportation How One Startup Airline Is Leveraging Charter Flights

Apr 24, 2025 -

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 24, 2025

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 24, 2025 -

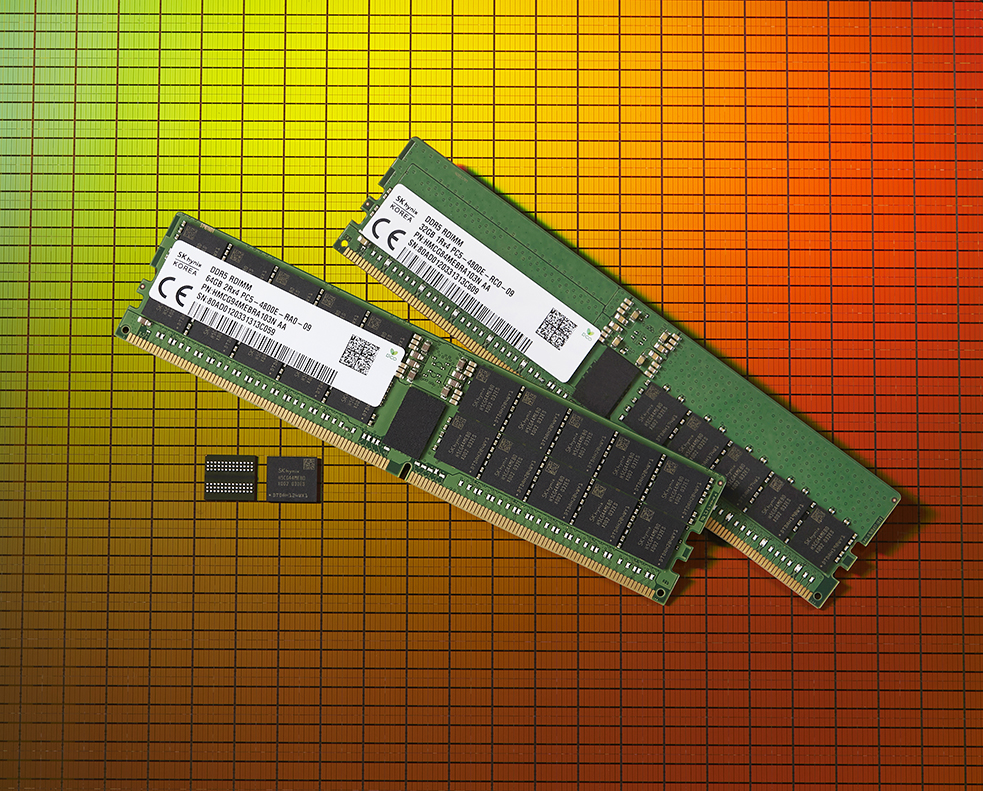

Sk Hynix New Dram Leader Thanks To Ai Advancements

Apr 24, 2025

Sk Hynix New Dram Leader Thanks To Ai Advancements

Apr 24, 2025 -

Nba All Star Saturday Night Herros 3 Point Shootout Win Cavs Skills Challenge Victory

Apr 24, 2025

Nba All Star Saturday Night Herros 3 Point Shootout Win Cavs Skills Challenge Victory

Apr 24, 2025 -

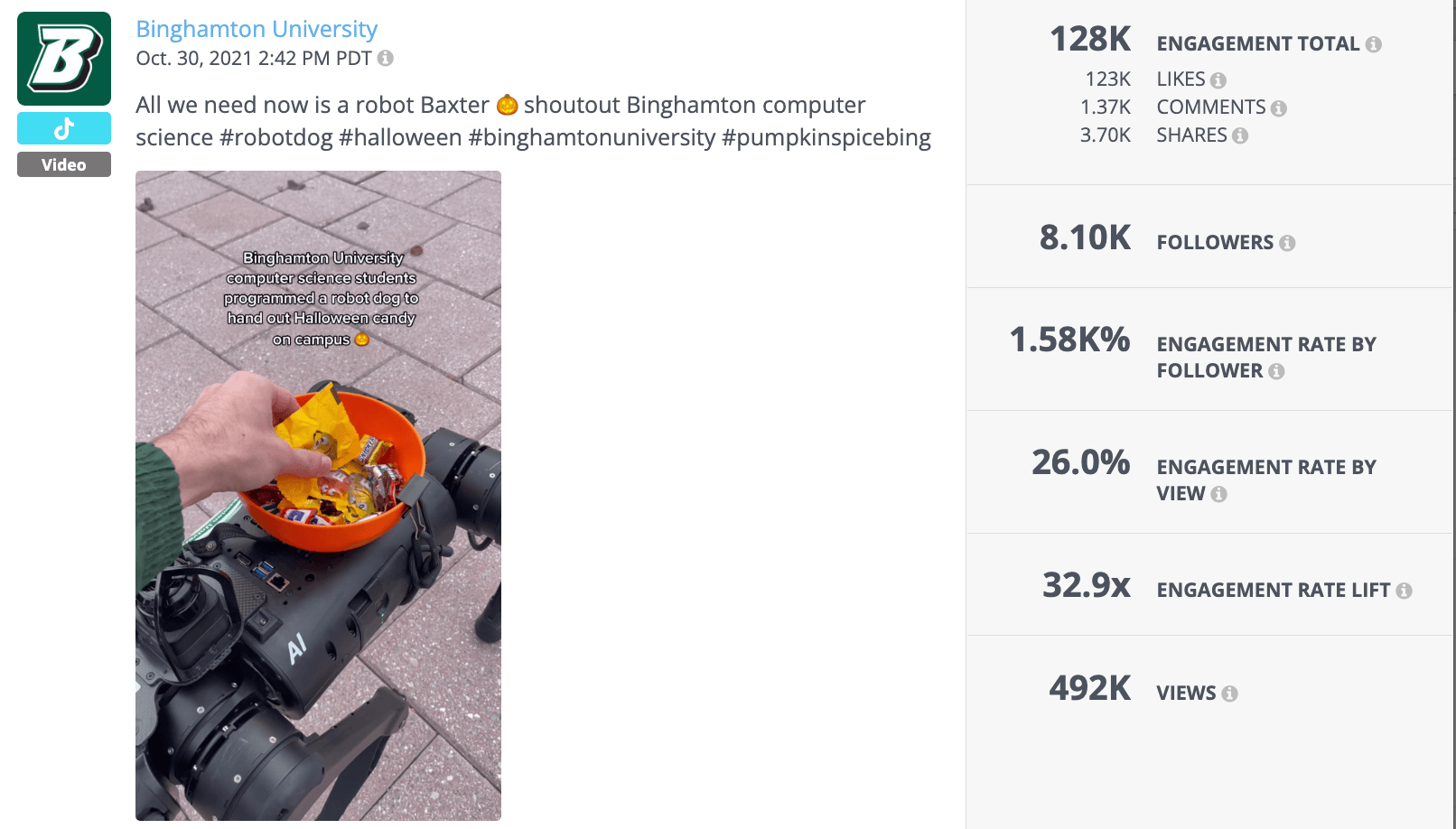

Instagrams Tik Tok Rival A New Video Editing App

Apr 24, 2025

Instagrams Tik Tok Rival A New Video Editing App

Apr 24, 2025